Agreement Personal Document For Payment

Description

How to fill out Agreement Between Personal Trainer And Client?

Utilizing legal document examples that adhere to federal and state laws is crucial, and the web provides numerous choices to select from.

However, what is the benefit of spending time searching for the right Agreement Personal Document For Payment template online when the US Legal Forms digital library already houses such documents gathered in one location.

US Legal Forms is the largest online legal database with over 85,000 editable templates created by lawyers for any professional and personal scenario. They are straightforward to navigate with all documents organized by state and intended use. Our specialists keep up with legal changes, ensuring that your form is always current and compliant when obtaining an Agreement Personal Document For Payment from our site.

Click Buy Now when you’ve located the suitable form and choose a subscription plan. Create an account or Log In and complete the payment using PayPal or a credit card. Select the format for your Agreement Personal Document For Payment and download it. All templates you discover through US Legal Forms are reusable. To re-download and fill out previously saved forms, access the My documents tab in your profile. Enjoy the most comprehensive and user-friendly legal paperwork service!

- Acquiring an Agreement Personal Document For Payment is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the correct format.

- If you are new to our site, follow the steps below.

- Review the template using the Preview feature or the text description to confirm it meets your requirements.

- Use the search function at the top of the page to find a different sample if necessary.

Form popularity

FAQ

A legal document for payment agreement is a written contract that outlines the terms of a financial transaction between two parties. It specifies the payment amount, due dates, and any penalties for late payments. This document serves as a safeguard for both parties, ensuring that expectations are clear. You can easily create this agreement personal document for payment using templates available at uslegalforms.

Writing a simple payment contract involves outlining the essential components clearly. Start with the names and contact information of the parties involved, followed by the payment amount and schedule. Be sure to include any terms for late payments or disputes. For convenience, you can access uslegalforms to find templates that guide you in crafting your agreement personal document for payment.

To draw up your payment agreement, begin by gathering all necessary details about the transaction. Write down the total amount, payment dates, and any interest or fees involved. Ensure that both parties understand and agree to these terms. Using a platform like uslegalforms can simplify this process by providing customizable templates for your agreement personal document for payment.

Creating a simple payment agreement is straightforward. Start by clearly stating the names of both parties and the payment amount. Next, outline the payment terms, including deadlines and methods of payment. For added clarity, you can use a template from uslegalforms, which provides a structured format for your agreement personal document for payment.

To make your agreement personal document for payment legally binding, both parties must reach a mutual understanding and agree to the terms. Include essential details such as the amount owed, payment schedule, and any consequences for non-payment. It is also advisable to have both parties sign the document in the presence of a witness or a notary. This ensures that the agreement holds up in court if necessary.

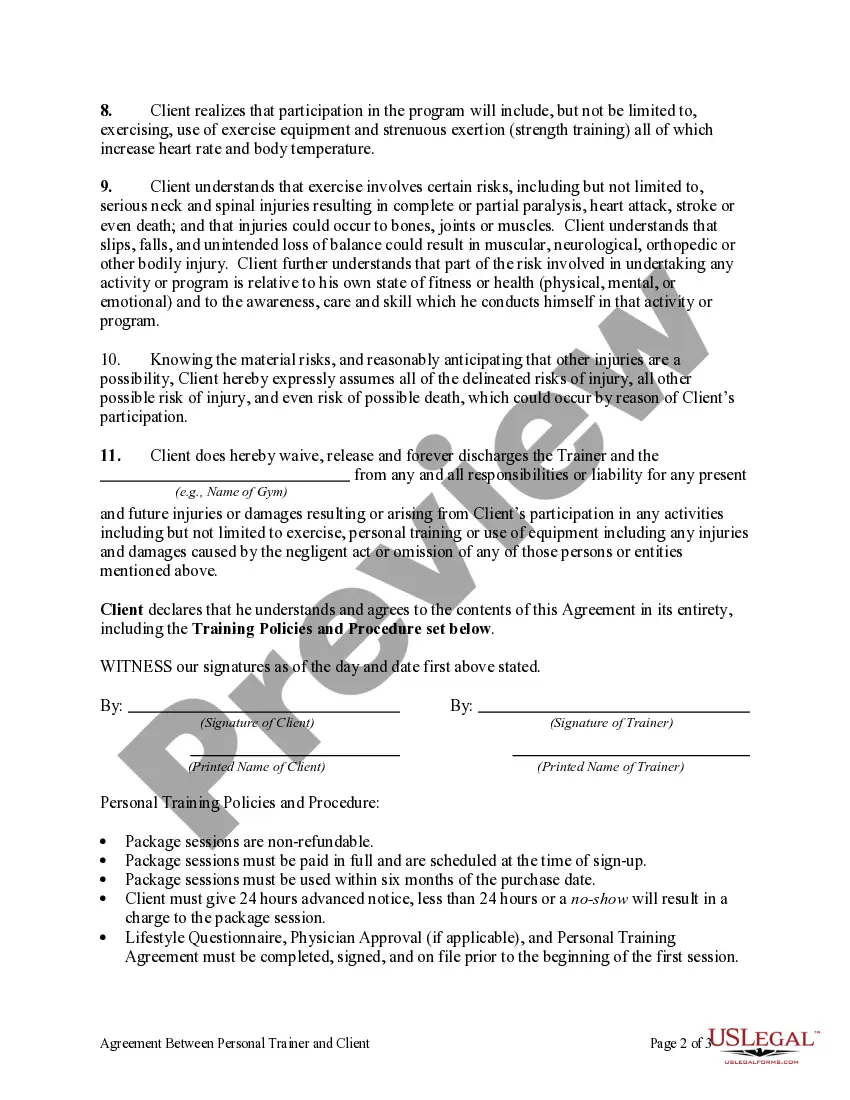

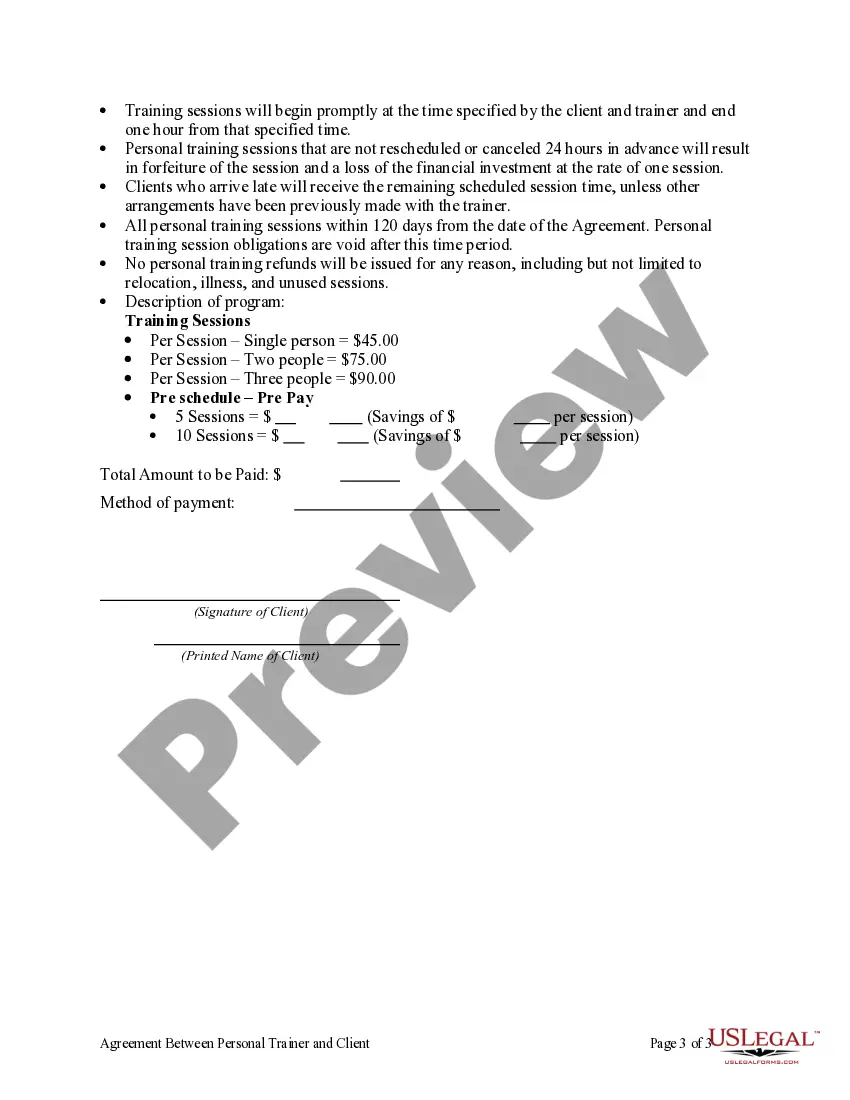

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Your payment agreement should mention the following details: term, transfer fee, money transfer instructions, authorization to transfer, indemnification, communication, governing law, acceptance, and details about security and authenticity. End the agreement with the signatures of both parties.

The payment agreement should include: Creditor's Name and Address; Debtor's Name and Address; Acknowledgment of the Balance Owed; Amount Owed; Interest Rate (if any); Repayment Period; Payment Instructions; Late Payment (if any); and.

Here are the steps to write a letter of agreement: Title the document. Add the title at the top of the document. ... List your personal information. ... Include the date. ... Add the recipient's personal information. ... Address the recipient. ... Write an introduction paragraph. ... Write your body. ... Conclude the letter.