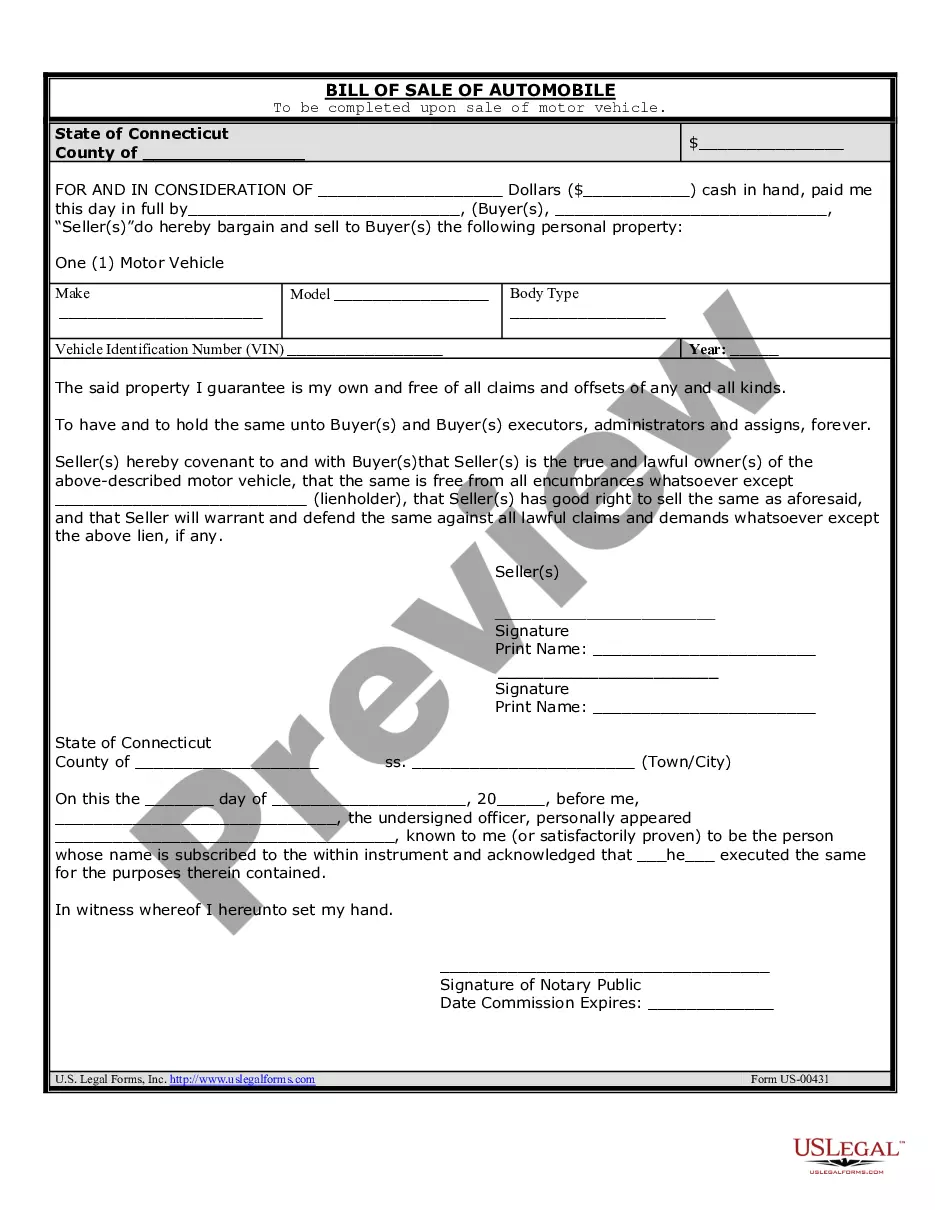

Any Child Support Withholding Order

Description

How to fill out Marital Settlement Agreement Dealing With Domiciliary Custody And Moving Away?

Bureaucracy requires exactness and correctness.

If you do not manage the completion of documents like Any Child Support Withholding Order routinely, it might lead to some misconceptions.

Choosing the proper sample from the outset will guarantee that your document submission proceeds smoothly and avert any troubles of resending a document or starting the same task entirely from the beginning.

For non-subscribers, finding the needed sample may take additional steps: Locate the template using the search feature. Ensure the Any Child Support Withholding Order you've found is suitable for your state or county. Preview the form or read the description containing application details. When the result aligns with your query, click the Buy Now button. Select the appropriate option from the available subscription plans. Log In to your account or register for a new one. Complete the transaction using a credit card or PayPal method. Download the document in your desired format. Finding the right and current samples for your documentation is a matter of minutes with a US Legal Forms account. Eliminate bureaucratic uncertainties and simplify your paperwork.

- Acquire the proper sample for your documentation at US Legal Forms.

- US Legal Forms is the largest online repository of forms, housing over 85,000 templates across various topics.

- Access the most current and pertinent version of the Any Child Support Withholding Order by simply searching it on the site.

- Locate, store, and preserve templates in your account or review the description to ensure you possess the correct one.

- With a US Legal Forms account, you can amass, keep in one location, and browse the templates you save for quick access.

- On the website, click the Log In button to Log In.

- Proceed to the My documents page, where your forms history is maintained.

- Examine the form descriptions and save the ones you require at any time.

Form popularity

FAQ

A withholding order is a legal directive that instructs an employer to deduct a specific amount from an employee's paycheck to fulfill child support obligations. This order ensures that funds are consistently allocated for the care and support of the child involved. Understanding any child support withholding order is crucial because it helps both parents maintain clarity in their financial responsibilities. With the right tools, you can manage and track these orders effectively.

The withdrawal of a withholding order refers to the process of ending or canceling an existing child support withholding order. This can occur when the obligations for child support are fulfilled, or a change in circumstances dictates a new arrangement. It's important to monitor any child support withholding orders so that they reflect your current financial responsibilities accurately. If you need assistance with this process, the USLegalForms platform can guide you through the necessary steps and documentation.

When an employer does not respond to a child support withholding order, they may face legal penalties, including fines or sanctions. This non-compliance can negatively affect the employee and their child, causing delays in receiving support payments. It is crucial for both employees and employers to understand their roles in this process to avoid complications. Utilizing platforms like US Legal Forms can provide clarity and assist in ensuring compliance with any child support withholding order.

Yes, in Florida, employers are required by law to implement any child support withholding order issued by the state. This means that employers must deduct child support payments from an employee's paycheck and send them directly to the state’s disbursement unit. Failure to comply with these orders can result in legal consequences for the employer. If you are dealing with such a situation, understanding the procedures for a child support withholding order can guide you on what steps to take.

In Georgia, child support laws focus on ensuring that both parents contribute to the upbringing of their children. The law establishes specific guidelines for calculating support amounts based on factors like income and the needs of the child. Additionally, Georgia requires any child support withholding order to be followed by employers, ensuring timely payments. If you need assistance navigating these regulations, resources from platforms like US Legal Forms can be extremely beneficial.

If you fall behind on your child support payments, the potential for facing jail time typically occurs after several months of non-payment. Generally, being more than three to six months behind can trigger enforcement actions, including possible jail time. A judge may issue a contempt order, which can include incarceration to compel you to comply. To address this issue, you might consider a child support withholding order to manage and enforce payments more effectively.

The maximum child support amount is not fixed and varies across states based on individual financial circumstances. Many states calculate child support amounts considering parents' income, expenses, and the child's needs. If you’re unsure about the maximum amount applicable in your case, reviewing resources through USLegalForms and any child support withholding order may help you find precise information.

The maximum rate of child support varies by state and considers numerous factors, including income and the needs of the child. Many jurisdictions refer to guidelines that suggest rates based on the paying parent's income, typically a percentage ranging from 17% to 25%, dependent on the number of children. Understanding these guidelines can clarify how any child support withholding order applies to your situation.

An Income Withholding Order (IWO) typically takes effect within seven business days after it is issued to the employer. However, some delays are possible due to employer processing times. To ensure a smooth and timely process, utilizing USLegalForms can help streamline compliance with any child support withholding order.

Employers cannot ignore a child support order; doing so may result in penalties and legal consequences. It is their legal obligation to comply with any child support withholding order they receive. If you face issues with an employer failing to comply, seeking help from legal services or USLegalForms can guide you on the next steps.