Agreement Mortgage Application Form Aib

Description

How to fill out Agreement To Purchase Note And Mortgage?

Utilizing legal templates that adhere to federal and local regulations is essential, and the internet provides numerous choices available.

However, why waste time searching for the suitable Agreement Mortgage Application Form Aib example online when the US Legal Forms library already houses these templates in one convenient location.

US Legal Forms stands as the largest online legal repository offering over 85,000 editable templates crafted by attorneys for various business and personal needs.

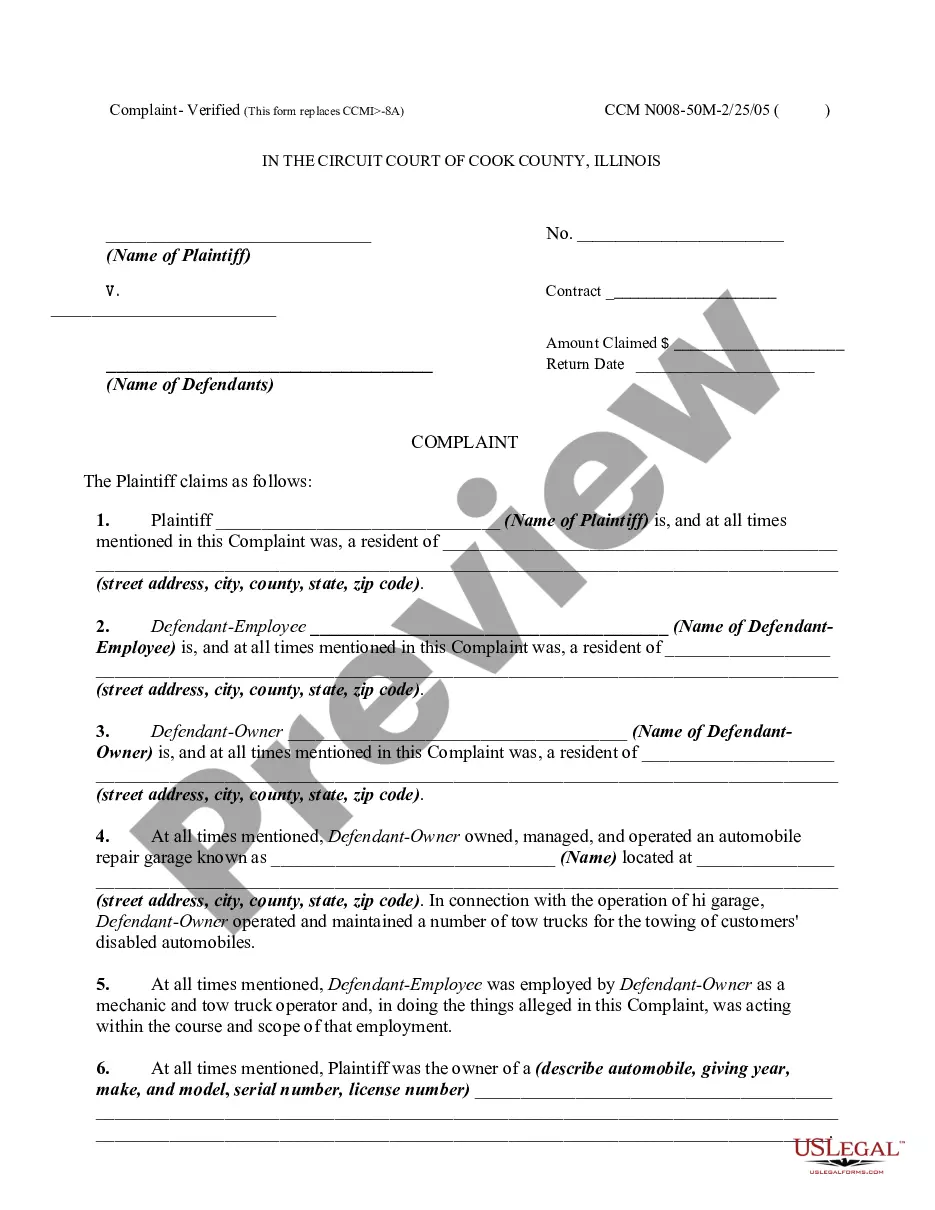

Explore the template using the Preview option or through the text outline to verify it fulfills your requirements.

- They are easy to navigate, with all documents sorted by state and intended use.

- Our team keeps up with legal updates, ensuring that your form remains current and compliant when obtaining an Agreement Mortgage Application Form Aib from our site.

- Acquiring an Agreement Mortgage Application Form Aib is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in your desired format.

- If you are unfamiliar with our platform, follow the instructions below.

Form popularity

FAQ

To apply for a mortgage in Ireland, you'll need several important documents. Generally, you will require proof of identity, such as a passport or driver's license, along with recent payslips or bank statements to demonstrate your income. Additionally, having details about your existing debts, along with a signed Agreement mortgage application form aib, will help streamline the process. If you seek further assistance with the application, uslegalforms can provide customized solutions to help organize and submit all necessary paperwork efficiently.

From application to approval and closing, getting a mortgage can take anywhere from 30 days to 60 days. However, some home purchases can take longer, depending on factors unique to the purchase transaction and the home loan processing time.

How do I order a statement for my account? Call our Customer Service Team on 0818 724 724 (+353 1 771 24 24 from outside Ireland). Select option 1 and enter your security details. Press 4 for PIN Retrieval and Statement Order, and follow the steps to get complete your request.

B) We will let you know our decision on your mortgage application within ten business of receiving all the information we need; c) If we cannot make a decision within ten business days we will tell you why and when we are likely to make a decision.

A mortgage application requires extensive information, including the property being considered for purchase, the borrower's financial situation and employment history, and more. Lenders use the information in the application to decide whether or not to approve the loan.

Generally speaking, it usually takes two to six weeks to get a mortgage approved. The application process can be accelerated by going through a mortgage broker who can find you the best deals that suit your circumstances. A mortgage offer is usually valid for 6 months.