Sample Answer To Foreclosure Complaint Nj

Description

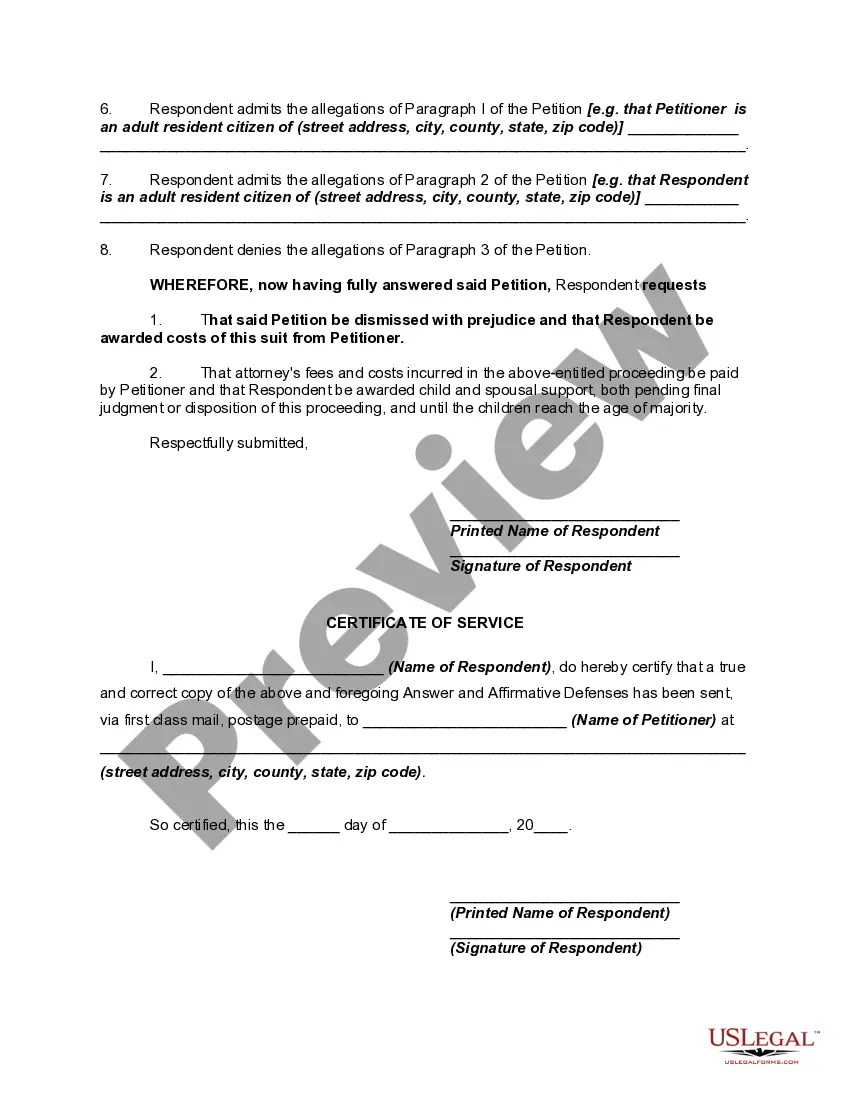

How to fill out Answer Or Response To Petition Or Complaint For Dissolution Of Marriage Or Divorce?

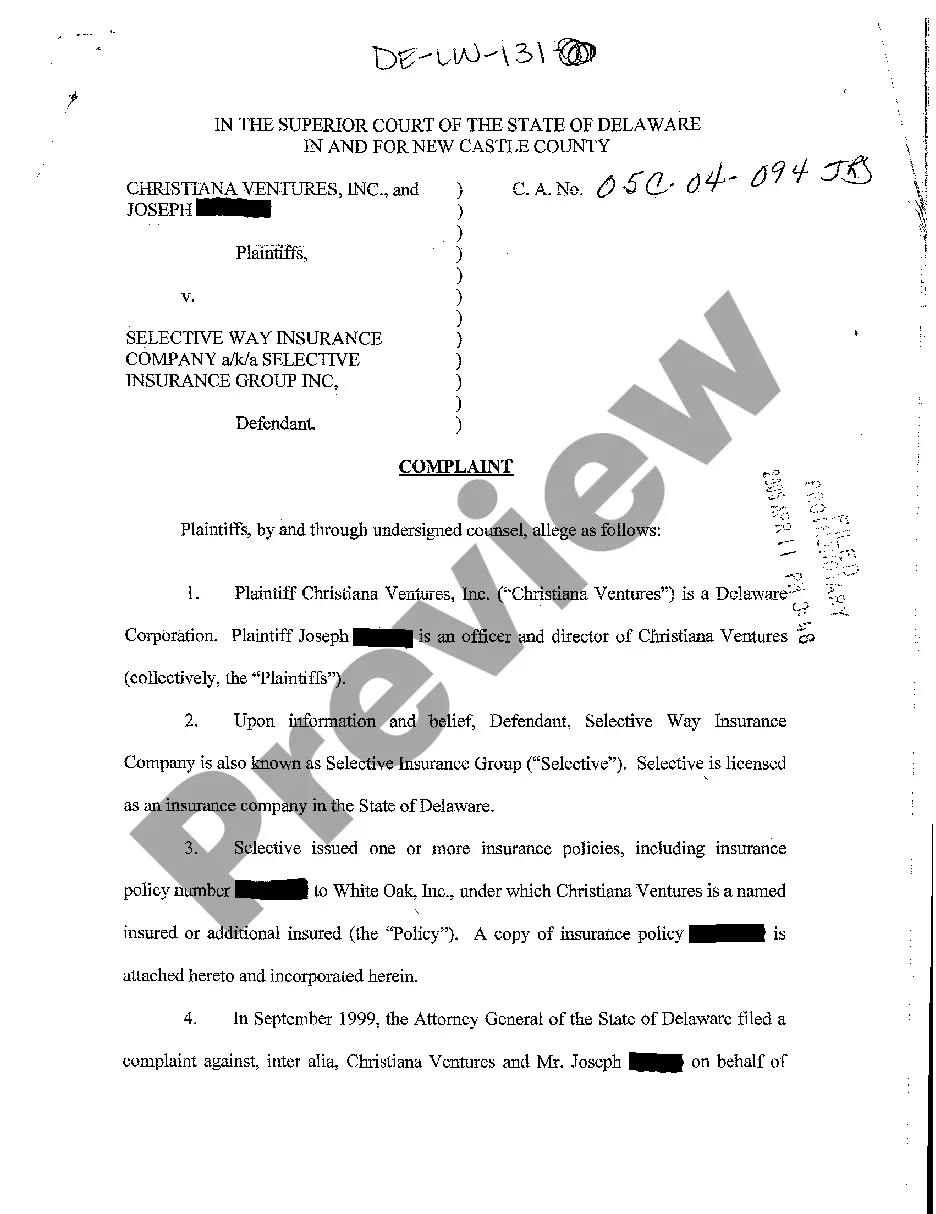

The Example Response To Foreclosure Complaint Nj displayed on this page is a reusable legal document created by skilled attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal experts with more than 85,000 verified, state-specific forms for every business and personal need. It’s the quickest, simplest, and most dependable method to secure the documents you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Register with US Legal Forms to have authenticated legal templates available for all of life’s circumstances.

- Explore the document you require and examine it.

- Search through the file you queried and preview it or review the form description to verify it meets your needs. If it does not, use the search bar to find the correct one. Click Buy Now once you have identified the template you want.

- Choose a subscription and sign in.

- Select the pricing plan that fits you and create an account. Utilize PayPal or a credit card for swift payment. If you possess an existing account, Log In and verify your subscription to continue.

- Obtain the editable template.

- Select the format you desire for your Example Response To Foreclosure Complaint Nj (PDF, Word, RTF) and download the sample onto your device.

- Fill out and sign the documents.

- Print the template to fill it out manually. Alternatively, employ an online versatile PDF editor to swiftly and accurately complete and sign your form with an electronic signature.

- Re-download your documents.

- Access the same file anytime required. Open the My documents section in your profile to re-download any previously acquired forms.

Form popularity

FAQ

contesting answer in NJ foreclosure refers to a response where the homeowner acknowledges the legitimacy of the lender's claim without disputing it. This type of answer typically indicates a willingness to negotiate or settle the debt. Understanding this option can be beneficial if you wish to avoid protracted litigation. For further clarity, you can look at a sample answer to foreclosure complaint NJ.

You must sign and notarize the original power of attorney document, and certify several copies. Banks and other businesses will not likely allow your agent to act on your behalf unless they receive a certified copy of the power of attorney. Remember, you can revoke a power of attorney at any time.

The Missouri Division of Finance regulates those state-chartered banks, trust companies, credit facilities, mortgage brokers, and savings/loan institutions. They ensure the safety and soundness of those institutions, as well as monitoring of compliance with laws and regulations.

The Federal Reserve System is one of several banking regulatory authorities. The Federal Reserve regulates state-chartered member banks, bank holding companies, foreign branches of U.S. national and state member banks, Edge Act Corporations, and state-chartered U.S. branches and agencies of foreign banks.

The Missouri Division of Finance regulates banks and other financial institutions in the state. The division is headed by a director, who is appointed by the governor with the advice and consent of the state senate.

The FDIC regulates a number of community banks and other financial institutions. To determine who regulates your bank, go to FDIC Bank Find.

The Missouri Division of Finance regulates state-chartered banks, trust companies, consumer credit facilities, mortgage brokers, and savings and loan institutions.

The cost of hiring a law firm to write a Power of Attorney can add up to anywhere from $200 to $500.

A durable power of attorney does not have to be recorded to be valid and binding between the principal and attorney in fact or between the principal and third persons, except to the extent that recording may be required for transactions affecting real estate under sections 442.360 and 442.370. 4.