Response Petition Form For 501

Description

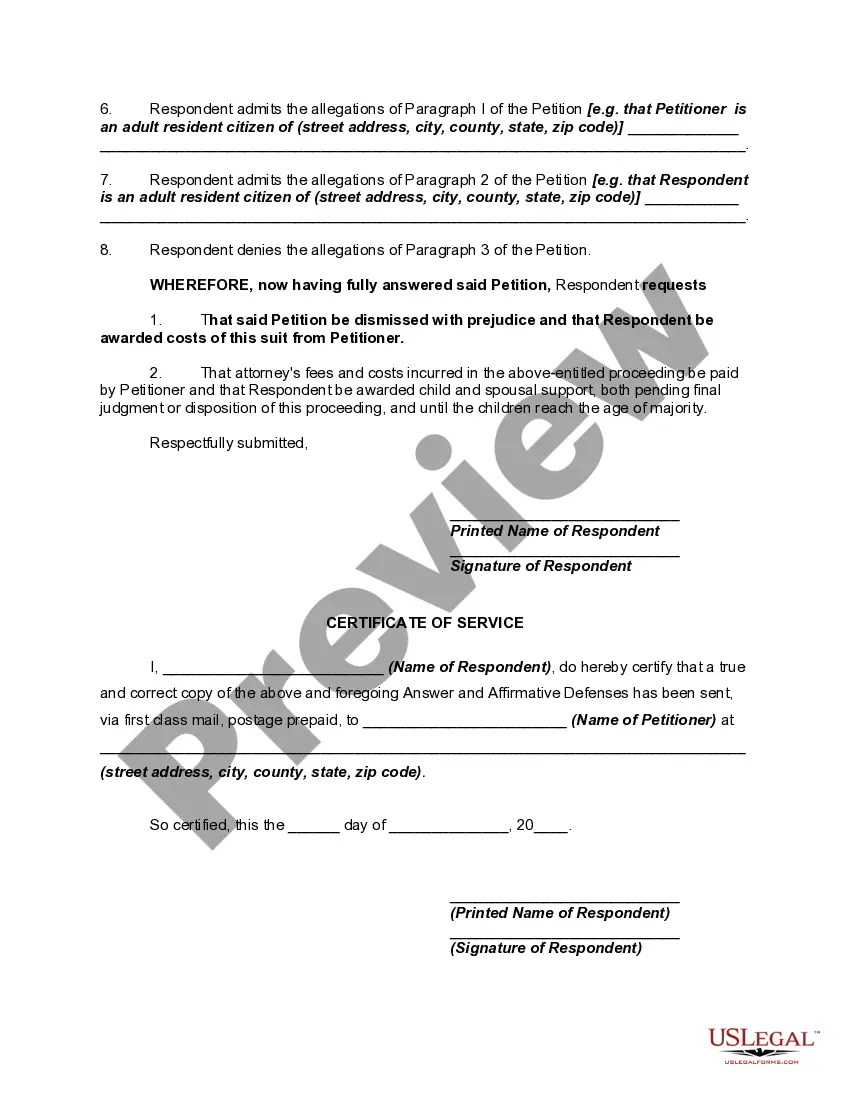

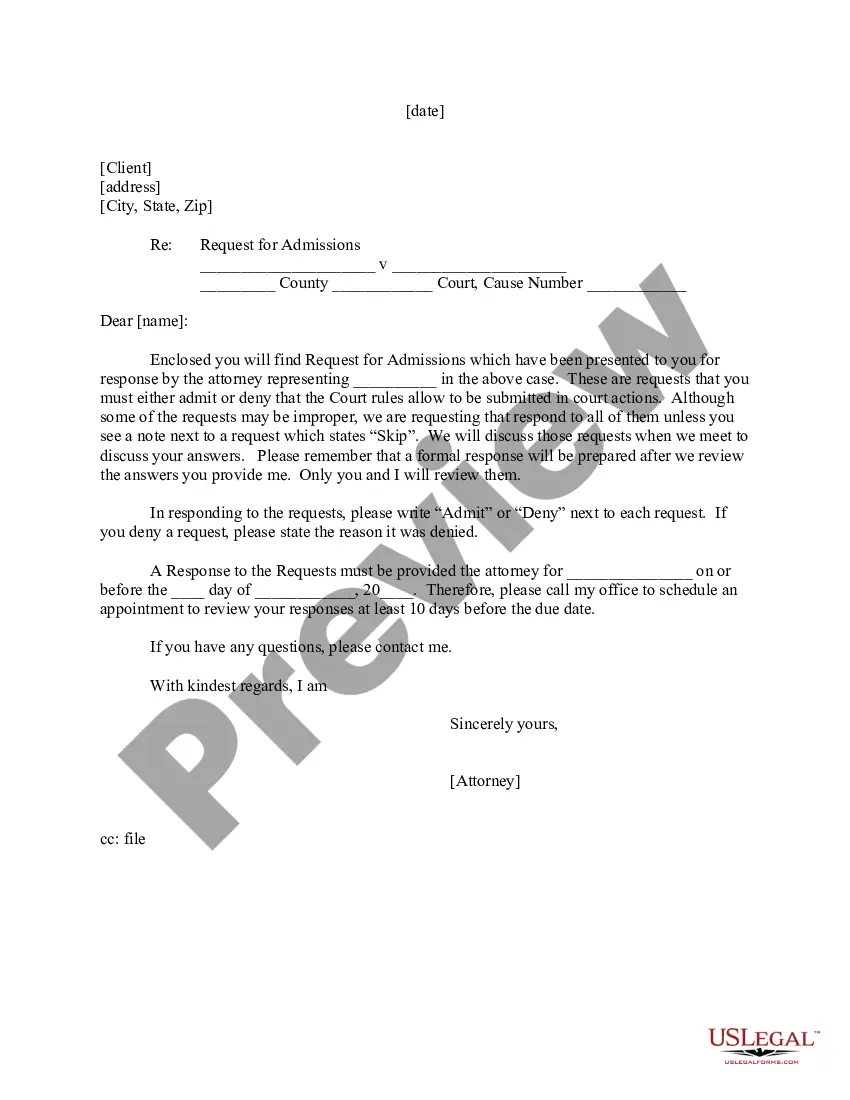

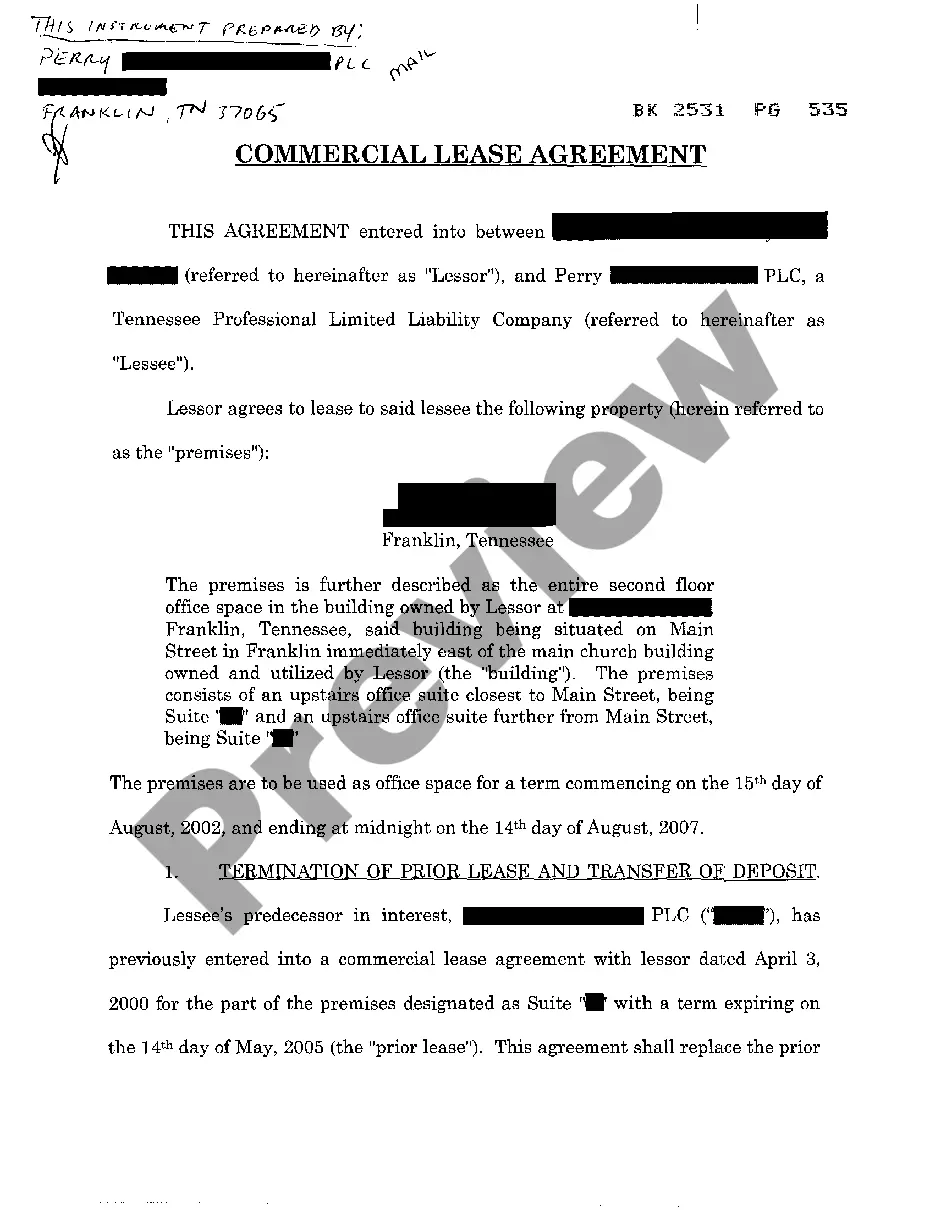

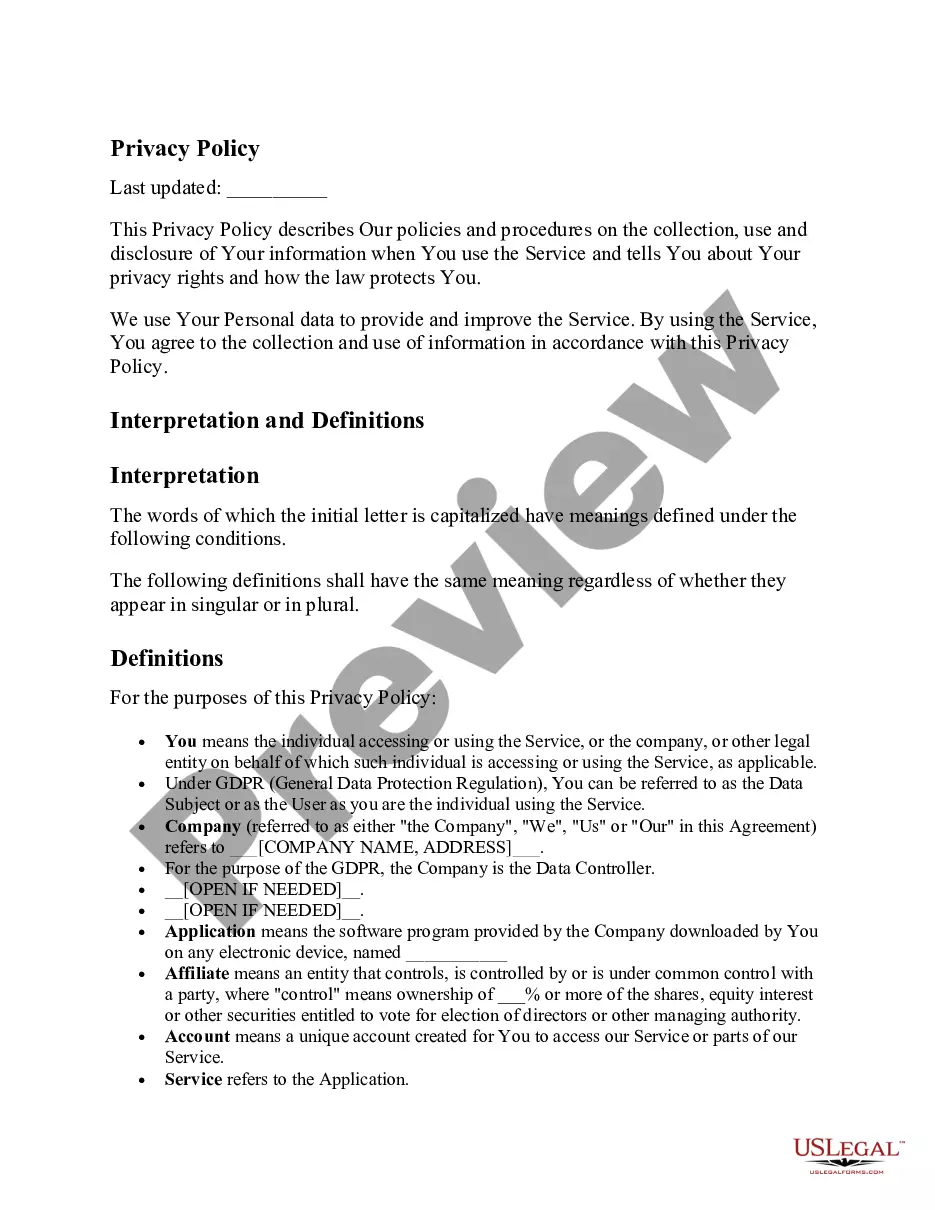

How to fill out Answer Or Response To Petition Or Complaint For Dissolution Of Marriage Or Divorce?

Handling legal documents can be daunting, even for the most experienced professionals.

When you are looking for a Response Petition Form For 501 and lack the time to dedicate to finding the suitable and updated version, the process can be stressful.

US Legal Forms caters to all your requirements, ranging from personal to corporate documents, all in a single platform.

Employ sophisticated tools to fill out and handle your Response Petition Form For 501.

Once you have downloaded the form you need, consider the following steps: Verify that it is the correct form by previewing and reviewing its details.

- Explore a valuable resource collection of articles, guides, and materials related to your circumstances and needs.

- Save time and effort in locating the documents you require by using US Legal Forms’ advanced search and Review feature to find Response Petition Form For 501 and obtain it.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to review the documents you have previously downloaded and to manage your folders as you wish.

- If this is your initial experience with US Legal Forms, create an account to gain unlimited access to all platform benefits.

- Utilize a robust online form repository to effectively handle these matters.

- US Legal Forms is a leader in digital legal documents, offering over 85,000 state-specific legal forms at your convenience.

- Access an extensive range of state or county-specific legal and organizational documents.

Form popularity

FAQ

To fill out a W-9 for a 501(c)(3), begin by entering your organization's name and checking the appropriate box to indicate your tax classification. You will also need to provide your Employer Identification Number (EIN), and complete the rest of the necessary fields. Accuracy is essential to avoid issues with the IRS when submitting your Response petition form for 501.

The Do's for Lending to Friends and Family Lend Money Only to People You Trust. Limit Loans to What You Can Afford. Get It in Writing. Don't Lend More Than You Can Afford. Don't Let Guilt Drive Your Decision. Don't Lend Someone Your Credit.

If you lend the money at no interest, the IRS can consider the loan a gift, making you liable for gift taxes. The repayment schedule that the borrower must follow. State whether you'll require periodic payments, a balloon payment or some combination.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

Do you need to notarize a Loan Agreement? First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

Wiedman suggests putting everything involving the loan in your written agreement: "The date of the loan, loan amount, repayment terms, interest rate, payment due dates and so forth." That said, putting everything in writing can make things awkward, but it's a safe move if you want to ensure repayment.

Loaning friends and family money is a hotly-debated topic, but one thing that is always a given ? the threshold after which the IRS gets involved. ing to the U.S. Code, that figure is $10,000. It's referred to as the ?de minimis exception? ? referring to small loans from the tax agency's perspective.