What Can Child Support Be Used On

Description

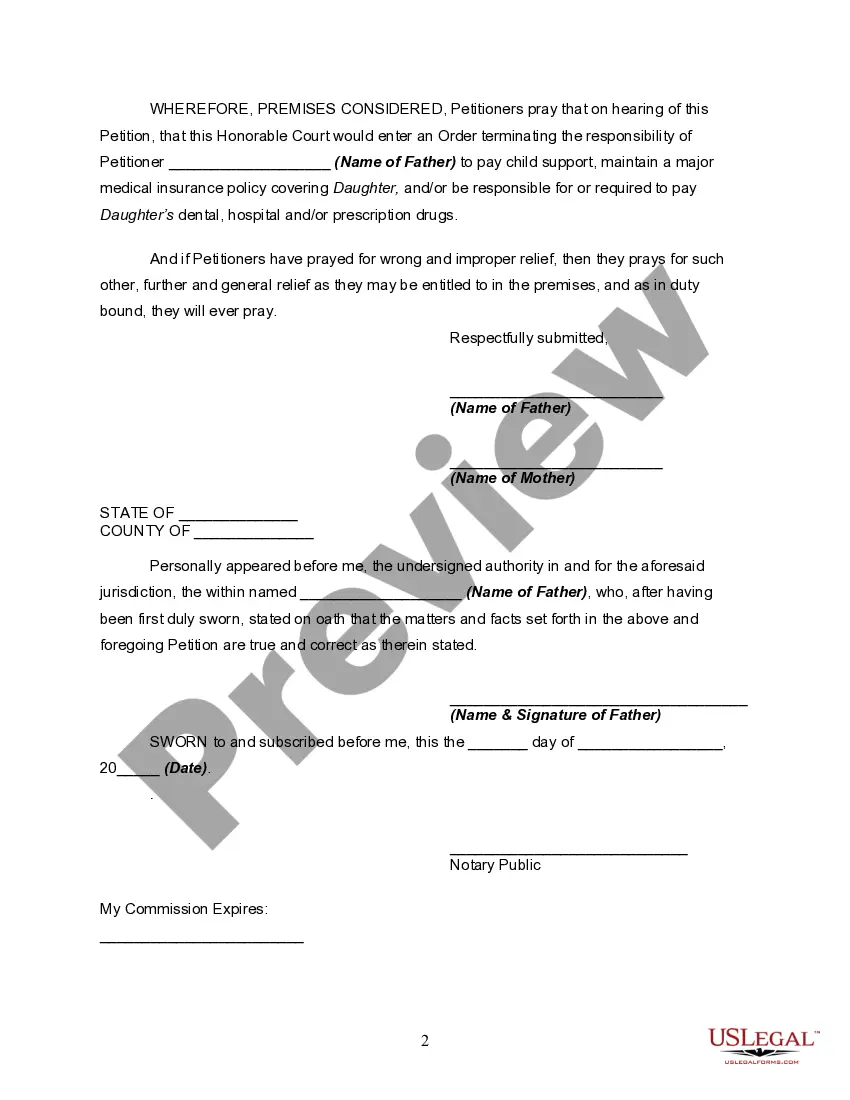

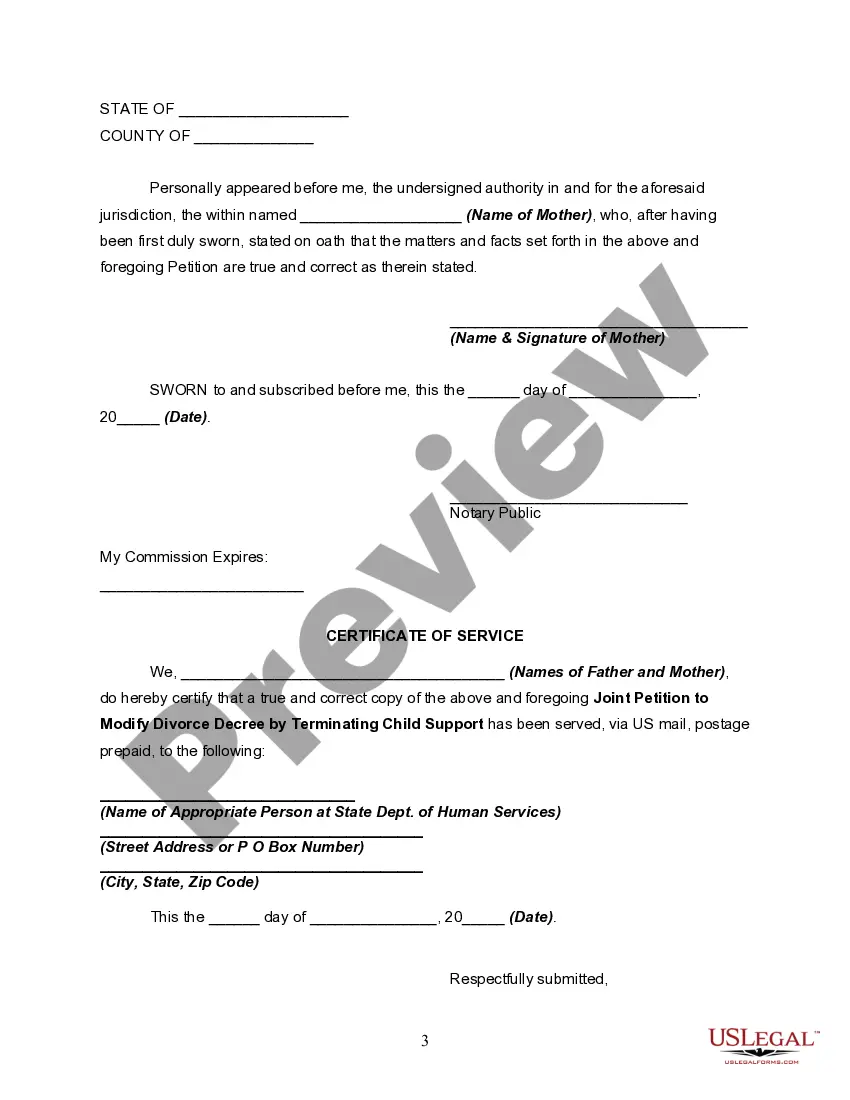

How to fill out Joint Petition To Modify Or Amend Divorce Decree By Terminating Child Support - Minor Left Home, Living Independently, Refuses To Work Or Go To School?

- Log in to your US Legal Forms account if you are a returning user and ensure your subscription is active.

- For first-time users, start by reviewing the form descriptions and previews to select the correct document for your needs.

- If you find any discrepancies, utilize the search feature to locate the appropriate template that fits your local jurisdiction.

- After finding the appropriate form, click the Buy Now button and choose a subscription plan that suits you, registering an account when prompted.

- Complete your purchase by entering your payment information via credit card or through PayPal.

- Once your transaction is successful, download the form to your device and easily access it later in the My Forms section of your profile.

US Legal Forms not only streamlines the document preparation process but also offers users access to an extensive library of over 85,000 legal forms. This robust collection ensures you can find more forms at competitive prices compared to other services.

Additionally, with the support of premium experts available for consultation, users can ensure their documents are completed accurately and legally. Start empowering your legal journey today with US Legal Forms.

Form popularity

FAQ

To ensure that child support is spent on the child, open communication between parents is crucial. Consider setting clear agreements on how to allocate funds for various expenses that contribute to the child's needs. Additionally, documenting expenditures related to the child can provide transparency and accountability. Utilizing platforms like US Legal Forms can help you create structured agreements that specify how child support funds should be spent effectively.

Child support is designated to cover specific needs of the child, including basic necessities like food, clothing, and education-related expenses. However, the use of these funds can be flexible as long as they ultimately benefit the child's wellbeing. It is essential to document expenses to ensure that child support is spent in a way that meets legal and ethical obligations. To gain a better understanding of what child support can be used on, consider consulting with a legal expert.

Kansas law mandates that child support is determined using a detailed formula that considers both parents' income and the child's needs. As a responsible parent, it's essential to understand what child support can be used on, including housing, food, and other necessary expenses for the child’s upbringing. Kansas law aims to ensure that child support directly benefits the child's quality of life. For more in-depth information, legal guidance can help you navigate your unique circumstances.

In Minnesota, child support law emphasizes the child's best interests and focuses on providing financial support for their well-being. The law outlines specific guidelines that determine child support amounts based on both parents' income and needs of the child. Ensuring that funds are used correctly aligns with understanding what child support can be used on, such as education, healthcare, and basic living expenses. If you have further questions about Minnesota law, consulting legal resources can clarify your specific situation.

If child support is not being used for the child, it can create a difficult situation for both the parent providing support and the child. It is important to communicate and address this issue with the receiving parent to understand their perspective. Additionally, documenting how the funds are spent can be helpful. In some cases, you may need to seek legal advice to ensure that funds allocated for child support actually support the child's needs.

Extraordinary expenses for child support often involve costs that go beyond regular monthly expenditures. This can include emergency medical expenses, psychological counseling, or specialized tutoring for learning disabilities. Recognizing these costs is essential for parents to understand what can child support be used on effectively. If you're unsure about your obligations regarding these expenses, USLegalForms can provide valuable guidance and templates to assist you.

Expenses used to calculate child support typically include basic needs such as food, housing, education, and healthcare. These figures help establish a fair amount that reflects the true costs of raising a child. Moreover, understanding these expenses provides clarity on what can child support be used on, enabling both parents to contribute appropriately to the child's upbringing. If you have questions about calculating these costs, consider using USLegalForms to find resources and support.

Extraordinary expenses refer to significant costs that may arise unexpectedly and are essential for the well-being of the child. This can include things like tuition for private schooling, specialized medical care, or costs associated with extracurricular activities. It's important to discuss these expenses with the other parent, as they also fall under what can child support be used on. Understanding this can lead to better financial planning for both parents.

It's essential to keep detailed receipts for any expenses related to your child's needs. This includes receipts for educational expenses, clothing, and medical bills, among others. By retaining these documents, you provide clear evidence of how child support funds are used, aligning with guidelines about what can child support be used on. This practice not only promotes accountability but also helps in case of future disputes.

Child support cannot be used for personal expenses unrelated to the child's needs. This means expenses like vacations, luxury items, or even personal debts are not valid uses of child support funds. It's crucial to understand that these funds are intended specifically for the child's direct needs. Keeping this in mind will help ensure compliance with your legal obligations regarding child support.