Interest States Statement For Mortgage

Description

How to fill out Assignment Of Interest In United States Patent?

Creating legal documents from the beginning can sometimes feel overwhelming.

Certain instances may require extensive research and considerable financial investment.

If you’re seeking a simpler and more cost-effective method for generating Interest States Statement For Mortgage or any other paperwork without the hassle, US Legal Forms is readily accessible.

Our online collection of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

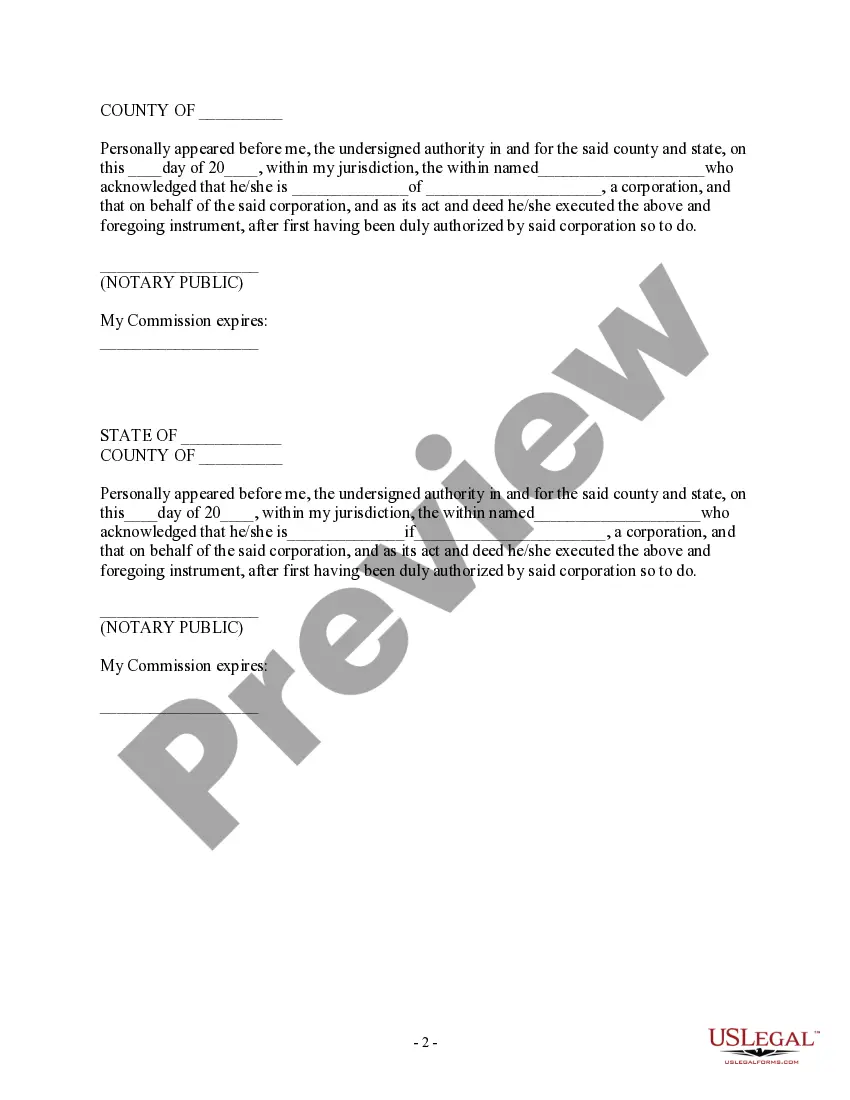

However, before proceeding to download the Interest States Statement For Mortgage, consider these guidelines: Review the form preview and descriptions to ensure you find the document you need. Confirm that the template you select meets the stipulations of your state and county. Choose the most appropriate subscription plan to acquire the Interest States Statement For Mortgage. Download the file and then fill it out, certify it, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make form completion effortless and efficient!

- With just a few clicks, you can immediately obtain state- and county-compliant documents thoughtfully assembled by our legal experts.

- Utilize our website whenever you need dependable and trustworthy services through which you can swiftly find and download the Interest States Statement For Mortgage.

- If you are familiar with our services and have previously registered an account with us, simply Log In to your account, choose the form, and download it or re-download it later in the My documents section.

- Don’t have an account? No problem. It requires minimal time to sign up and browse the catalog.

Form popularity

FAQ

In Oklahoma, the landlord can evict the tenant for a lease violation. The landlord must provide a written notice called a 15-Day Notice to Comply which gives the tenant 10 days to fix the issue. Should the tenant be unable to correct the issue in 10 days, then they have the remaining 5 days to vacate the property.

Oklahoma tenant screening should include eviction records when screening an applicant for a lease or rental agreement. Eviction records can be searched either statewide or nationwide. Tenant screening agencies can report the applicant address history and if they paid their rent.

Comply With the Eviction Notice, If Possible If you comply with the eviction notice by either paying all the rent due and owing or correcting the lease violation, then, in Oklahoma, the landlord must not proceed with the eviction (see Okla. Stat.

Evictions typically stay on your public record for up to seven years, but they usually won't show up on your credit reports or directly affect your credit. The information provided on this website does not, and is not intended to, act as legal, financial or credit advice.

What is the Cost of Filing an Eviction Process in Oklahoma Type of Eviction ClaimFiling FeeIllegal Activity$85 plus service chargeObligation for less than $5000$58 plus service chargeObligation of more than $5000$209.14 plus service chargeUncontested Residential eviction$247.85 plus service charge2 more rows

How Long Does an Eviction Stay on Your Record? An eviction itself doesn't appear on your credit report. However, any unpaid rent and fees could be sent to collections and remain on your credit report for seven years from the original delinquency date.

Here are seven steps to remove an eviction from your record. Check Your State Laws. ... Win Your Eviction Case. ... Review Your Eviction Paperwork. ... Determine Your Expungement Type. ... File Your Motion of Expungement. ... Attend the Hearing. ... Check the Court Record. ... Send Copies to Tenant Screening Companies.

If you do not have a lease: The landlord can ask the judge to evict you without a reason. BUT the landlord must give you notice. If you pay your rent monthly, the landlord MUST give you a written 30-day notice telling you that you must move within 30 days.