Work Claims Injuries With Longest Recovery Time

Description

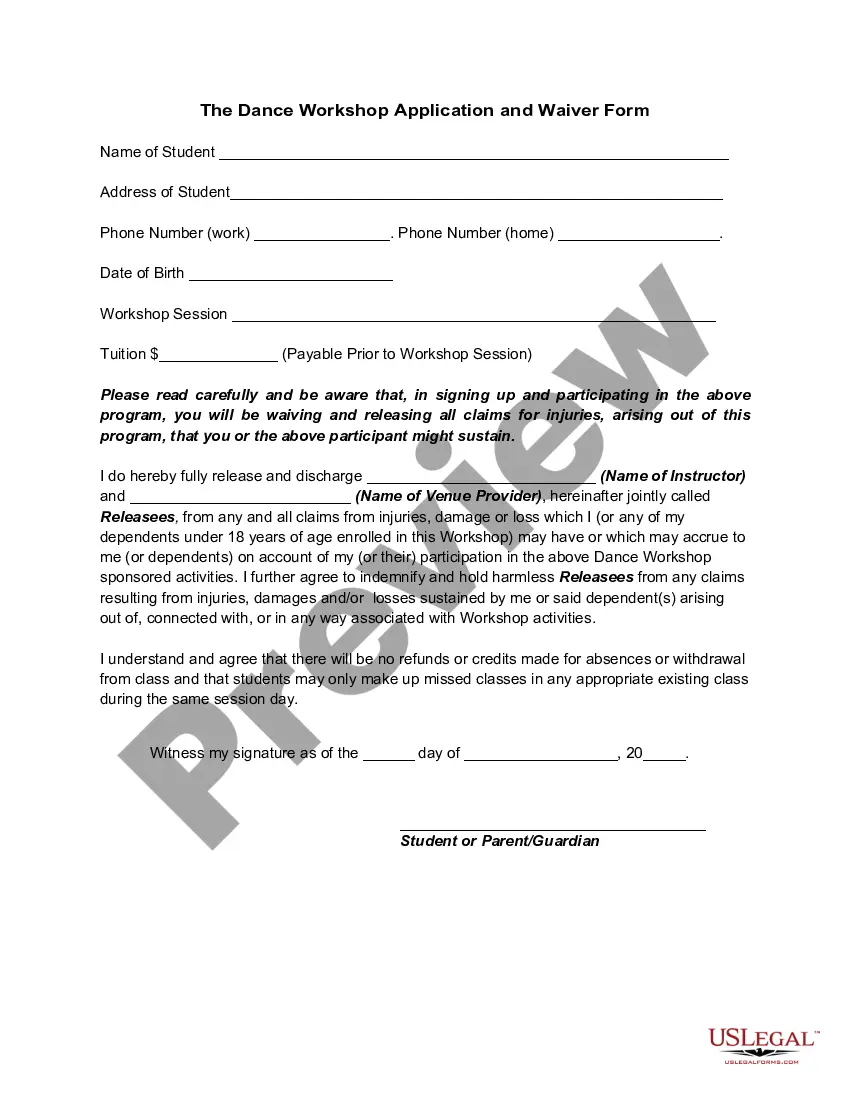

How to fill out The Dance Workshop Or School Application And Waiver Form?

The Work Claims Injuries With Longest Recovery Time you observe on this page is a versatile formal template crafted by experienced attorneys in accordance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific forms for any professional and personal situation. It’s the quickest, simplest, and most reliable method to acquire the necessary paperwork, as the service ensures the utmost level of data protection and anti-malware security.

Select the format you prefer for your Work Claims Injuries With Longest Recovery Time (PDF, DOCX, RTF) and save the file on your device.

- Browse the document you require and verify it.

- Search through the document you looked for and preview it or review the form description to ensure it meets your needs. If it does not, utilize the search option to discover the appropriate one. Click Buy Now when you have found the template you require.

- Select and Log Into your account.

- Choose the subscription plan that works for you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

Form TRD-41406, New Solar Market Development Tax Credit Claim Form, is used by a taxpayer who has been certified for a new solar market development tax credit by the Energy, Minerals and Natural Resources Department (EMNRD) and wishes to claim the credit against personal or fiduciary income tax liability (Section 7-2- ...

If you've already filed your 2022 return, you'll be able to file an amended return. If you filed your original return before the normal tax deadline (usually April 15) and find an error that would make you owe more money, you might want to hurry.

Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone ? 800-TAX-FORM (800-829-3676).

File amended returns using the PIT-1 form for the appropriate tax year. Mark the ?amended? checkbox or write ?amended? at the top of the form. For these years do not file an amended return on Form PIT-X.

Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.

You can request copies of your IRS tax returns from the most recent seven tax years. To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2023, the IRS charges $43 for each return you request.

For tax years 2005 to present, file your amended return on the PIT-X form for that tax year. For example, to amend a return for the 2005 tax year, use Form 2005 PIT-X; to amend a return for tax year 2006, use Form 2006 PIT-X, etc. For tax years beginning prior to January 1, 2005, there is no special form.

Where's my refund? To check the status of your refund for the current taxable year visit the Taxation and Revenue Department's online service the Taxpayer Access Point (TAP). Once you are on the TAP website go to the ?Personal Income? tile and select the ?Where's My Refund?? link.