Blank Credit Card Payment Form For Irs

Description

How to fill out Credit Card Charge Authorization Form?

Whether for commercial intentions or personal matters, everyone must handle legal issues at some point in their life.

Completing legal paperwork necessitates meticulous care, starting with choosing the proper form template.

With a comprehensive US Legal Forms collection available, you will never have to waste time seeking the correct template online. Utilize the library’s straightforward navigation to find the right form for any scenario.

- For instance, if you select an incorrect version of a Blank Credit Card Payment Form For Irs, it will be denied upon submission.

- Thus, it is essential to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Blank Credit Card Payment Form For Irs template, follow these straightforward steps.

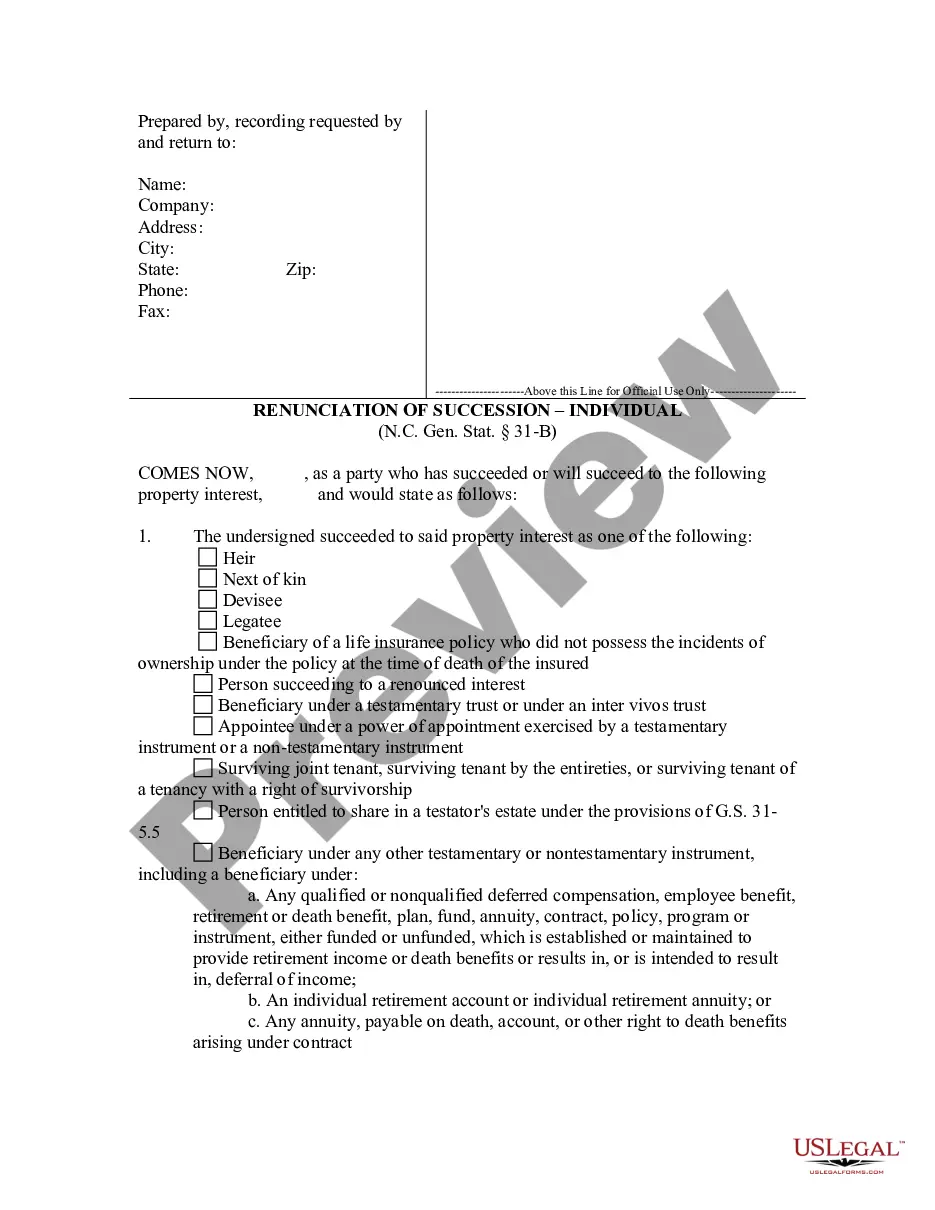

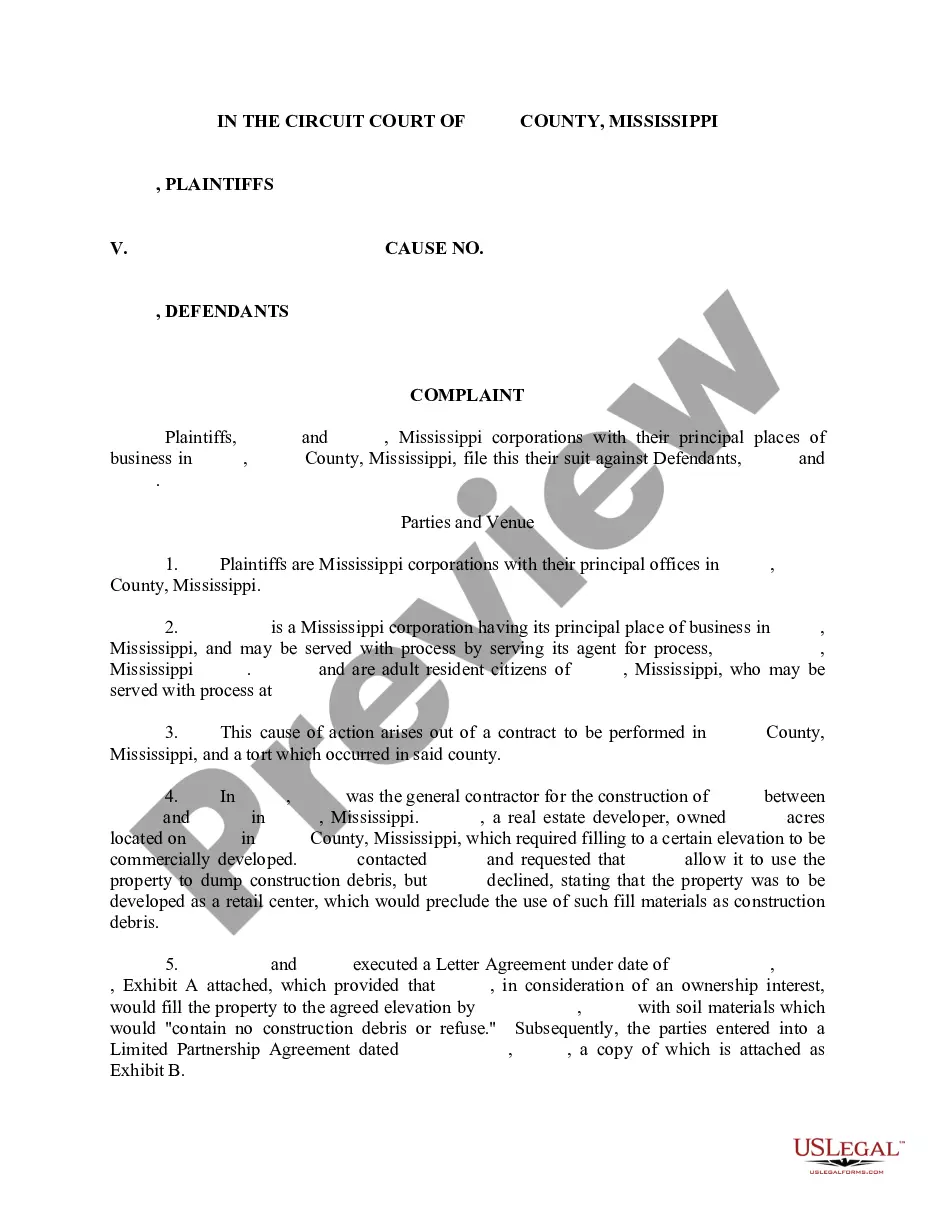

- Obtain the template you require using the search bar or catalog navigation.

- Review the form’s description to ensure it is suited to your circumstances, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search tool to find the Blank Credit Card Payment Form For Irs sample you need.

- Download the template once it meets your standards.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can download the form by clicking Buy now.

- Choose the right pricing option.

- Fill out the profile registration form.

- Select your payment method: you can use a credit card or a PayPal account.

- Select the file format you desire and download the Blank Credit Card Payment Form For Irs.

- Once it is saved, you can complete the form using editing software or print it out and fill it in by hand.

Form popularity

FAQ

Attach Form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you have already filed your return or you're filing this form in response to a notice, file Form 9465 by itself with the Internal Revenue Service Center using the address in the table below that applies to you.

While an immediate response is provided through the Online Payment Arrangement (OPA) system, submitting Form 9465 typically leads to a response within 30 days.

In fact, you need to file all expenses incurred through the Credit Card. Once you file the expenses, you are liable to pay income tax on your Credit Card.

The user fee for requesting an installment agreement using Form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account. To qualify for a lower user fee, you can request an installment agreement using the IRS Online Payment Agreement tool.

A Notice of Federal Tax Lien (NFTL) may be filed to protect the government's interests until you pay in full. However, an NFTL is generally not filed with a Guaranteed Installment Agreement. Attach Form 9465 to the front of your return and send it to the address shown in your tax return booklet.