Authorization Form To Pull Credit For Mortgage

Description

How to fill out Credit Card Charge Authorization Form?

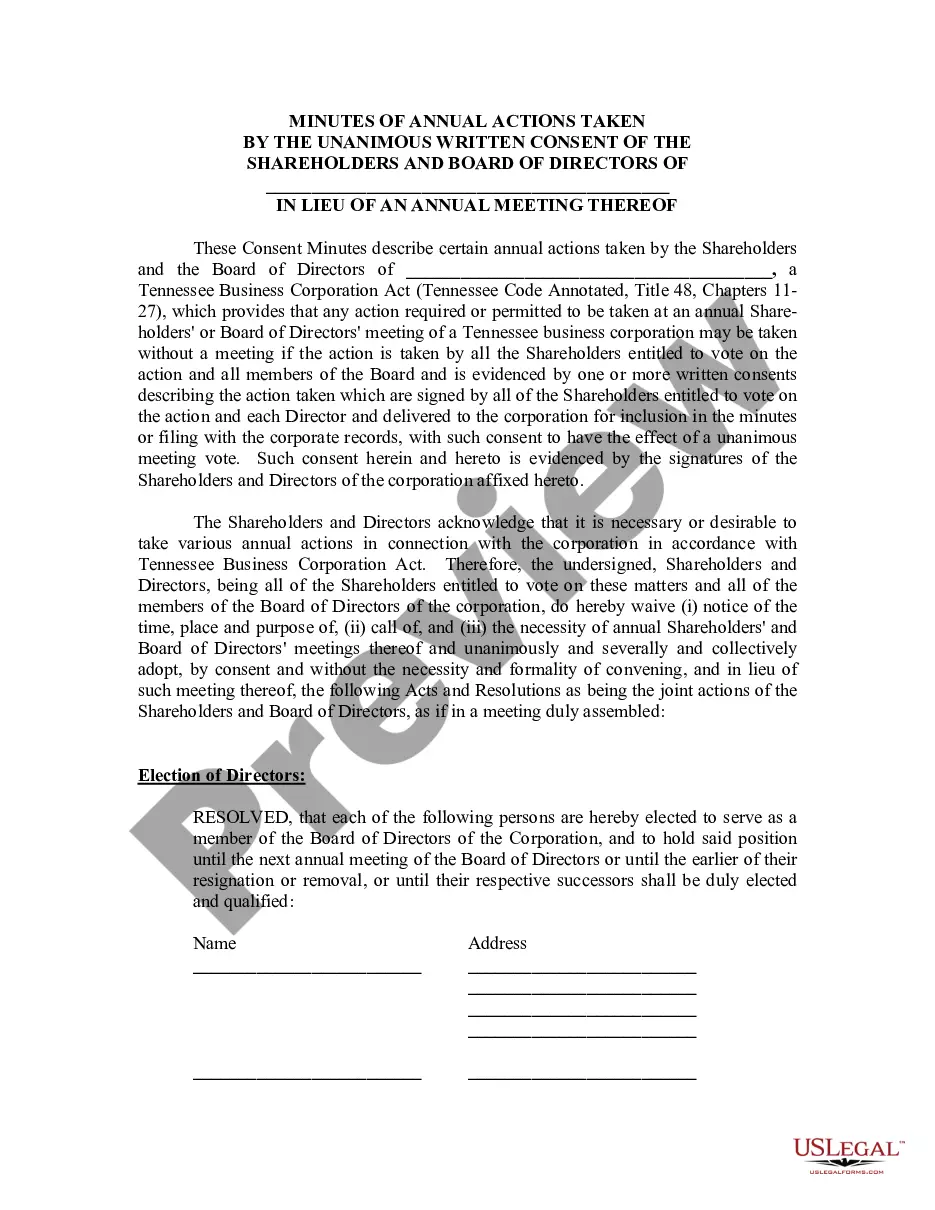

The Authorization Document To Obtain Credit For Mortgage displayed on this page is a versatile legal template created by experienced attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners access to over 85,000 validated, state-specific forms for any business or personal need. It's the quickest, easiest, and most reliable method to acquire the documents you require, as the service ensures bank-level data security and anti-malware safeguards.

Select the format you desire for your Authorization Document To Obtain Credit For Mortgage (PDF, Word, RTF) and save the sample onto your device.

- Search for the document you require and examine it.

- Go through the file you looked up and preview it or read the form summary to verify it meets your needs. If it doesn’t, utilize the search function to find the appropriate one. Click Buy Now once you have located the template you want.

- Choose a subscription plan and Log In.

- Pick the pricing option that works for you and set up an account. Use PayPal or a credit card to process a quick payment. If you already have an account, Log In and check your subscription to move further.

- Acquire the editable template.

Form popularity

FAQ

The borrower's authorization form enables lenders to access your financial information for evaluation. This form grants permission to pull necessary data from credit bureaus, allowing lenders to assess your credit history accurately. By using this authorization form to pull credit for mortgage, you streamline the application process and enhance the chances of approval. It's a crucial step in securing your mortgage.

A third party authorization form says to your mortgage company that you allow a third party to receive information about you and your mortgage. It may allow the third party to take actions for you.

Before a financier, landlord, or any party would like to perform a credit check on an individual, it's required, under the Fair Credit Reporting Act, that the individual gives consent before their credit is searched.

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

Credit Report Authorization Form EXPLAINED - YouTube YouTube Start of suggested clip End of suggested clip A credit report authorization form is used to give an individual or organization consent to performMoreA credit report authorization form is used to give an individual or organization consent to perform a credit report credit. Report authorization forms are commonly used in cases involving financial

The borrower authorization form is a standard form that is signed by a loan applicant authorizing the lender to verify his/her information from a third party.