Action Limitations With 500

Description

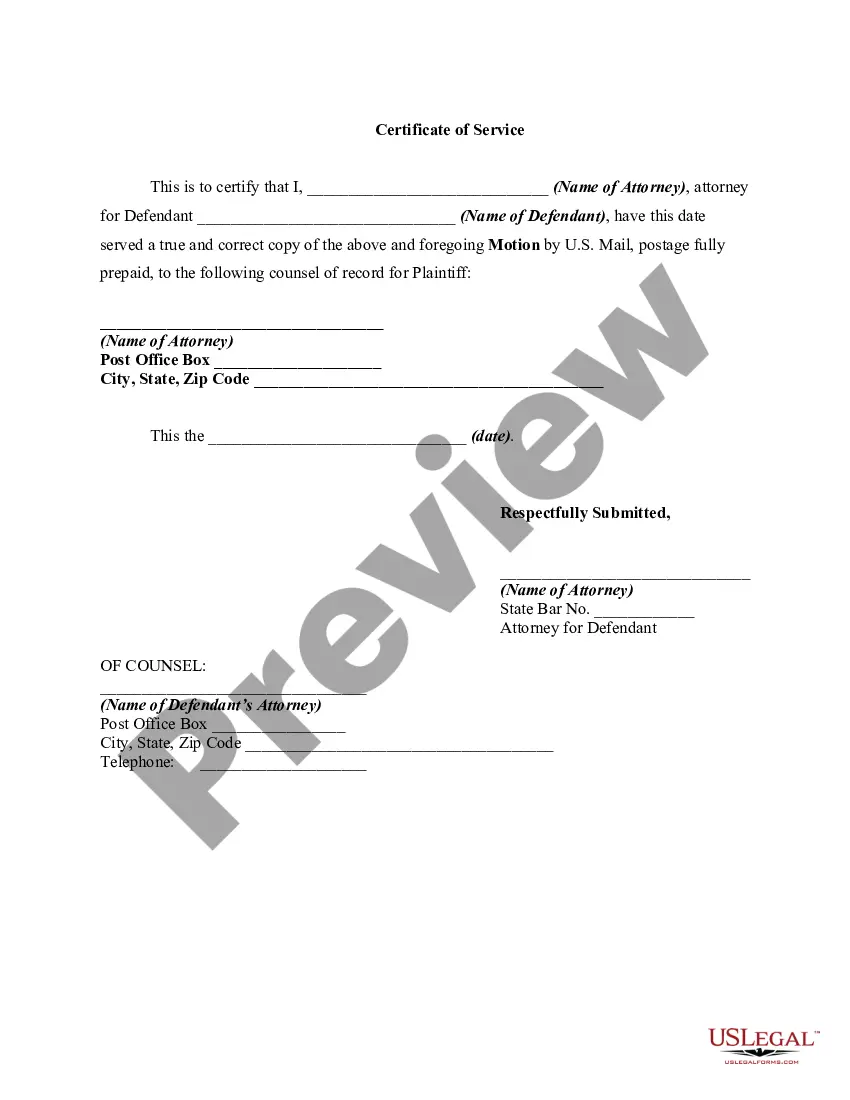

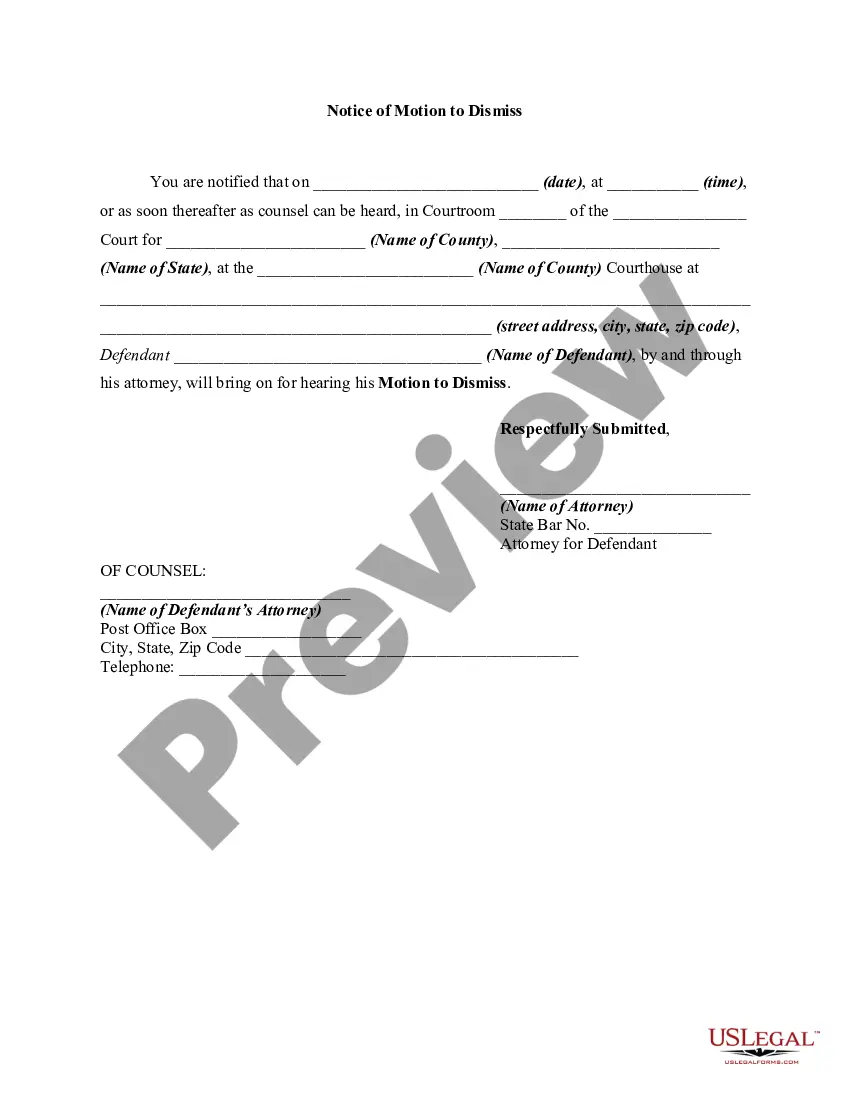

How to fill out Motion To Dismiss Action With Prejudice Of Plaintiff's Cause Of Action Barred By Statute Of Limitations?

Whether for commercial reasons or personal matters, everyone must face legal circumstances at some point in their lives.

Completing legal paperwork requires meticulous consideration, starting with selecting the proper form template.

Once it is downloaded, you can complete the form using editing applications or print it out and complete it manually. With an extensive US Legal Forms inventory available, you do not have to waste time searching for the correct sample across the web. Make use of the library’s straightforward navigation to find the suitable template for any event.

- For instance, if you choose an incorrect version of an Action Limitations With 500, it will be rejected upon submission.

- Thus, it is crucial to obtain a trustworthy source of legal documents such as US Legal Forms.

- If you need to obtain an Action Limitations With 500 template, follow these simple steps.

- Acquire the sample you require by utilizing the search bar or catalog navigation.

- Examine the form’s description to ensure it suits your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong form, return to the search function to locate the Action Limitations With 500 sample you need.

- Download the file if it satisfies your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not yet have an account, you may download the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the profile registration form.

- Choose your payment method: you can use a credit card or PayPal.

- Select the document format you desire and download the Action Limitations With 500.

Form popularity

FAQ

For example, if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower. If the trader is looking to sell shares of XYZ's stock with a $14.50 limit, the trader will not sell any shares until the price is $14.50 or higher.

So, for example, if a trader was looking to buy EURUSD and the current price is 1.3050, he may decide to put the Price at 1.3150 because he believes it will reach that point. But, because he believes that it will reverse and start going back down, he places a Buy order with a Stop Limit Price at 1.3100.

For example, if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower. If the trader is looking to sell shares of XYZ's stock with a $14.50 limit, the trader will not sell any shares until the price is $14.50 or higher.

Why Is My Limit Order Not Being Filled? Bear in mind that, for a buy limit order, you've set the highest price at which you want to buy shares. Thus, your order fills only if the market trades at that price or better. If the market is trading above your limit price, there's no guarantee your order will be executed.

To help avoid this situation, some traders place their limit order prices slightly above the best ask price for buy limit orders or slightly below the best bid price for sell limit orders. This allows for a small amount of price fluctuation while still protecting the trader from an unexpected price execution.