Modify Amend Withholding Tax

Description

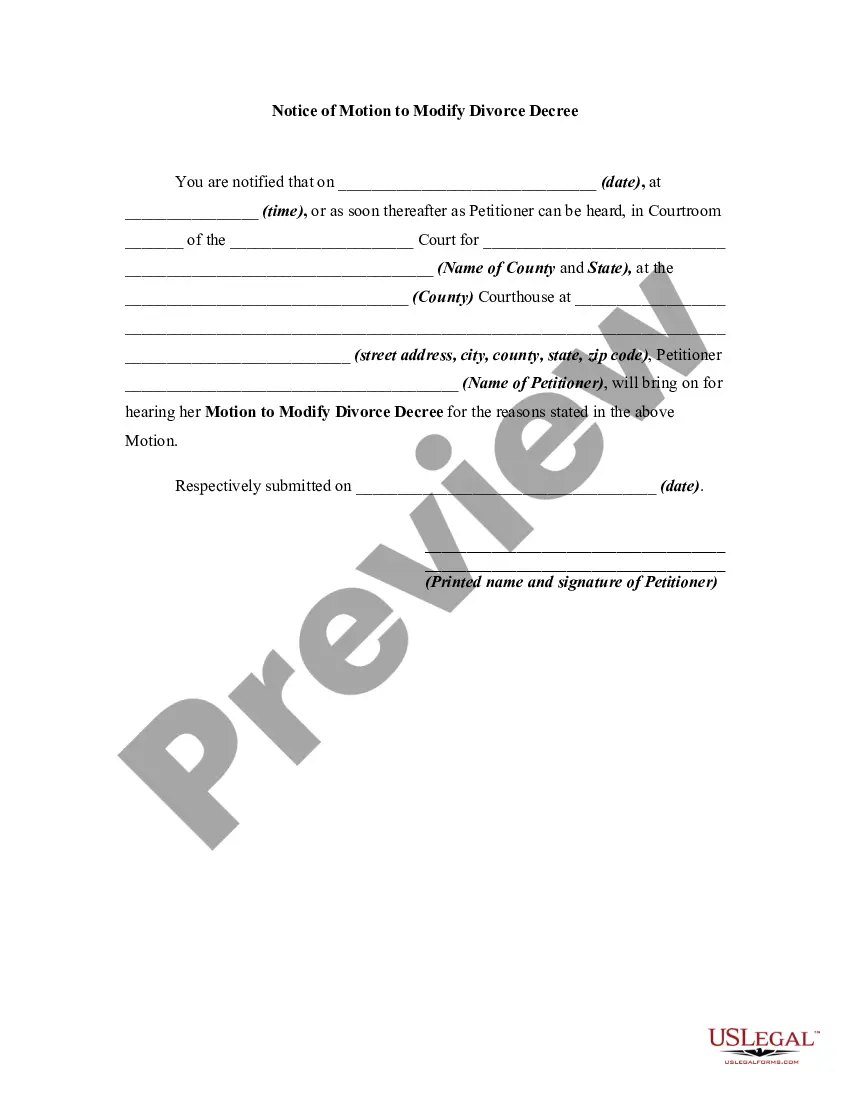

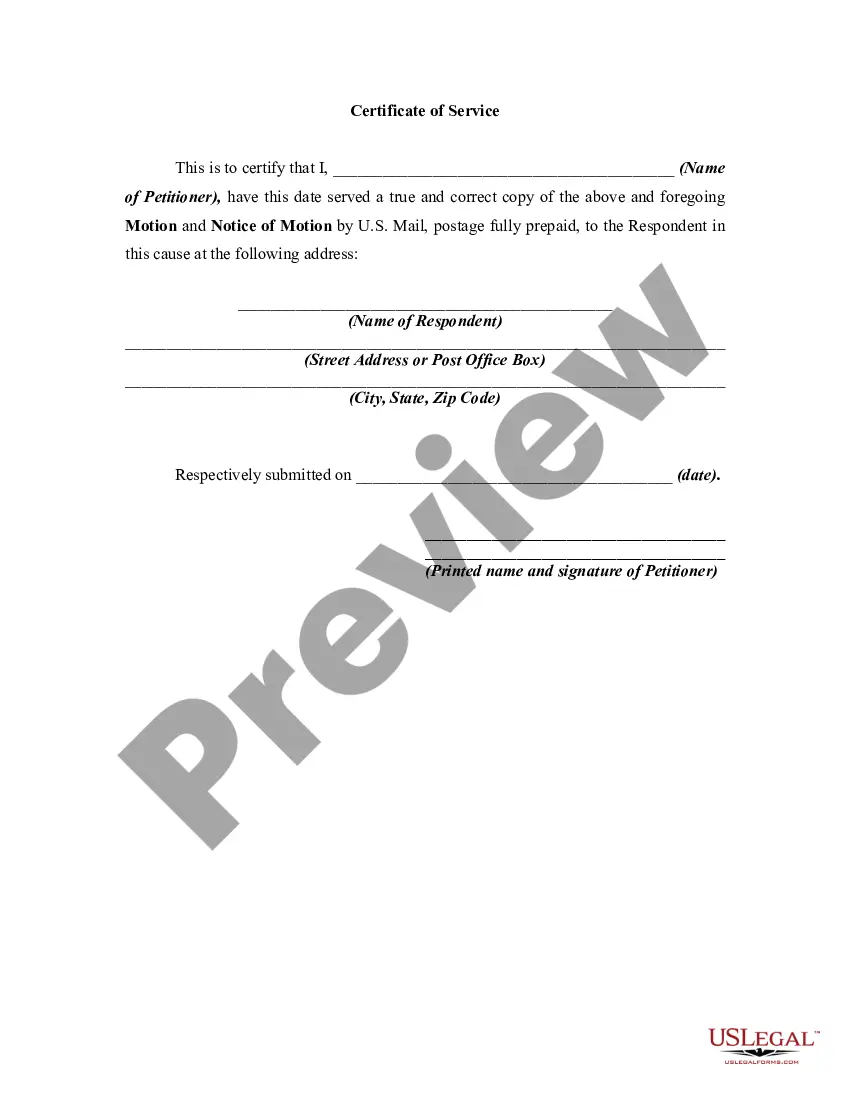

How to fill out Motion To Modify Or Amend Divorce Decree To Change Name Back To Married Name?

Obtaining legal templates that meet the federal and regional laws is crucial, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the appropriate Modify Amend Withholding Tax sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and life scenario. They are easy to browse with all papers collected by state and purpose of use. Our professionals keep up with legislative updates, so you can always be confident your form is up to date and compliant when obtaining a Modify Amend Withholding Tax from our website.

Obtaining a Modify Amend Withholding Tax is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, follow the steps below:

- Examine the template utilizing the Preview feature or through the text outline to make certain it meets your needs.

- Look for another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Modify Amend Withholding Tax and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

The IRS form for amending a return is Form 1040-X. You'll also need any forms that will be impacted by your change. For example, if you're changing your itemized deductions, you'll also need a copy of Schedule A for that tax year.

Submitting the request for Rectification Go to the 'S?ervices ' menu and Click 'Rectification' link. Click no '+ New Request' Select order passed under 'Income Tax' or 'Wealth Tax' & Assessment year and click on proceed. Select any one of the following options of 'Request Type' from list and submit the request.

Section 119 ? In brief In addition, section 119(2)(b) empowers CBDT to direct income tax authorities to allow any claim for exemption, deduction, refund and any other relief under the income tax act even after the expiry of the time limit to make such claim.

Return Filed Under Section 119(2)(b) To help taxpayers with genuine hardship the CBDT may authorise the income-tax authority to admit a belated application or claim for any deduction, exemption, refund or any other relief even after the expiry of the period specified under the Act for making such claim or application.

Section 119(2)(b) provides that CBDT for avoiding genuine hardship authorise income tax authority to admit an belated application or claim for any deduction, exemption, refund or any other relief even after the expiry of the period specified under the Act for making such claim or application.