Name Change Application Process With Irs

Description

How to fill out Affidavit In Of Good Character In Connection With Petition For A Name Change?

Drafting legal documents from scratch can sometimes be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more cost-effective way of creating Name Change Application Process With Irs or any other paperwork without jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of more than 85,000 up-to-date legal forms covers almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-compliant templates carefully prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Name Change Application Process With Irs. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to register it and explore the library. But before jumping directly to downloading Name Change Application Process With Irs, follow these tips:

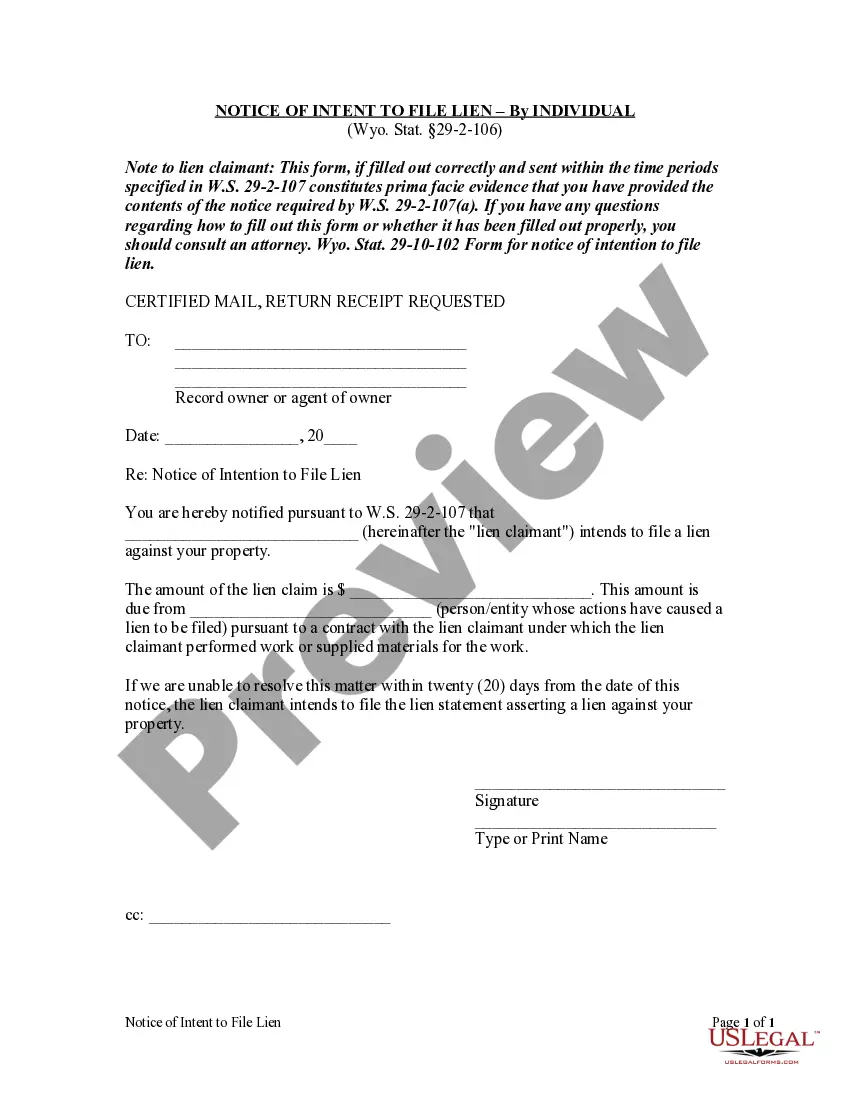

- Review the form preview and descriptions to ensure that you are on the the document you are searching for.

- Make sure the form you choose conforms with the requirements of your state and county.

- Choose the right subscription option to get the Name Change Application Process With Irs.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us now and transform document execution into something easy and streamlined!

Form popularity

FAQ

By Form. To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party ? Business and send them to the address shown on the forms.

You can use Form 8822 to notify the Internal Revenue Service if you changed your home mailing address.

Contents of the Name Change Letter Your current EIN. The old name of the business as mentioned in the IRS records. Complete address of the business as it exists in the IRS records. The new name of your business. Date from which the name has been changed. New address if applicable.

If you change your name soon after you file your annual tax return, then you can inform the IRS of the EIN number change name through a signed notification, similar to a sole proprietorship.

Whether you file Form SS-5 at your local Social Security office or by mail, you'll need to provide documents to support your legal name change, such as an original or certified copy of your marriage certificate. For more information, go to IRS.gov.