Buyout Contract Template For Startup

Description

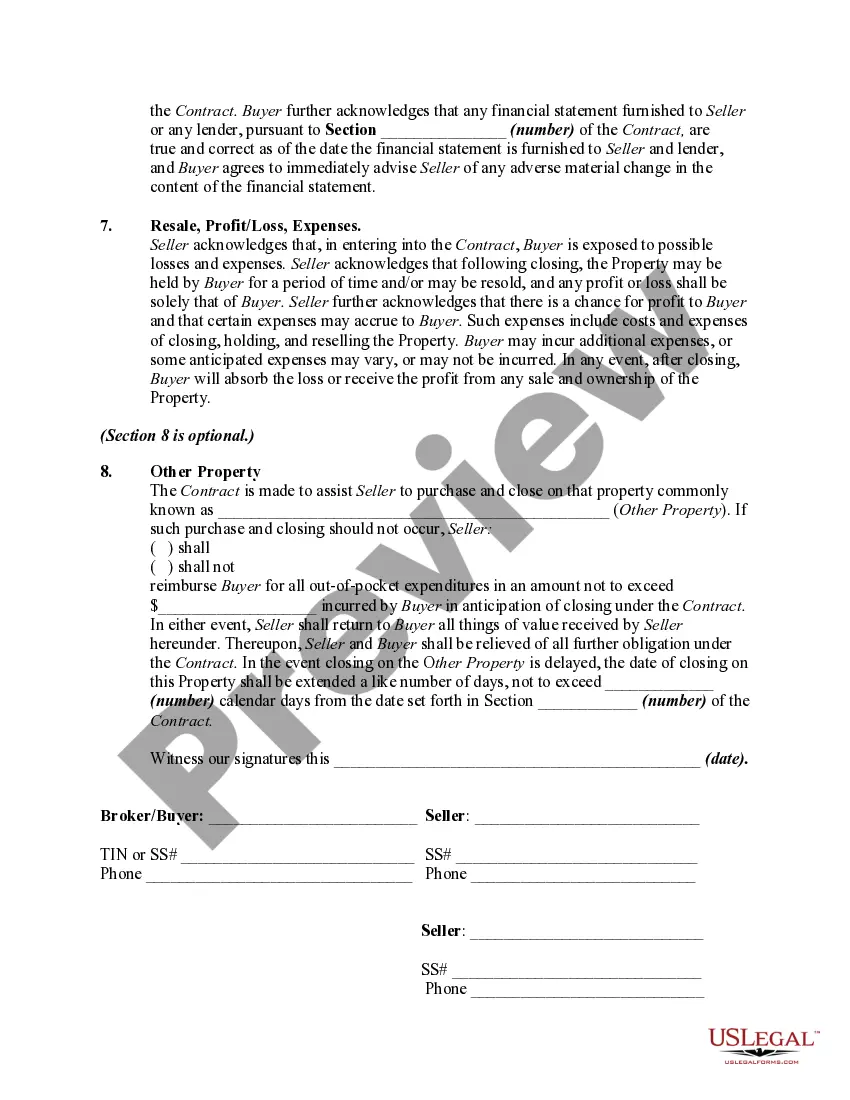

How to fill out Real Estate Broker BuyOut And Price Addendum To Contract To Buy And Sell Real Estate?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you are seeking a simpler and more cost-effective method of preparing a Buyout Contract Template for Startup or any other documentation without unnecessary complications, US Legal Forms is always accessible.

Our online repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters.

Examine the form preview and descriptions to ensure you have located the document you need. Verify that the form you choose adheres to the rules and regulations of your state and county. Select the appropriate subscription plan to purchase the Buyout Contract Template for Startup. Download the document. Then complete, sign, and print it. US Legal Forms boasts a strong reputation and over 25 years of expertise. Join us now and make document preparation a straightforward and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously crafted by our legal experts.

- Utilize our platform whenever you require dependable and trustworthy services that allow you to quickly find and download the Buyout Contract Template for Startup.

- If you’re already familiar with our services and have created an account with us before, simply Log In to your account, find the document, and download it or retrieve it later from the My documents section.

- Not signed up yet? No problem. Registering is quick and easy, and navigating the library is straightforward.

- However, before diving straight into downloading the Buyout Contract Template for Startup, consider these suggestions.

Form popularity

FAQ

To get a buyout agreement, start by identifying the specific terms you need for your situation. You can use a buyout contract template for startup to simplify the process. This template provides a clear structure, ensuring you cover key elements like valuation, payment terms, and responsibilities. Additionally, consider using a reliable platform like US Legal Forms, which offers customizable templates and expert support to help you create a solid buyout agreement.

To write a simple agreement between two parties, start by defining the purpose of the agreement and clearly stating the responsibilities of each party. Include essential details such as payment terms, deadlines, and any other relevant conditions. Utilizing a buyout contract template for startup from USLegalForms can provide a straightforward structure that makes the agreement easy to understand and enforce.

Yes, an LLC should have a buy-sell agreement to protect the interests of its members. This agreement outlines the procedures for transferring ownership in case of events like death, retirement, or voluntary exit. Having a buyout contract template for startup ensures that your agreement is comprehensive and legally sound, reducing potential conflicts in the future.

A typical buyout offer generally includes the valuation of the member’s share based on the company’s current worth. It may take into account factors like assets, liabilities, and projected revenue. When preparing for negotiations, having a well-structured buyout contract template for startup can guide you through the process and ensure fairness.

A: A buyout agreement should include all matters related to the transfer of ownership or control of a business, such as details about the purchase price, payment terms, transfer of assets or debts, warranties and indemnities, and any restrictions on future activities by either party.

A sample buyout clause might read, "If a third-party seller wishes to assume the duties of Corporation A to act as the seller under this agreement, the buyer must agree to the arrangement in writing, and the third party must pay a sum of $10,000 to Corporation A."

There are generally three options for structuring a merger or acquisition deal: Stock purchase. The buyer purchases the target company's stock from its stockholders. ... Asset sale/purchase. The buyer purchases only assets and assumes liabilities that are specifically indicated in the purchase agreement. ... Merger.

A buyout agreement should include details such as the purchase price, payment terms, the triggering event that would initiate the buyout, and any restrictions on the sale of ownership interests.

For example, three doctors could form a joint practice, and the doctors can agree to a buyout agreement where all remaining doctors can buy a doctor's ownership for $1,000,000 upon retirement.