Property Deed For Transfer

Description

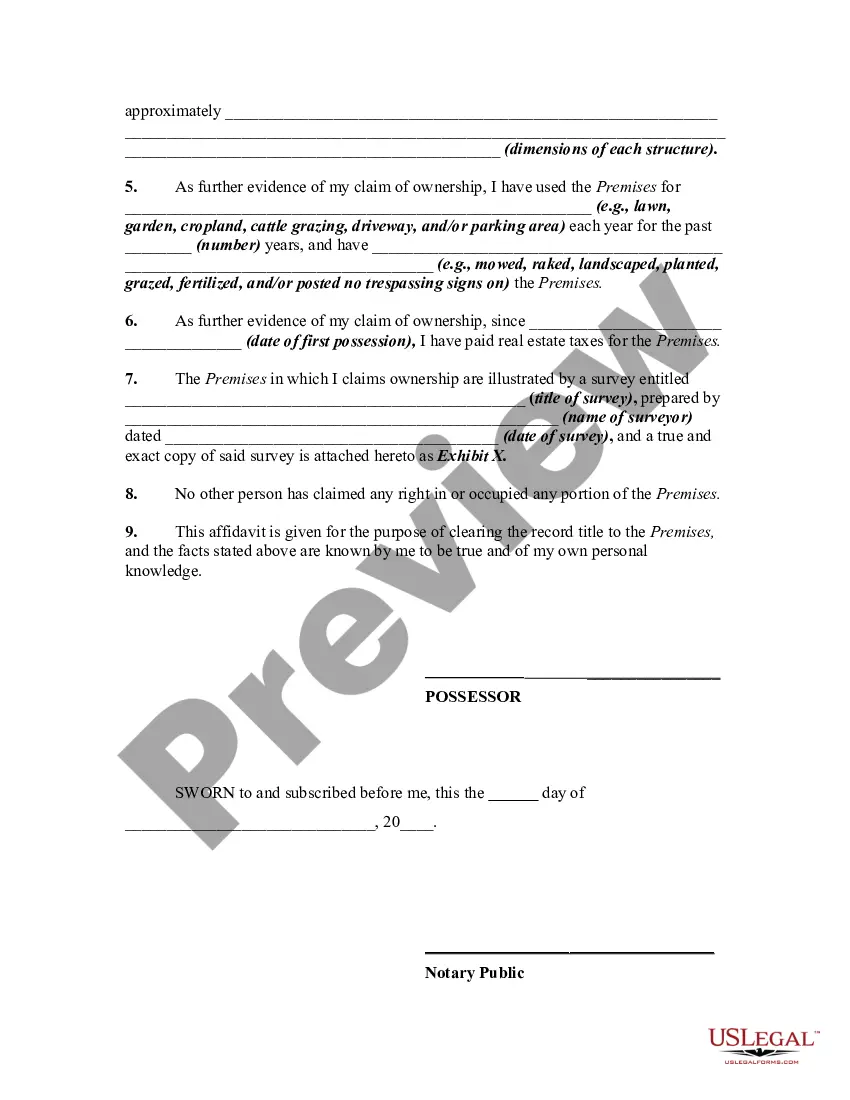

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

Legal documents handling can be daunting, even for the most adept professionals.

When you are seeking a Property Deed For Transfer and lack the time to search for the correct and updated version, the processes can be stressful.

Access a knowledge base of articles, guides, and resources pertinent to your situation and requirements.

Save time and energy searching for the documents you require, and take advantage of US Legal Forms’ sophisticated search and Preview feature to obtain Property Deed For Transfer.

Make sure the sample is valid in your state or county. Choose Buy Now once you are prepared. Select a subscription plan. Choose the format you want, then Download, fill out, sign, print, and send your document. Leverage the US Legal Forms online catalogue, supported by 25 years of expertise and reliability. Enhance your daily document management into a simple and user-friendly experience today.

- If you possess a membership, Log In to your US Legal Forms account, locate the form, and acquire it.

- Visit the My documents tab to check the documents you have previously saved and manage your folders as needed.

- If it is your first experience with US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- Here are the steps to follow after obtaining the form you desire.

- Ensure it is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to all requirements you might have, ranging from personal to business paperwork, all in one location.

- Utilize advanced tools to fill out and manage your Property Deed For Transfer.

Form popularity

FAQ

You do not need a lawyer to transfer property in Pennsylvania, but having one can be beneficial for complex cases. Completing a property deed for transfer requires attention to detail to avoid legal issues. US Legal Forms offers straightforward resources and templates that empower you to handle the transfer process effectively on your own.

In Pennsylvania, the seller typically pays the deed transfer tax, but this can be negotiated in the sale agreement. When preparing a property deed for transfer, it’s crucial to understand who is responsible for these taxes. Check local regulations or consult platforms like US Legal Forms for assistance in navigating this process.

You do not necessarily need an attorney to add someone to a deed, but having one can help clarify the process. A property deed for transfer that includes additional names must meet specific legal requirements. Using resources from US Legal Forms ensures you complete the necessary forms correctly, reducing the chance of making costly mistakes.

The easiest way to transfer ownership of a house is by executing a property deed for transfer. This legal document outlines the change of ownership and should be filled out correctly. Working with platforms like US Legal Forms can simplify this process, allowing you to access accurate templates and guidance for your specific needs.

Transferring a property deed in North Carolina does not legally require a lawyer; however, having legal assistance can simplify the process. A lawyer can help ensure that all documentation is correctly completed and filed, reducing the risk of future disputes. If you prefer to manage this on your own, uslegalforms provides user-friendly solutions to facilitate the property deed for transfer process. Ultimately, the choice depends on your comfort level with legal documents.

To receive the deed to your house, you generally need to complete the property deed for transfer process. This includes having the deed signed and notarized, then recorded at the local county register of deeds. After recording, the office will provide you with a copy of the deed, which serves as proof of ownership. If you need assistance with this process, uslegalforms offers clear guidance on handling property deeds.

Transferring a property title in Michigan involves drafting a property deed for transfer, which must clearly specify the parties involved and the property being transferred. After you complete and sign the deed in the presence of a notary, you will need to record it with your county's register of deeds. It's essential to ensure compliance with state laws throughout this process. For guidance, consider using USLegalForms to access templates and instructions tailored to Michigan's requirements.

To transfer property from one person to another in Michigan, you will need to prepare a property deed for transfer. This deed must be filled out correctly, signed in front of a notary, and filed with the county clerk's office. You should also check for any additional local regulations or taxes that may apply. Utilizing platforms like USLegalForms can help ensure everything is completed accurately.

The best way to transfer a property title between family members is to use a property deed for transfer. This legal document clearly indicates the change in ownership. It is important to ensure that all requirements are met, including notarization and recording with local authorities. Using a service like USLegalForms can simplify this process, making it easy to create the necessary paperwork.

The best way to transfer a property to a family member is through a properly executed property deed for transfer. Consider using a quitclaim deed if the transfer is informal and between trusted family members. Always ensure that the deed is notarized and recorded with the local government to protect everyone’s interests. Using uslegalforms can help you create a legally binding document.