Texas Parole Release For Release

Description

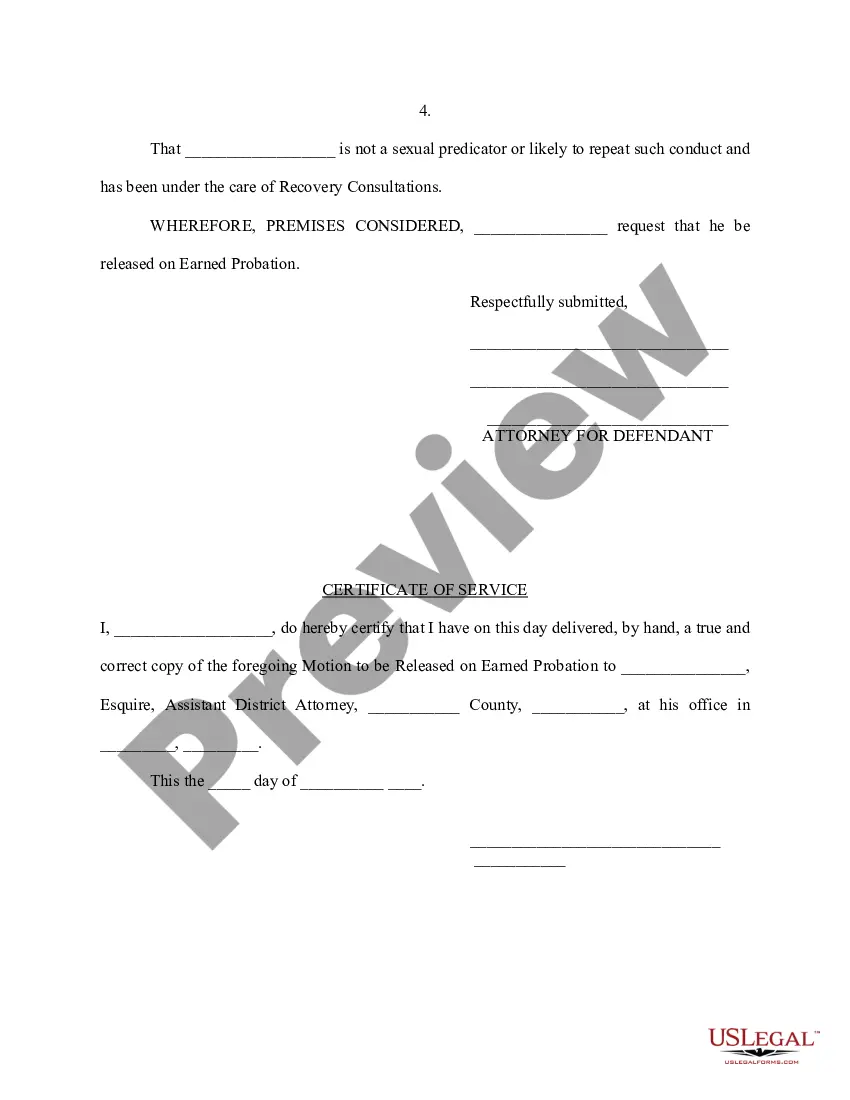

How to fill out Motion To Release On Earned Probation?

The Texas Parole Release For Release you find on this webpage is a versatile legal template crafted by expert attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, organizations, and legal practitioners more than 85,000 validated, state-specific documents for a variety of business and personal events. It represents the quickest, most uncomplicated, and most reliable method to obtain the forms you require, as the service ensures top-notch data security and anti-malware measures.

Register with US Legal Forms to have confirmed legal templates for all of life's situations readily available.

- Search for the document you need and examine it.

- Browse through the file you searched and preview it or verify the form description to ensure it meets your requirements. If it does not, utilize the search tool to find the correct one. Click Buy Now when you have found the template you need.

- Subscribe and Log In.

- Select the pricing option that works for you and create an account. Use PayPal or a credit card for immediate payment. If you already have an account, Log In and view your subscription to proceed.

- Access the editable template.

- Choose the format you want for your Texas Parole Release For Release (PDF, Word, RTF) and save the document on your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to swiftly and accurately complete and sign your form with a valid signature.

- Download your documents again.

- Use the same document again as needed. Visit the My documents tab in your profile to redownload any previously saved forms.

Form popularity

FAQ

The 41-day rule for parole in Texas refers to the maximum period that can pass before your choice for parole is decided. This rule aims to ensure timely decisions, allowing for a smoother transition once you qualify for Texas parole release for release. Additionally, knowing this rule helps manage your expectations and plan for your release effectively. It’s recommended to consult your parole officer or legal expert for personalized advice.

The three categories of release management in Texas include administrative release, conditional release, and absolute release. Administrative release is based on the fulfillment of requirements set by the parole board. Conditional release means the individual must adhere to specific terms, while absolute release occurs when an individual no longer has conditions tied to their release, allowing for full freedom.

The lien is effective from the date on which the security interest is noted on the certificate of title for a period of ten (10) years, or in the case of a manufactured home for a period of thirty (30) years or until discharged. Liens filed on or before 7-14-2016 are only valid for seven (7) years.

The deadline to file a Kentucky mechanics lien is 6 months from last providing materials or labor. An action to enforce a Kentucky mechanics lien must be commenced within 12 months from the date on which the lien was filed.

About Kentucky Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

If you file a lien, you need to provide proof of this service by affidavit and proof of mail delivery. The notice typically includes a description of the work or goods you will provide, the estimated total price of the work or goods you will provide, and the statutorily required statement.

This form advises the party that a lien will be filed if payment is not received within 10 days. Since this is a non required document, you can deliver it electronically, or via mail. Sendinging documents via certified mail always adds another layer of professionalism to your payment practices.

To attach a lien, the creditor records the judgment with the county clerk for the Kentucky county where the debtor has property now or may have any property in the future.

Ing to the mechanics lien law, after your notices are served timely the lien must be filed in the county recorder's office in the county where the property is located. The lien may either be served by certified mail, return receipt requested, or personally served on each of the parties.

If the married couple or joint owners of a property do not have a tenancy by the entireties title, any lien can attach to the person's interest in the property. Whether it's judgment or confessed judgment, the lien will attach to the homeowner's interest, making the lienor a co-owner of the property.