State Of Texas Gov Forms Withholding

Description

How to fill out Security Agreement - Short Form?

Legal papers managing can be overwhelming, even for knowledgeable specialists. When you are interested in a State Of Texas Gov Forms Withholding and don’t have the a chance to spend looking for the correct and updated version, the procedures might be stress filled. A strong web form library might be a gamechanger for everyone who wants to take care of these situations effectively. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms accessible to you at any time.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any needs you could have, from personal to enterprise papers, all in one spot.

- Employ innovative tools to accomplish and deal with your State Of Texas Gov Forms Withholding

- Gain access to a resource base of articles, tutorials and handbooks and materials relevant to your situation and needs

Save effort and time looking for the papers you will need, and use US Legal Forms’ advanced search and Preview tool to get State Of Texas Gov Forms Withholding and get it. If you have a membership, log in for your US Legal Forms account, search for the form, and get it. Review your My Forms tab to view the papers you previously downloaded as well as to deal with your folders as you can see fit.

Should it be the first time with US Legal Forms, create an account and get unrestricted access to all benefits of the platform. Listed below are the steps to consider after accessing the form you need:

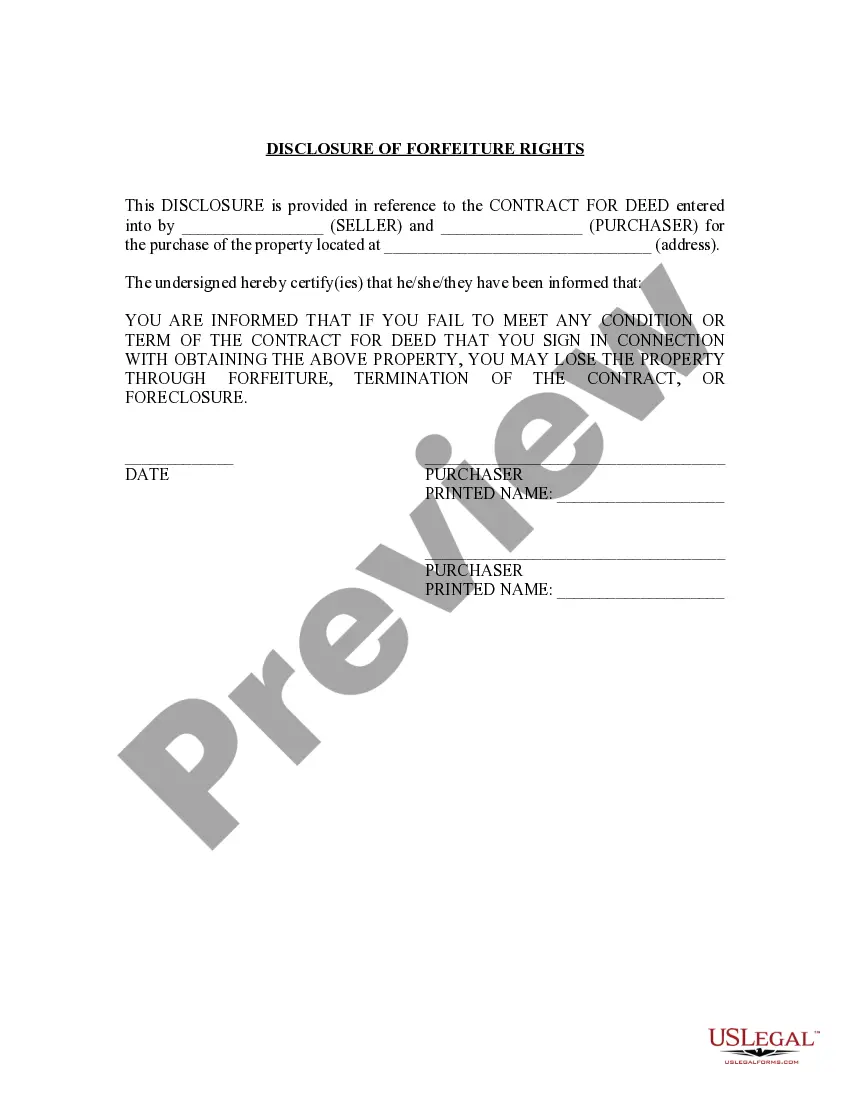

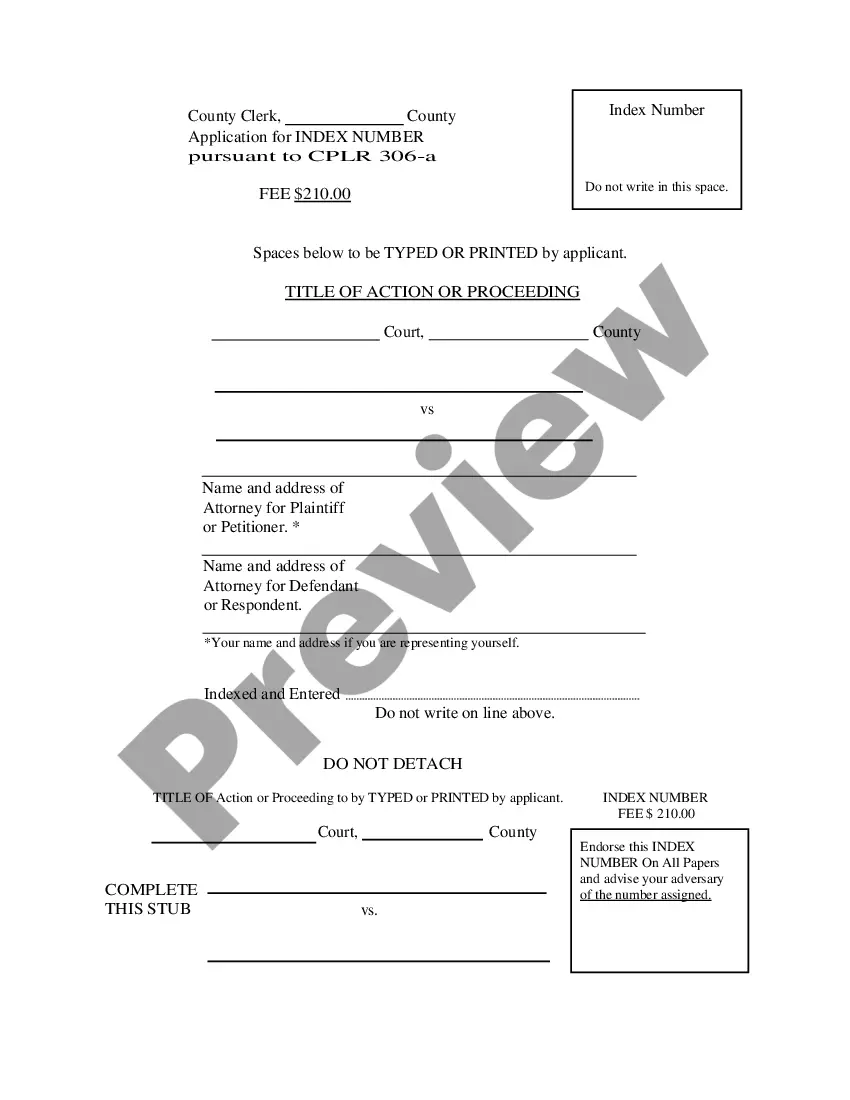

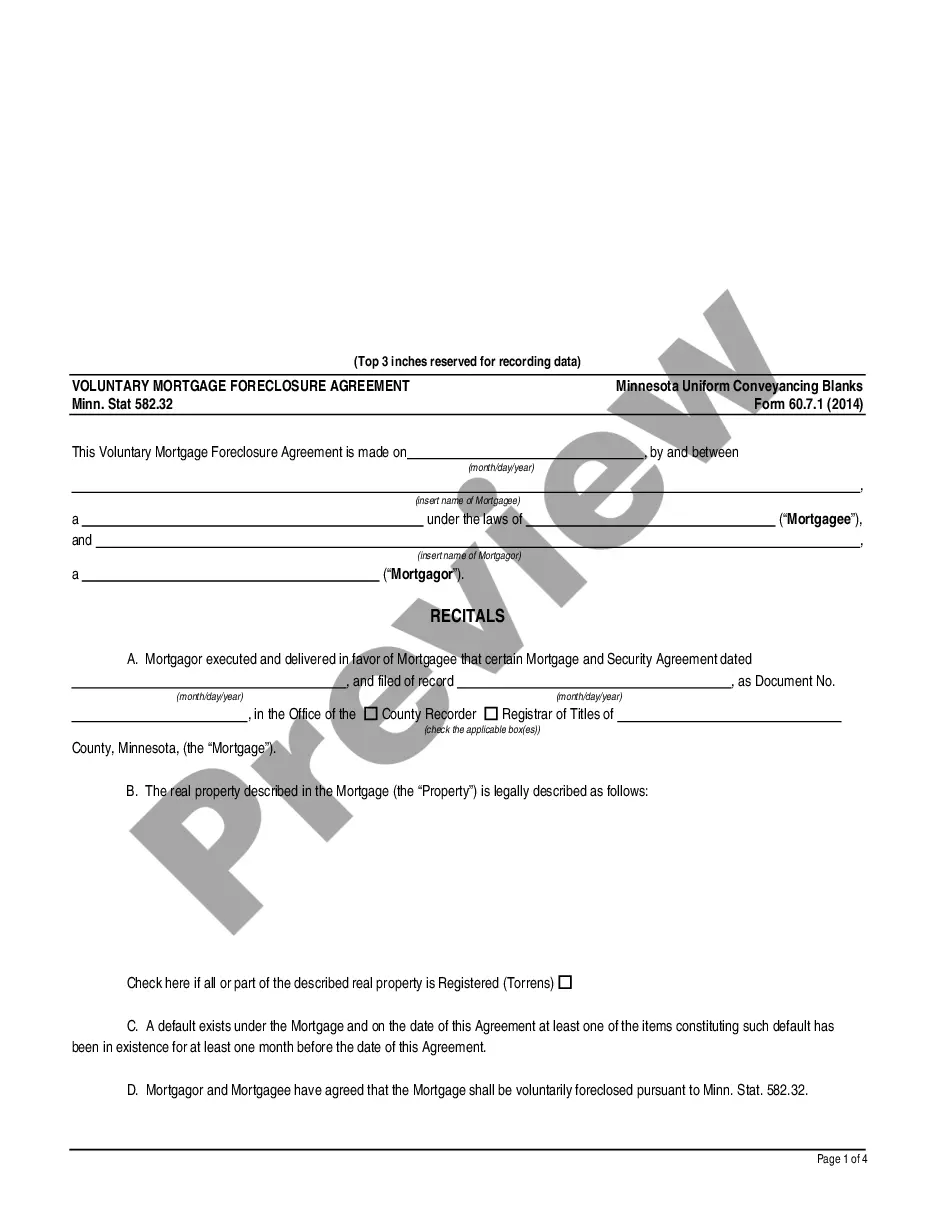

- Validate it is the proper form by previewing it and reading through its information.

- Be sure that the sample is acknowledged in your state or county.

- Choose Buy Now once you are all set.

- Select a subscription plan.

- Pick the formatting you need, and Download, complete, eSign, print out and send out your papers.

Take advantage of the US Legal Forms web library, backed with 25 years of experience and stability. Transform your day-to-day papers managing in a easy and user-friendly process right now.

Form popularity

FAQ

A resale certificate needs to include basic information, such as the names and addresses of the buyer and seller, the buyer's Texas sales tax permit number, and a general description of the items sold.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

Unless your employees work in a state with no state income tax, they generally must fill out the W-4 state tax form before starting a new job. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax.