Assignment Of Promissory Note By Lender With Personal

Description

How to fill out Promissory Note Assignment And Notice Of Assignment?

Handling legal paperwork and procedures might be a time-consuming addition to the day. Assignment Of Promissory Note By Lender With Personal and forms like it often need you to look for them and understand the best way to complete them correctly. As a result, whether you are taking care of economic, legal, or personal matters, using a comprehensive and convenient online library of forms on hand will go a long way.

US Legal Forms is the top online platform of legal templates, boasting over 85,000 state-specific forms and numerous resources to assist you complete your paperwork easily. Check out the library of appropriate documents available with just one click.

US Legal Forms offers you state- and county-specific forms offered by any time for downloading. Shield your document managing processes by using a high quality service that allows you to prepare any form within minutes without any additional or hidden cost. Just log in to the account, find Assignment Of Promissory Note By Lender With Personal and download it straight away from the My Forms tab. You may also access previously saved forms.

Is it your first time using US Legal Forms? Sign up and set up up your account in a few minutes and you will gain access to the form library and Assignment Of Promissory Note By Lender With Personal. Then, stick to the steps below to complete your form:

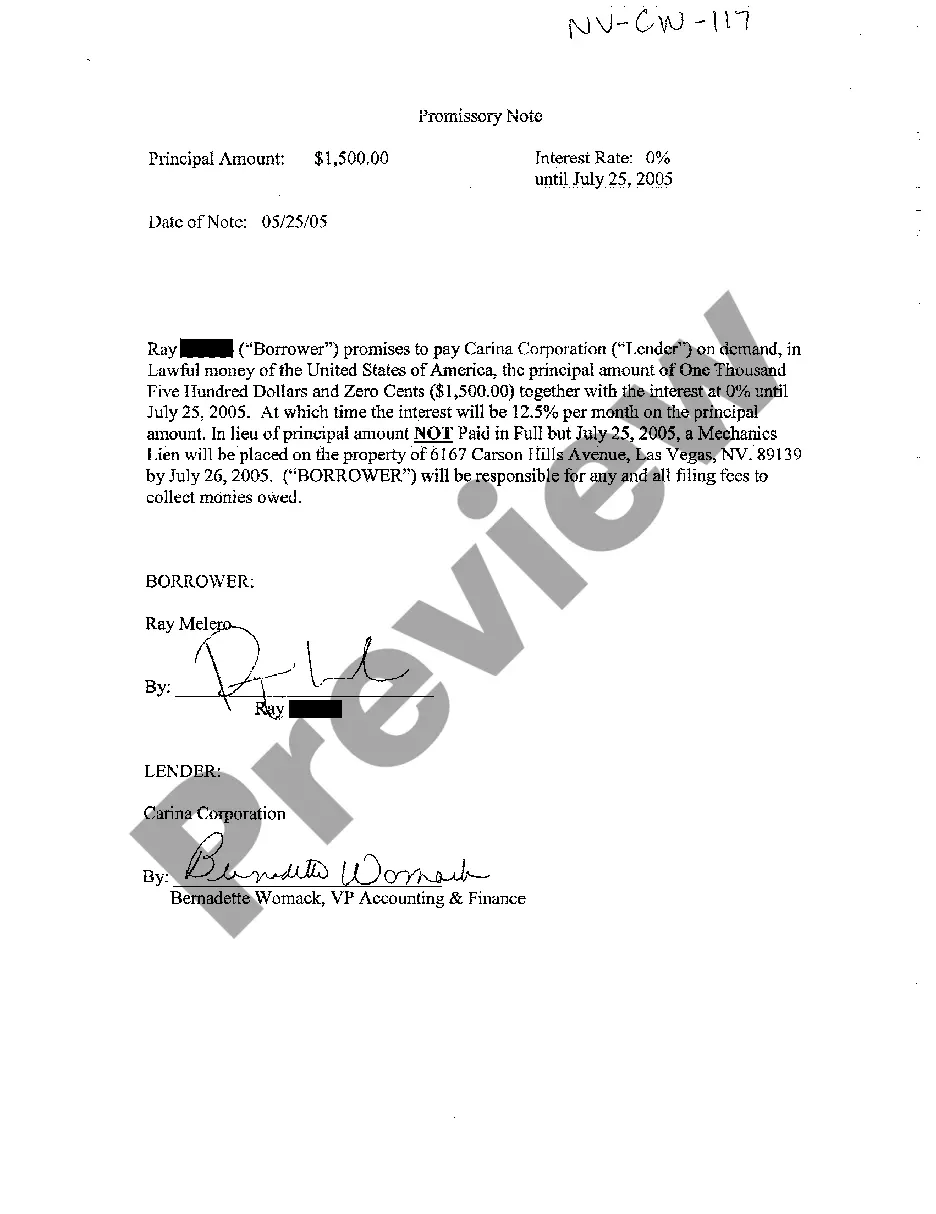

- Ensure you have discovered the proper form by using the Preview feature and reading the form description.

- Select Buy Now when all set, and select the monthly subscription plan that meets your needs.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise helping consumers manage their legal paperwork. Discover the form you want right now and enhance any process without breaking a sweat.

Form popularity

FAQ

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

By Practical Law Finance. A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee).

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

When you are applying for a loan to purchase a home, the lender may require you to sign a promissory note and a mortgage or a deed of trust. In the event that your loan is sold to another party, these documents will be transferred to the new owner with an assignment and an endorsement.

The transfer process of a promissory note typically involves the following steps: Conduct Due Diligence. Review the promissory note's obligations and terms. ... Negotiate and Draft the Transfer Contract. Determine the rights of the transferor and transferee. ... Obtain Consent and Approvals. ... Execute and Deliver the Transfer Contract.