Tip trusts, also known as Qualified Terminable Interest Property trusts, are estate planning tools that allow individuals to provide for their surviving spouse while still maintaining control over the distribution of their assets. These trusts are especially beneficial for couples with blended families or complex financial situations. In a nutshell, a Tip trust acts as a type of marital trust where the assets are transferred to the trust upon the death of the first spouse. The surviving spouse then receives income generated by the trust for the remainder of their life, with certain restrictions on the principal. Upon the surviving spouse's death, the remaining assets in the trust can be distributed to other beneficiaries, such as children from a previous marriage or family members. This type of trust ensures that the surviving spouse is financially supported during their lifetime while guaranteeing that the original granter's intended beneficiaries receive the assets afterwards. Tip trusts are especially useful in situations where there are concerns about the surviving spouse remarrying or mismanaging the assets, as the trustee can have control over the distribution. There are several variations of Tip trusts that can be utilized depending on the specific objectives and circumstances of the individuals involved: 1. Simple Tip Trust: This is the most basic form of a Tip trust where the surviving spouse receives income generated by the trust, and upon their death, the remaining assets pass to the designated beneficiaries. 2. TIP Marital Trust: This type of trust guarantees the surviving spouse's financial security while offering flexibility in choosing the ultimate beneficiaries of the trust assets after their passing. 3. TIP Bypass Trust: This trust allows for the preservation of estate tax exemptions by transferring assets above the exemption threshold into a bypass trust rather than directly to the surviving spouse. 4. Reverse TIP Trust: In certain scenarios, a reverse Tip trust allows the surviving spouse to disclaim or pass on the trust assets to other beneficiaries like children or grandchildren to minimize estate taxes. By implementing a Tip trust, individuals can ensure efficient wealth transfer while also addressing specific family dynamics and tax considerations. It is recommended to consult with a qualified estate planning attorney or financial advisor to determine the most suitable type of Tip trust based on individual needs and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Qtip Trusts Explained For Dummies - Living Trust - Irrevocable

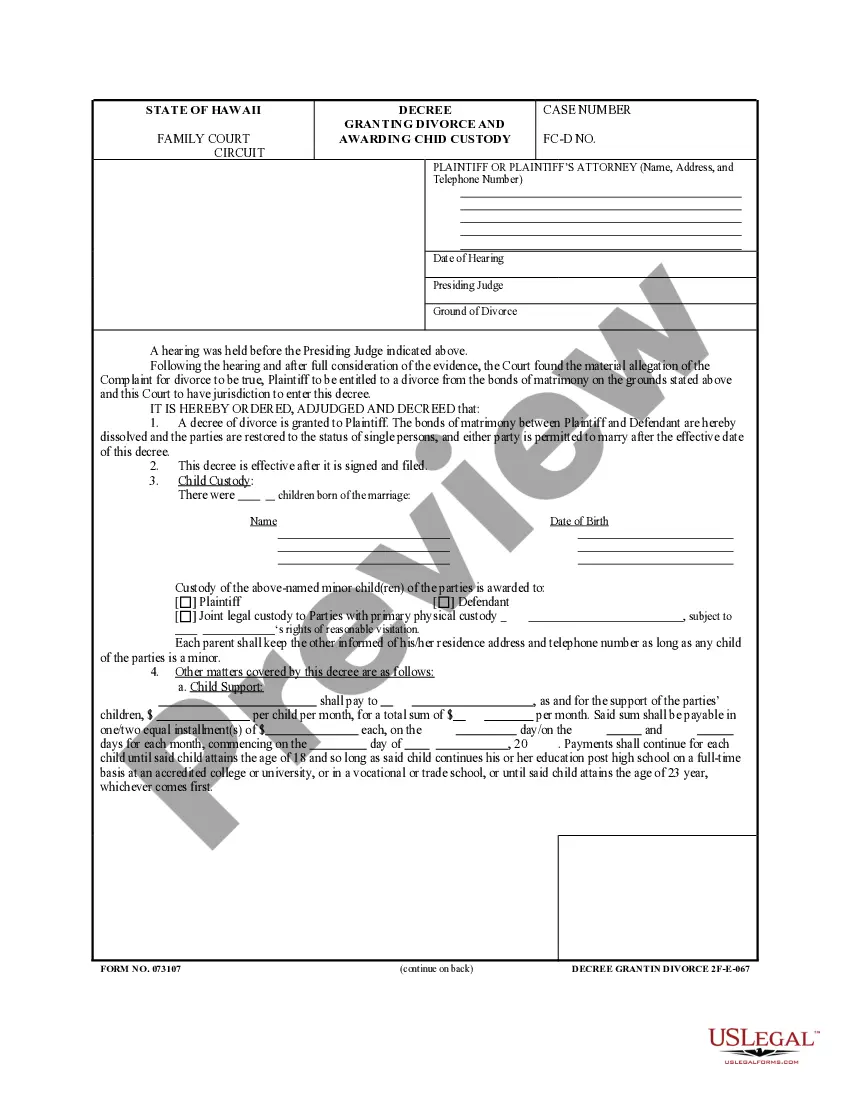

Description

How to fill out Qtip Trusts Explained For Dummies?

Legal papers management may be overwhelming, even for the most experienced experts. When you are searching for a Qtip Trusts Explained For Dummies and don’t get the time to devote searching for the correct and up-to-date version, the processes could be nerve-racking. A robust online form library can be a gamechanger for anybody who wants to deal with these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any demands you could have, from individual to enterprise papers, all in one spot.

- Utilize advanced resources to complete and manage your Qtip Trusts Explained For Dummies

- Gain access to a resource base of articles, tutorials and handbooks and materials relevant to your situation and requirements

Help save effort and time searching for the papers you will need, and employ US Legal Forms’ advanced search and Preview tool to discover Qtip Trusts Explained For Dummies and get it. In case you have a monthly subscription, log in to your US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the papers you previously downloaded as well as to manage your folders as you can see fit.

If it is your first time with US Legal Forms, register an account and acquire limitless use of all benefits of the library. Listed below are the steps to take after getting the form you want:

- Validate it is the right form by previewing it and reading its description.

- Ensure that the sample is accepted in your state or county.

- Select Buy Now once you are all set.

- Select a monthly subscription plan.

- Pick the formatting you want, and Download, complete, eSign, print out and send out your papers.

Take advantage of the US Legal Forms online library, backed with 25 years of expertise and stability. Enhance your day-to-day papers managing in a easy and user-friendly process right now.