Sample Letter To Be Removed From Mailing List With The Irs In Harris - Sample Letter for Opt-Out - Direct Mailing List

Description

Form popularity

FAQ

Reach out to the biggest offenders and politely state what you did here. “I appreciate you keeping me in the loop, but I am starting to lose control of my inbox. Can you please only cc me in the following instances: x, y, z? Thank you—I want to be as helpful as possible going forward.”

Sample Letter to the IRS Dear Sir/Madam, I am writing to request a correction to my tax return. My social security number is 123-45-6789, and I filed my tax return for the 2020 tax year. I received a notice from the IRS stating that I owe additional taxes due to an error in my return.

Write to explain why you disagree and include any documents and information you wish the IRS to consider, along with the bottom tear-off portion of the notice. Mail the information to the IRS address shown in the lower left part of the notice. Allow at least 30 days for a response.

Make a copy of the notice you received from the IRS and include it with your letter. In the first paragraph of your letter, explain why you are writing the IRS. Mention the date of their notice. For example, you can write, “I am writing to request an abatement of $4,512.33 as assessed in the notice sent 7/3/2017.”

Removing someone from your email list is very simple, and depending on the email client or marketing tools you use, the process of removing them is relatively the same. Go to your contacts, lists, subscribers, or audiences. Place a checkmark by each contact you want to remove. Choose to unsubscribe, or delete.

Just email all and say something like , our client is no longer involved in this action please take me off this email chain.

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

Write to explain why you disagree and include any documents and information you wish the IRS to consider, along with the bottom tear-off portion of the notice. Mail the information to the IRS address shown in the lower left part of the notice. Allow at least 30 days for a response.

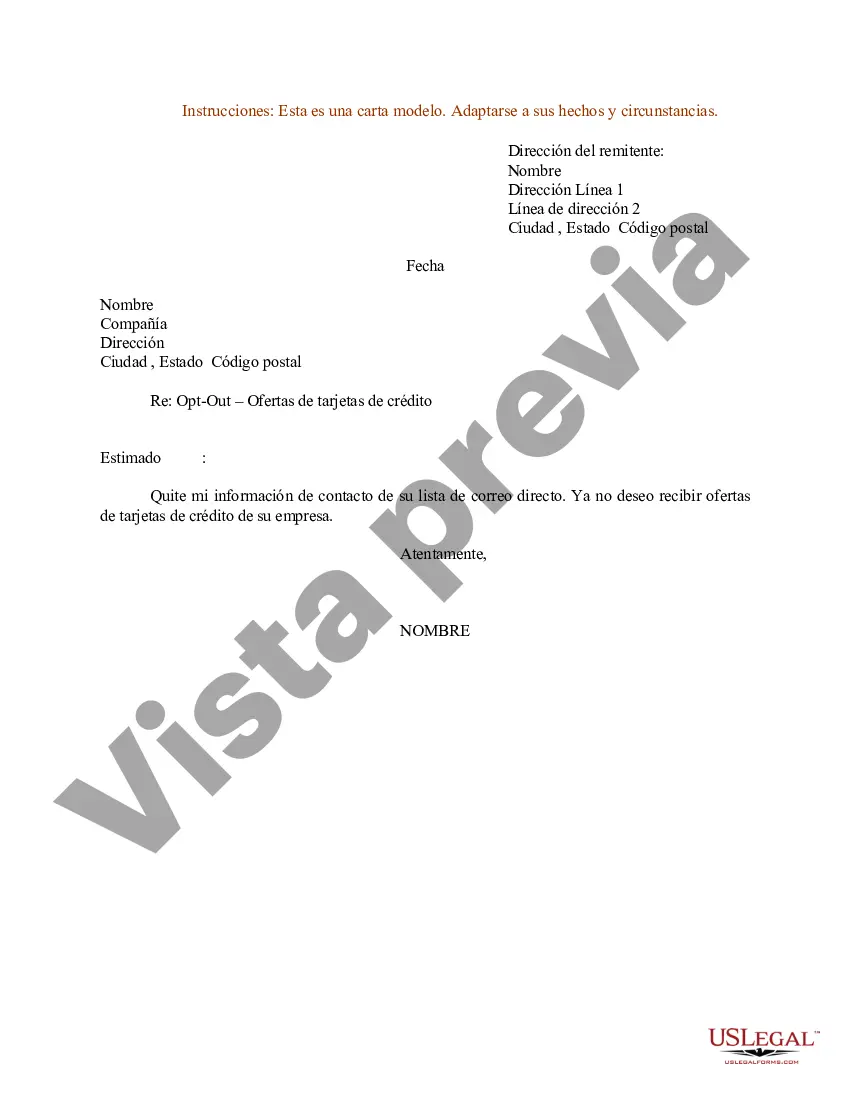

Dear Sir/Madam, This is a request that my personal information is removed from all of your mailing lists for unsolicited mail. I would like my name and address removed, effective immediately. You are currently sending unsolicited mail to: insert name, address, and zip code.

You may not use email for communications that do not satisfy the criteria described under “When you may use email.” Unless you're involved in an ongoing interaction with an IRS employee and they request a document by email, do not use email to respond to an IRS notice or to submit your original tax return to the IRS.