Texas 490

Description

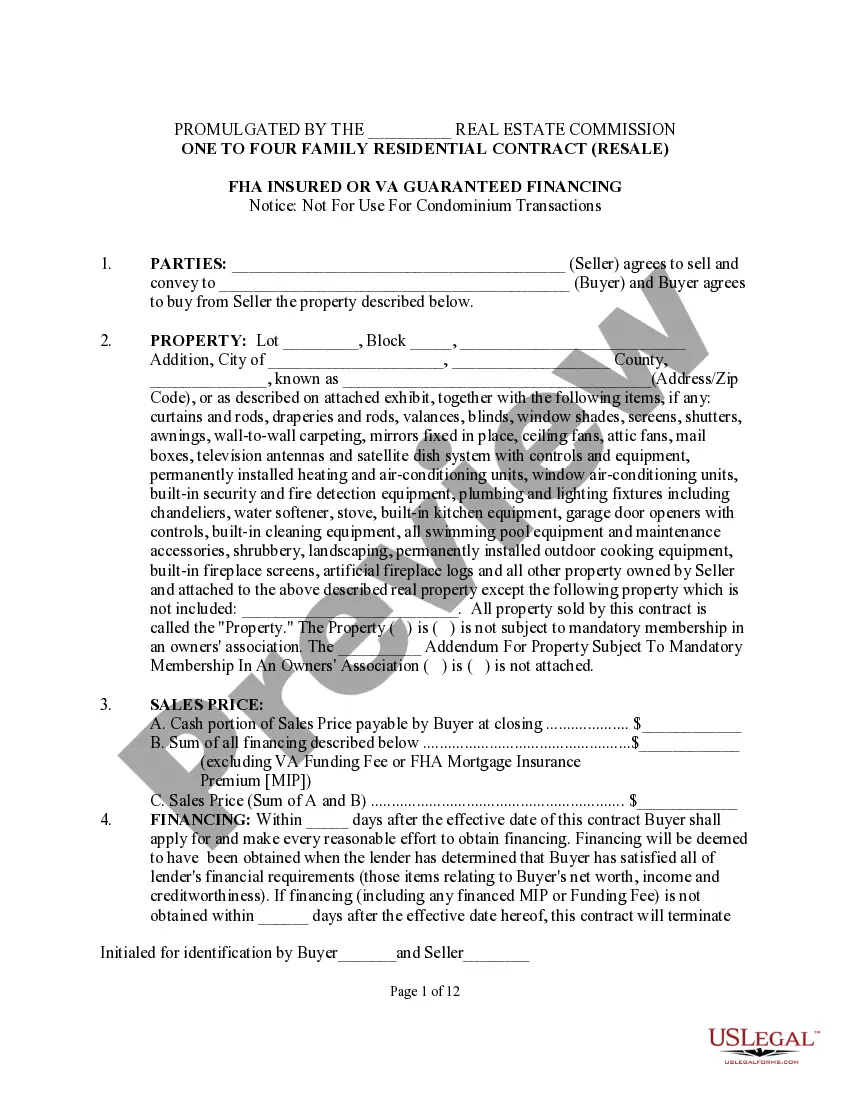

How to fill out Texas One To Four Family Residential Contract - Resale - All Cash, Assumption, Third Party Conventional Or Seller Financing?

- Start by logging into your US Legal Forms account. If you’re a first-time user, create an account to begin your journey.

- Browse the extensive online library and check the preview for Texas 490 documents that match your needs and local jurisdiction.

- If the form doesn’t meet your requirements, utilize the search feature to find a more suitable template.

- Once you select the correct document, click on 'Buy Now' and choose your preferred subscription plan to gain access to the library.

- Complete your purchase by providing payment information via credit card or PayPal.

- After payment, download your chosen form to your device for easy completion and access it anytime via 'My Forms'.

By using Texas 490 with US Legal Forms, you can ensure precision in your legal documents. This service not only offers a variety of forms but also grants access to expert advice to help you through the completion process.

Start simplifying your legal paperwork today with US Legal Forms. Explore the vast collection and find the tools you need for hassle-free document preparation!

Form popularity

FAQ

To fill out a Texas Two-Step lottery ticket, you need to make selections in two parts of the ticket. Start by choosing two numbers from the first set and then selecting four numbers from the second set. Be sure to accurately mark your choices and consider using the Quick Pick feature for ease. For an in-depth look at the ticket process, resources from USLegalForms can guide you through the requirements specific to Texas 490.

Filling out a Texas Lotto ticket requires you to select six numbers from a range of 1 to 54. Mark your numbers on the ticket or choose the Quick Pick option for randomly generated numbers. After you've made your selections, review them carefully to ensure accuracy. For a streamlined process, USLegalForms can provide helpful templates related to lottery forms for Texas 490.

To win the Texas Two Step lottery, you need to match at least four numbers, which include two from a specific set and two from another. Additionally, matching the bonus number can enhance your chances of winning. It's important to remember that the more numbers you match, the higher the prize tier. For more assistance with understanding the details of the lottery, you can always check out USLegalForms.

To fill out a Texas Two Step lottery ticket, begin by marking your chosen numbers in the appropriate sections of the ticket. You will need to select two numbers from one group and several from another. If you find it challenging, you can opt for a Quick Pick option for random numbers. Using resources from USLegalForms may help you navigate the ticket filling process more easily as it relates to Texas 490.

Filling out a lottery ticket involves selecting your numbers or opting for a quick pick. First, choose your preferred game and then mark your selections clearly on the ticket. Make sure to double-check your entries to avoid mistakes, as errors can affect your winnings. If you prefer a guided approach, consider using USLegalForms for tips on lottery ticket procedures related to Texas 490.

To fill out a Texas title transfer form, start by locating the title for the vehicle. Ensure all required fields, such as the buyer's name and address, seller's information, and vehicle details, are accurately completed. Don't forget to sign the form where indicated. You can use USLegalForms to access a correct and easy-to-understand title transfer form tailored for Texas 490.

Yes, an LLC in Texas is generally required to file a franchise tax return. This obligation applies even if your LLC does not owe taxes. Filing ensures your business maintains good standing within the state, which is critical for operations related to Texas 490. Timely and accurate filing can prevent potential penalties and headaches down the line.

Claiming unclaimed land in Texas requires you to follow specific procedures outlined by the state. First, check the Texas General Land Office for any unclaimed properties. Then, you may need to provide proof of ownership eligibility and complete any required forms. Utilizing platforms like uslegalforms can simplify this process related to Texas 490, giving you access to necessary resources.

Yes, you can file your Texas franchise tax return electronically. The Texas Comptroller provides an online portal specifically for this purpose, making the process quick and convenient. Electronic filing reduces paperwork and can streamline your compliance related to Texas 490. It's a preferred option for many businesses, ensuring timely submissions.

Filing the Texas franchise tax form involves several steps. First, determine the correct version of the form based on your business structure and revenue. You'll then fill out the necessary sections, ensuring accurate reporting of your financials related to Texas 490. Once completed, submit your form online or via mail to the Texas Comptroller's office on or before the due date.