Texas Hearing Form For Medicaid

Description

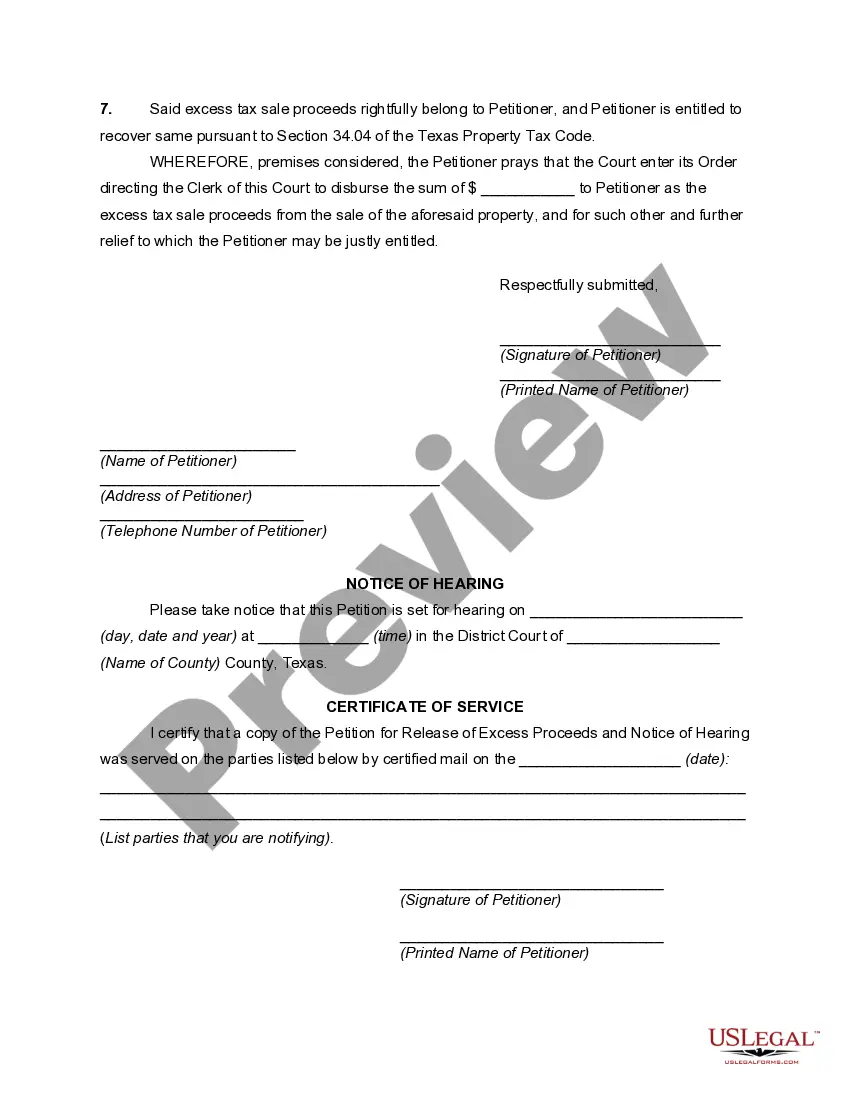

How to fill out Texas Petition For Release Of Excess Proceeds And Notice Of Hearing?

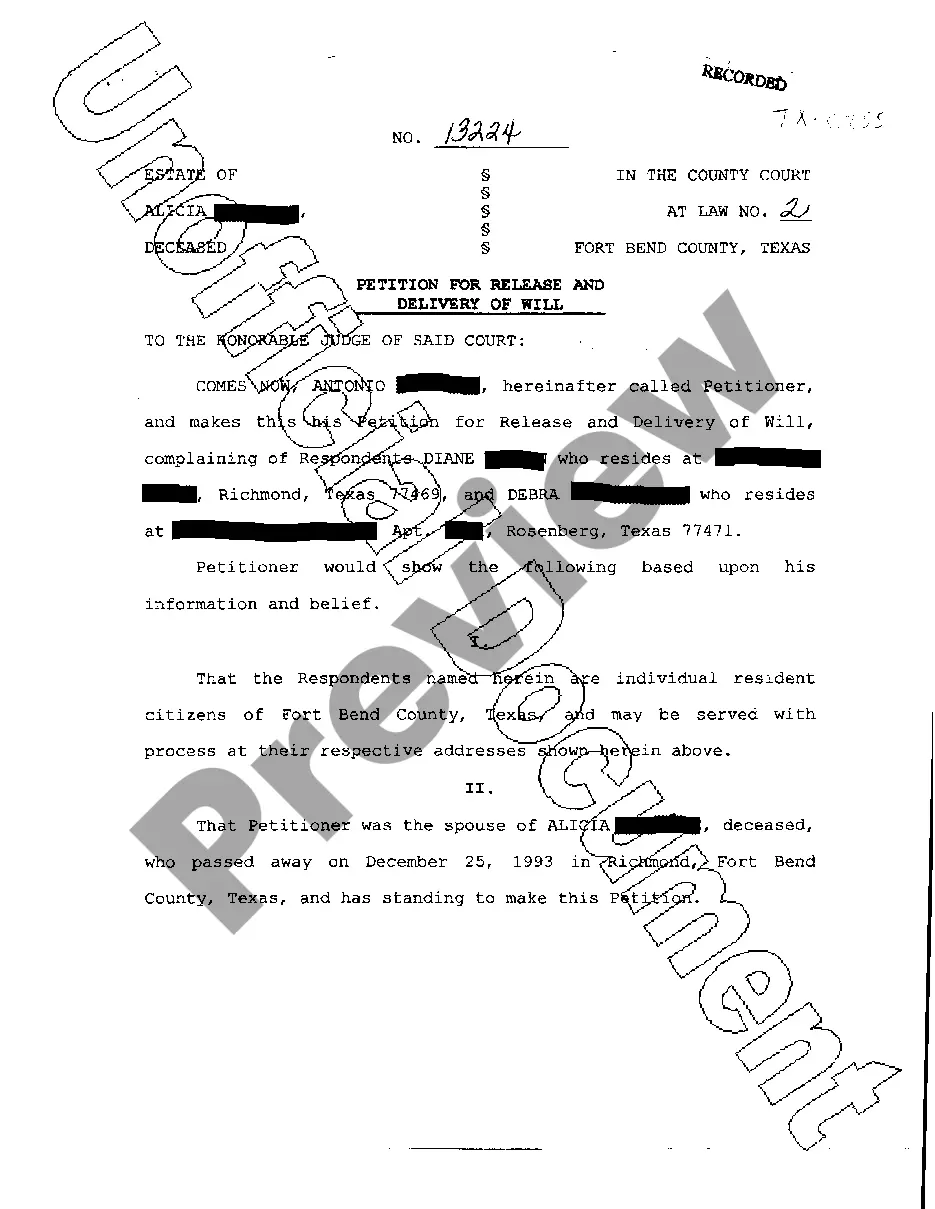

Securing a reliable source for acquiring the most up-to-date and pertinent legal documents is a significant part of navigating bureaucracy.

Locating the appropriate legal forms demands precision and careful consideration, which is why it is crucial to obtain samples of the Texas Hearing Form For Medicaid exclusively from trustworthy sources, such as US Legal Forms.

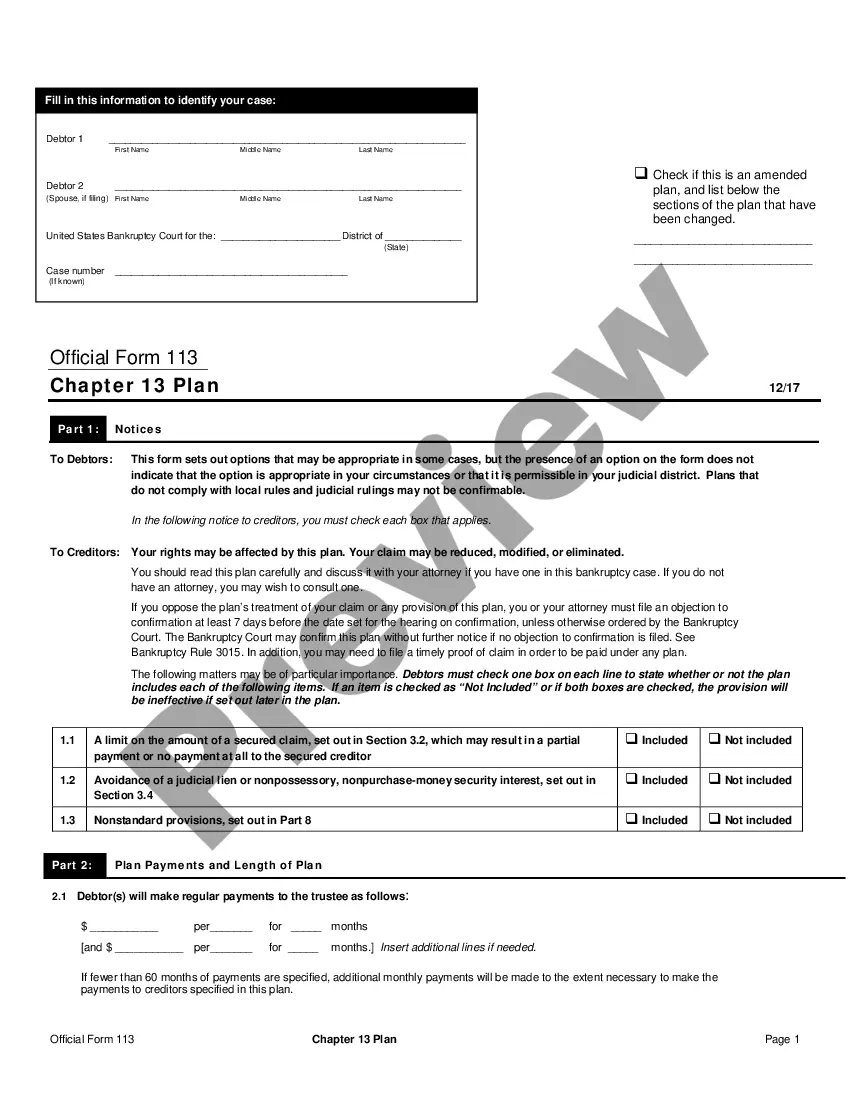

Once the form is on your device, you have the option to edit it using the editor or print it out to fill it in by hand. Eliminate the hassle tied to your legal documentation. Explore the vast collection at US Legal Forms where you can find legal templates, verify their applicability, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Examine the form's information to ensure it meets the needs of your state and locality.

- Preview the form, if available, to confirm that it is what you are looking for.

- Return to the search and identify the correct document if the Texas Hearing Form For Medicaid does not align with your requirements.

- Once you are confident in the form's applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you haven't set up a profile yet, click Buy now to acquire the form.

- Choose the pricing plan that best suits your needs.

- Proceed with registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Select the format for downloading the Texas Hearing Form For Medicaid.

Form popularity

FAQ

Name your Nebraska LLC. ... Choose your registered agent. ... Prepare and file certificate of organization. ... File an affidavit of publication. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

To start a corporation in Nebraska, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Secretary of State. You can file this document online or by mail. The articles cost a minimum of $65 to file.

If you have not yet formed a Nebraska business, you can become your own Nebraska registered agent when you fill out the formation documents. There is space on the formation documents for the address and name of the business' registered agent; put your information here.

How much does it cost to open an LLC in Nebraska? It costs $100 to start a Nebraska LLC. This is a one-time filing fee for the LLC Certificate of Organization when filed online. If you file the Certificate of Organization by mail instead, it costs a little more: $110.

As the owner of an LLC, you must pay self-employment tax and federal income tax, both of which are levied as ?pass-through taxation." Federal taxes can be complicated, so speak to your accountant or professional tax preparer to ensure that your Nebraska LLC is paying the correct amount.

General Business License licensure is not required on the State level in Nebraska. Nebraska does not have a general business license at the state level, but local licenses are often required.

Business name and registration Register your business name with the county clerk where your business is located. If you are a corporation, you will also need to register with the Secretary of State.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office. It typically takes the state 10 days to process your paperwork after they receive it.