South Dakota Affidavit Of Survivorship Form

Description

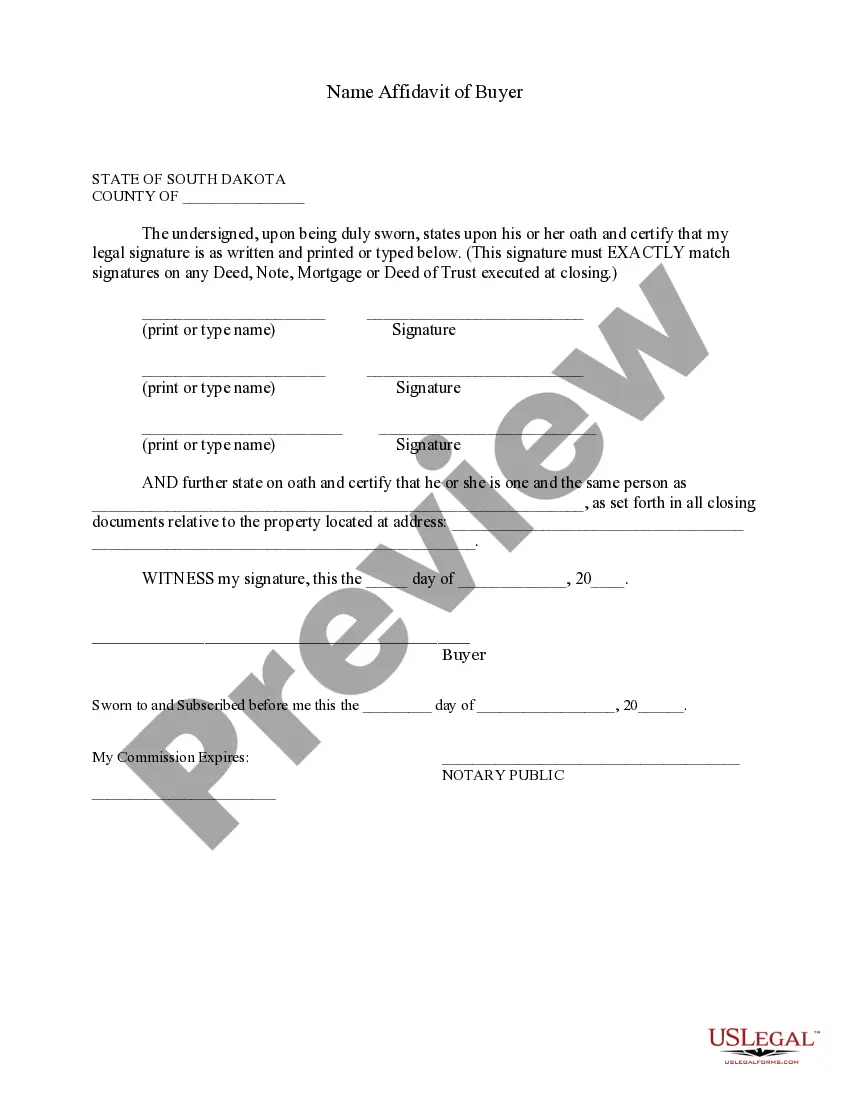

How to fill out South Dakota Name Affidavit Of Buyer?

When you need to finalize the South Dakota Affidavit Of Survivorship Form in accordance with your local state's statutes and regulations, there can be various options to choose from.

There’s no need to verify every document to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Utilizing US Legal Forms makes obtaining properly drafted legal documents effortless. Moreover, Premium users can also take advantage of robust integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most comprehensive online directory with an archive of over 85k ready-to-use papers for business and personal legal matters.

- All templates are validated to comply with each state's legislation.

- Therefore, when you download the South Dakota Affidavit Of Survivorship Form from our site, you can trust that you possess a legitimate and current document.

- Acquiring the required template from our platform is remarkably straightforward.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- Afterward, you can access the My documents section in your profile and retrieve the South Dakota Affidavit Of Survivorship Form at any time.

- If this is your initial interaction with our library, kindly follow the instructions below.

- Navigate through the suggested page and verify it for compliance with your standards.

Form popularity

FAQ

In a situation in which the sole owner's property is transferred to a beneficiary or the personal representative of the sole owner, the personal representative can transfer the property to the beneficiaries by simply filling out the whole of registered title: Assent AS1 form and submitting the required documents that

Make sure all mandatory documents are complete as this will be submitted to the BIR:Photocopy of the death certificate (bring the original copy too for verification)Proof of payment (official receipt or deposit slip and duly validated return)TIN of Estate.Affidavit of Self Adjudication.More items...?

As joint tenants, each person owns the whole of the property with the other. If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property.

To get that done, take the signed deed to the land records office for the county in which the real estate is located. This office is commonly called the county recorder, land registry, or register of deeds, or sometimes it's part of the county clerk's office.

On July 1, 2014, South Dakota enacted the Real Property Transfer on Death Act, which provides for the transfer of real property in the event of death.