South Carolina Mechanics Lien On Financed Vehicle

Description

Form popularity

FAQ

In South Carolina, a lien typically lasts for ten years from the date of filing. This duration applies to various types of liens, including those related to financed vehicles. It's essential to keep this duration in mind and address any obligations promptly to avoid complications related to your South Carolina mechanics lien on a financed vehicle.

South Carolina has specific lien laws that govern how mechanics liens function, including the rights of creditors and property owners. These laws ensure that claims are properly filed, and rights are protected. Understanding these laws can help you navigate complexities, especially when dealing with a South Carolina mechanics lien on a financed vehicle.

In South Carolina, a lien generally remains on your property for ten years if not released. This time frame includes any liens associated with a financed vehicle. Once the period is up, the lien will automatically expire unless you take steps to extend it, which emphasizes the need for timely resolutions.

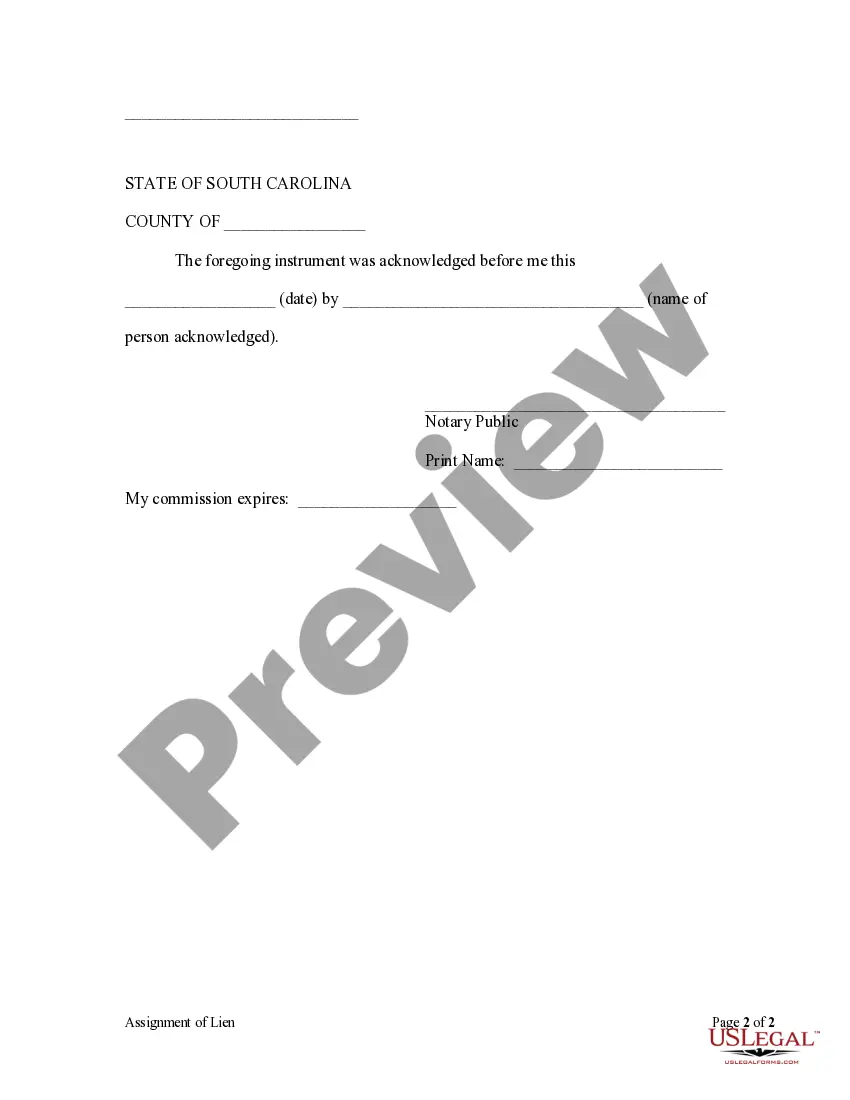

Removing a lien in South Carolina typically requires paying off the debt or resolving the issue that led to the lien. Once resolved, you must file a Satisfaction of Lien with the appropriate court to officially remove the lien from your records. If you need assistance navigating this process, consider using USLegalForms, which provides resources to help manage a South Carolina mechanics lien on a financed vehicle.

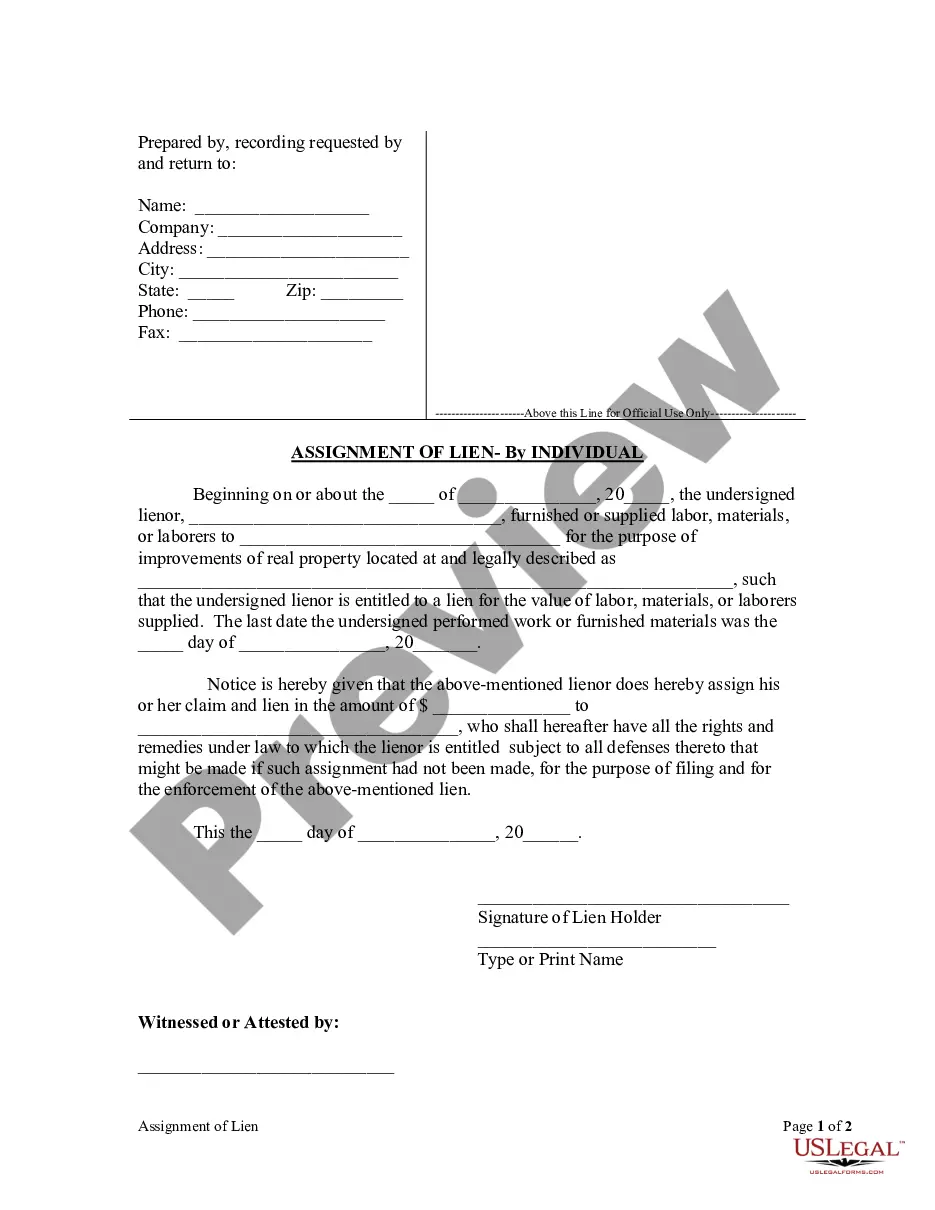

To file a mechanic's lien in South Carolina, you must provide essential details such as the description of the property, the amount owed, and the name of the lien claimant. You must also file your lien within a specific timeframe after completing the work or providing materials. By adhering to these requirements, you ensure that your claim regarding a South Carolina mechanics lien on a financed vehicle is valid.

A notice of intent to lien in South Carolina serves as a formal warning that a lien may be filed against a property, including financed vehicles. This notice informs the property owner and gives them an opportunity to settle the debt before the lien is officially recorded. By understanding the importance of this notice, you can protect your rights when dealing with a South Carolina mechanics lien on a financed vehicle.

In South Carolina, judgments generally expire ten years after the date they were granted. If you have obtained a South Carolina mechanics lien on a financed vehicle, it's essential to understand how judgments interact with liens. While judgments may expire, liens remain valid until they are formally released, so timely action is crucial.

To place a lien on someone's property in South Carolina, you must prepare a mechanics lien and file it with the county clerk of court. Ensure you include essential details, such as the property owner's name and address, a description of the work done, and the amount owed. Timing is critical, as you must file the lien within a period that aligns with the completion of your work. Utilize resources from US Legal Forms to draft your lien accurately and navigate the process smoothly.

To place a lien on a car in South Carolina, you need to prepare and file specific documents with the South Carolina Department of Motor Vehicles. You'll usually require the vehicle's title, a completed lien form, and payment of any applicable fees. This process ensures your interest in the vehicle is legally recognized. For detailed instructions and forms, check out US Legal Forms to streamline the process related to South Carolina mechanics lien on financed vehicles.

To navigate around a mechanics lien on your property, consider negotiating with your creditor. You may also explore options such as filing for a lien release or disputing the lien if you believe it was filed incorrectly. Staying informed about your rights can empower you to make better decisions. You can find resources about South Carolina mechanics lien on financed vehicles through platforms like US Legal Forms.