Pennsylvania Correction Pa Form Pa-40

Description

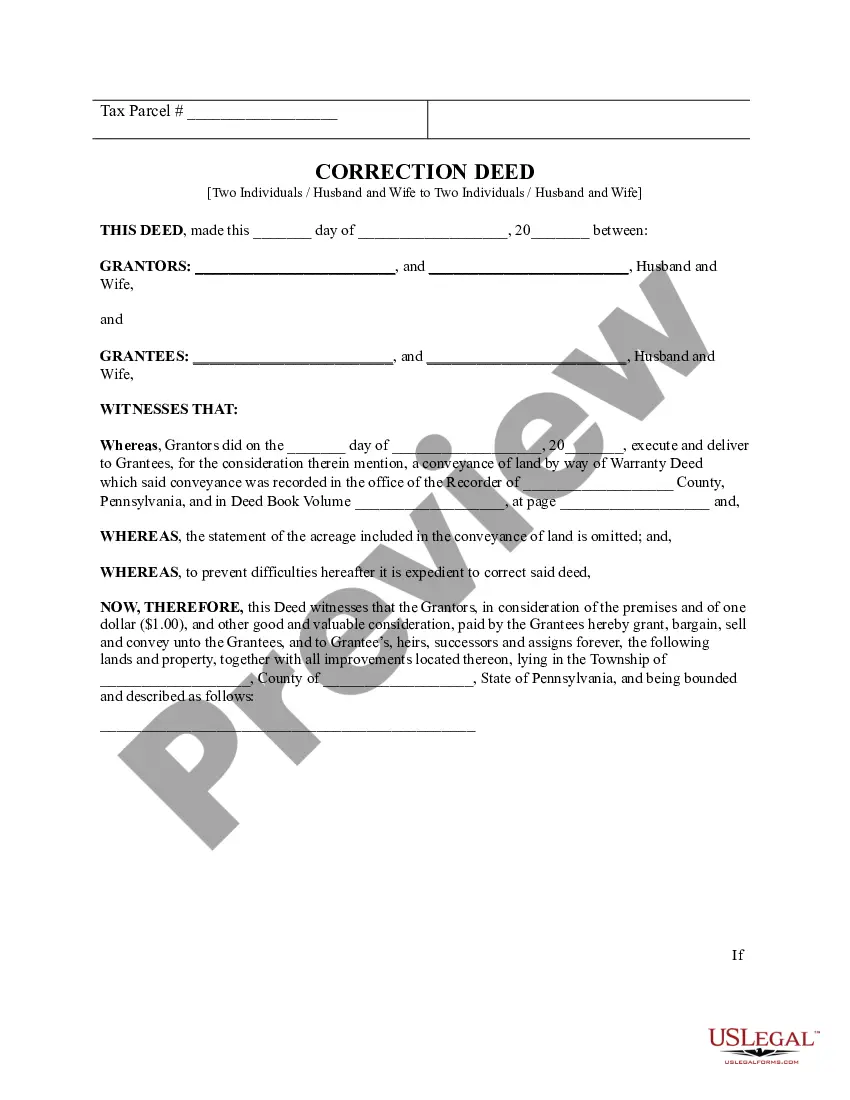

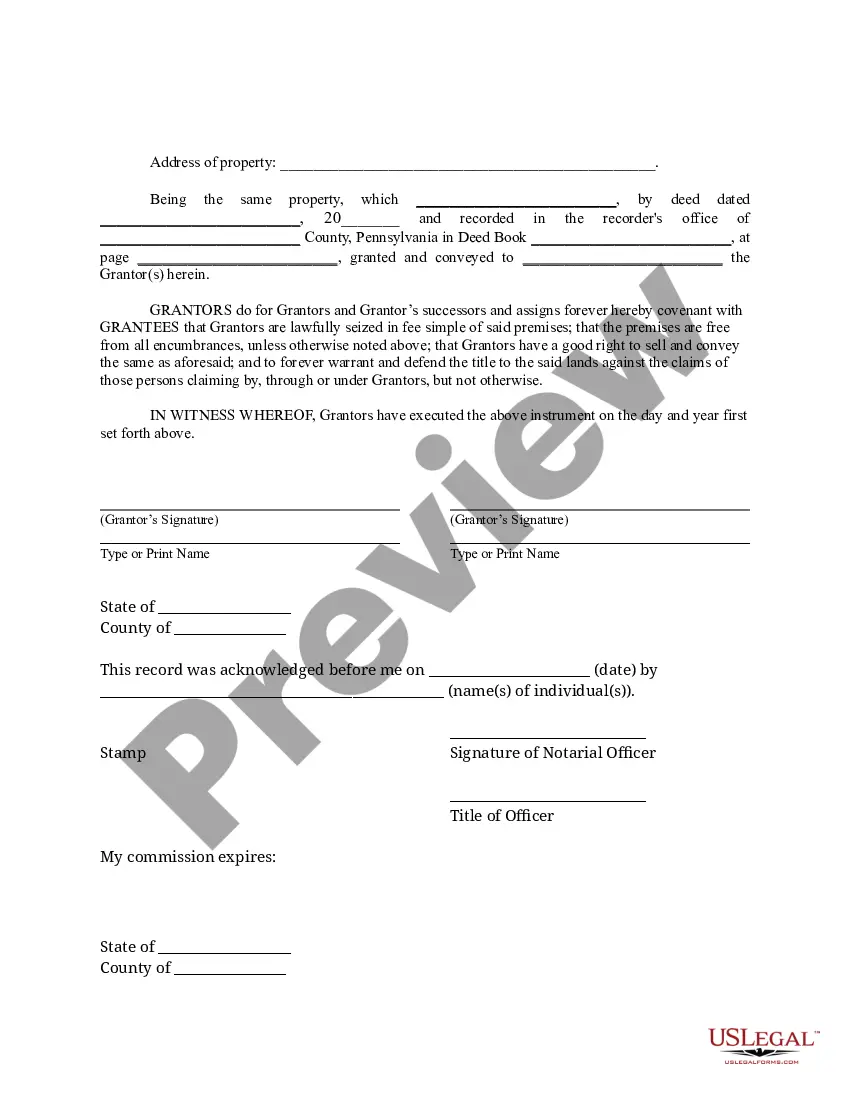

How to fill out Pennsylvania Correction Deed -?

Whether for business purposes or for personal affairs, everyone has to handle legal situations sooner or later in their life. Filling out legal papers demands careful attention, starting with selecting the proper form template. For example, if you pick a wrong edition of the Pennsylvania Correction Pa Form Pa-40, it will be turned down once you send it. It is therefore important to have a reliable source of legal papers like US Legal Forms.

If you need to obtain a Pennsylvania Correction Pa Form Pa-40 template, stick to these easy steps:

- Find the template you need using the search field or catalog navigation.

- Check out the form’s information to make sure it suits your case, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong document, go back to the search function to locate the Pennsylvania Correction Pa Form Pa-40 sample you need.

- Get the template when it meets your requirements.

- If you have a US Legal Forms profile, click Log in to access previously saved files in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the profile registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Select the file format you want and download the Pennsylvania Correction Pa Form Pa-40.

- After it is downloaded, you are able to complete the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you never need to spend time searching for the appropriate template across the internet. Take advantage of the library’s simple navigation to get the correct template for any situation.

Form popularity

FAQ

Amended Returns - Pennsylvania supports electronic filing for Schedule PA 40X.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

PA-40 Schedule W-2S has been eliminated. All copies of Forms W-2, 1099-R, 1099-MISC, 1099-NEC and any other documents reporting compensation must be included with the tax return. Form 1099-R Filing Tips have been added to the compensation instructions for taxpayers required to include those documents.

All copies of Forms W-2, 1099-R, 1099-MISC, 1099-NEC and any other documents reporting compensation must be included with the tax return.

Description:Step 1: Select the Form PA-40 by Tax Year below. Step 2: Fill in the space next to to "Amended Return" on the upper right-hand corner to indicate that it's an amended return. Step 3: Download, Complete Schedule PA-40X as an explanation of your amended return. Attach it to your Form PA-40.