Pennsylvania Records Corporations With Credit Package

Description

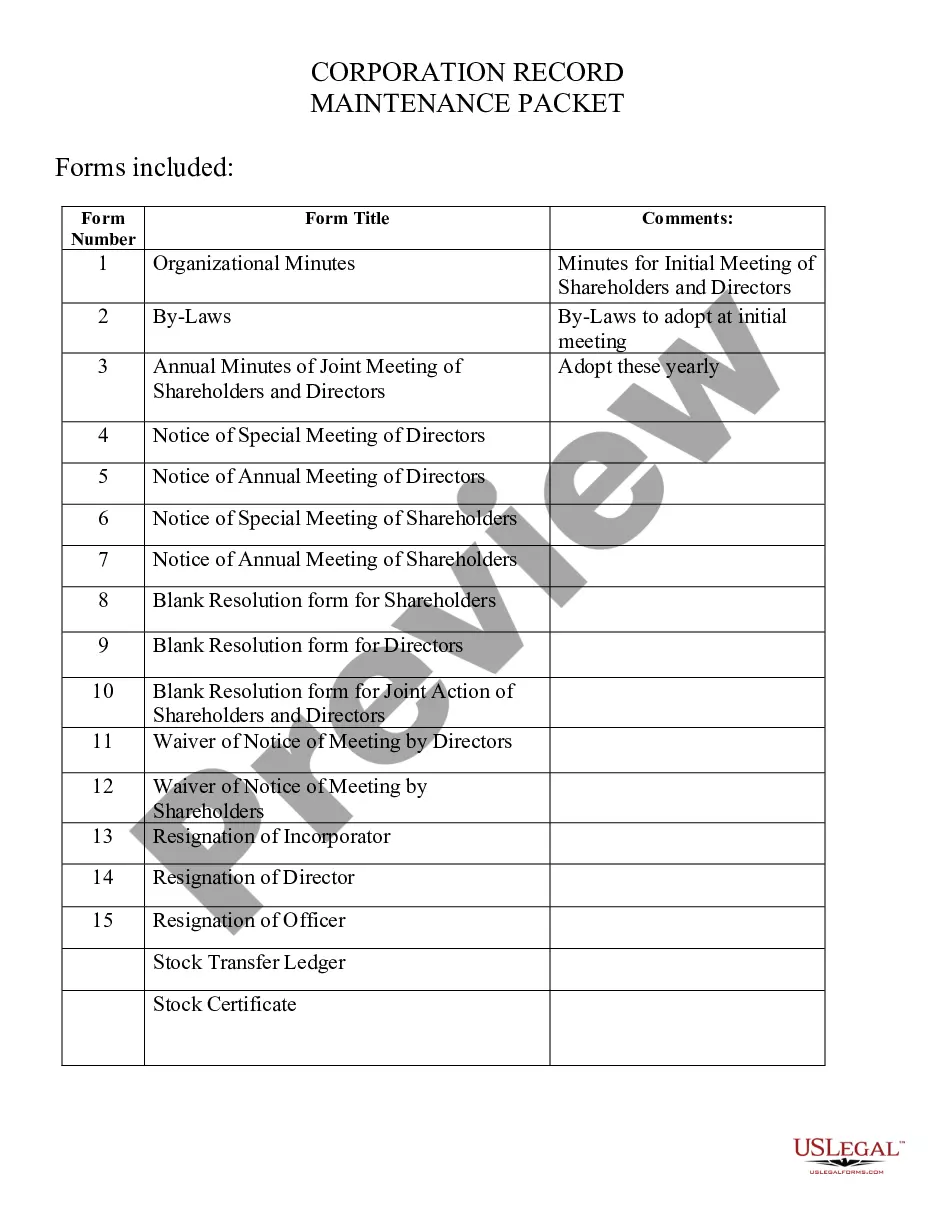

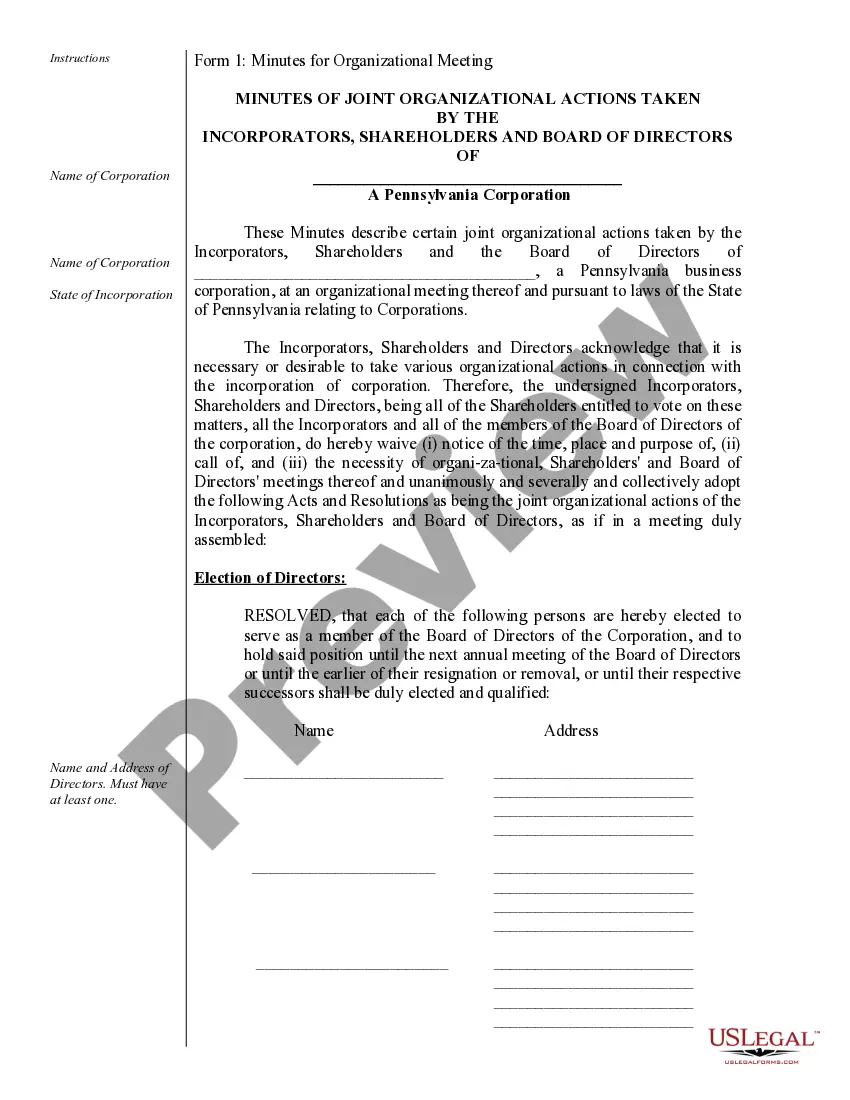

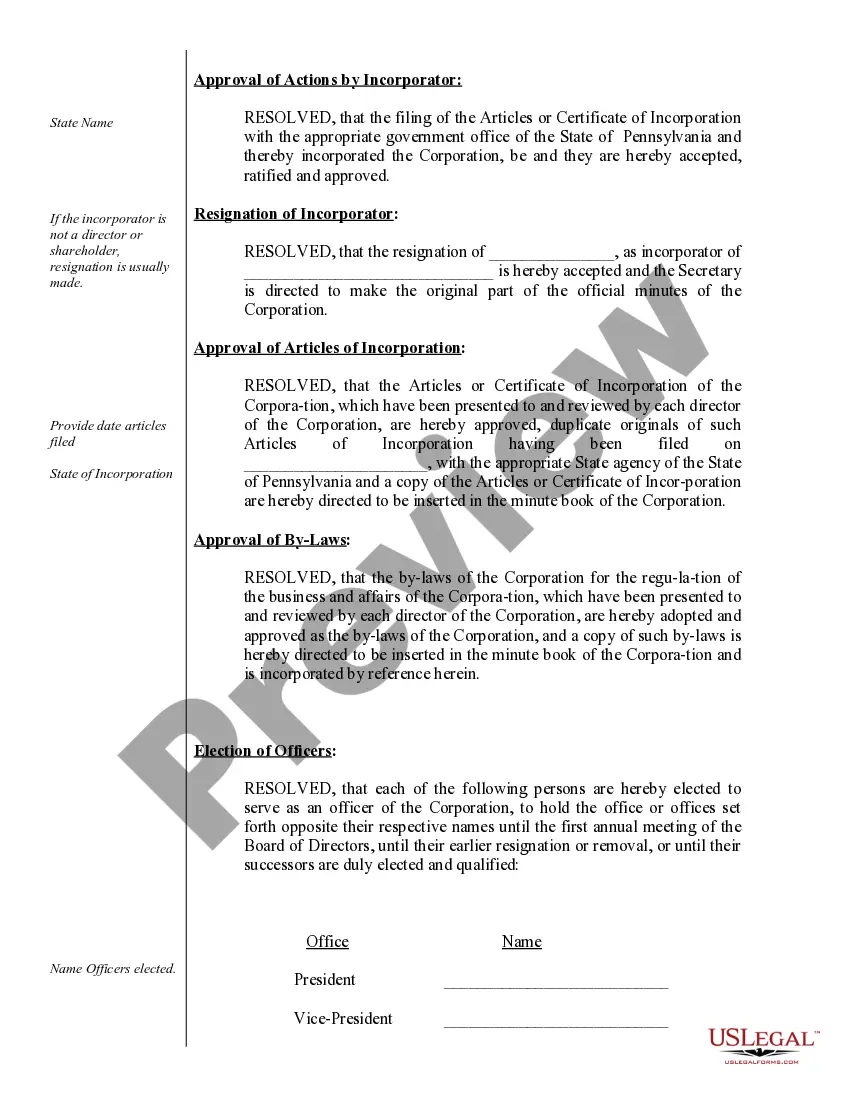

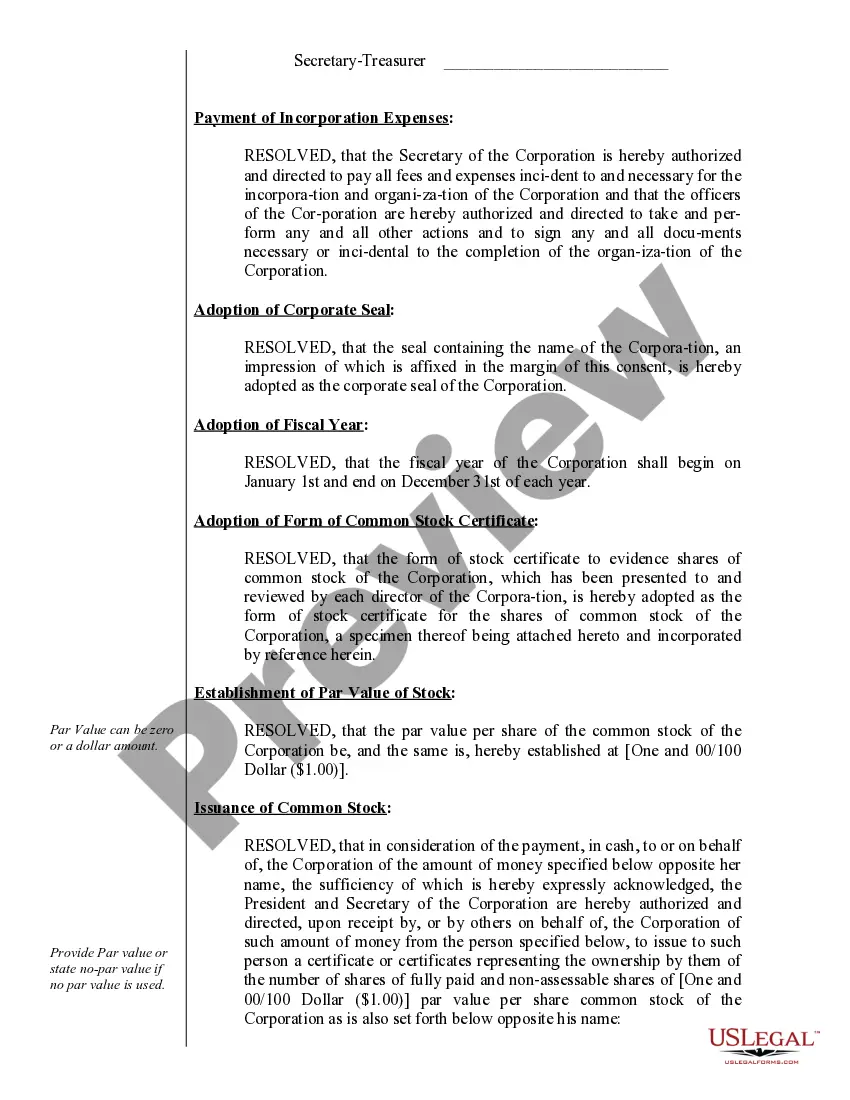

How to fill out Pennsylvania Corporate Records Maintenance Package For Existing Corporations?

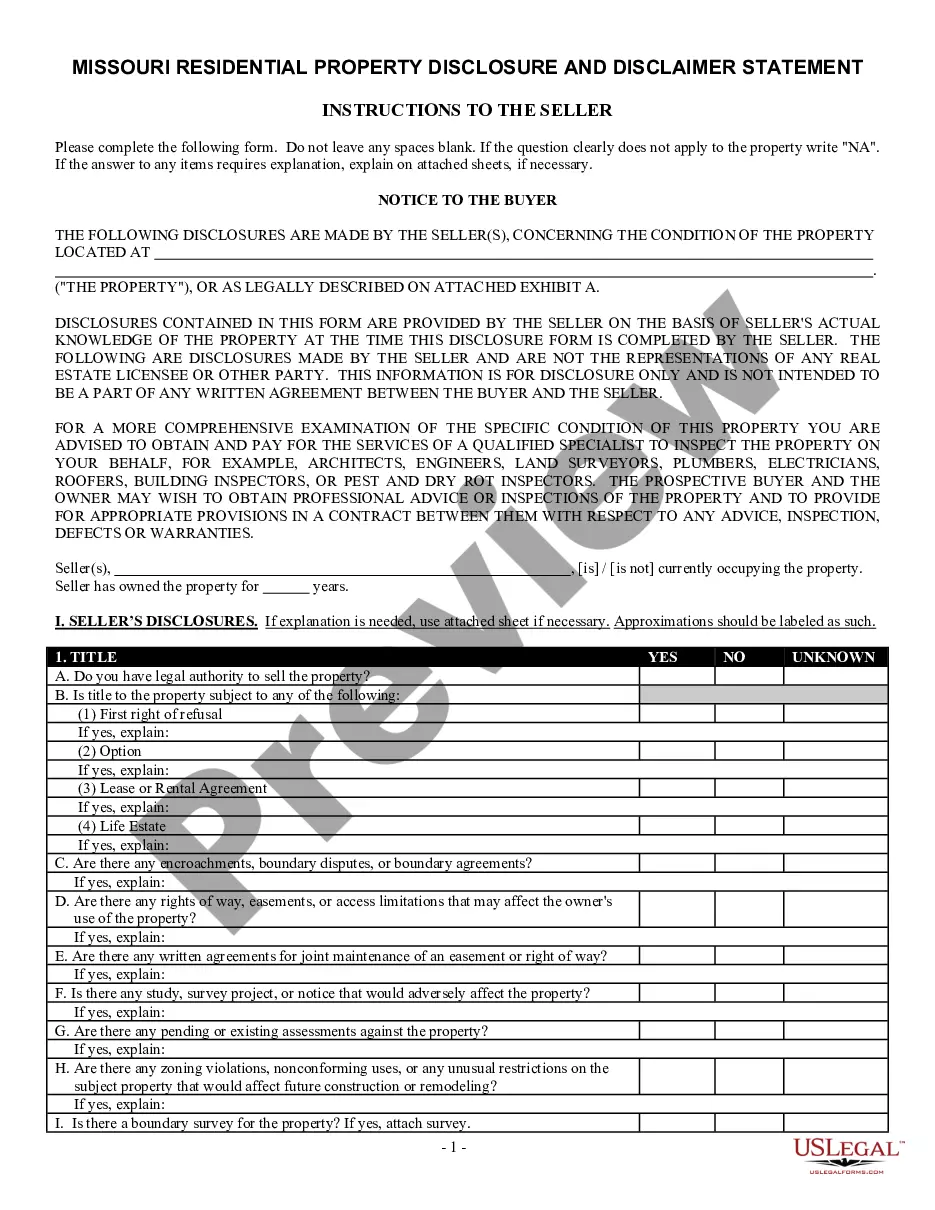

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more affordable way of creating Pennsylvania Records Corporations With Credit Package or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of over 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific templates carefully prepared for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can easily find and download the Pennsylvania Records Corporations With Credit Package. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes minutes to set it up and explore the catalog. But before jumping straight to downloading Pennsylvania Records Corporations With Credit Package, follow these recommendations:

- Check the document preview and descriptions to make sure you are on the the document you are searching for.

- Check if template you choose conforms with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Pennsylvania Records Corporations With Credit Package.

- Download the file. Then complete, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and transform form completion into something simple and streamlined!

Form popularity

FAQ

When filing an RCT-101, PA Corporate Net Income Tax Report, all corporate taxpayers are required to include forms and schedules to support the calculation of the tax liability. The type of information required depends on how the entity reports income to the IRS.

Pennsylvania research credits are transferable with approval from the Department of community and Economic Development. Any unused Pennsylvania research credits may be carried forward for a period up to 15 years but may not be carried back.

The state has a limit of $55 million for the PA R&D credit.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

Make a Business Tax Payment Pay By Electronic Funds Transfer. File/Pay By Phone. Pay By Credit/Debit Card. Motor and Alternative Fuels Tax Payment. Business Tax Payment Plans.