Pennsylvania Records Corporation Withholding

Description

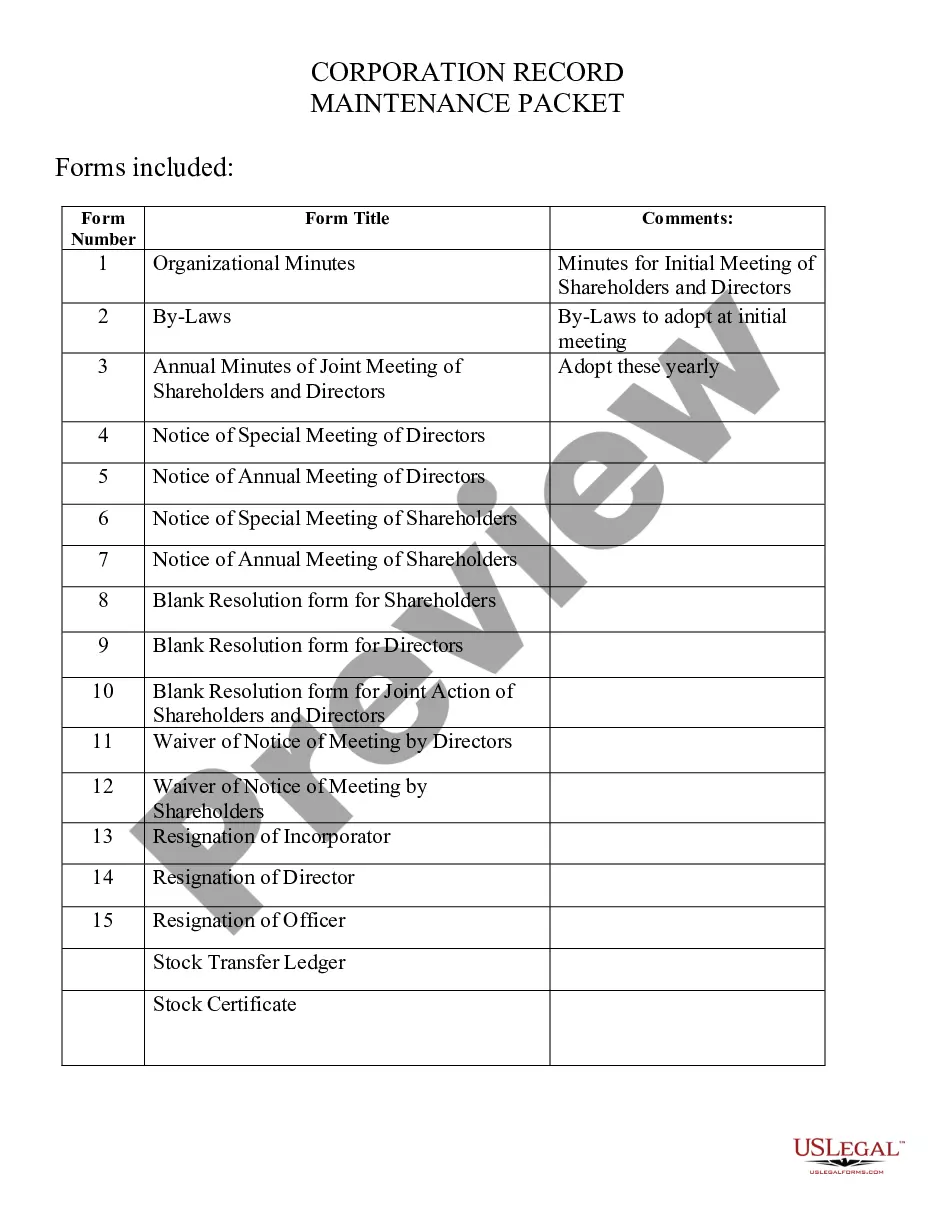

How to fill out Pennsylvania Corporate Records Maintenance Package For Existing Corporations?

Drafting legal paperwork from scratch can often be intimidating. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more affordable way of creating Pennsylvania Records Corporation Withholding or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online library of over 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-specific forms diligently prepared for you by our legal professionals.

Use our website whenever you need a trusted and reliable services through which you can quickly find and download the Pennsylvania Records Corporation Withholding. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes minutes to register it and explore the library. But before jumping directly to downloading Pennsylvania Records Corporation Withholding, follow these recommendations:

- Check the document preview and descriptions to ensure that you have found the document you are looking for.

- Make sure the template you select conforms with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Pennsylvania Records Corporation Withholding.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

Register for Employer Withholding online by visiting mypath.pa.gov. Registering online allows business owners to withhold employer taxes with the Pennsylvania Department of Revenue and open Unemployment Compensation accounts administered by the Pennsylvania Department of Labor & Industry.

Complete Form REV-419 so that your employer can with- hold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situation changes.

If you intend to make your payment by check, please make the check payable to the PA Department of Revenue. Note on the check your PA Employer Account Identification Number, your Federal Employer Identification Number or Revenue ID, and the tax period begin and end dates.

Definition of an Employer Employers are required to withhold PA personal income tax at a flat rate of 3.07 percent of compensation from resident and nonresident employees earning income in Pennsylvania. This rate remains in effect unless you receive notice of a change from the Department of Revenue.

Pennsylvania Individual Tax The Pennsylvania individual income tax withholding rate remains at 3.07% for 2021.