Affidavit Of Waiver Form Withholding

Description

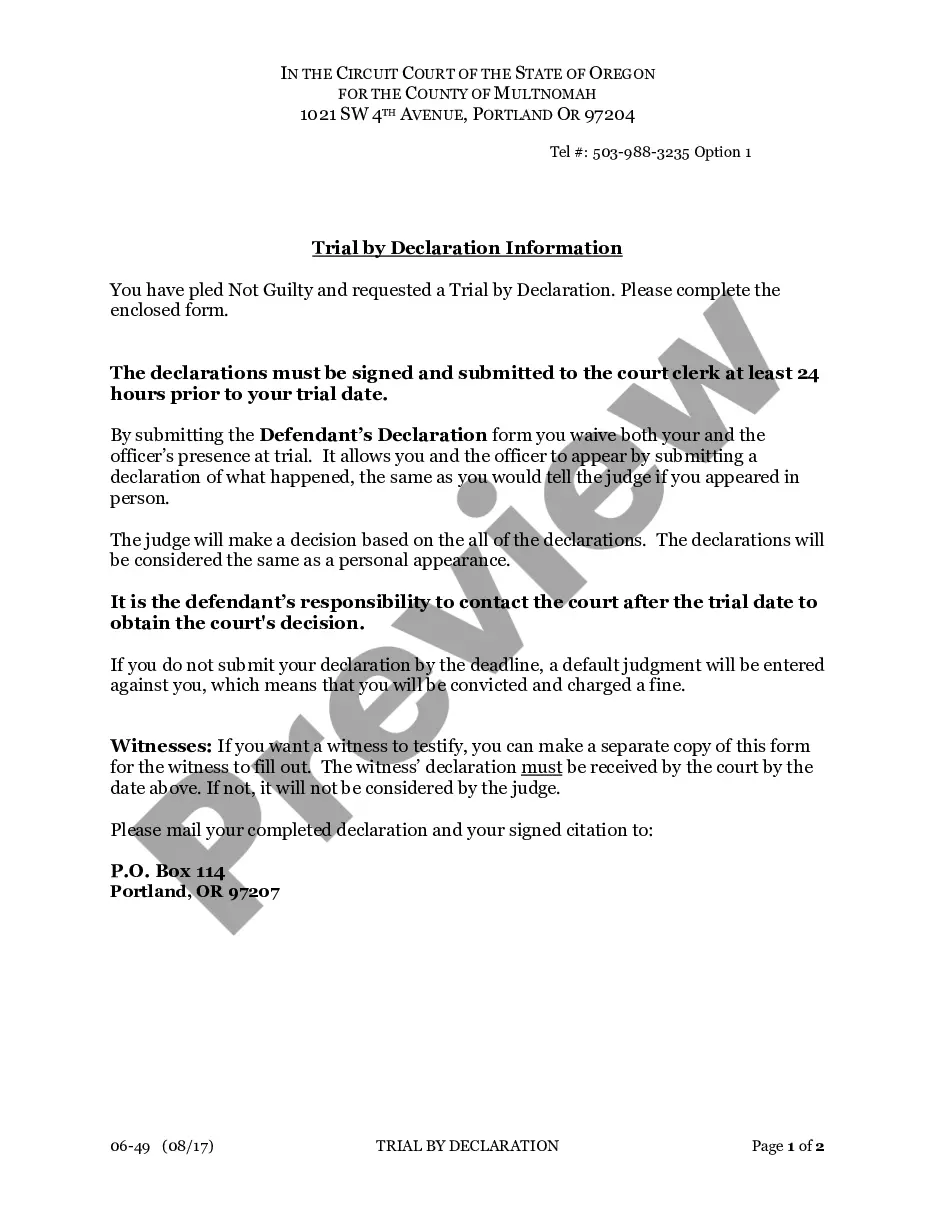

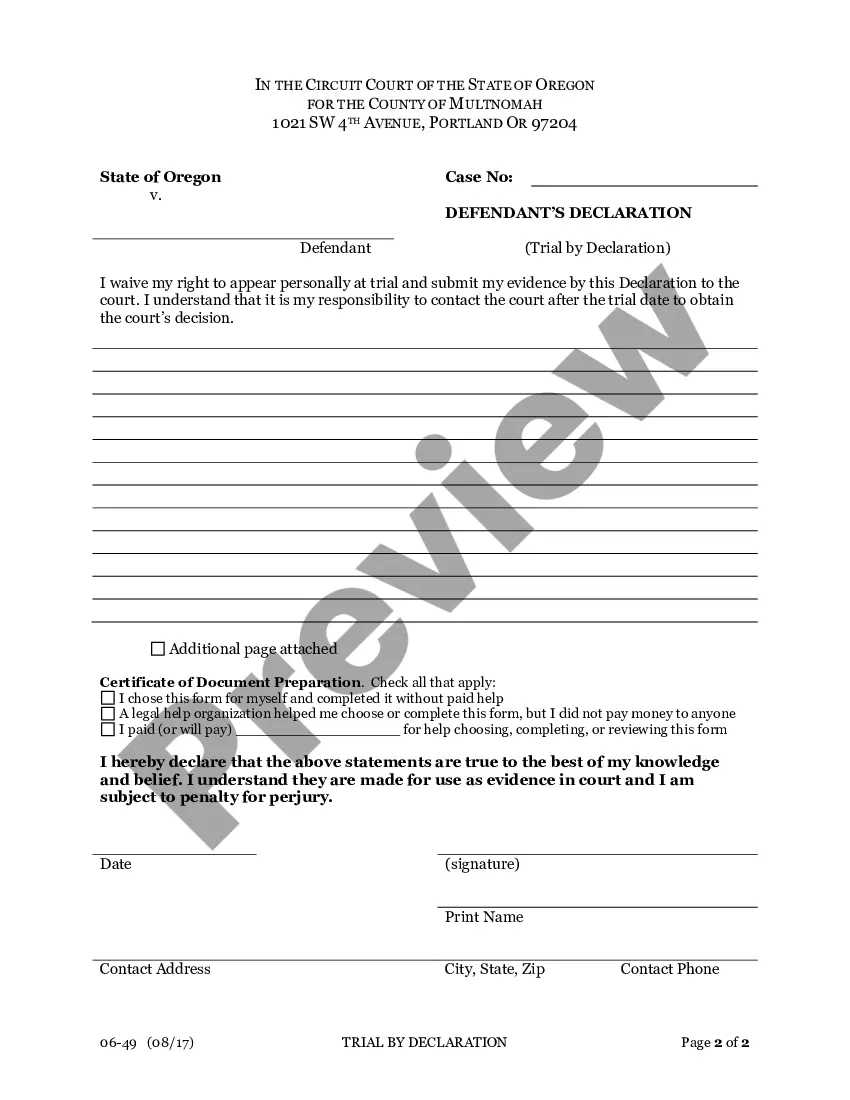

How to fill out Oregon Trial By Affidavit - Waiver?

Bureaucratic processes necessitate accuracy and exactness.

If you don’t frequently engage in completing documentation like the Affidavit Of Waiver Form Withholding, it might lead to some misunderstandings.

Selecting the correct sample initially will guarantee that your document submission will proceed smoothly, thereby avoiding any hassles of re-sending a file or repeating the same task from the start.

For non-subscribed users, finding the necessary sample may involve a few extra steps: Identify the template using the search field, confirm the Affidavit Of Waiver Form Withholding you discovered is applicable for your state or area, examine the preview or consult the description that provides details on the use of the sample, if the result aligns with your search, click the Buy Now button, select the appropriate option among the suggested subscription plans, Log In to your account or make a new one, complete the purchase using a credit card or PayPal account, and acquire the form in your preferred format. Locating the correct and current samples for your documentation only takes a few minutes with an account at US Legal Forms. Eliminate the uncertainty of bureaucracy and simplify your form dealings.

- You can easily acquire the suitable sample for your documentation at US Legal Forms.

- US Legal Forms is the largest online repository of forms, which contains over 85 thousand samples across various subjects.

- You can find the latest and most suitable version of the Affidavit Of Waiver Form Withholding by simply searching for it on the platform.

- Store and download templates in your account or refer to the description to confirm that you have the correct version readily available.

- Having an account with US Legal Forms makes it simple to obtain, consolidate in one place, and browse through the templates you save to find them with just a few clicks.

- While on the website, click the Log In button to authenticate.

- Next, go to the My documents page, where your forms are organized.

- Review the descriptions of the forms and download those you require at any time.

Form popularity

FAQ

Form 590 is certified (completed and signed) by the payee. California residents or entities exempt from the withholding requirement should complete Form 590 and submit it to the withholding agent before payment is made.

Here's a step-by-step look at how to complete the form.Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Nonresident income types Your payer must withhold 7% from your CA source income that exceeds $1,500 in a calendar year. Trust distributions. Partnership and LLC distributions.

A withholding allowance is an exemption that reduces how much income tax an employer deducts from an employee's paycheck.

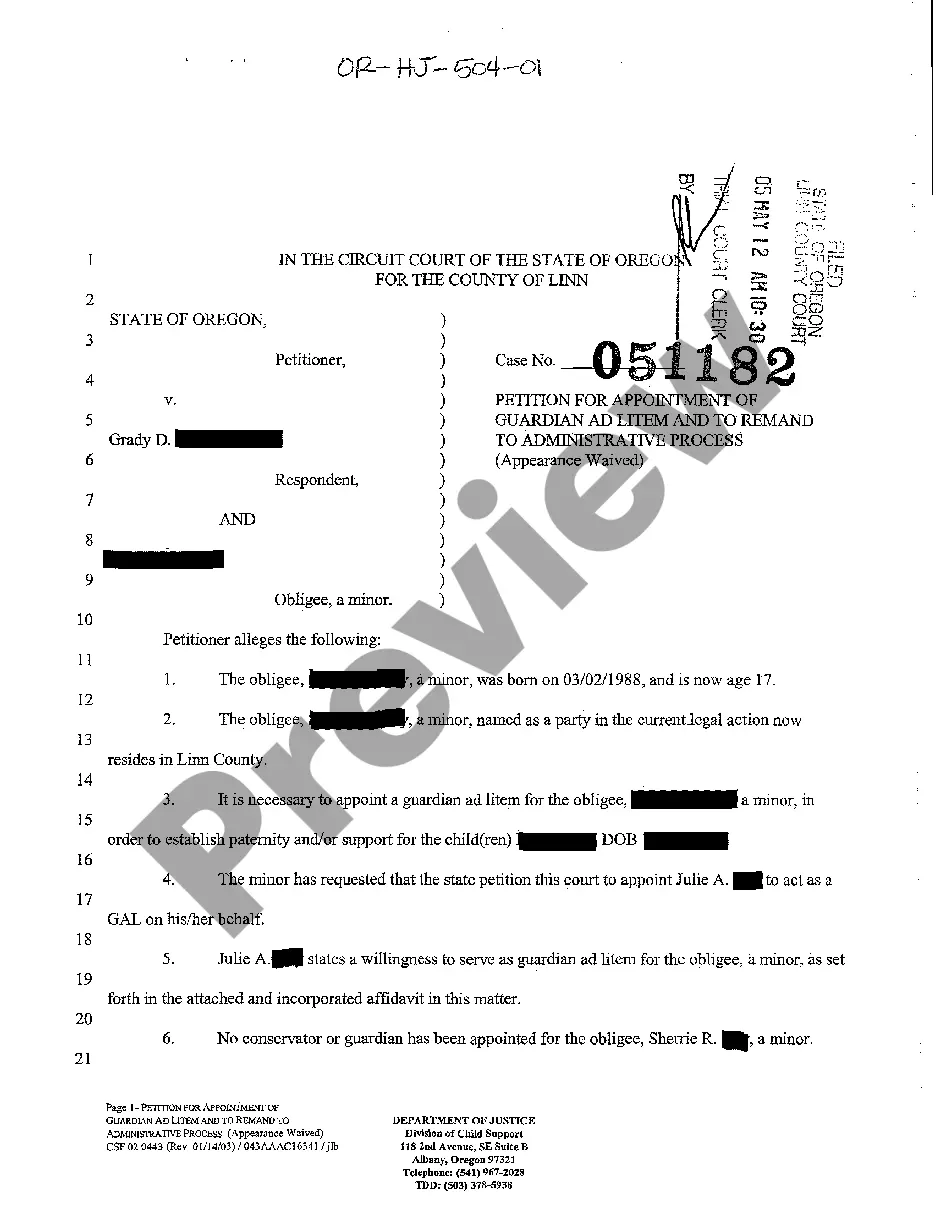

A. Purpose. Use Form 588, Nonresident Withholding Waiver Request, to request a waiver from withholding on payments of California source income to nonresident payees. Do not use Form 588 to request a waiver if you are a foreign (non-U.S.) partner or member.