Affidavit Of Heirship Oregon Without Attorney

Description

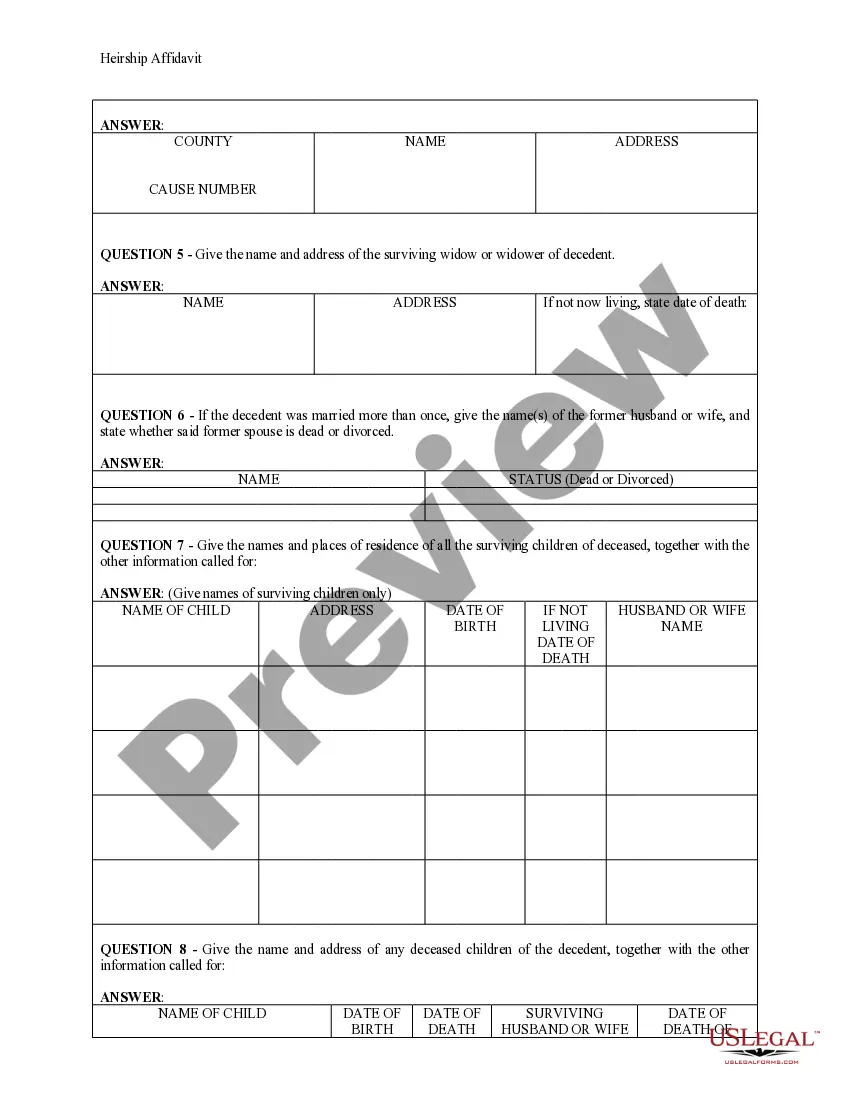

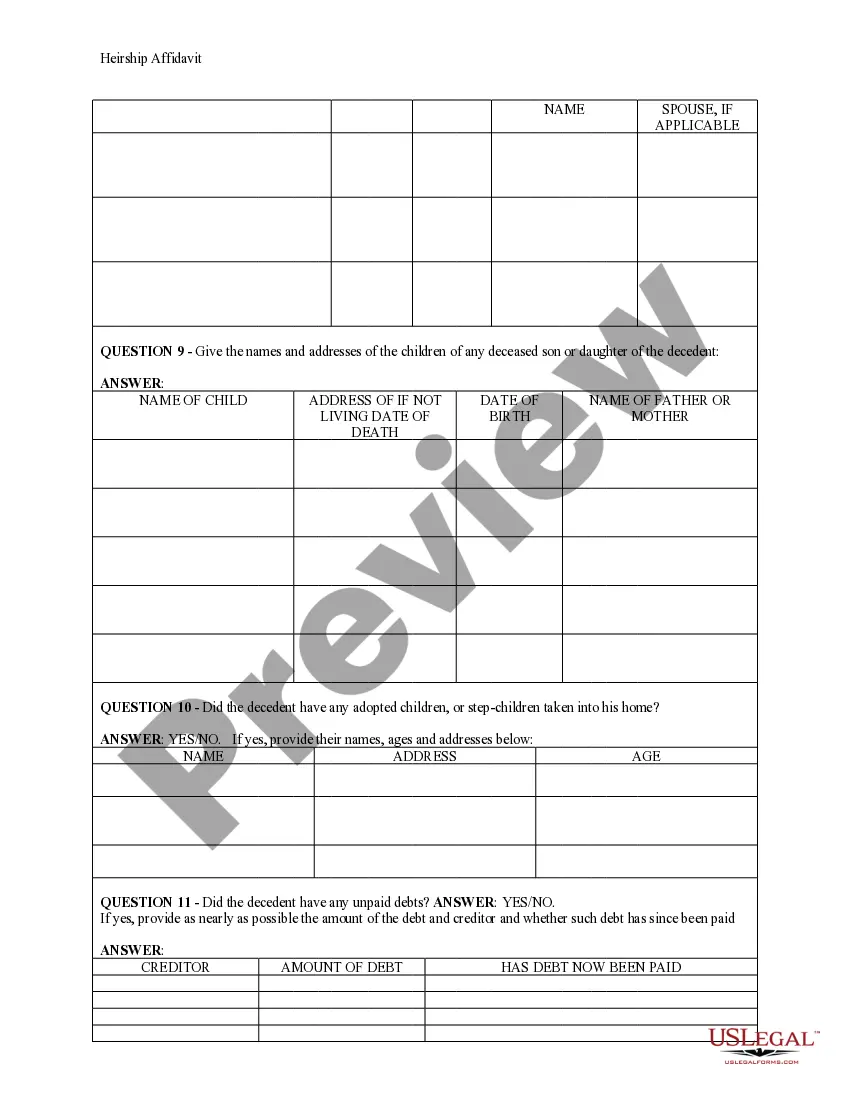

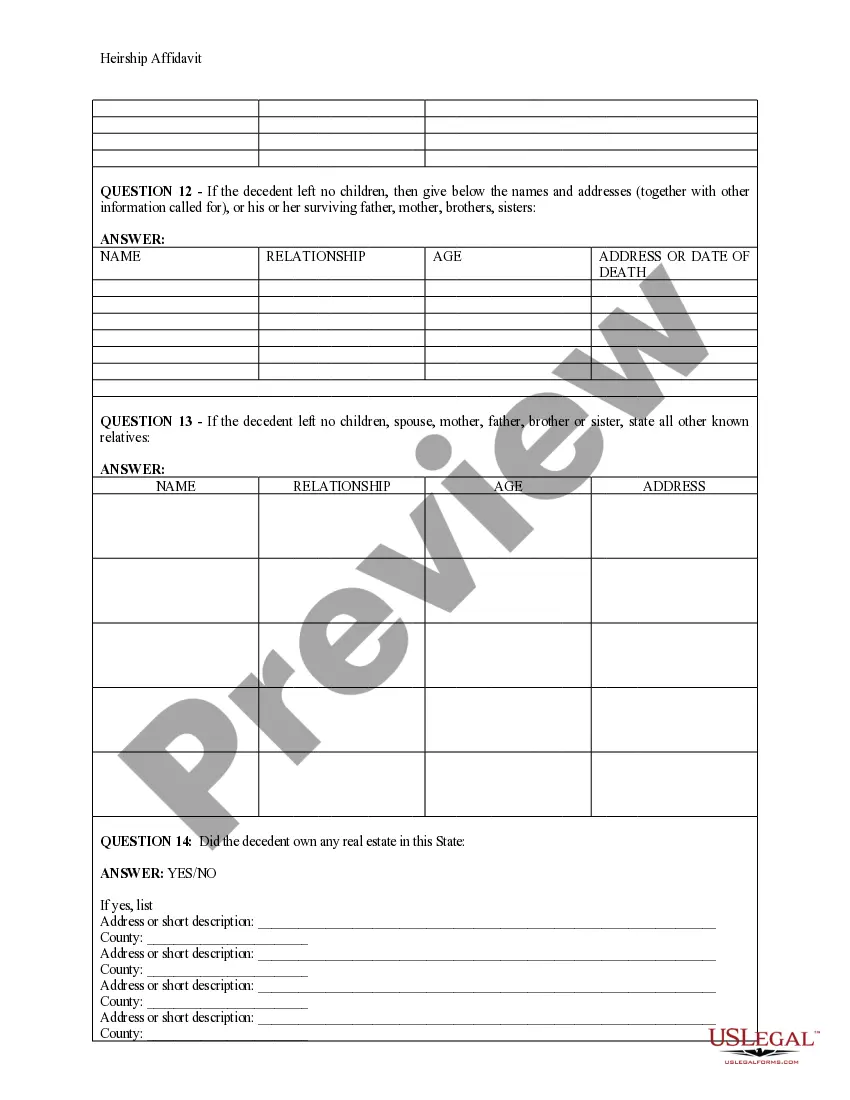

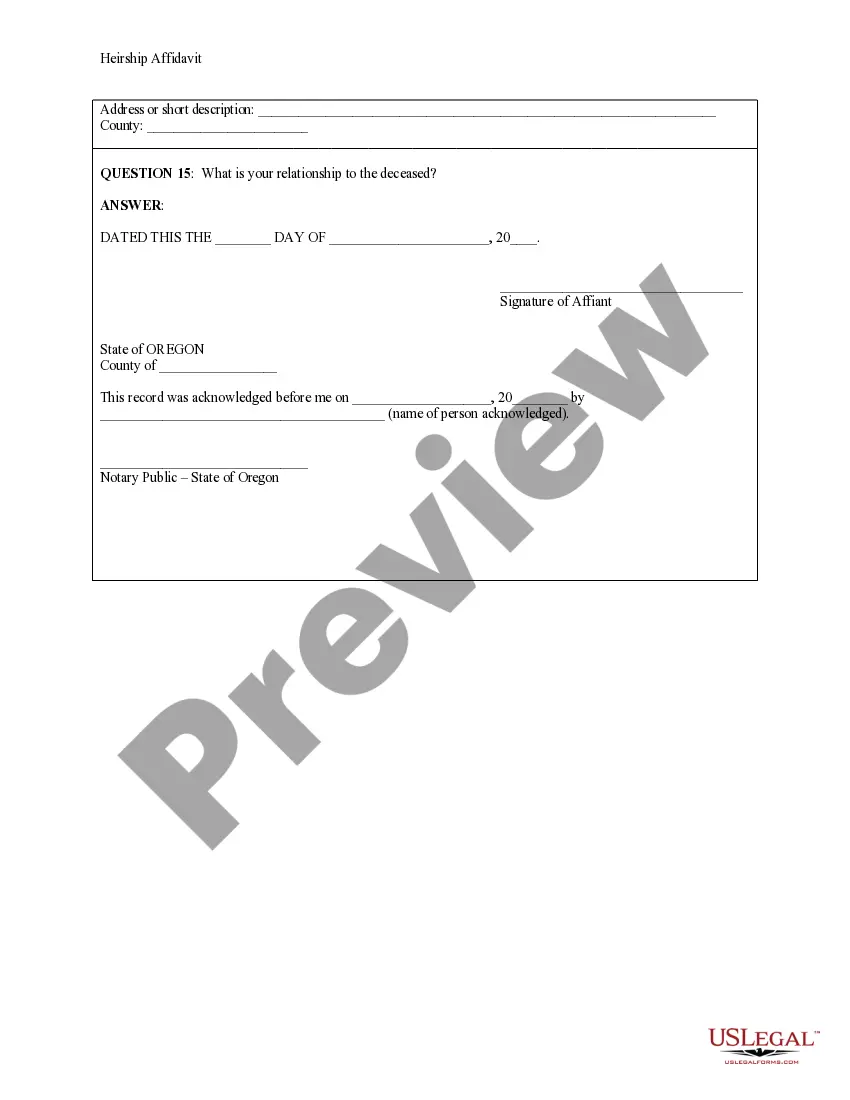

How to fill out Oregon Heirship Affidavit - Descent?

Getting a go-to place to take the most recent and relevant legal samples is half the struggle of dealing with bureaucracy. Choosing the right legal papers needs precision and attention to detail, which is why it is important to take samples of Affidavit Of Heirship Oregon Without Attorney only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and see all the details regarding the document’s use and relevance for your circumstances and in your state or region.

Take the listed steps to finish your Affidavit Of Heirship Oregon Without Attorney:

- Make use of the library navigation or search field to find your template.

- View the form’s information to see if it matches the requirements of your state and area.

- View the form preview, if there is one, to ensure the template is the one you are interested in.

- Resume the search and find the correct document if the Affidavit Of Heirship Oregon Without Attorney does not suit your needs.

- When you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the template.

- Select the pricing plan that fits your requirements.

- Go on to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (bank card or PayPal).

- Select the file format for downloading Affidavit Of Heirship Oregon Without Attorney.

- When you have the form on your gadget, you can alter it using the editor or print it and complete it manually.

Remove the headache that comes with your legal paperwork. Explore the comprehensive US Legal Forms catalog to find legal samples, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

Your signature must be notarized by a court clerk or notary public. You will need photo identification. Sign the Affidavit in the presence of the notary or clerk. ? You will need the death certificate and the will (if any) o You need a certified copy of the death certificate.

The estate is large. Full probate may be avoided when handling small estates. Under Oregon law, a small estate affidavit can be filed if the estate has no more than $75,000 in personal property and no more that $200,000 in real property. These limits may be subject to change. A larger estate may require probate.

All of the requirements in the Affidavit of Claiming Successor Testate Estate must be completed. The Affidavit must be filled out correctly and the mailings completed as required, one copy to Department of Human Services and one copy to the Oregon Health Authority. The filing fee for a Small Estate is $124.00.

Who Can Use the Small Estate Affidavit Process? An heir, devisee, personal representative, or creditor may file a Small Estate Affidavit. Heir. An heir is an individual who would inherit from the estate under Oregon's laws of intestacy.

If any child has died before you, and that child has children, then the deceased child's share will go to your grandchildren. If you are single and have no descendants, your parents will inherit your property in equal shares. If one of your parents dies before you, your surviving parent will receive all your property.