Llc Operating Agreement Nevada For Rental Property

Description

How to fill out Nevada Limited Liability Company LLC Operating Agreement?

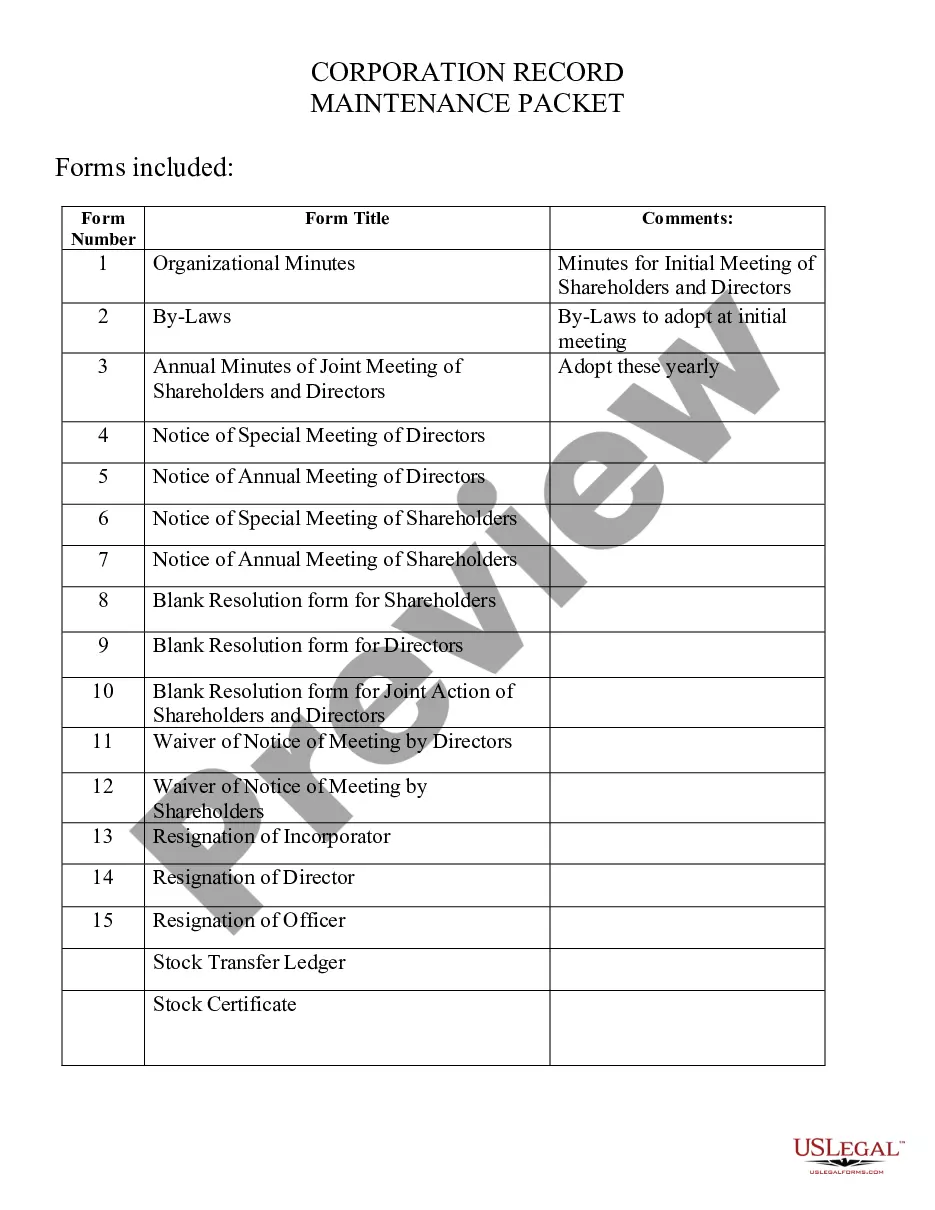

Accessing legal templates that meet the federal and state regulations is essential, and the internet offers many options to choose from. But what’s the point in wasting time searching for the right Llc Operating Agreement Nevada For Rental Property sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any professional and personal scenario. They are simple to browse with all files grouped by state and purpose of use. Our experts keep up with legislative changes, so you can always be confident your form is up to date and compliant when obtaining a Llc Operating Agreement Nevada For Rental Property from our website.

Obtaining a Llc Operating Agreement Nevada For Rental Property is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the right format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template using the Preview feature or via the text description to ensure it meets your requirements.

- Browse for another sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Llc Operating Agreement Nevada For Rental Property and download it.

All templates you find through US Legal Forms are reusable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

Technically, an SMLLC does not need an operating agreement in the state, and you do not need to file these organizational papers with Nevada. Even so, an operating agreement benefits your organization because your procedures are documented for reference.

A Nevada single-member LLC operating agreement is a legal document that will allow a single owner of a business to set forth the policies and daily activities of their company. This document will make it possible to separate personal assets and financial accounts from those of the business.

Operating Agreement There is no legal requirement for the form in Nevada, however, it is recommended that one be drafted and reviewed by the managing member(s), and thereafter signed by each member.

Disadvantages of LLCs for Rental Property 1 Disadvantages of LLCs for Rental Property. 2 Tax Complexity. 3 Setup Challenges. 4 Transferred Tax Obligations. 5 Asset Protection Not Guaranteed. 6 Financing Challenges. 7 Increasing Expenses. 8 Considerations and Conclusion.

How to form an LLC for your Nevada rental property. ... Step 1: Choose an LLC Name. ... Step 2: Appoint a Registered Agent in Nevada. ... Step 3: File Nevada Articles of Organization. ... Step 4: Draft a Nevada Operating Agreement. ... Step 5: Apply for an EIN. ... Next Steps. ... What to know before creating a rental property LLC in Nevada.