Power Attorney Property Sample Withdraw Money From Bank

Description

How to fill out Nebraska General Durable Power Of Attorney For Property And Finances Or Financial Effective Upon Disability?

There’s no longer any need to invest hours searching for legal documents to fulfill your local state prerequisites.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our website offers more than 85,000 templates for various business and personal legal situations categorized by state and usage area.

Utilize the search bar above to look for an alternative template if the previous one doesn’t suit your needs.

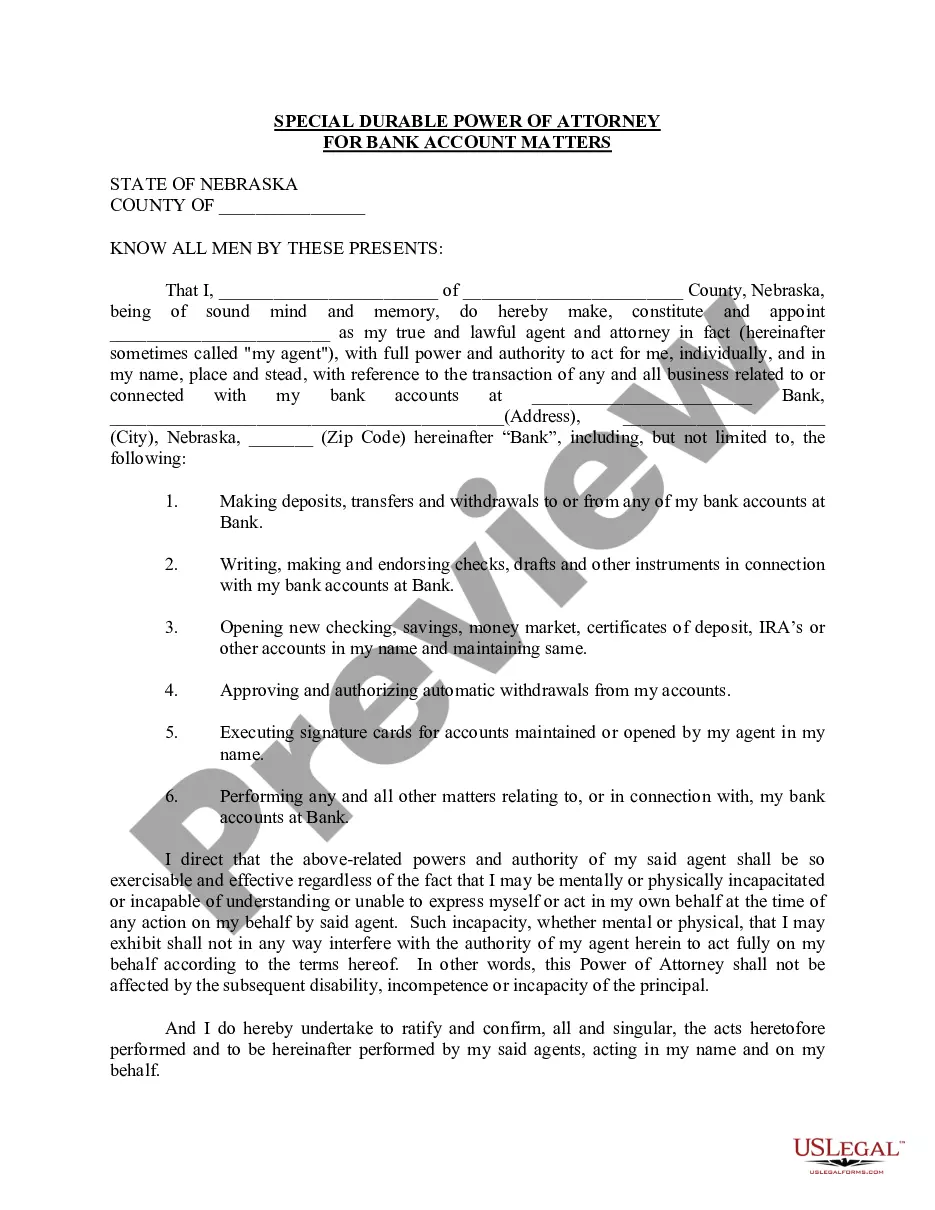

- All forms are properly drafted and authenticated for accuracy, ensuring that you are obtaining an up-to-date Power Attorney Property Sample Withdraw Money From Bank.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also retrieve all previously acquired documents whenever needed by visiting the My documents section in your profile.

- If you are a new user and have never utilized our platform before, the process will require a few more steps to complete.

- Here’s how new users can find the Power Attorney Property Sample Withdraw Money From Bank in our catalog.

- Review the content on the page thoroughly to confirm it includes the sample you require.

- To do this, make use of the form description and preview options if available.

Form popularity

FAQ

Through the use of a valid Power of Attorney, an Agent can sign checks for the Principal, withdraw and deposit funds from the Principal's financial accounts, change or create beneficiary designations for financial assets, and perform many other financial transactions.

General power of attorney With a general power of attorney, you authorize your agent to act for you in all situations allowed by local law. This includes legal, financial, health, and business matters. General POAs can be durable or non-durable, depending on your preferences.

Common Reasons Why Banks Won't Accept a Power of Attorney A financial institution might raise objections such as these: Your POA isn't durable. If the person who made the POA is now incapacitated, the agent can't use the POA unless it's durablethat is, made to last even during incapacitation.

If you sign a general power of attorney form without including any limitations, you give your agent authority to take any financial action on your behalf that you could take yourself, including obtaining a debit card.

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.