North Dakota Transfer On Death Deed Form With Signature

Description

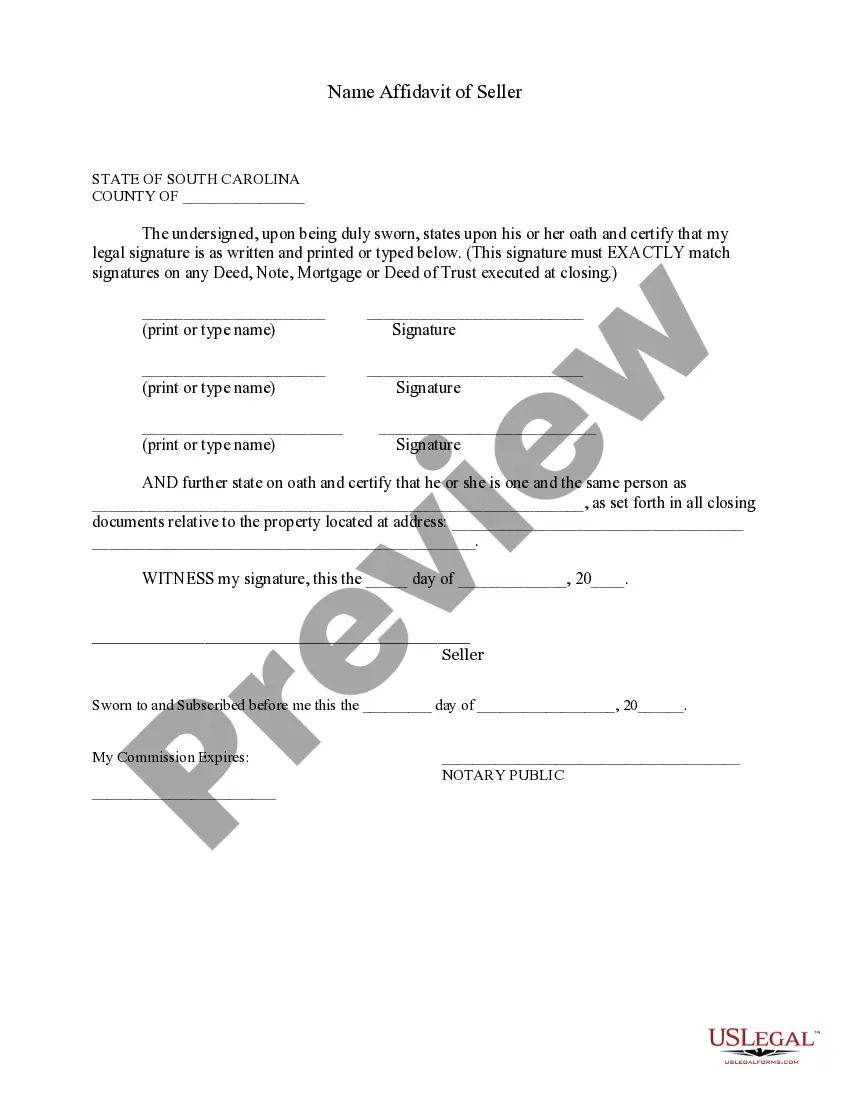

How to fill out North Dakota Transfer On Death Deed Or TOD - Beneficiary Deed From An Individual To Three (3) Individuals?

The North Dakota Transfer On Death Deed Form With Signature you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, simplest and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this North Dakota Transfer On Death Deed Form With Signature will take you just a few simple steps:

- Search for the document you need and check it. Look through the sample you searched and preview it or check the form description to confirm it fits your requirements. If it does not, use the search option to get the appropriate one. Click Buy Now when you have found the template you need.

- Sign up and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Select the format you want for your North Dakota Transfer On Death Deed Form With Signature (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a valid.

- Download your papers again. Use the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

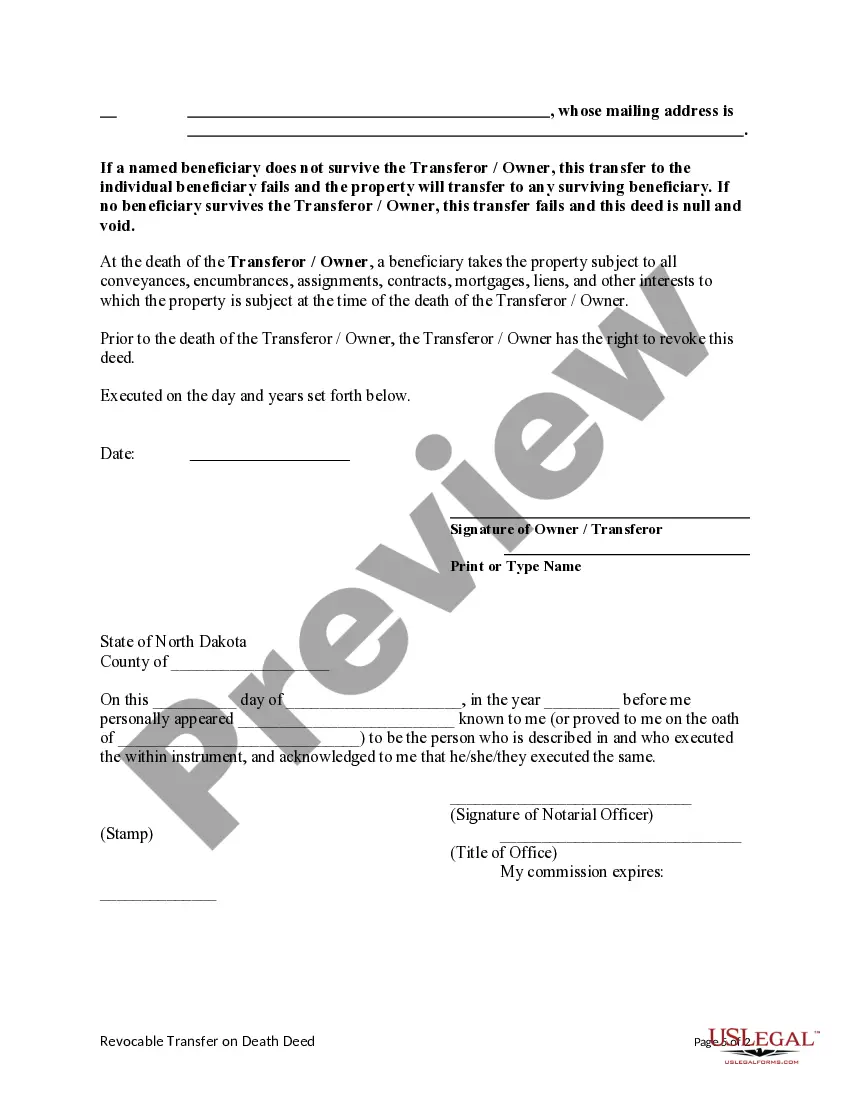

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

Because a TOD deed, also known as a beneficiary deed, bypasses probate, it can simplify the inheritance process and reduce costs for your loved ones. Consider working with a financial advisor as you plan how your estate will be distributed upon your death.

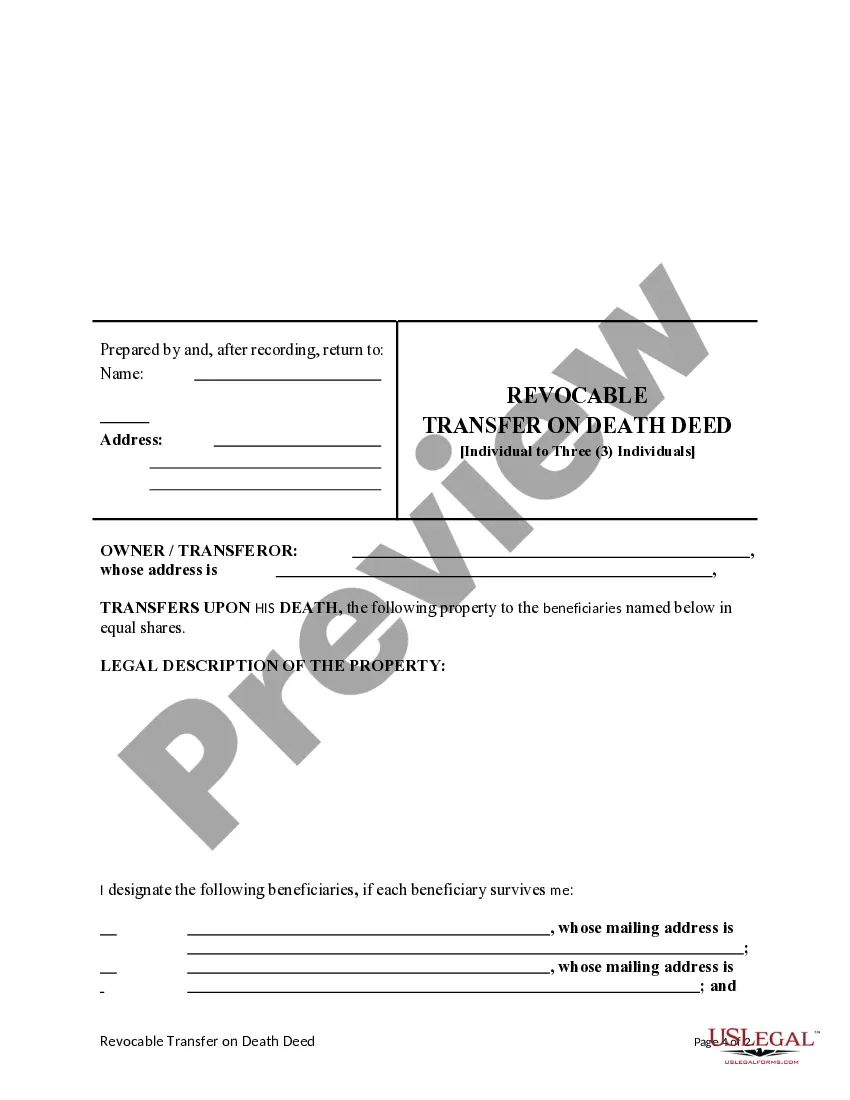

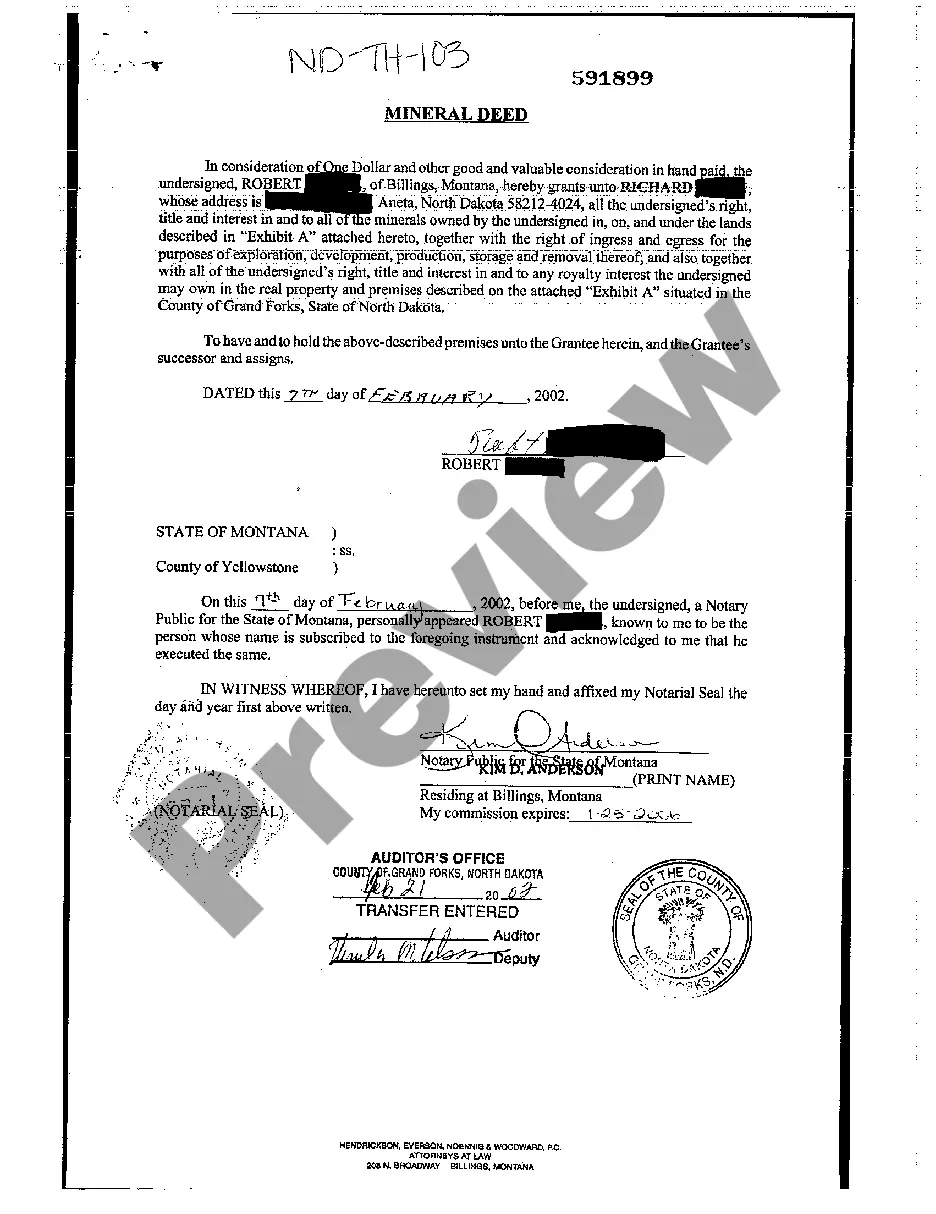

A North Dakota property owner may transfer or retitle real estate during the owner's life using a signed, written deed. A North Dakota deed must satisfy the legal requirements described below to be eligible for recording and to legally transfer title to the new owner.

Cent. Code § 30.1-32.1-02. An individual may transfer property to one or more beneficiaries effective at the transferor's death by a transfer on death deed.

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.