Disadvantages Of Transfer On Death Deed

Description

How to fill out North Dakota Transfer On Death Deed Or TOD - Beneficiary Deed From An Individual To Three (3) Individuals?

It’s no secret that you can’t become a law expert immediately, nor can you figure out how to quickly draft Disadvantages Of Transfer On Death Deed without having a specialized background. Creating legal documents is a long venture requiring a particular education and skills. So why not leave the creation of the Disadvantages Of Transfer On Death Deed to the professionals?

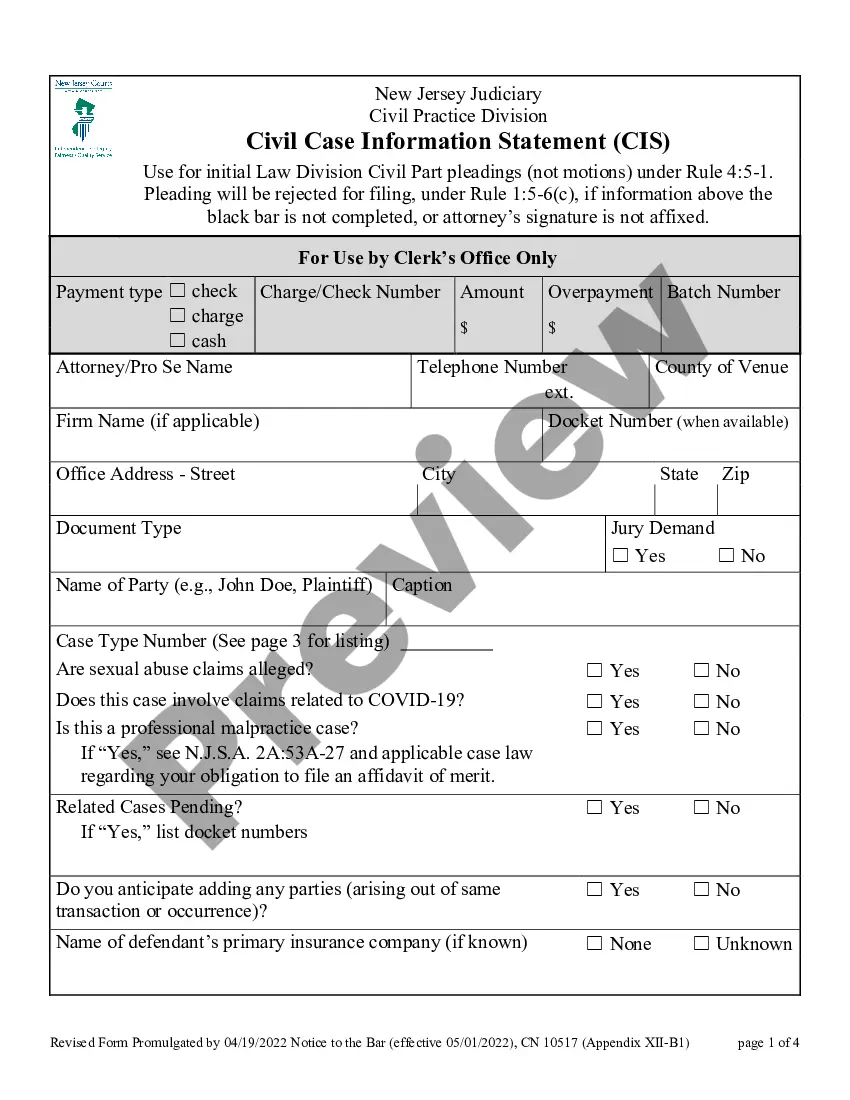

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court paperwork to templates for in-office communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our platform and get the form you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

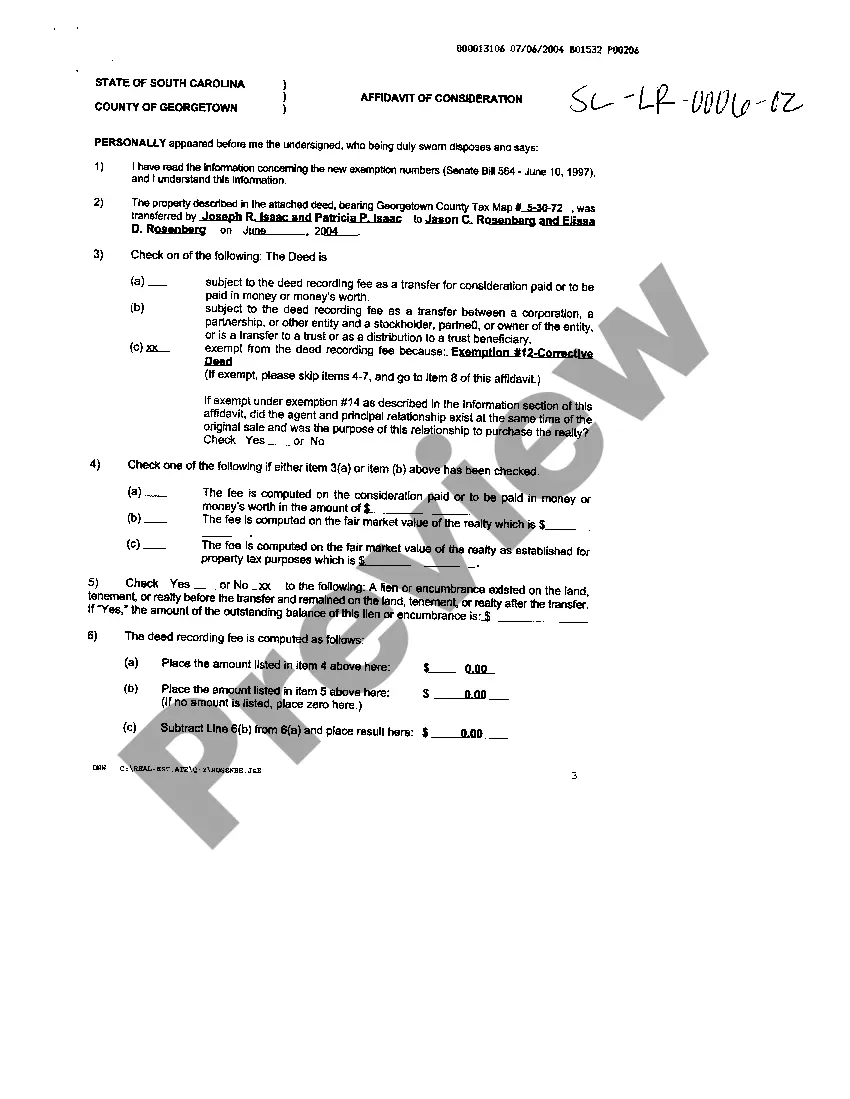

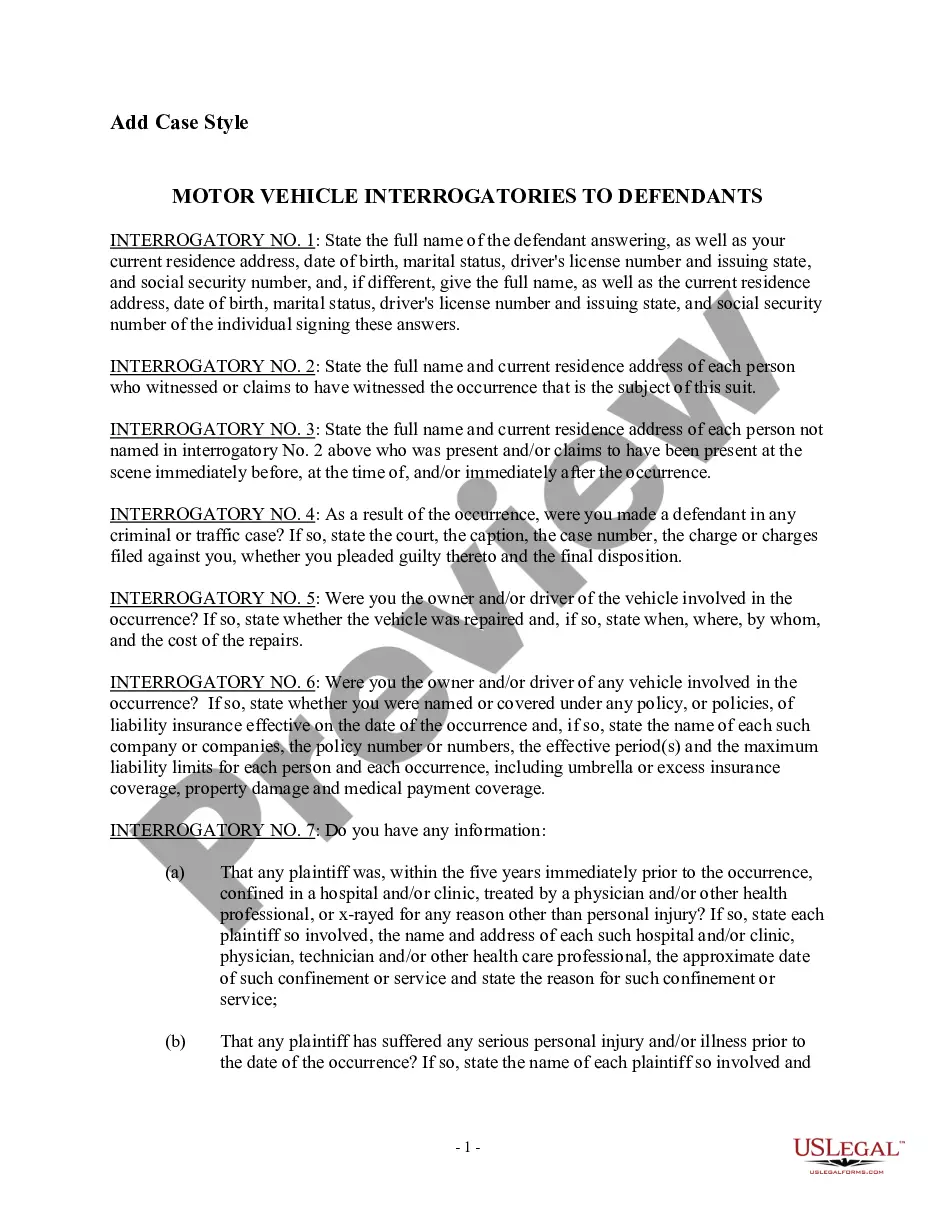

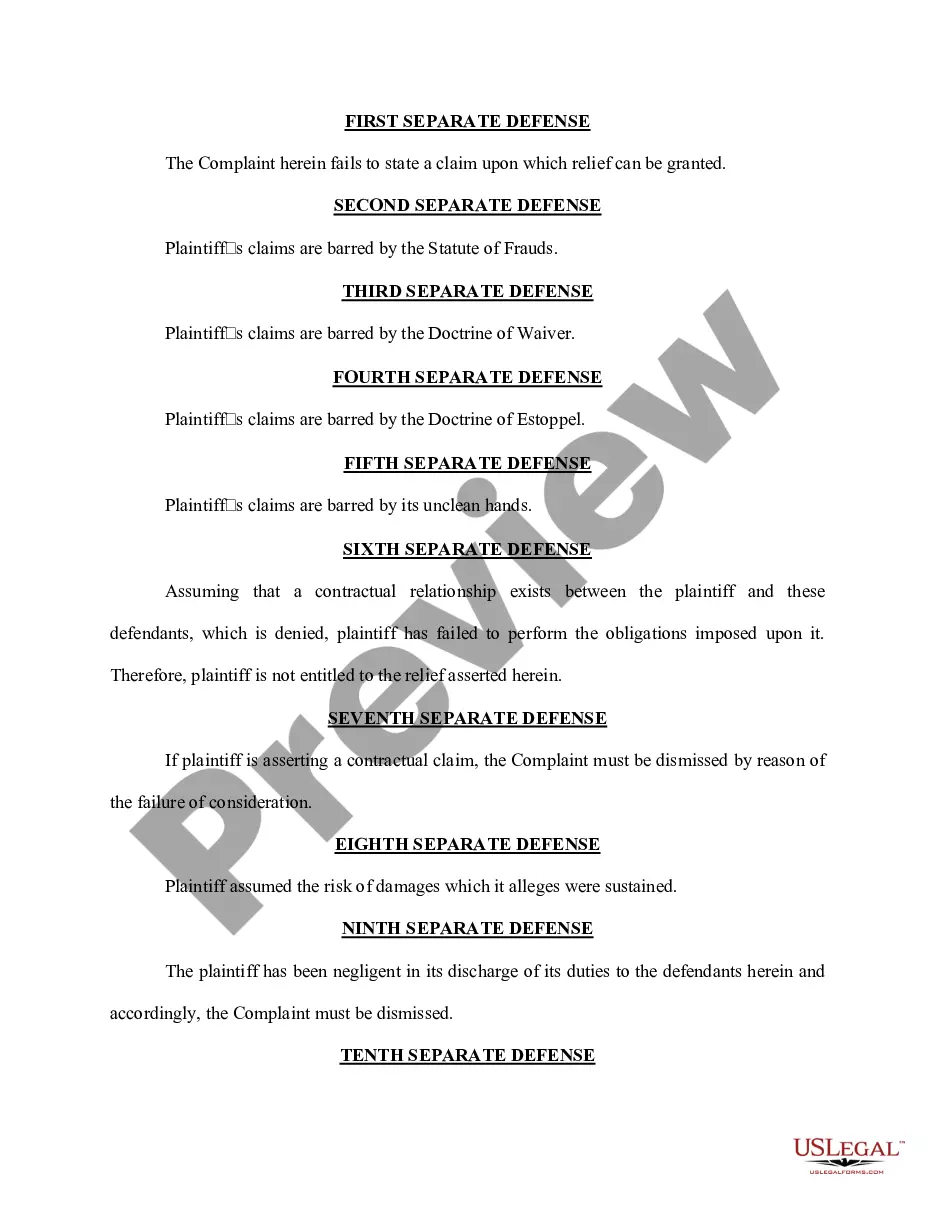

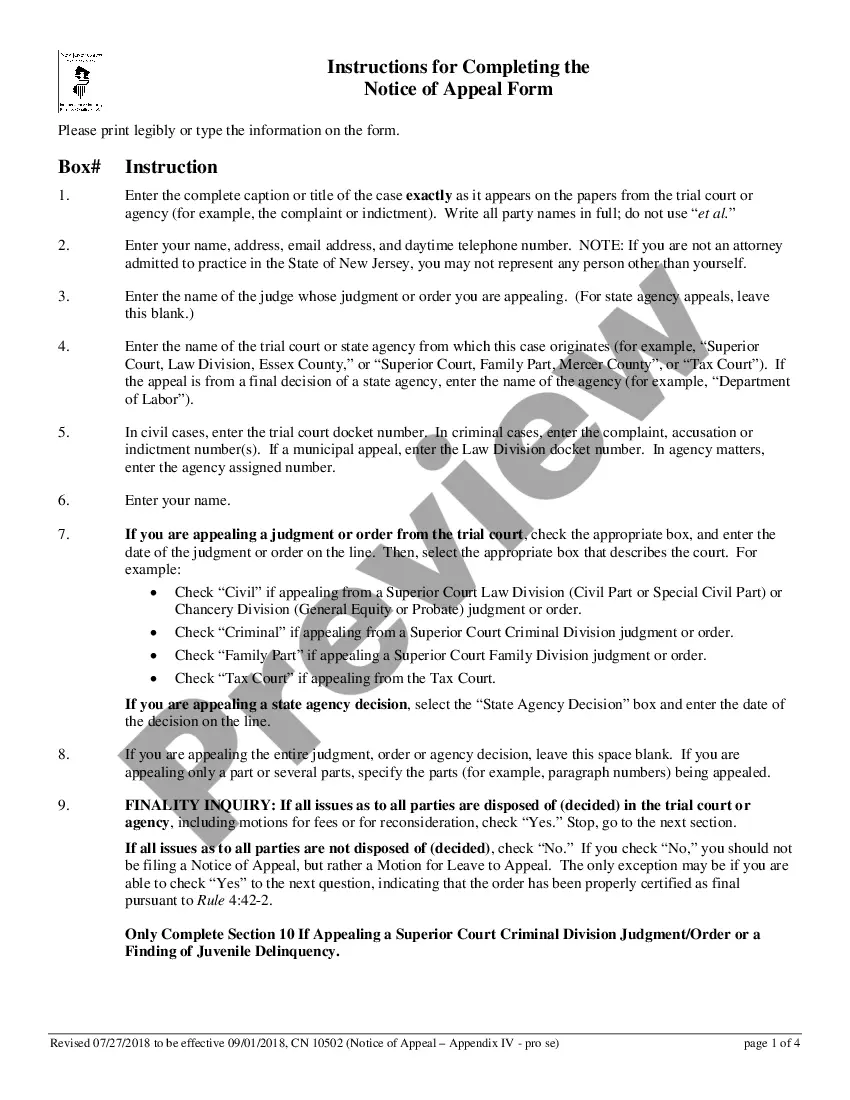

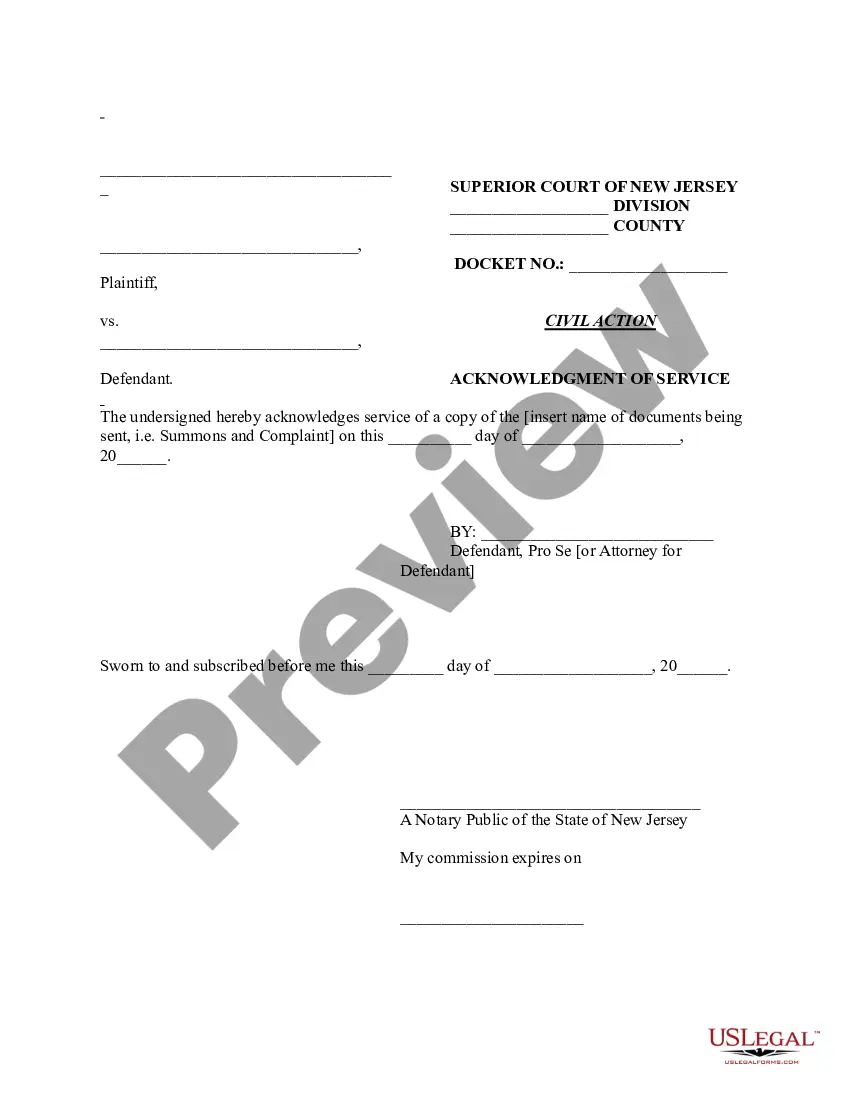

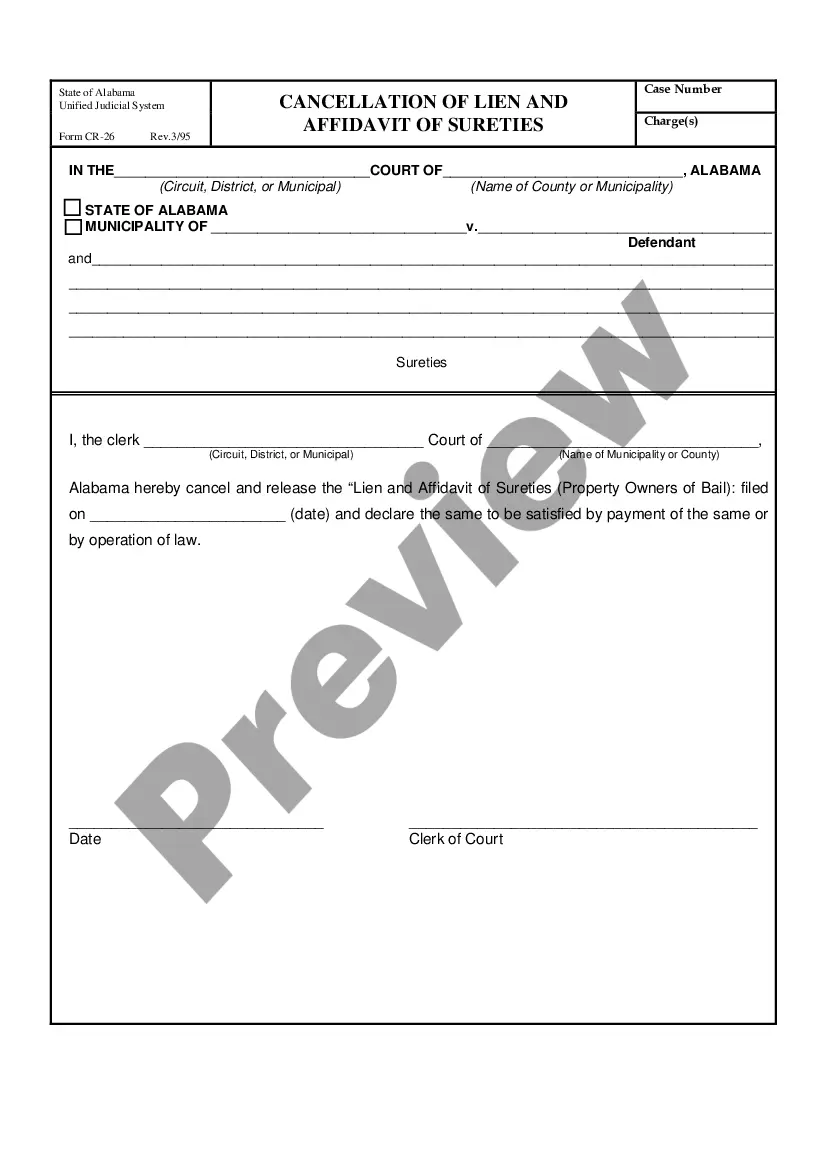

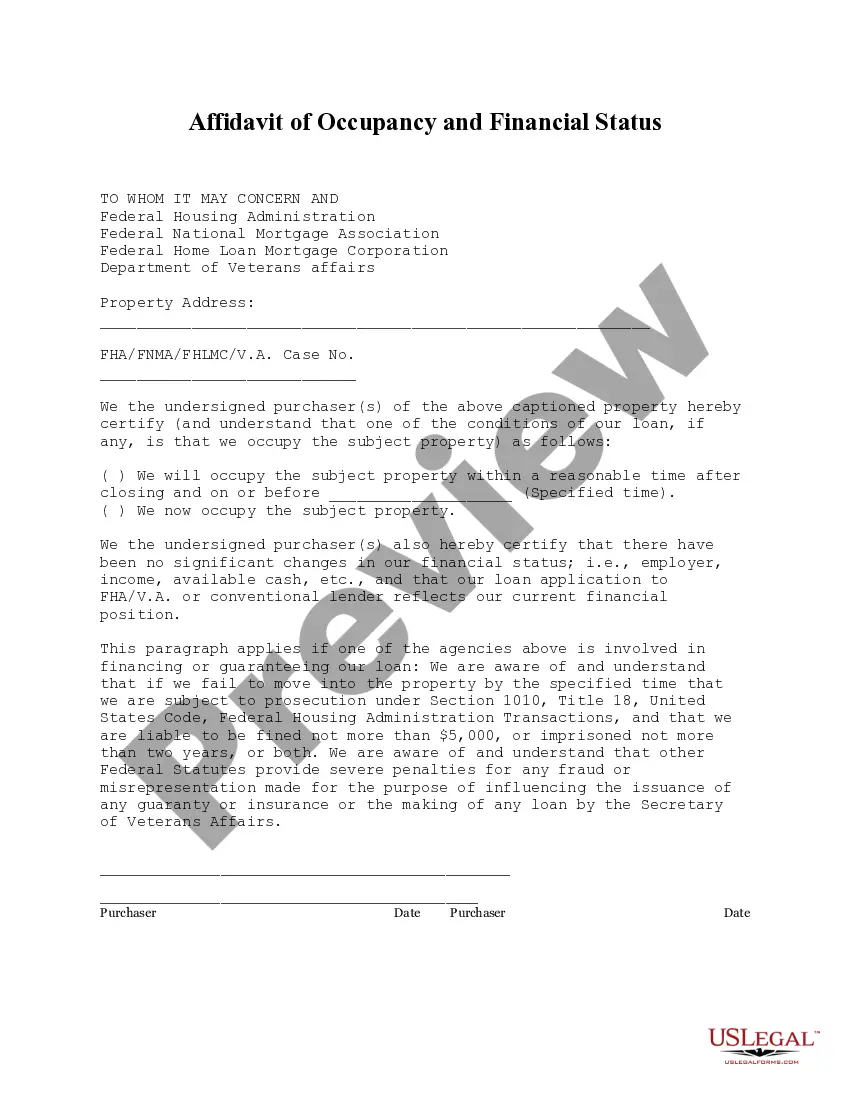

- Preview it (if this option provided) and check the supporting description to determine whether Disadvantages Of Transfer On Death Deed is what you’re searching for.

- Start your search again if you need any other template.

- Register for a free account and select a subscription plan to buy the form.

- Choose Buy now. As soon as the payment is complete, you can download the Disadvantages Of Transfer On Death Deed, complete it, print it, and send or send it by post to the necessary individuals or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

No plan for incapacity. If you suddenly become incapacitated and unable to manage your own affairs, a transfer-on-death clause will do nothing to help you. Your beneficiary will not be able to access the money to pay your bills because they only get the money once you have died.

Invalidation and Probate The transfer on the death deed is rendered ineffective if the designated recipient passes away before the property owner. This could cause the property to enter probate without adequate planning or execution, negating the goal of using a transfer on the death deed to avoid probate.

Pros and cons of a transfer on death deed Avoid probate. Property with a TOD deed typically does not have to pass through probate court to transfer to its beneficiaries. ... Avoid federal gift tax paperwork. ... Maintain Medicaid eligibility. ... It might prevent property from being used to repay Medicaid benefit costs.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

The most important benefit of a TOD account is simplicity. Estate planning can help minimize the legal mess left after you die. Without it, the probate system can take over the distribution of your assets. It can also name an executor of your estate and pay off your remaining debts with your assets.