Mississippi Support Application For Ad Valorem Tax Exemption

Description

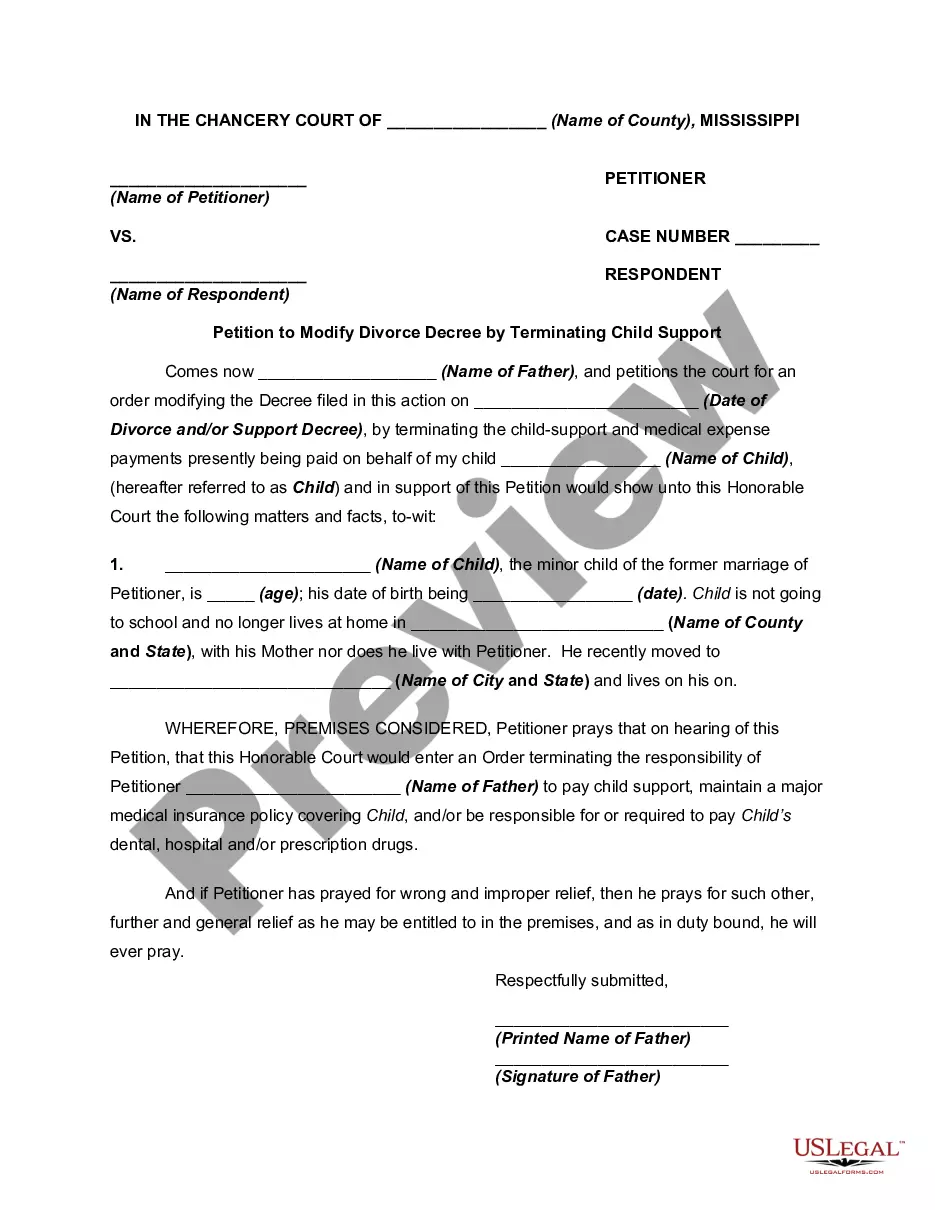

How to fill out Mississippi Petition To Modify Divorce Decree By Terminating Child Support - Child Emancipated?

Maneuvering through the red tape of official documents and templates can be challenging, particularly if one does not engage in that professionally.

Even locating the suitable template for the Mississippi Support Application For Ad Valorem Tax Exemption may prove to be labor-intensive, as it must be accurate and correct to the final digit.

However, you will need to dedicate considerably less time selecting an appropriate template from the resources you can trust.

Acquire the correct form in a few simple steps: Enter the document's title in the search bar. Locate the suitable Mississippi Support Application For Ad Valorem Tax Exemption among the results. Review the description of the sample or view its preview. If the template meets your requirements, click Buy Now. Continue to select your subscription plan. Utilize your email and establish a security password to register an account at US Legal Forms. Choose a credit card or PayPal payment option. Download the template file onto your device in the format of your preference. US Legal Forms can save you time and effort determining if the form you found online is appropriate for your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of finding the right forms online.

- US Legal Forms serves as a single source one needs to acquire the latest document samples, understand their use, and download these samples to complete them.

- It is a compilation of over 85K forms applicable in diverse sectors.

- When searching for a Mississippi Support Application For Ad Valorem Tax Exemption, you will not have to doubt its authenticity as all forms are validated.

- An account at US Legal Forms will guarantee you have all the essential samples at your fingertips.

- You can archive them in your history or append them to the My documents collection.

- You can access your stored forms from any device by clicking Log In at the library site.

- If you still lack an account, you can always search for the template you require.

Form popularity

FAQ

The ad valorem tax on vehicles in Mississippi is calculated based on the car's assessed value, which can change annually. Typically, the tax rate is 3% of the assessed value for most vehicles. By leveraging the Mississippi support application for ad valorem tax exemption, you can better understand how to manage or potentially reduce your vehicle's tax impact.

Ad valorem tax for car registration is a tax based on the value of the vehicle you own. The tax amount reflects the vehicle's market value as determined by the state. Through the Mississippi support application for ad valorem tax exemption, you can explore potential exemptions that might reduce the tax burden on your vehicle.

In Mississippi, property tax exemptions for seniors typically apply to individuals who are 65 years or older. However, eligibility for these exemptions may depend on various factors, including income and residency. Utilizing the Mississippi support application for ad valorem tax exemption can help you find out if you qualify and save on property taxes.

The ad valorem tax exemption in Mississippi allows eligible property owners to reduce their property taxes based on the assessed value of their property. This exemption aims to alleviate the financial burden on qualifying individuals, enhancing homeownership opportunities. To benefit from this exemption, complete the Mississippi support application for ad valorem tax exemption to start saving today.

Exemptions from property taxes in Mississippi apply to various groups, including seniors, disabled individuals, and veterans. Additionally, churches and nonprofit organizations often enjoy such exemptions. If you believe you qualify, using the Mississippi support application for ad valorem tax exemption can simplify your application process and ensure you receive the benefits you deserve.

In Mississippi, certain properties are exempt from ad valorem taxes, including public property, churches, and non-profit organizations. Additionally, homes owned by individuals who meet specific criteria may also qualify. To learn more about exemptions relevant to your situation, consider using the Mississippi support application for ad valorem tax exemption.

In Mississippi, individuals who turn 65 years old can apply for exemptions that significantly reduce or eliminate their property tax burden. However, stopping payment entirely on property taxes depends on individual circumstances and specific exemptions applied. The Mississippi support application for ad valorem tax exemption can help seniors navigate this process effectively.

In Mississippi, homeowners who occupy their homes as their primary residence may qualify for the homestead exemption. This includes individuals who are 65 years old or older, as well as those with disabilities. To apply, you must complete the Mississippi support application for ad valorem tax exemption, providing necessary documentation to verify your eligibility.

Ad valorem, in the context of taxes, means 'according to value'. This term indicates that the tax due is calculated based on the assessed value of the property or item in question. Understanding this concept is essential, especially when considering the Mississippi support application for ad valorem tax exemption. This application can provide guidance and potentially simplify how you navigate your tax responsibilities, ensuring you take advantage of any exemptions available to you.

Ad valorem tax in Mississippi refers to a tax system where the amount taxed is based on the value of personal property, including vehicles and real estate. This tax is crucial for generating revenue for local governments which support services like education and public infrastructure. By using the Mississippi support application for ad valorem tax exemption, you can explore your eligibility for exemptions that may decrease the amount you owe. It’s a practical way to manage your expenses while staying compliant with state tax laws.