Quitclaim Deed With Life Use

Description

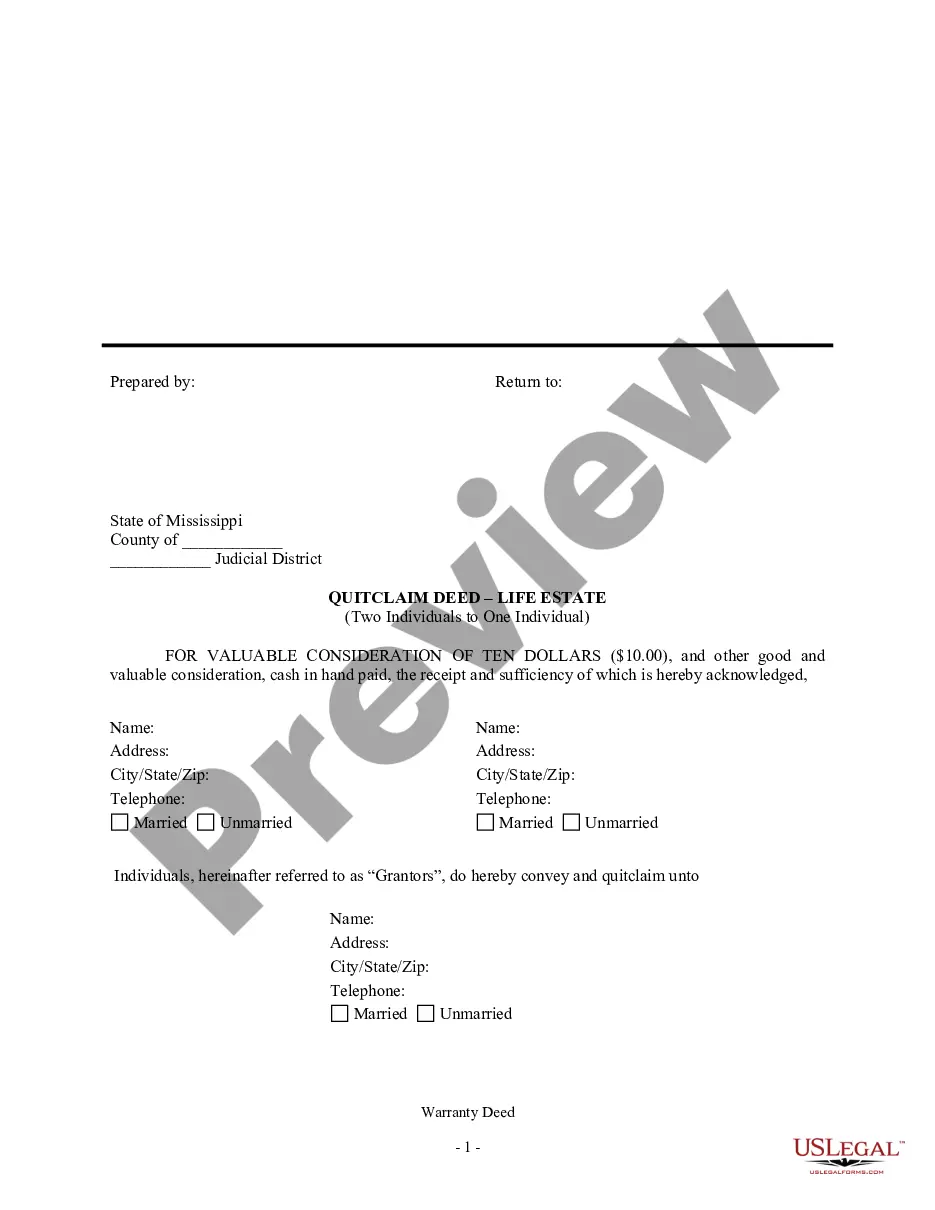

How to fill out Mississippi Quitclaim Deed - Life Estate - Two Grantors To One Grantee?

The Quitclaim Deed With Life Use you see on this page is a multi-usable legal template drafted by professional lawyers in line with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Quitclaim Deed With Life Use will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or review the form description to confirm it suits your requirements. If it does not, utilize the search bar to find the right one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Pick the format you want for your Quitclaim Deed With Life Use (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a eSignature.

- Download your papers one more time. Use the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Among other things, a quitclaim deed or non-warranty deed must include the following items: Names and addresses of the current owner and new owner; A legal description of the property; The name of the person who prepared the deed;23 and. A statement that the property is or is not the transferor's primary residence.

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The title is transferred without any amendments or additions.

A quitclaim deed to real estate may be substantially the same as a warranty deed, with the word "quitclaim" inserted in connection with the words "do hereby grant, bargain, sell and convey," as follows: "Do hereby quitclaim, grant, bargain, sell and convey," and by omitting the words, "and warrant the title to the same ...

Due to this, quitclaim deeds typically are not used in situations where the property involved has an outstanding mortgage. After all, it would be difficult for many grantors to pay off a mortgage without proceeds from the sale of the property.

There is a four-year statute of limitations for a prior deed to come into the chain of title and take effect.