Changing Name After Marriage Maine

Description

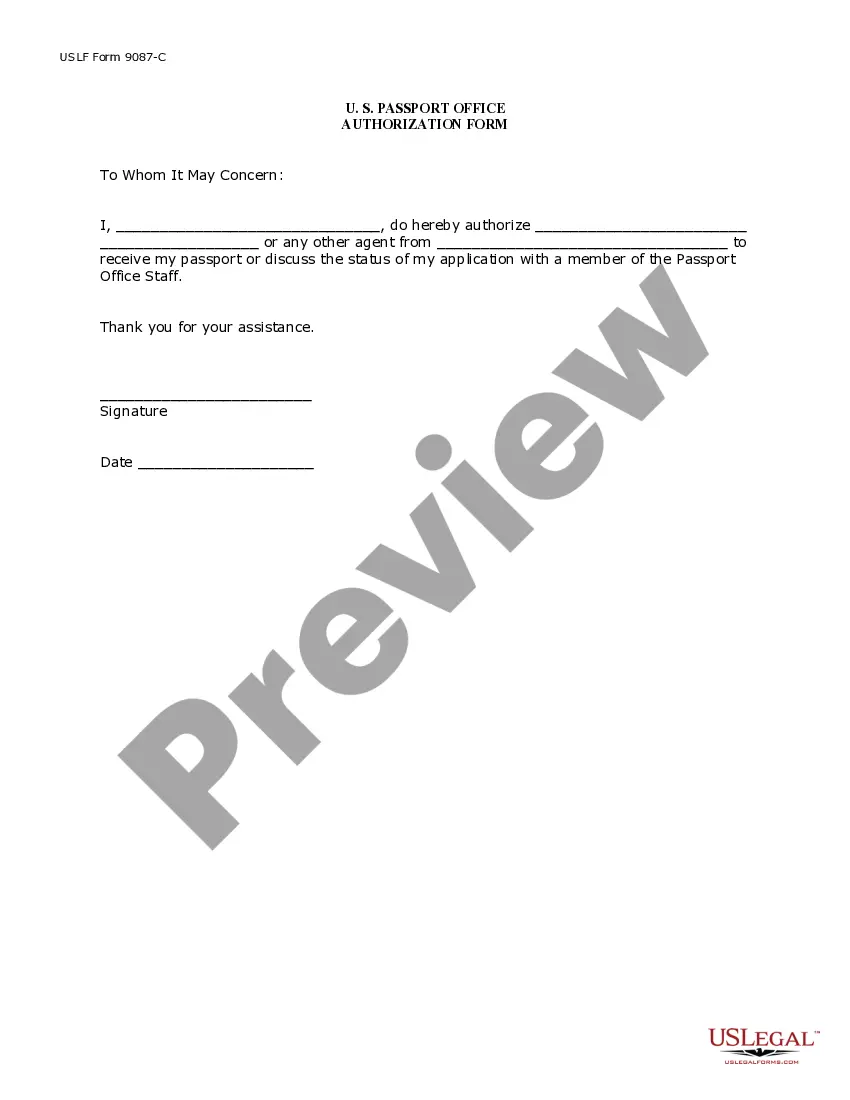

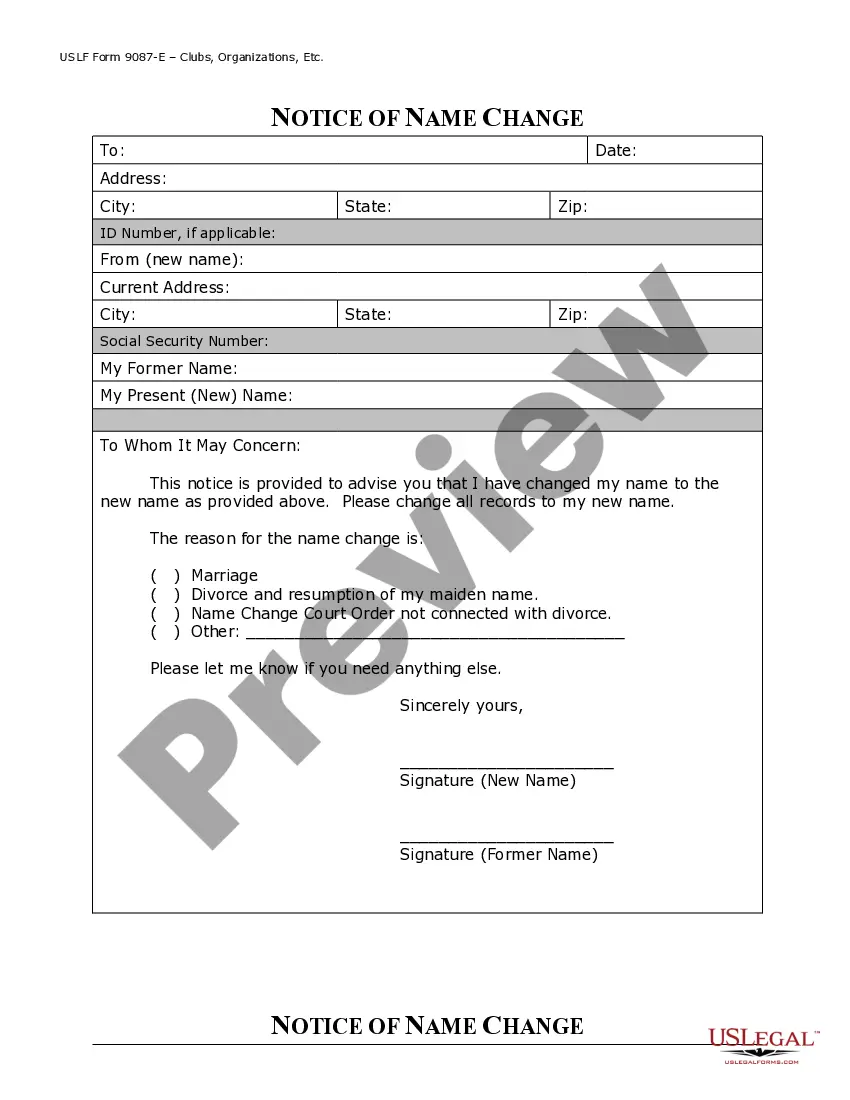

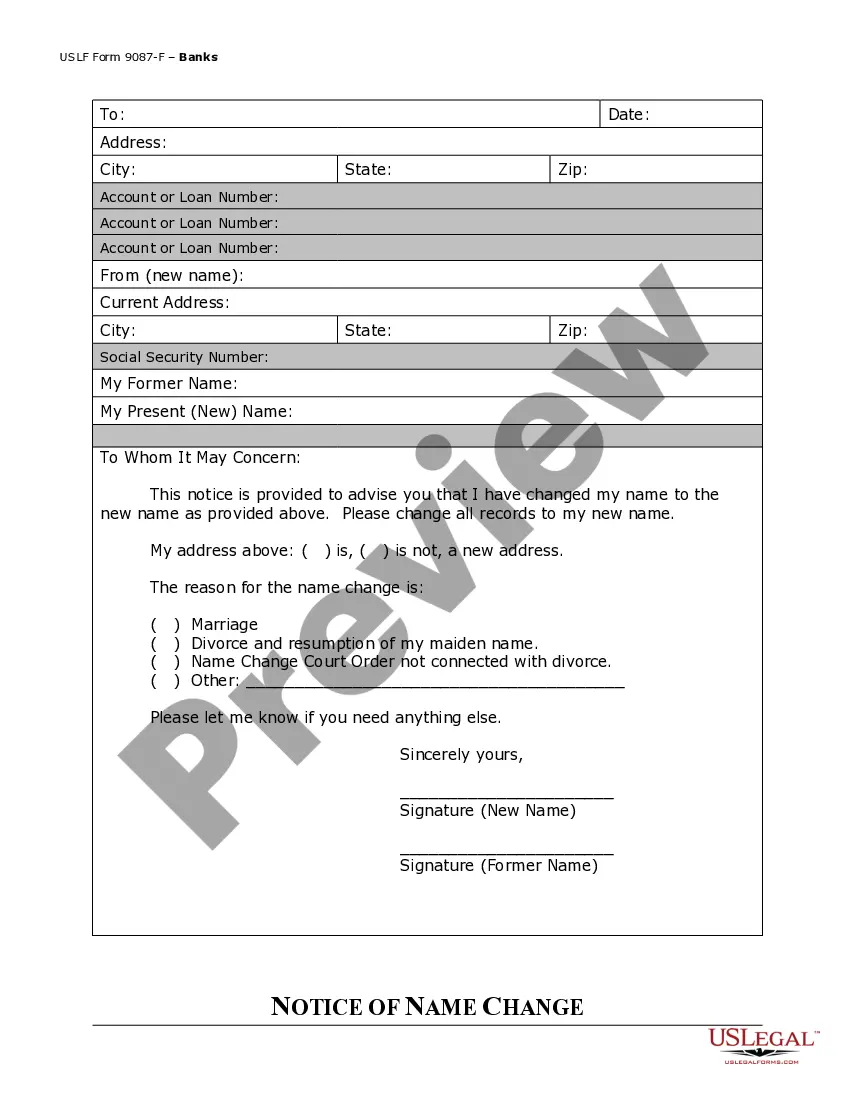

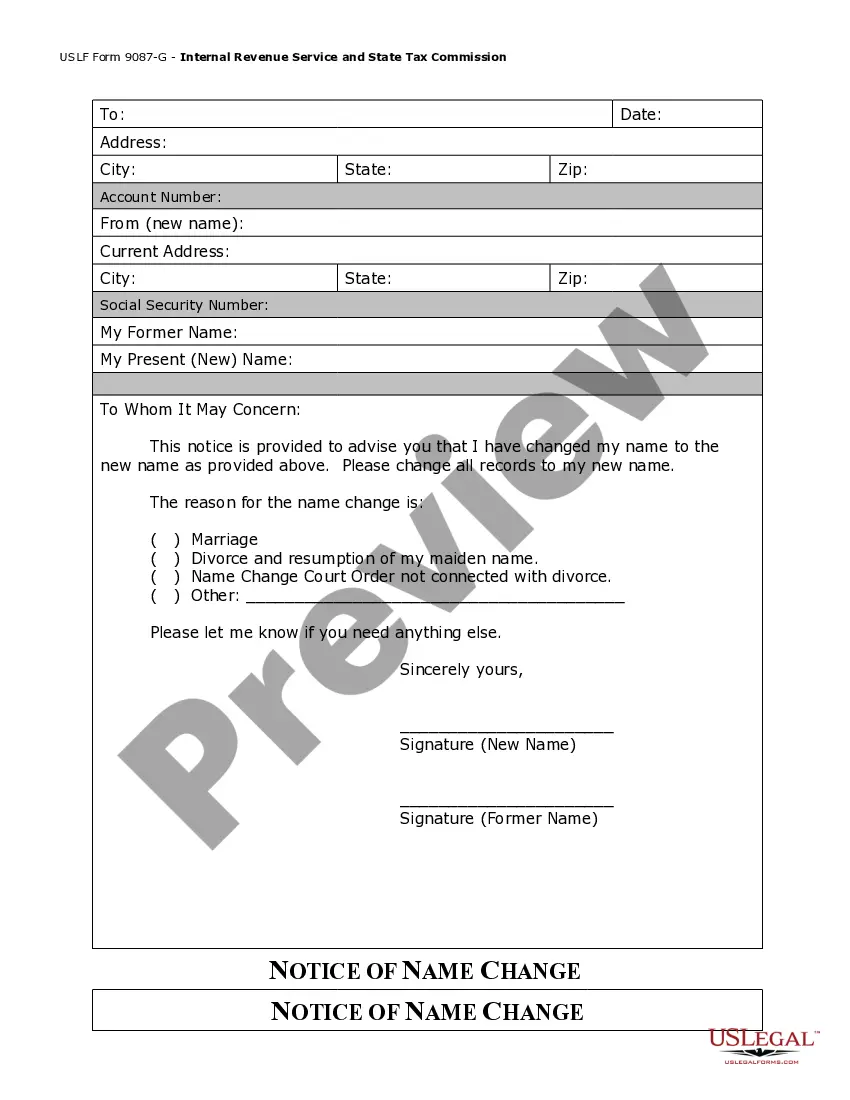

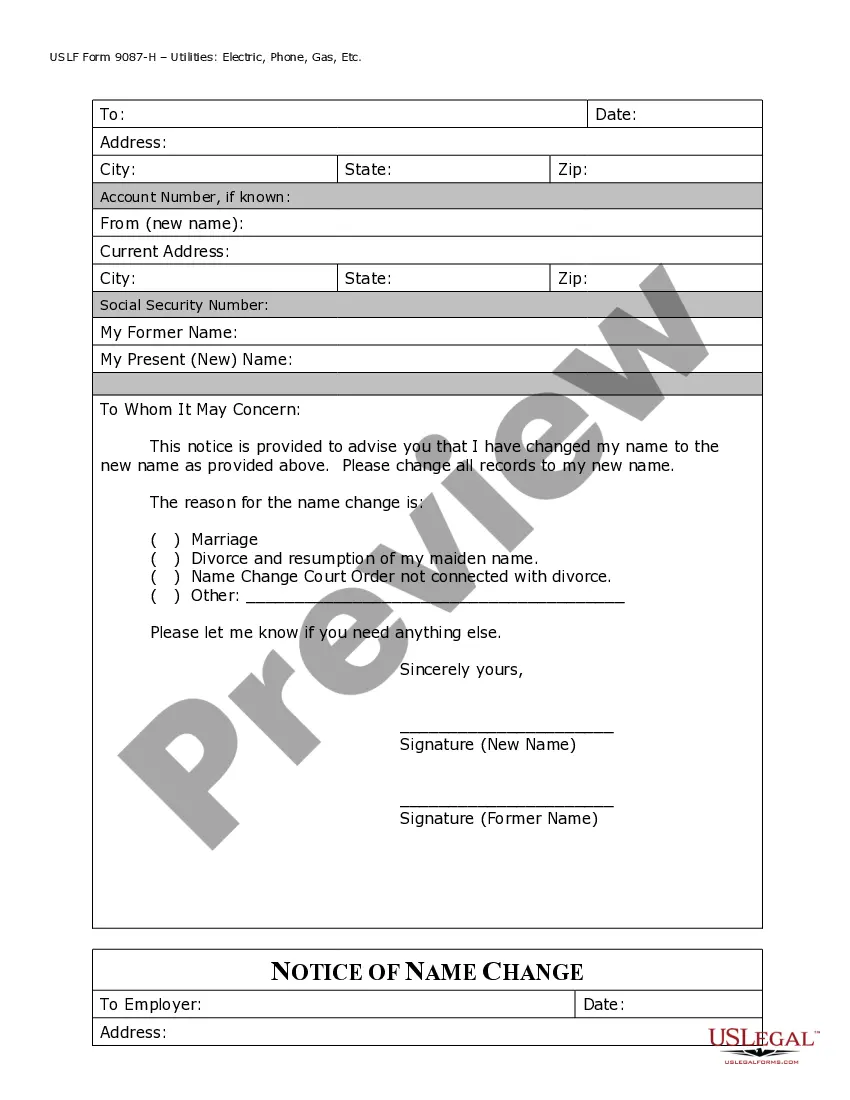

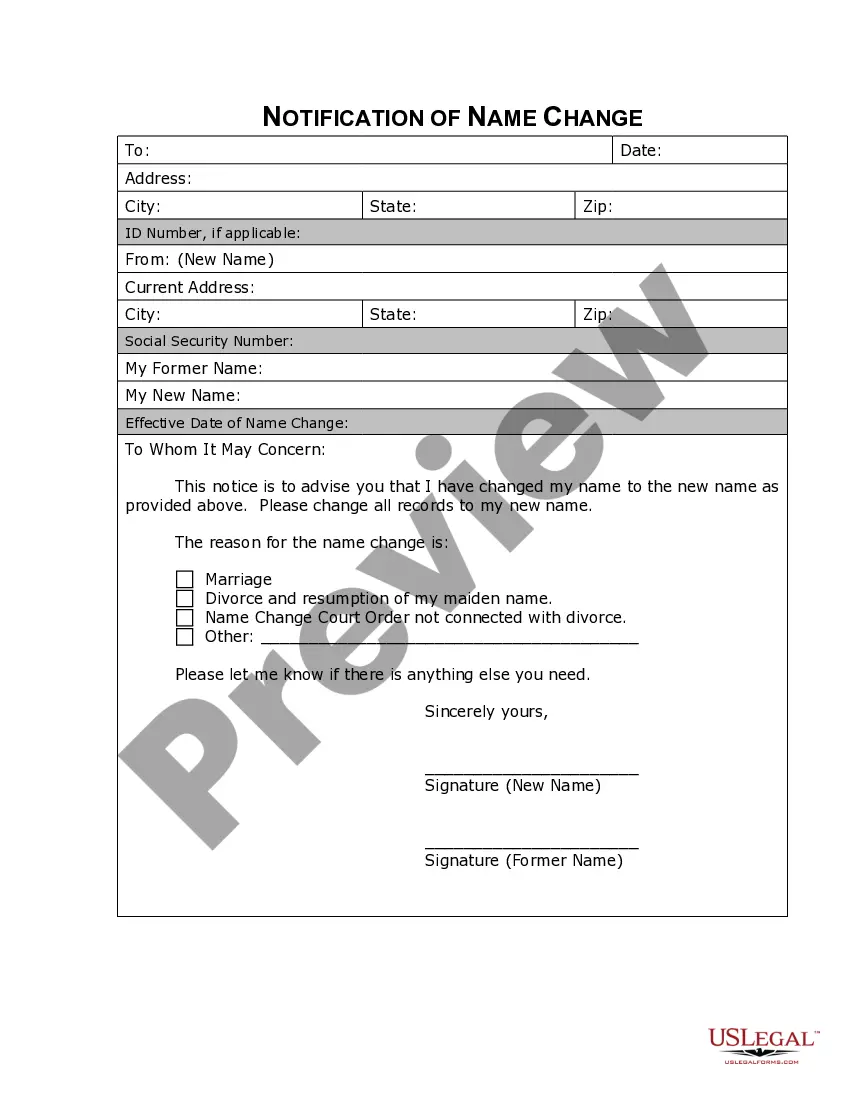

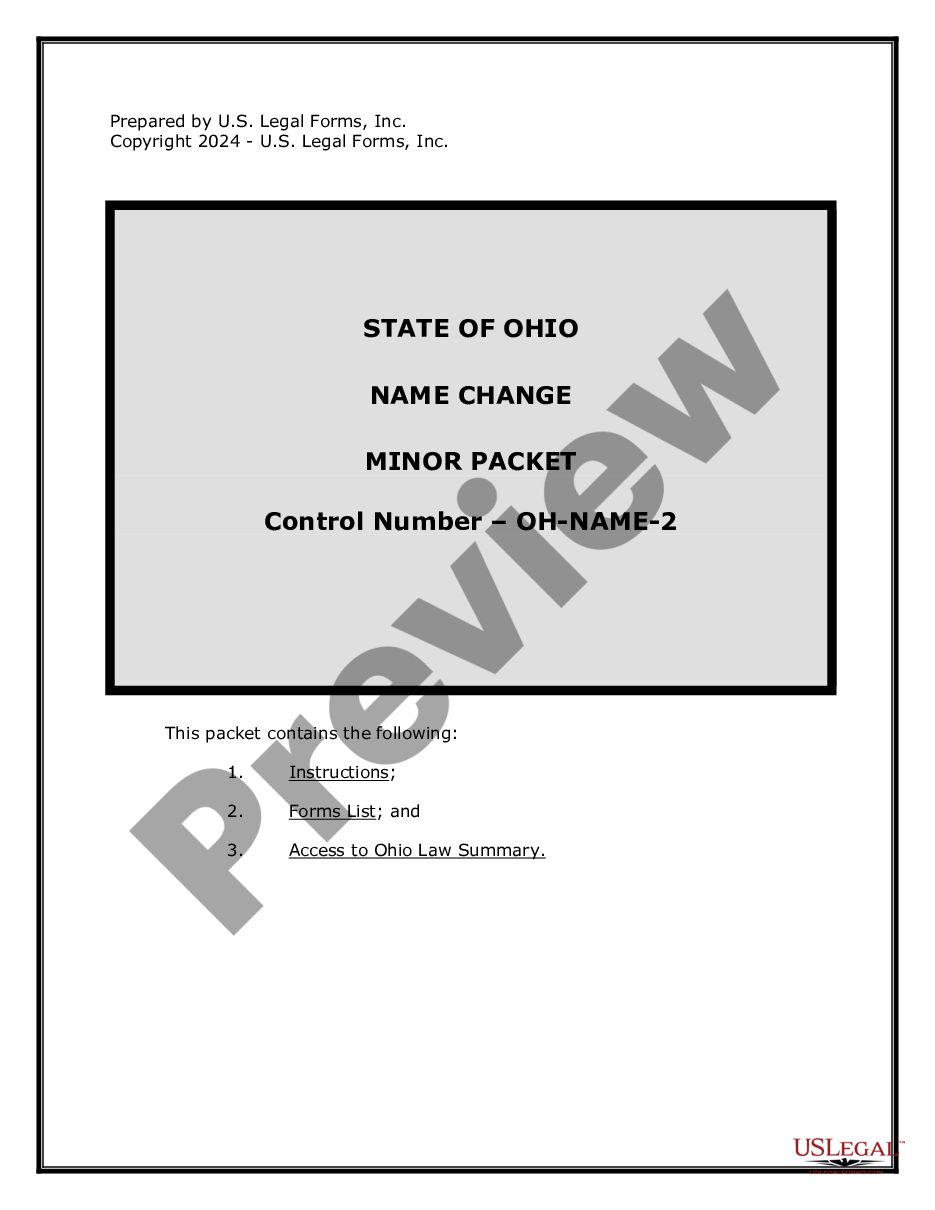

How to fill out Maine Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

It’s clear that becoming a legal authority instantly is unrealistic, and you won’t be able to master the swift creation of Changing Name After Marriage Maine without specialized expertise.

Compiling legal documents is an extensive endeavor that demands particular training and abilities. So why not entrust the development of the Changing Name After Marriage Maine to the professionals.

With US Legal Forms, offering one of the most comprehensive libraries of legal templates, you can locate everything from court papers to templates for internal corporate correspondence. We understand the significance of compliance and adherence to federal and state laws and regulations. This is why all forms on our site are tailored to specific locations and kept current.

Select Buy now. After your payment is processed, you can obtain the Changing Name After Marriage Maine, fill it out, print it, and send it to the intended individuals or organizations either physically or by post.

You can re-access your forms from the My documents section at any time. If you already have an account, you can simply Log In, and find and download the template from the same area.

Regardless of the purpose of your document—be it financial and legal, or personal—our website is here to assist you. Experience US Legal Forms today!

- Begin with our website to acquire the document you need within moments.

- Identify the form you require using the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to confirm if Changing Name After Marriage Maine matches your needs.

- If you require a different template, restart your search.

- Sign up for a free account and select a subscription plan to obtain the form.

Form popularity

FAQ

Structure of an I-Owe-You Contract The lender's full name. The borrower's full name. The amount of money ($) borrowed. The due date for the borrowed money. The amount ($) the borrower will pay per month/week. The date the borrower and seller signed the document.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

A loan agreement is: A borrower's written promise to repay a sum of money, or principal, to the lender. A document that outlines the terms of a loan, including a repayment plan, between a lender and a borrower.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

What is a Promissory Note? A Promissory Note documents the borrower's legally binding promise to repay a loan under certain terms and conditions.

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

A promissory note is essentially a written promise to pay someone. This type of document is common in financial services and is something you've likely signed in the past if you've taken out any kind of loan. If you decide to lend money to someone, you may want to create a promissory note to formalize the loan.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.