41e Dismissal With Prejudice

Description

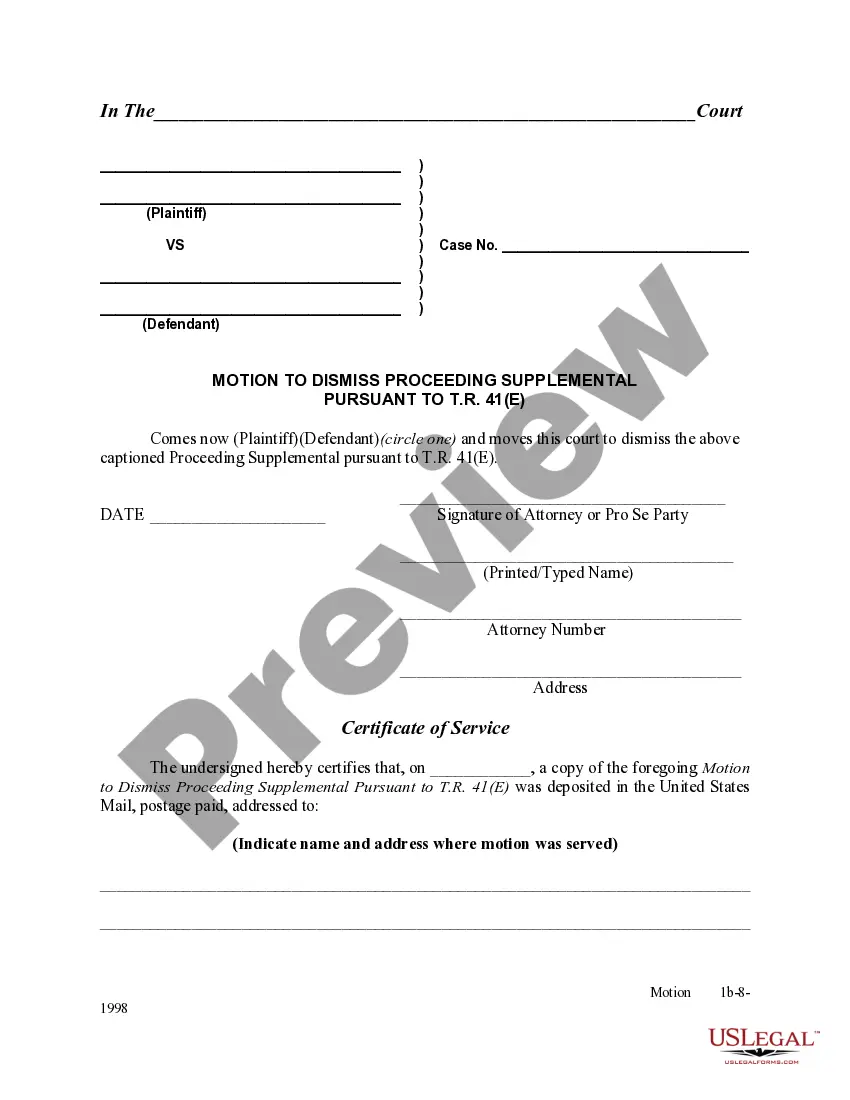

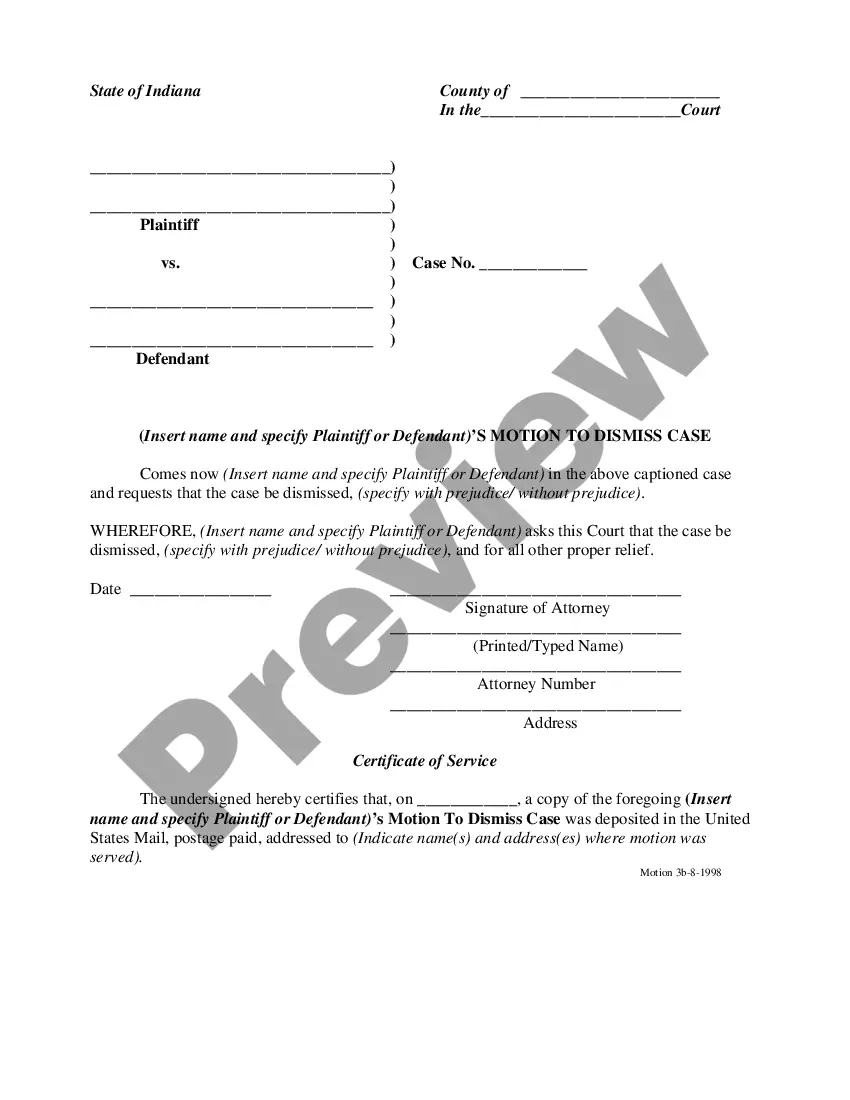

How to fill out Indiana Motion To Dismiss Case Pursuant To T.R . 41e?

Locating a reliable source for the latest and suitable legal templates is a major part of navigating bureaucracy.

Acquiring the correct legal documents necessitates accuracy and meticulousness, which is why it is vital to obtain samples of 41e Dismissal With Prejudice solely from reputable sources, such as US Legal Forms.

Once you have the form on your device, you can modify it using the editor or print it out and fill it in by hand. Eliminate the complications that come with your legal paperwork. Explore the extensive US Legal Forms catalog to find legal templates, assess their relevance to your situation, and download them instantly.

- Utilize the library navigation or search function to find your template.

- View the information of the form to confirm it meets your state's and area's requirements.

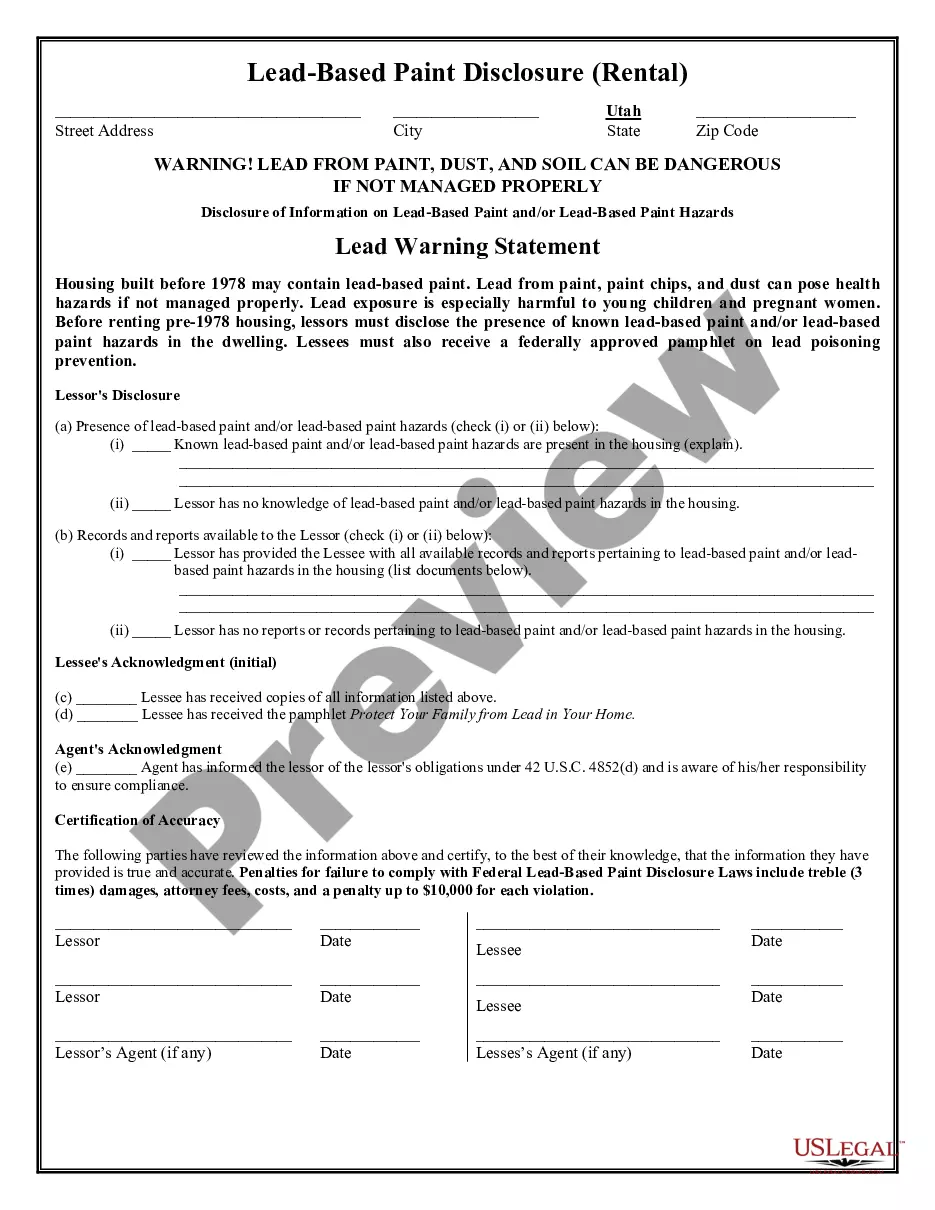

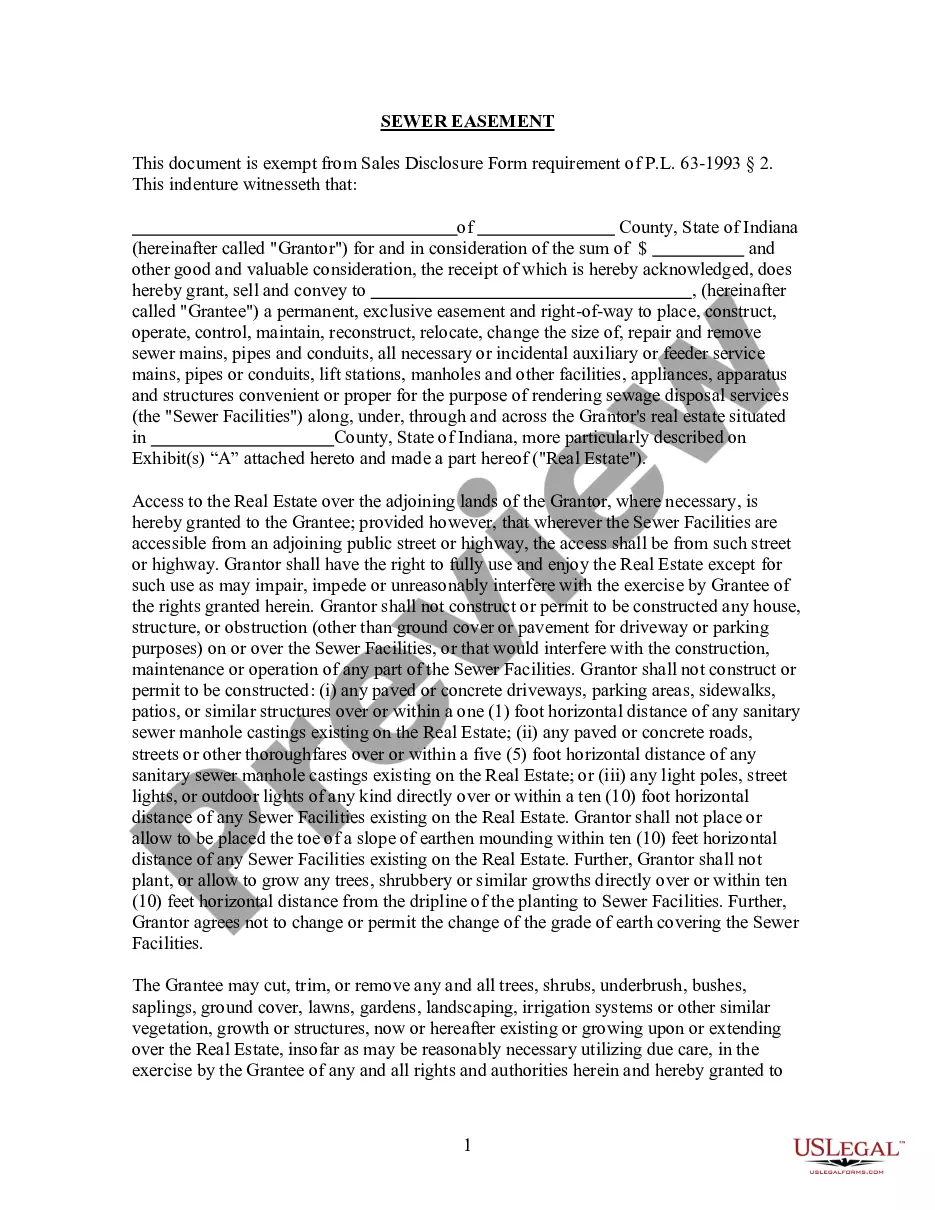

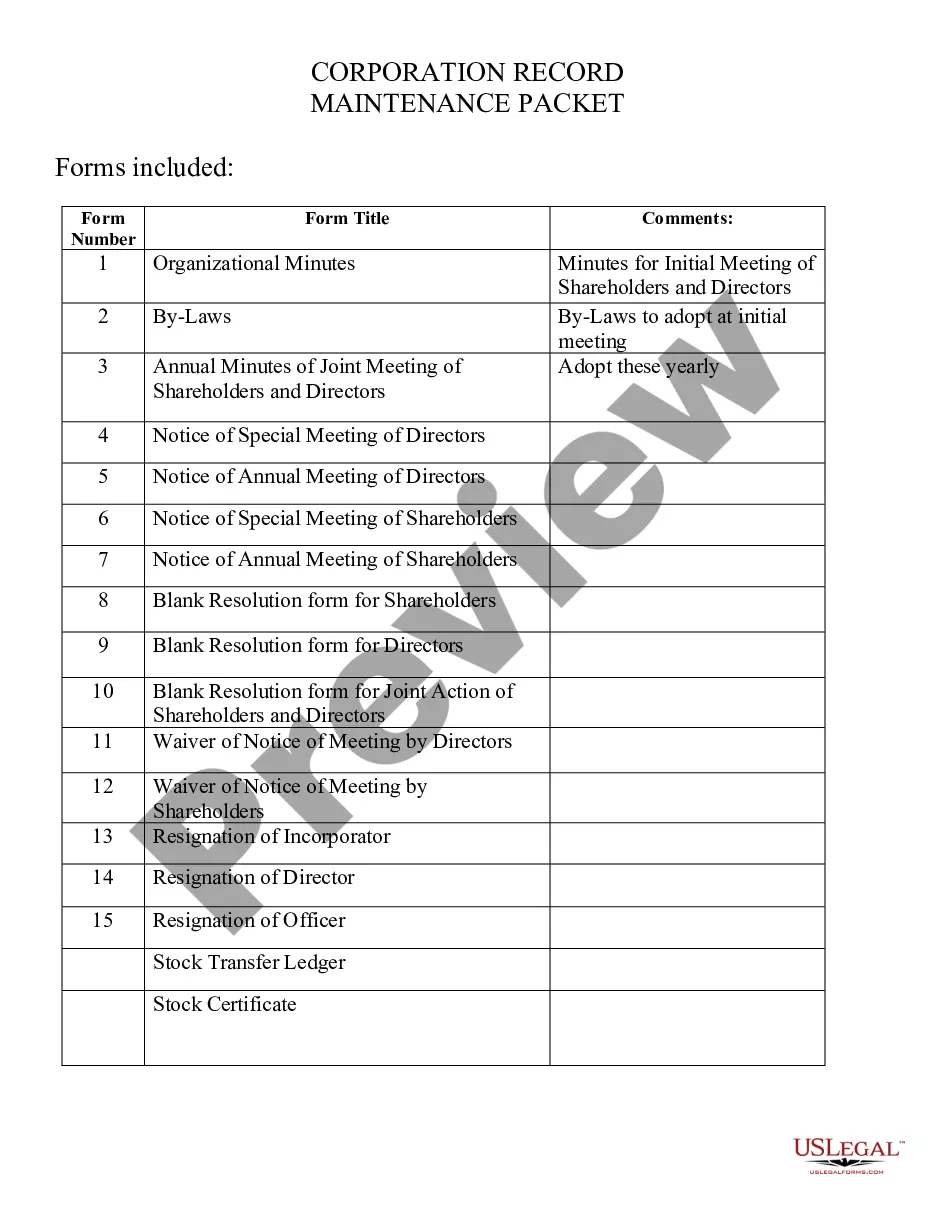

- Check the form preview, if available, to ensure that the document is indeed the one you require.

- Return to the search to find the appropriate document if the 41e Dismissal With Prejudice does not align with your needs.

- Once you are certain of the form's relevance, download it.

- If you are a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you do not yet have an account, click Buy now to acquire the form.

- Select the pricing plan that suits your needs.

- Proceed with registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the format of the document for downloading 41e Dismissal With Prejudice.

Form popularity

FAQ

First, filing Form 8832 lets the IRS know that you want to be taxed as a corporation. Then, you will elect S Corp taxation by filing Form 2553 Election by a Small Business Corporation with the IRS.

Searching the Massachusetts Name Database Visit the Corporations Division Business Entity Search. Search Your LLC Name. Select ?Search by entity name?, then enter your desired LLC name in the ?Enter name? box. Browse the Results. Change the ?Display number of items to view? to 100 items per page.

An LLP or an LLC with two or more members will be treated as a partnership if it's treated as a partnership for federal tax purposes. An LLP or LLC will be treated as a corporation for Massachusetts income tax purposes if it is classified as such for federal tax purposes.

A Massachusetts LLC is similar to a corporation but less formal. The owners are referred to as ?members,? whereas the owners of a corporation are its ?shareholders.? Members of an LLC are taxed like a sole proprietorship, partnership, or S Corp, with income from the LLC passing through to the LLC members.

After you form an LLC in Massachusetts, you must file an Annual Report every year. This requirement applies to all LLCs doing business in Massachusetts, even if you didn't earn any money in that year. You need to file an Annual Report in order to keep your LLC in compliance and in good standing with the state.

Limits and separates your personal liability from your business liability and debts. Simple tax filing and potential advantages for tax treatment. Strong support for small local businesses. Numerous business tax credits.

LLCs that want to file a Massachusetts amendment have to file a Certificate of Amendment with the Corporations Division of the Secretary of the Commonwealth and pay at least $100 for the filing fee. You can do this by fax, mail, or in person. Massachusetts does not have a ready-made form, so you have to draft your own.