Illinois Lead Based Paint Disclosure With Tenants

Description

How to fill out Illinois Lead Based Paint Disclosure For Sales Transaction?

Creating legal documents from the ground up can frequently feel overwhelming.

Certain situations may require extensive research and significant expenses.

If you’re looking for a more effortless and economical method to generate the Illinois Lead Based Paint Disclosure With Tenants or any other forms without unnecessary complications, US Legal Forms is readily available.

Our digital library of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

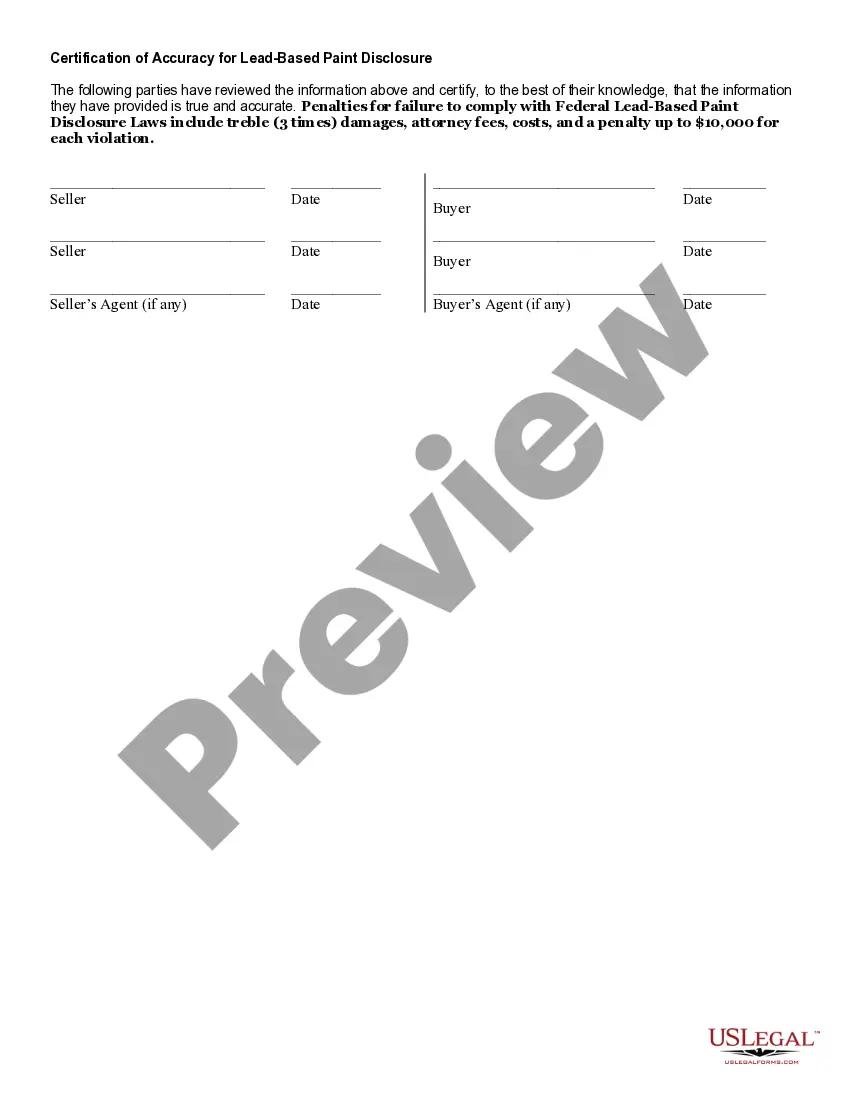

Before diving straight into downloading the Illinois Lead Based Paint Disclosure With Tenants, consider these suggestions: Review the form preview and descriptions to ensure that you have the correct form. Verify that the form you select adheres to the regulations and laws of your state and county. Choose the appropriate subscription plan to purchase the Illinois Lead Based Paint Disclosure With Tenants. Download the form, then complete, certify, and print it. US Legal Forms has an excellent reputation and over 25 years of expertise. Join us today and make document execution a straightforward and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously prepared for you by our legal experts.

- Utilize our platform whenever you need a dependable service through which you can effortlessly find and download the Illinois Lead Based Paint Disclosure With Tenants.

- If you are familiar with our services and have previously established an account with us, simply Log In to your account, locate the template, and download it or re-download it at any time in the My documents section.

- Not registered yet? No worries. It requires minimal effort to create and navigate the library.

Form popularity

FAQ

Yes, landlords in Ohio must disclose known lead-based paint hazards in properties built before 1978. Similar to Illinois, this requirement is aimed at ensuring tenant safety. Therefore, understanding the Illinois lead based paint disclosure with tenants can provide valuable insight into the measures needed across state lines, reinforcing the importance of transparency.

This form is to be used by employers and taxpayers to report essential information for the collection and distribution of Local Earned Income Taxes to the local EIT collector. This form must be used by employers when a new employee is hired or when a current employee notifies employer of a name or address change.

Go to and type in your address. If I am newly hired, but have not yet relocated for my job, is this form required? Yes, the RCF must be completed for all new hires. If you have not yet relocated, complete the form using your current permanent address.

Such evidence may include some or all of the following: lease or purchase of a permanent Pennsylvania residence; payment of Pennsylvania taxes; transfer bank accounts, stock, automobile, and other registered property to Pennsylvania; acquisition of Pennsylvania driver's license; registration to vote in the State of ...

Tax Records ? Lease Agreements ? Mortgage Documents ? W-2 Form ? Current Utility Bills (Water, Gas, Electric, Cable, etc.)

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

The following things can be used to prove an individual's residence: A rent receipt. A receipt for mortgage or utility payments. A deed. A lease agreement. A driver's license. A church record. An affidavit from someone who knows the applicant. A tax office record.

Visit a Driver License Center with: The completed DL-180 (PDF) The completed DL-180TD (PDF)(if under the age 18). ... Proof of identity, which is listed on reverse side of DL-180 (PDF). ... Two acceptable proofs of residency, listed on reverse side of DL-180 (PDF), if you are 18 years of age or older. ... Your Social Security card.

Tax Records ? Lease Agreements ? Mortgage Documents ? W-2 Form ? Current Utility Bills (Water, Gas, Electric, Cable, etc.)