Partial Release Of Mortgage Without Satisfaction Of Debt

Definition and meaning

A partial release of mortgage without satisfaction of debt is a legal document that permits a lender to release their lien on a designated portion of a property while retaining the lien on the remaining property. This type of release is commonly used in real estate transactions, particularly when a borrower sells a portion of a property, grants an easement, or engages in property development. The original mortgage remains in force for the unpaid balance on the remaining property, ensuring that the lender's interests are protected even after the release.

How to complete a form

To complete the partial release of mortgage form, follow these steps:

- Begin by filling out the lender and borrower information accurately.

- Identify the mortgage document, including the date and recording details.

- Describe the specific portion of the property being released, or attach a separate exhibit if necessary.

- Ensure the corporation executing the release is correctly named and authorized.

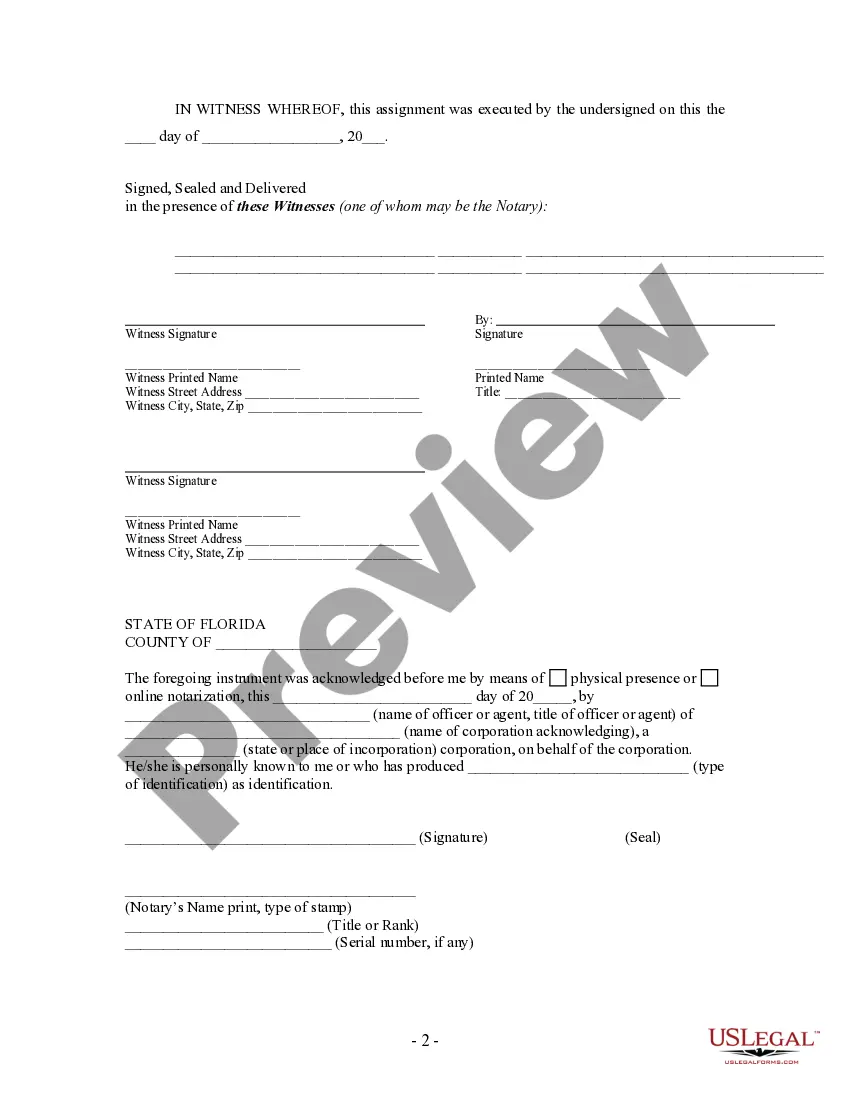

- Obtain the necessary signatures from the borrower and witnesses.

- Submit the completed form to your lender for approval.

- Once approved, record the release document with the appropriate county office.

Common mistakes to avoid when using this form

When filling out a partial release of mortgage, it is important to avoid these common mistakes:

- Incomplete Information: Ensure all required fields are filled out completely to prevent processing delays.

- Incorrect Property Description: Double-check the property description and ensure it matches public records.

- Notary Issues: Make sure that the document is notarized correctly, as any failure may render it invalid.

- Missing Fees: Be aware of any fees associated with the release, and make timely payments if necessary.

Key components of the form

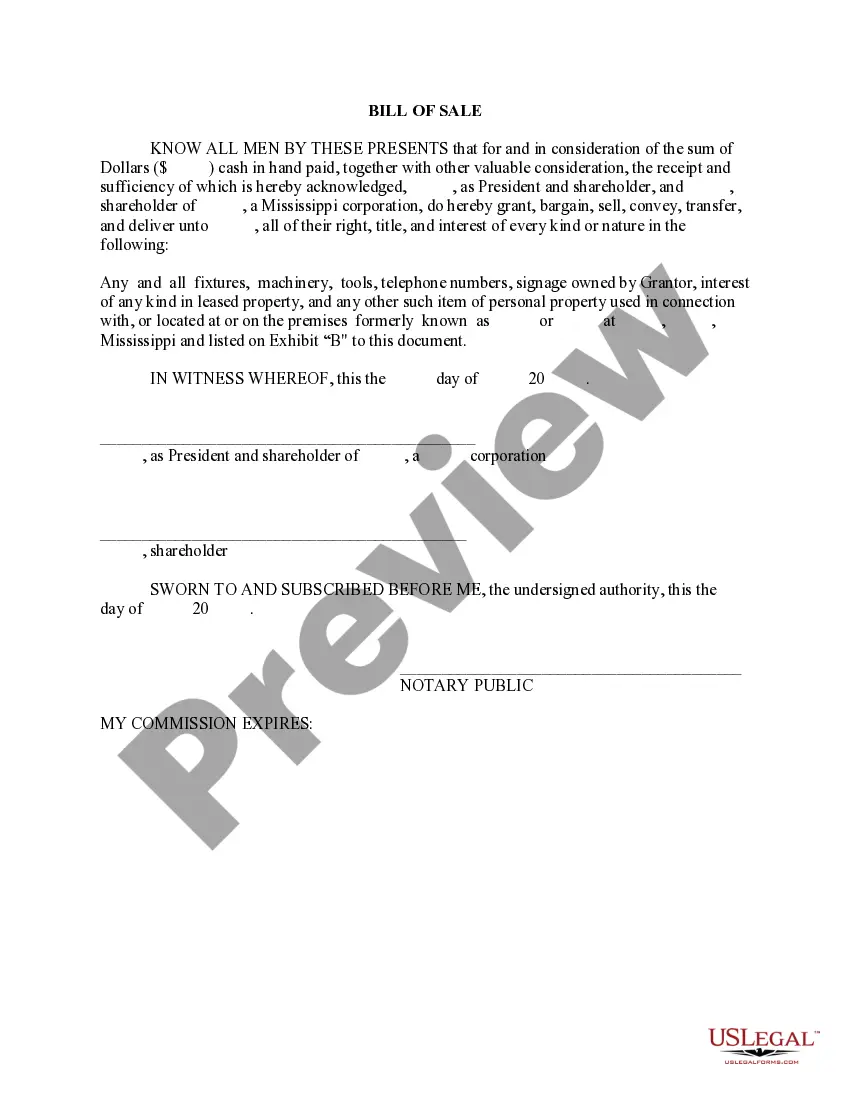

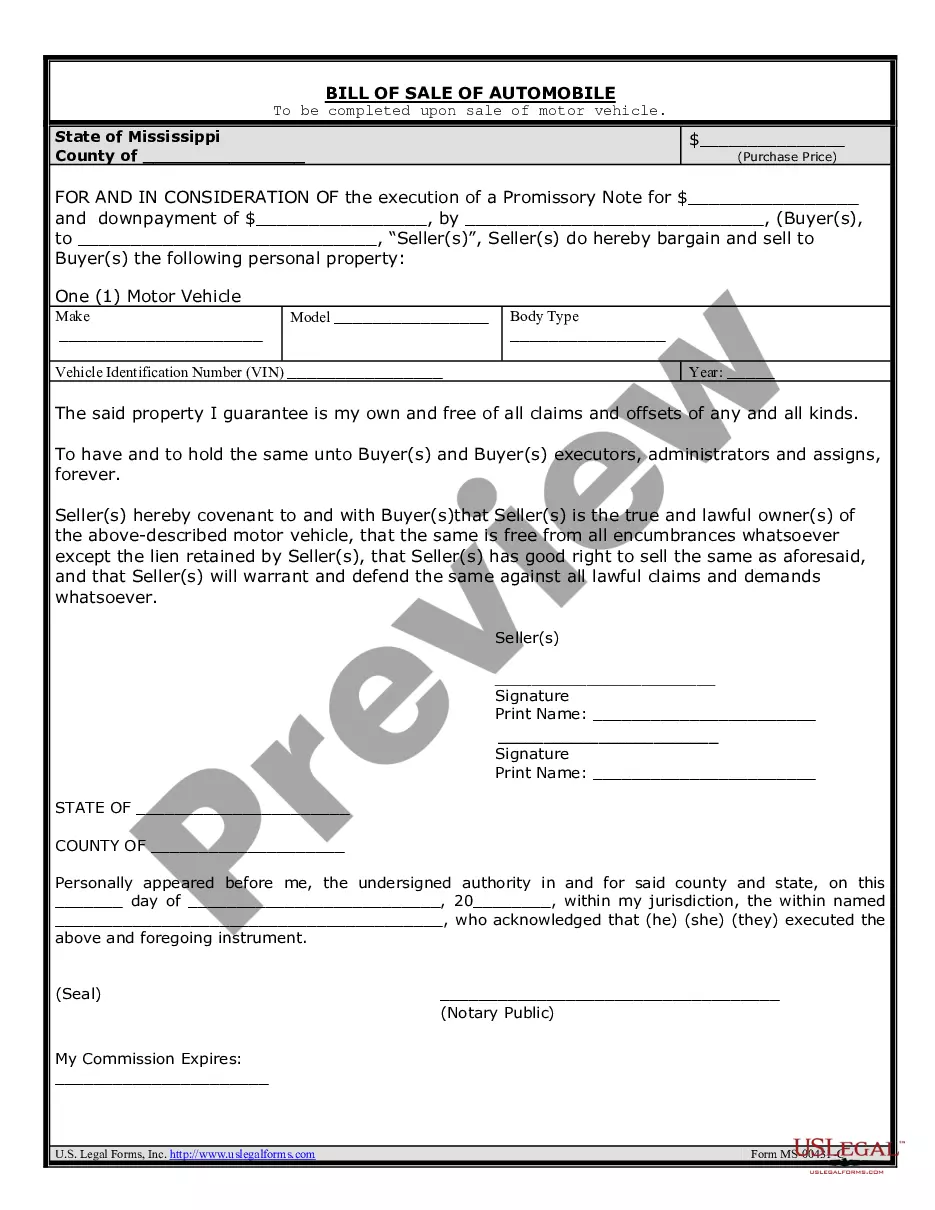

The partial release of mortgage form includes the following key components:

- The identities of the borrowers and lenders involved.

- The original mortgage details, including the date of execution and recording information.

- A clear description of the property being released.

- The statement indicating that this is a partial release and that the remaining property is still subject to the mortgage.

- Signature sections for the parties involved, as well as witness lines if required.

- Notarial acknowledgment section to verify the execution of the document.

What documents you may need alongside this one

When preparing to file a partial release of mortgage, you may also need the following documents:

- A survey map indicating the boundary of the property to be released.

- An appraisal of the remaining property, confirming its value.

- Proof of timely mortgage payments to assure the lender of the borrower's financial reliability.

Benefits of using this form online

Utilizing online resources to complete a partial release of mortgage offers several benefits:

- Convenience: Access the necessary forms anytime and anywhere, avoiding trips to legal offices.

- Time-Saving: Quickly fill out and submit forms without delays associated with traditional methods.

- Cost-Efficient: Often, online forms are available at a lower cost compared to hiring legal services.

- Guidance: Many online platforms provide step-by-step instructions and tips to help users accurately complete their forms.

How to fill out Florida Partial Release Of Property From Mortgage For Corporation?

Well-structured formal paperwork is one of the essential safeguards for preventing complications and disputes, but acquiring it without the help of an attorney may require time.

Whether you must promptly locate a current Partial Release Of Mortgage Without Satisfaction Of Debt or other templates for employment, family, or business scenarios, US Legal Forms is consistently here to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button alongside the selected document. Additionally, you can retrieve the Partial Release Of Mortgage Without Satisfaction Of Debt whenever needed, as all documents previously obtained on the platform remain accessible within the My documents section of your profile. Save time and resources on preparing official paperwork. Experience US Legal Forms today!

- Verify that the document is appropriate for your circumstances and location by reviewing the description and preview.

- Search for an alternate sample (if necessary) using the Search bar in the header of the page.

- Press Buy Now once you locate the relevant template.

- Choose the payment option, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose either PDF or DOCX format for your Partial Release Of Mortgage Without Satisfaction Of Debt.

- Press Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

A partial lien release is a legal contract that enables your lender to release their lien on a part of your mortgaged property. Under the typical terms of a partial release, if you pay down a certain amount of your mortgage principal, your lender will agree to release some of your property from the loan contract.

What is a Satisfaction of Mortgage? A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

In addition the following information should be included:The Payee Name.The Owner(s) of the mortgage holder.Total amount of mortgage.Mortgage date of execution.Full and legal description of the property to include tax parcel number.Acknowledgement that all payments have been made in full.More items...?

Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release. Borrowers may need to pay fees to the lender and to the county recorder's office. A mortgagor may request a partial release when they wish to sell a portion of the land on their property.