For Lease

Description

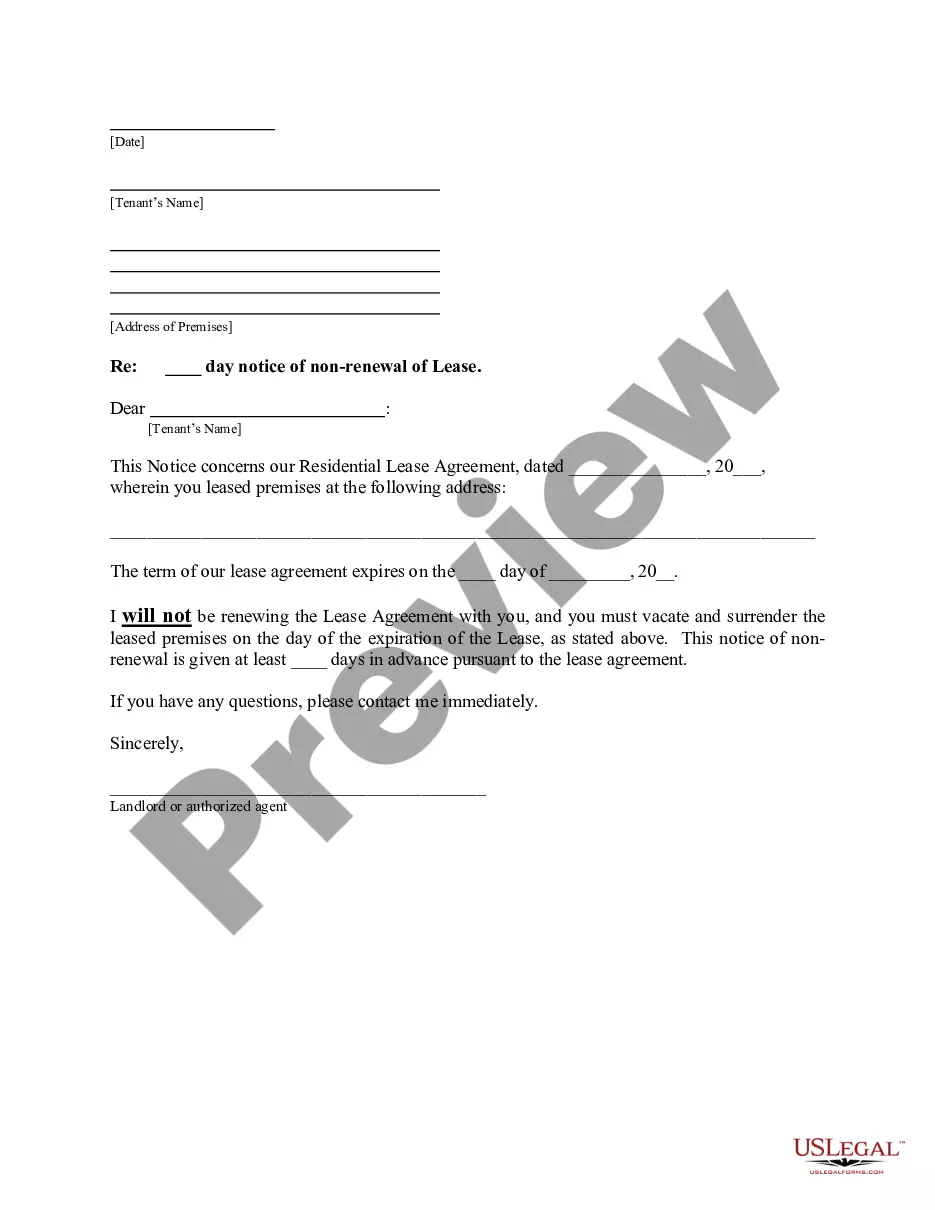

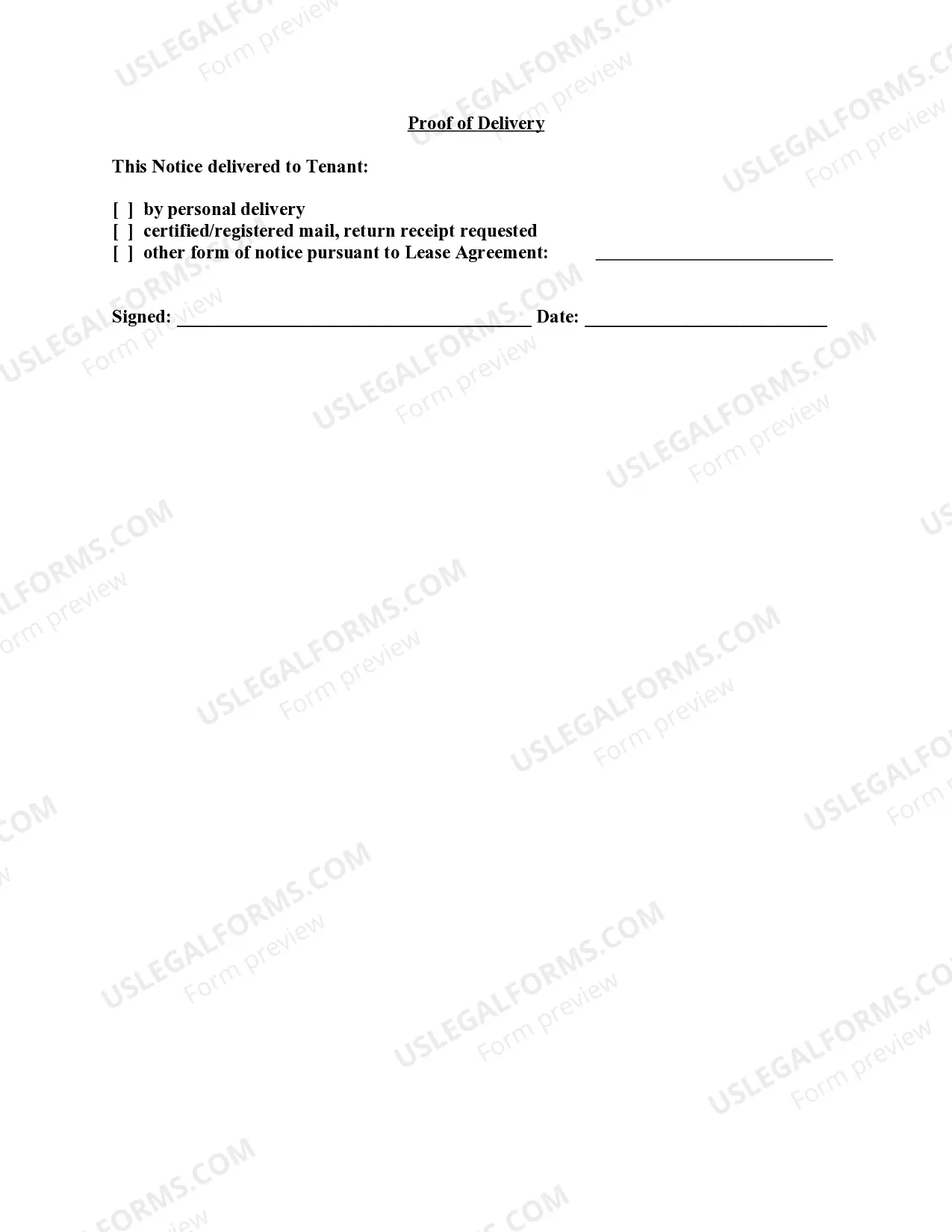

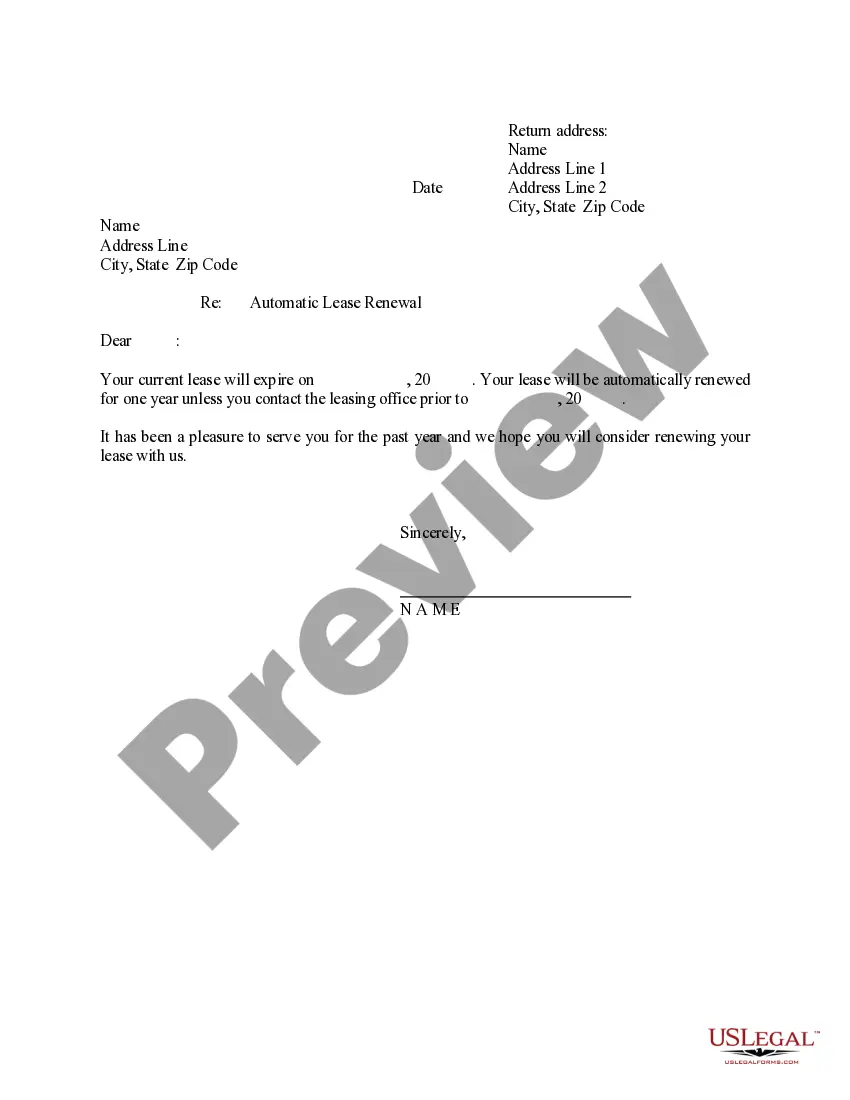

How to fill out Florida Letter From Landlord To Tenant With 30 Day Notice Of Expiration Of Lease And Nonrenewal By Landlord - Vacate By Expiration?

- Log in to your US Legal Forms account if you're a returning user. Make sure your subscription is active to access your documents.

- Preview the template you need by checking its description to ensure it matches your local jurisdiction and requirements.

- Utilize the search feature if you need a different form. This helps you find alternatives that suit your specific needs.

- Purchase the selected document by clicking 'Buy Now' and choosing your preferred subscription plan. Create an account if you're a new user.

- Complete your payment either through credit card or PayPal to finalize your subscription.

- Download the form to your device and access it anytime from the 'My Forms' section of your account.

By following these easy steps, you can ensure that you have the right legal documents at your fingertips. US Legal Forms not only saves you time but also provides peace of mind with its extensive library of over 85,000 fillable and editable forms.

Ready to get started? Visit US Legal Forms now to find the perfect templates for your legal needs!

Form popularity

FAQ

The difficulty in getting approved for a lease can vary based on your financial profile and the leasing company's policies. If your credit and income align with their requirements, the process should be manageable. Remember, preparing your finances ahead of time can make securing a lease much easier.

To get a leased car, you usually need a good credit score, proof of income, and valid insurance. Additionally, you should be prepared for a down payment and documentation verifying your identity. Meeting these requirements can speed up the process and help you secure the best deal for lease.

You can lease several cars for around $300 per month, including compact sedans and small SUVs. Options may vary based on promotions from leasing companies, and location can also play a role. Researching local deals will help you identify suitable cars that fit your budget for lease.

Getting approved for a lease can be straightforward if you meet the necessary criteria. Strong credit, a stable income, and a good leasing history can all work in your favor. While some may find it easier than others, resources like uslegalforms can assist you in preparing the required documentation.

Several factors can disqualify you from leasing a car, including poor credit history, lack of sufficient income, or having a recent bankruptcy. Additionally, if you have a high debt-to-income ratio, this could negatively impact your application for a lease. Addressing these issues upfront can improve your chances.

Income requirements for leasing often depend on the car's payment and lease terms. Generally, you should have a monthly income that allows you to comfortably afford the lease payment along with other expenses. Ensuring you meet these income requirements is crucial for successfully securing a lease.

The minimum credit score for a lease typically ranges from 620 to 650, depending on the leasing company. A higher score can improve your chances and may offer better terms. If you have concerns about your score, consider using uslegalforms to find resources that can help.

To qualify for a lease, you generally need to provide proof of income, a valid driver's license, and insurance. Additionally, leasing companies may check your credit history. Maintaining a stable employment record can also help strengthen your application for lease approval.

You can indeed create a lease yourself, provided you include all necessary legal provisions and conditions. Using templates from reputable sources like USLegalForms can guide you in drafting a comprehensive and enforceable lease agreement. This approach not only saves time but also ensures your lease for lease meets legal requirements.

Yes, conducting a walk-through before signing a lease is highly recommended. This allows you to inspect the property for any existing issues that may need addressing. Documenting these details can protect you later and ensures you know exactly what you are agreeing to when you sign.