Deed Individual Form For Fatca And Crs

Description

How to fill out Florida Enhanced Life Estate Or Lady Bird Deed - Two Individual / Husband And Wife To Individual?

Handling legal documents can be exasperating, even for the most seasoned professionals.

If you are seeking a Deed Individual Form For Fatca And Crs and lack the opportunity to dedicate time to finding the suitable and updated version, the process may be overwhelming.

Tap into a repository of articles, guides, manuals, and resources related to your circumstances and needs.

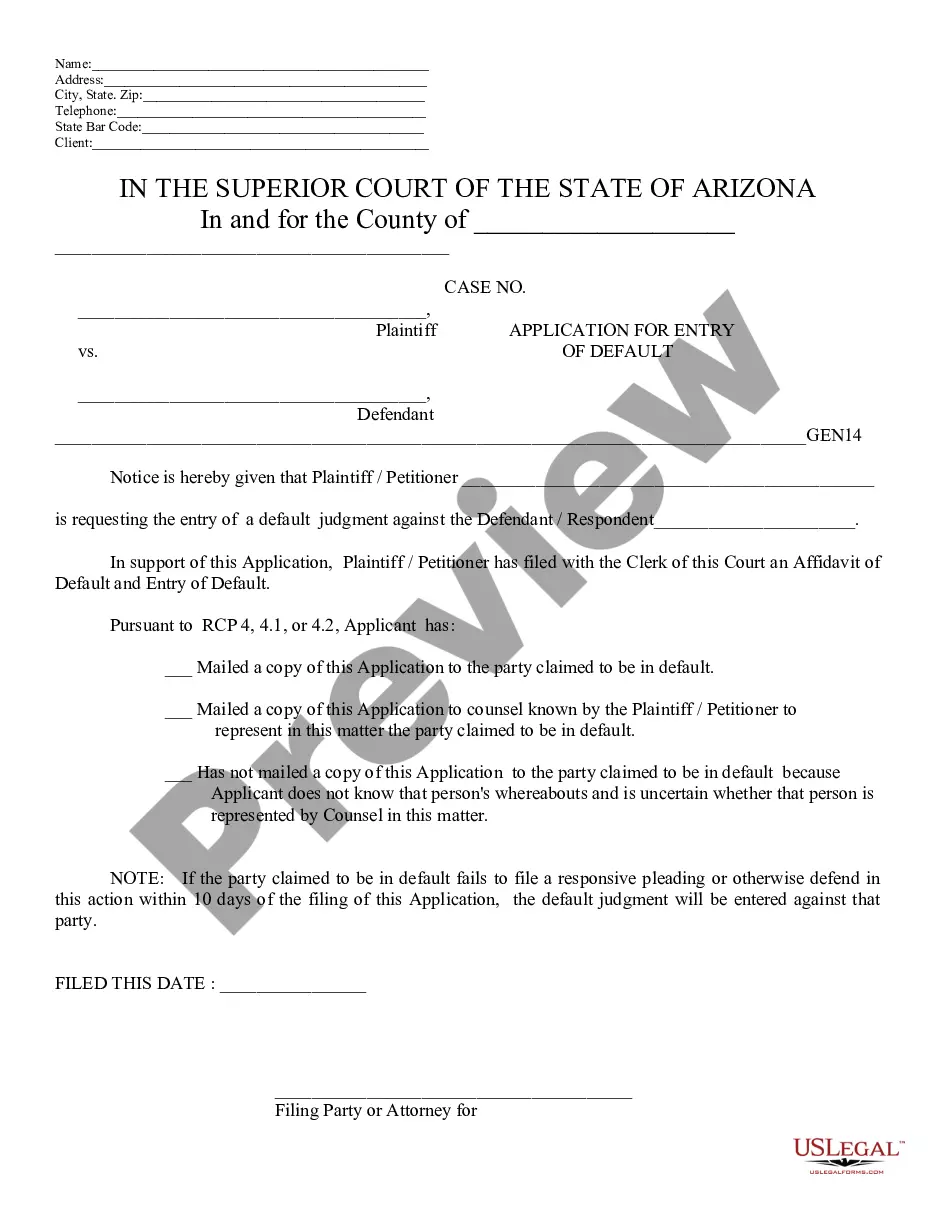

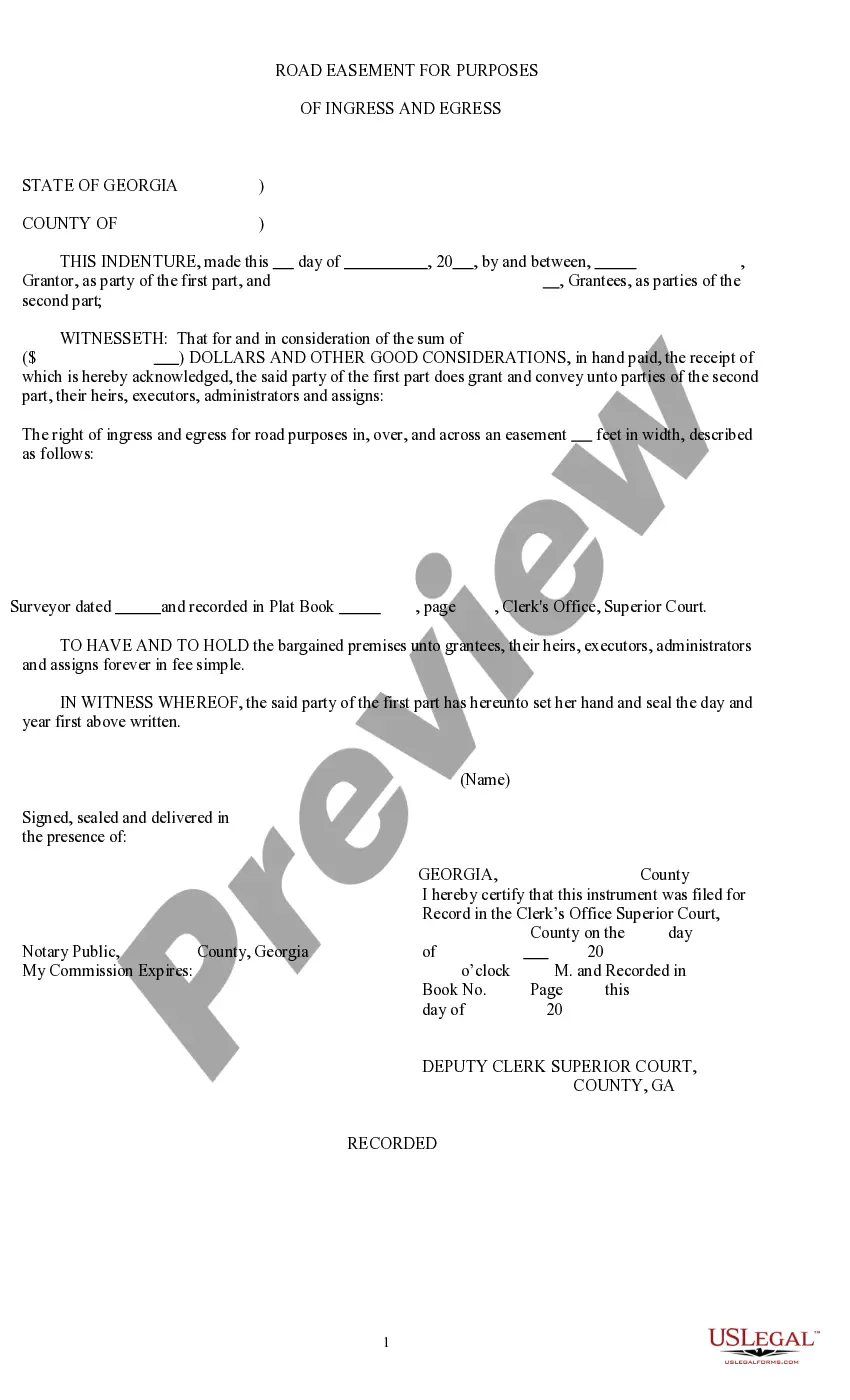

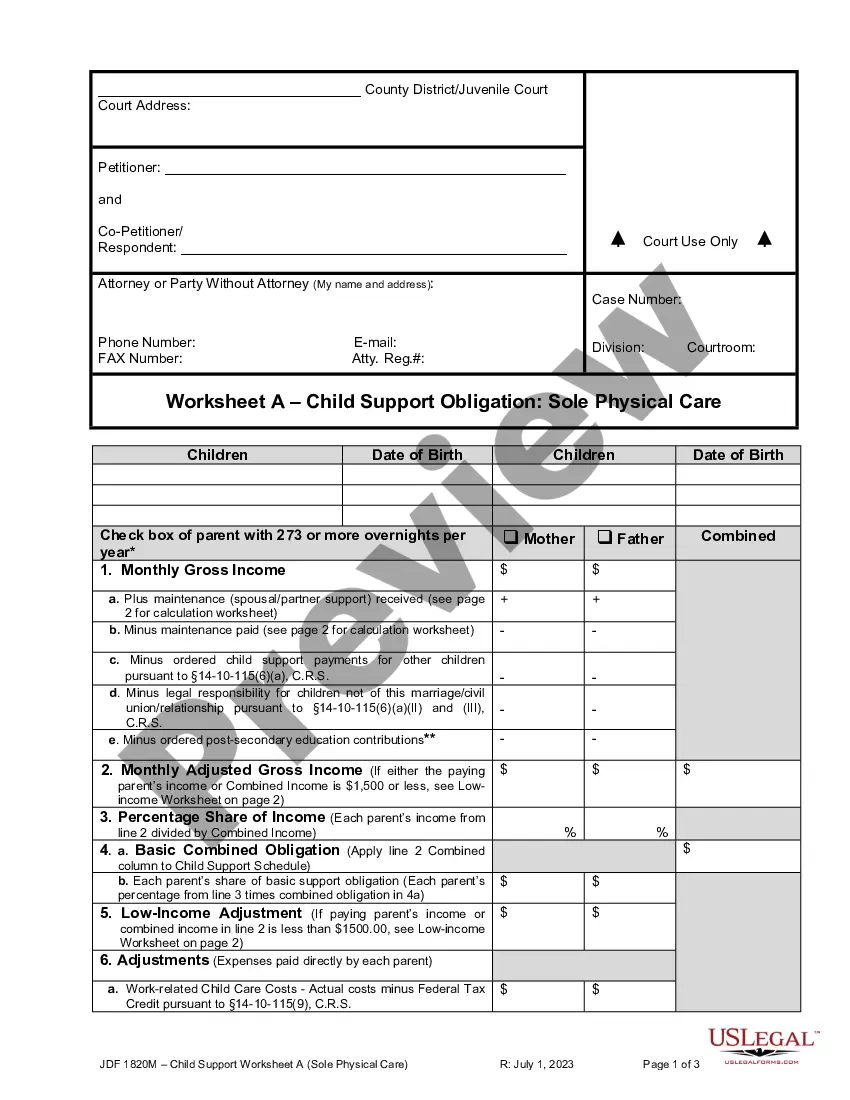

Save time and effort looking for the documents you require, and leverage US Legal Forms’ sophisticated search and Preview function to locate Deed Individual Form For Fatca And Crs and acquire it.

Experience the US Legal Forms online library, backed by 25 years of expertise and reliability. Transform your daily document management into a straightforward and user-friendly procedure today.

- If you hold a membership, Log In to your US Legal Forms account, locate the document, and obtain it.

- Check your My documents section to review the documents you have previously stored and manage your directories as needed.

- If it's your initial experience with US Legal Forms, register an account to enjoy unrestricted access to all features of the library.

- Here are the steps to follow after you have accessed the form you need.

- Confirm this is the correct document by previewing it and examining its details.

- Ensure that the template is recognized in your state or region.

- Click Buy Now once you are prepared.

- Select a monthly subscription option.

- Choose the format you desire, and Download, fill out, eSign, print, and send your document.

- Access state- or region-specific legal and business documents.

- US Legal Forms addresses any requirements you may encounter, from personal to business documentation, all in one location.

- Utilize cutting-edge tools to complete and manage your Deed Individual Form For Fatca And Crs.

Form popularity

FAQ

Regardless of the visa or occupation, the CRS form is a requirement to be completed by all customers. The Central Bank of the UAE mandates that this is completed and submitted ingly. 32. Why do I need to submit proof of residency if I am not paying taxes in my home country?

You should fill in the parts of the form that ask for your organisation's name, address etc. Put the same name and address as the bank uses to send you bank statements. You should sign and date the declaration at the end of the form. You can leave all the other parts of the form blank.

Online Submission of FATCA Self-Certification Log-in to your NPS account (please visit .cra-nsdl.com) Click on sub menu ?FATCA Self-Certification? under the main menu ?Transaction? Submit the required details under ?FATCA/CRS Declaration Form? Click on ?Submit?

Enter your name in fill. Specify the designation / position that you hold in the organization /entity. Select the check box to provide consent of the FATCA & CRS terms and conditions and to provide consent to the declaration. In the Full Name of Representative field, enter your full name.

Foreign Account Tax Compliance Act (?FATCA?) and Common Reporting Standard (?CRS?) regulations require financial institutions like us to collect and report information about where our customers are tax resident. Under these regulations, we have to ask you to provide the information requested in this form.