Affidavit Of Heirship For A House

Description

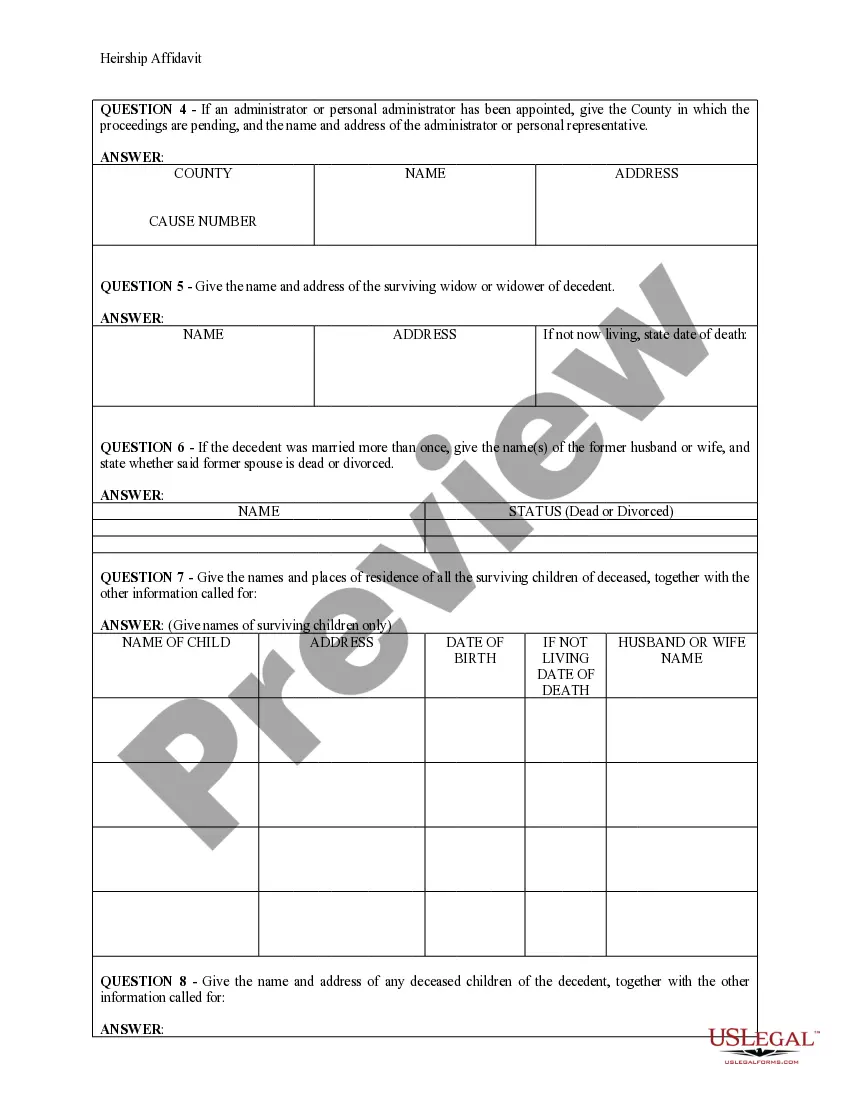

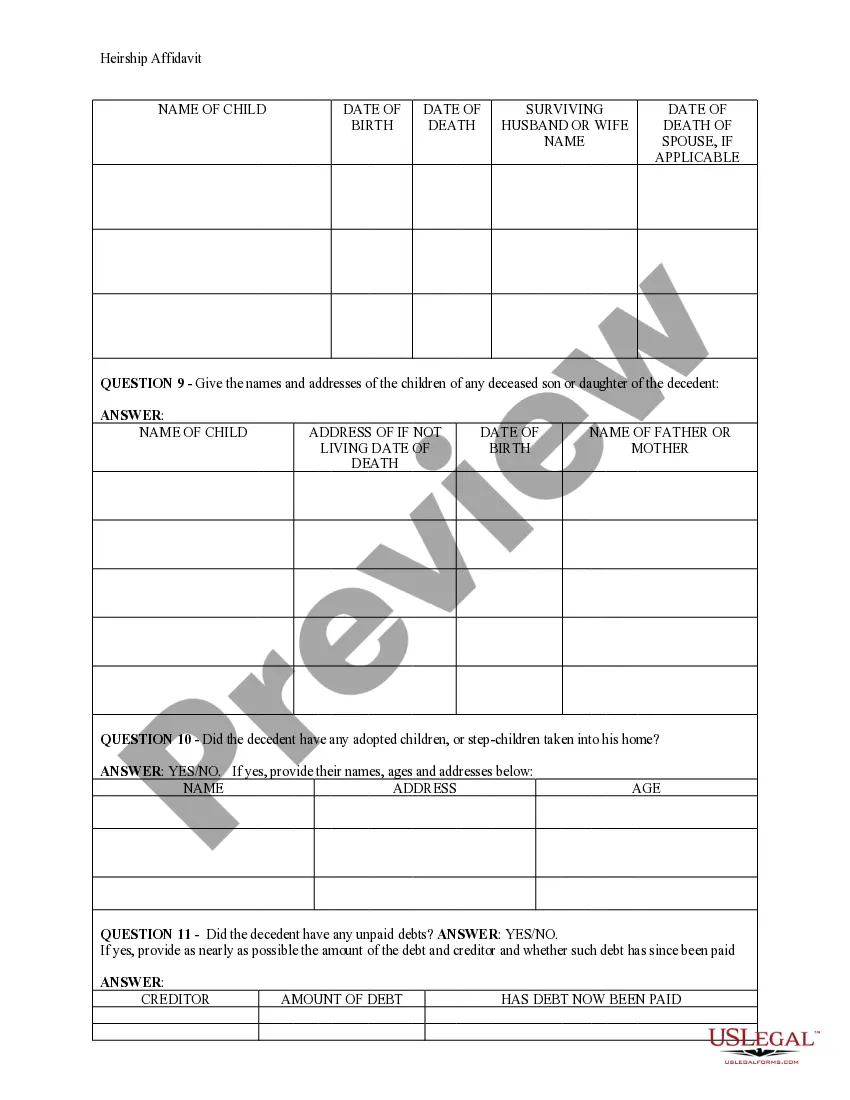

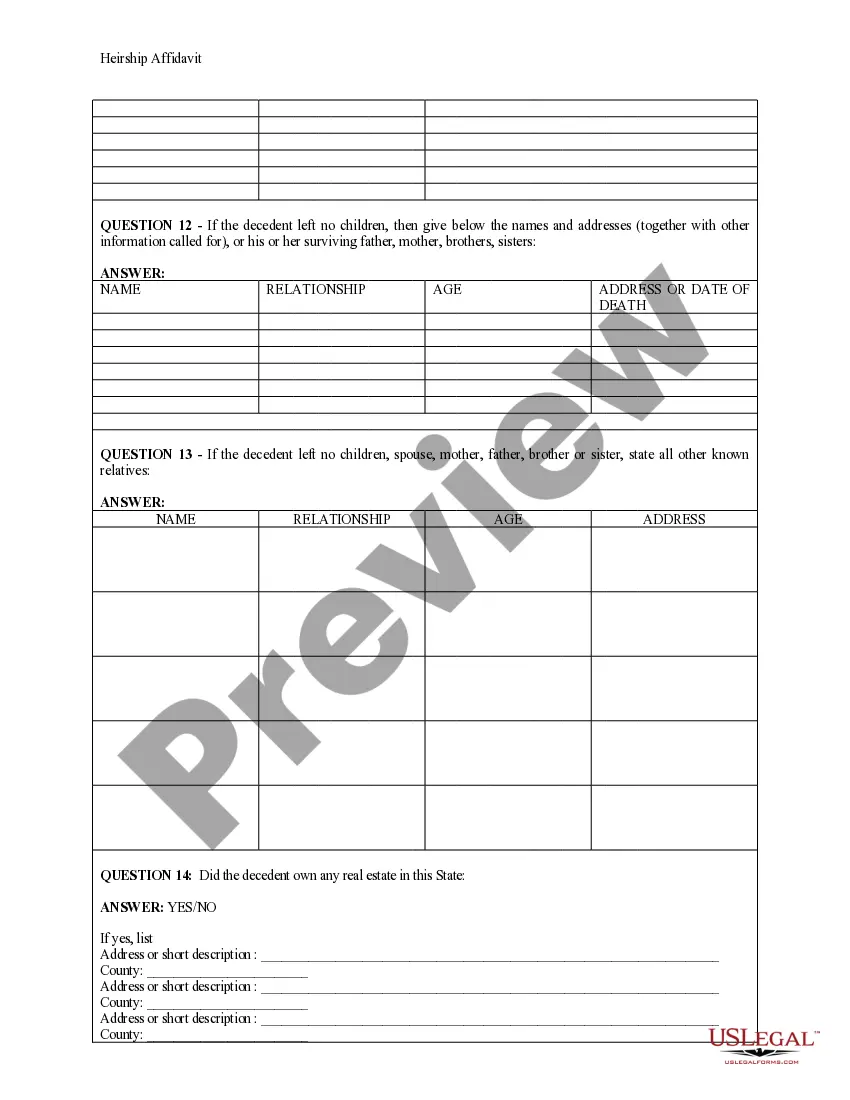

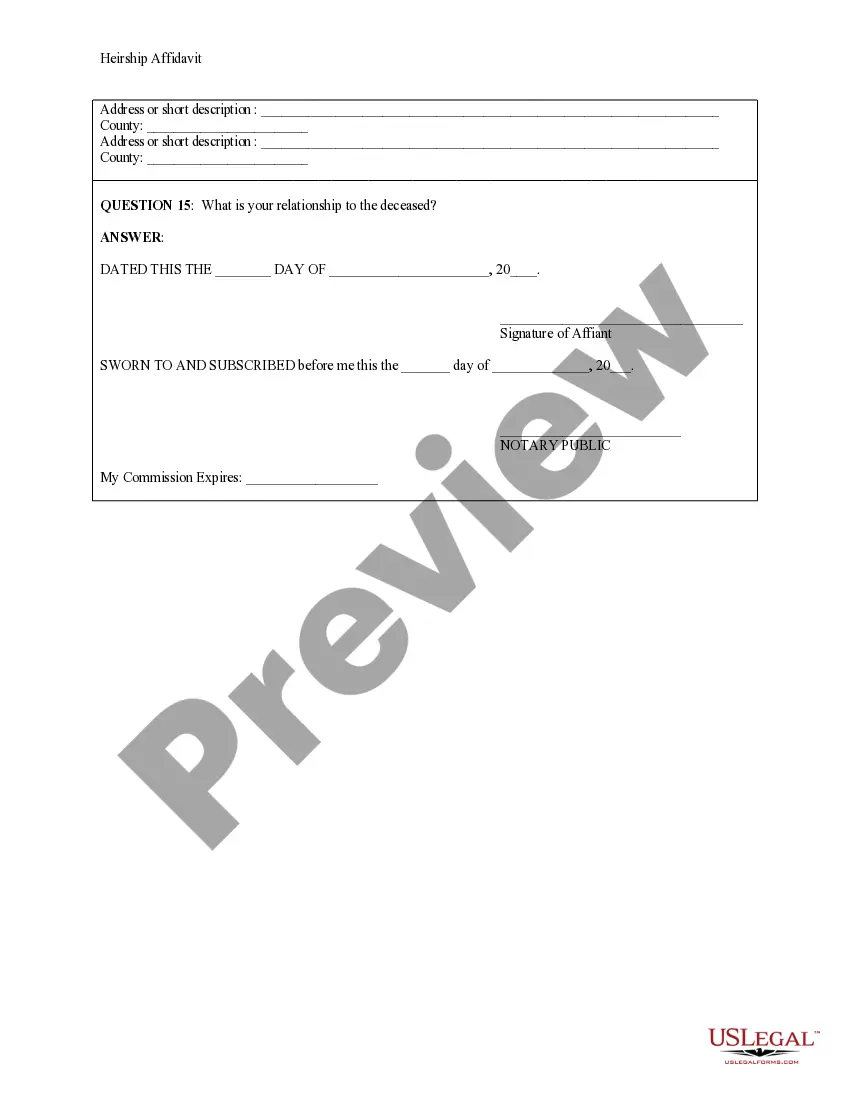

How to fill out District Of Columbia Heirship Affidavit - Descent?

- Log into your US Legal Forms account. Ensure your subscription is active to access the necessary forms.

- If you're a new user, start by exploring the extensive form library. Check the preview and form descriptions to ensure the document meets your specific needs.

- If the initial selection doesn't suit you, utilize the search function to find other relevant templates.

- Once you find the right affidavit, click on the 'Buy Now' button to select your preferred subscription plan. You will need to create an account to proceed.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Download the affidavit template to your device. Access it anytime from the 'My Forms' section of your profile for future reference.

US Legal Forms streamlines the process of acquiring legal documents, empowering users with an extensive library of over 85,000 editable forms. Their robust collection ensures you find what you need while also providing access to premium experts for guidance.

Don't delay! Start your journey to secure your legal rights today with US Legal Forms and access the affidavit of heirship you require.

Form popularity

FAQ

Yes, an affidavit of death typically needs to be notarized to confirm its authenticity and validity. An affidavit of heirship for a house requires notarization before it can be filed with the appropriate government office. This step is crucial to ensure that the document is recognized and processed correctly in matters concerning estate transfer.

In Texas, an affidavit of heirship for a house can be filled out by heirs who have personal knowledge of the family relationships and circumstances surrounding the deceased. While it’s possible for anyone to complete the document, it is advisable to seek assistance from a legal professional to ensure compliance with local laws. Using services like USLegalForms can help clarify requirements and streamline the process.

To get heir property in your name without a will, you can file an affidavit of heirship for a house to establish your right to inherit. This document will need to be notarized and filed with the county clerk where the property is located. If you're unsure how to proceed, consider using resources such as USLegalForms, which can guide you through the process and provide the necessary forms.

While a lawyer is not strictly required to create an affidavit of heirship for a house, their expertise can be invaluable. They can provide guidance on the specific requirements of your state, ensure all necessary information is included, and offer legal protection against potential challenges. Utilizing platforms like USLegalForms can also simplify the creation process, providing templates and legal guidance.

An affidavit of heirship for a house holds significant power in establishing ownership and legal rights to property. It serves as a sworn statement that identifies rightful heirs based on personal knowledge of the deceased and their familial relationships. This document can be critical to resolving disputes and ensuring a clear title to the property, aiding in smooth transitions of ownership.

Without an affidavit of heirship for a house, heirs may face challenges when trying to claim property. This could lead to disputes among potential heirs or complications in transferring ownership. Additionally, financial institutions may require this document to process matters related to the estate, which can delay inheritance and property transfer.

An affidavit of heirship for a house can be prepared by various individuals, including heirs, family members, and legal professionals. However, to ensure accuracy and compliance with state laws, many people choose to work with an attorney or legal expert. It's important to have all necessary information about the deceased's estate to complete the affidavit correctly.

To transfer a car title in Illinois, you usually need the vehicle's current title, a completed application for a title, and a bill of sale if applicable. If you are dealing with a deceased owner's vehicle, you may also require an affidavit of heirship for the house to prove your relationship to the deceased. Utilizing platforms like USLegalForms can provide you with the necessary templates to ensure you have all required documentation.

Yes, you can file your own affidavit of heirship for a house in Illinois. However, it's essential to ensure that the document is correctly prepared and complies with state laws. Many individuals find it helpful to use resources like USLegalForms to guide them through the preparation and filing process, ensuring everything is done correctly and efficiently.

After filing an affidavit of heirship for a house, the next steps typically involve recording the document with the local county recorder's office. This filing helps establish the legal ownership of the property among the heirs. Additionally, heirs may need to undertake further actions to address any remaining estate matters or to transfer ownership officially.