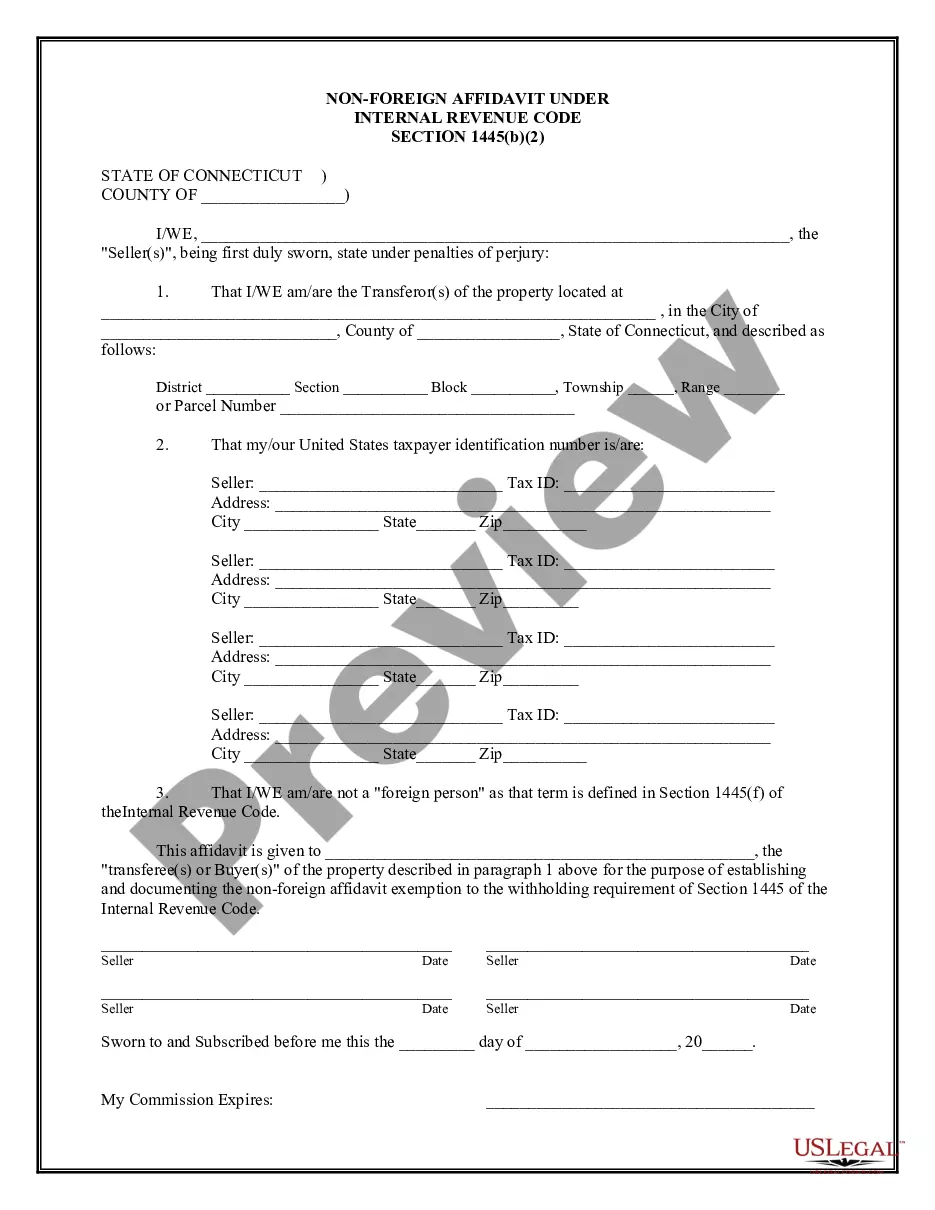

Non-Foreign Affidavit Under IRC 1445

Description: Under Federal law, (the Foreign

Investment in Real Property Tax Act (FIRPTA)(26 USC 1445) and the regulations

thereunder (26 CFR Parts 1 and 602)), a buyer of real estate is required

to withhold a tax from the sale of real property to a foreign person unless

an exemption applies. An exemption from withholding is provided for

individuals who purchase property for use as their principal residence

for $300,000 or less. Principal residence is defined to mean that the buyer

will reside there for more than 50% of the time in each of the next two

years. If you have a duty to withhold and you fail to do so, you

can be liable for an amount equal to your compensation in the transaction

and in some cases for the amount of tax that should have been withheld

The affidavit is needed to provide the buyer with assurance that the seller

is not a foreign person.

The general rule and exemptions as stated in Sec. 1445, Withholding

of tax on dispositions of United States real property interests, provides:

(a) General rule

Except as otherwise provided in this section, in the case of any

disposition of a United States real property interest (as defined in section

897(c)) by a foreign person, the transferee shall be required to deduct

and withhold a tax equal to 10 percent of the amount realized on the disposition.

(b) Exemptions

(1) In general

No person shall be required to deduct and withhold any amount under

subsection (a) with respect to a disposition if paragraph

(2), (3), (4), (5), or (6) applies to the transaction.

(2) Transferor furnishes nonforeign affidavit. Except as provided

in paragraph (7), this paragraph applies to the disposition if the transferor

furnishes to the transferee an affidavit by the transferor stating, under

penalty of perjury, the transferor's United States taxpayer identification

number and

that the transferor is not a foreign person.

(3) Nonpublicly traded domestic corporation furnishes affidavit that

interests in corporation not United States real property interests. Except as provided in paragraph (7), this paragraph

applies in the case of a disposition of any interest in any domestic corporation

if the domestic corporation furnishes to the transferee an affidavit by

the domestic corporation stating, under penalty of perjury, that -

(A) the domestic corporation is not and has not been a United States

real property holding corporation (as defined in section 897(c)(2)) during

the applicable period specified in section 897(c)(1)(A)(ii), or

(B) as of the date of the disposition, interests in such corporation

are not United States real property interests by reason of section 897(c)(1)(B).

(4) Transferee receives qualifying statement

(A) In general

This paragraph applies to the disposition if the transferee

receives a qualifying statement at such time, in such manner,

and subject to such terms and conditions as the Secretary may

by regulations prescribe.

(B) Qualifying statement

For purposes of subparagraph (A), the term ''qualifying statement''

means a statement by the Secretary that -

(i) the transferor either -

(I) has reached agreement with the Secretary (or such agreement has

been reached by the transferee) for the

payment of any tax imposed by section 871(b)(1) or

882(a)(1) on any gain recognized by the transferor on the disposition

of the United States real property interest, or

(II) is exempt from any tax imposed by section 871(b)(1)or 882(a)(1)

on any gain recognized by the transferor on

the disposition of the United States real property interest, and

(ii) the transferor or transferee has satisfied any transferor's

unsatisfied withholding liability or has provided adequate security to

cover such liability.

(5) Residence where amount realized does not exceed $300,000

This paragraph applies to the disposition if -

(A) the property is acquired by the transferee for use by him as a residence, and

(B) the amount realized for the property does not exceed $300,000.

(6) Stock regularly traded on established securities market

This paragraph applies if the disposition is of a share of a class

of stock that is regularly traded on an established

securities market.

(7) Special rules for paragraphs (2) and (3) Paragraph (2) or (3) (as

the case may be) shall not apply to any disposition -

(A) if -

(i) the transferee has actual knowledge that the affidavit

referred to in such paragraph is false, or

(ii) the transferee receives a notice (as described in

subsection (d)) from a transferor's agent or a transferee's agent

that such affidavit is false, or

(B) if the Secretary by regulations requires the transferee to furnish

a copy of such affidavit to the Secretary and the transferee fails to furnish

a copy of such affidavit to the Secretary at such time and in such manner

as required by such regulations.

....................

To open this summary in a separate window for printing, Click

Here.

How to Order: To complete your order of the form you

have located, close this window and click on the order icon, or Member

Download link if you are a Registered User.

Help: If you need help locating a form, please use the Helpline

link on the main forms page.

Note: All Information and Previews are subject to the

Disclaimer located on the main forms page, and also linked at the bottom

of all search results.