Promissory Note Template California With Collateral

Description

How to fill out California Unsecured Installment Payment Promissory Note For Fixed Rate?

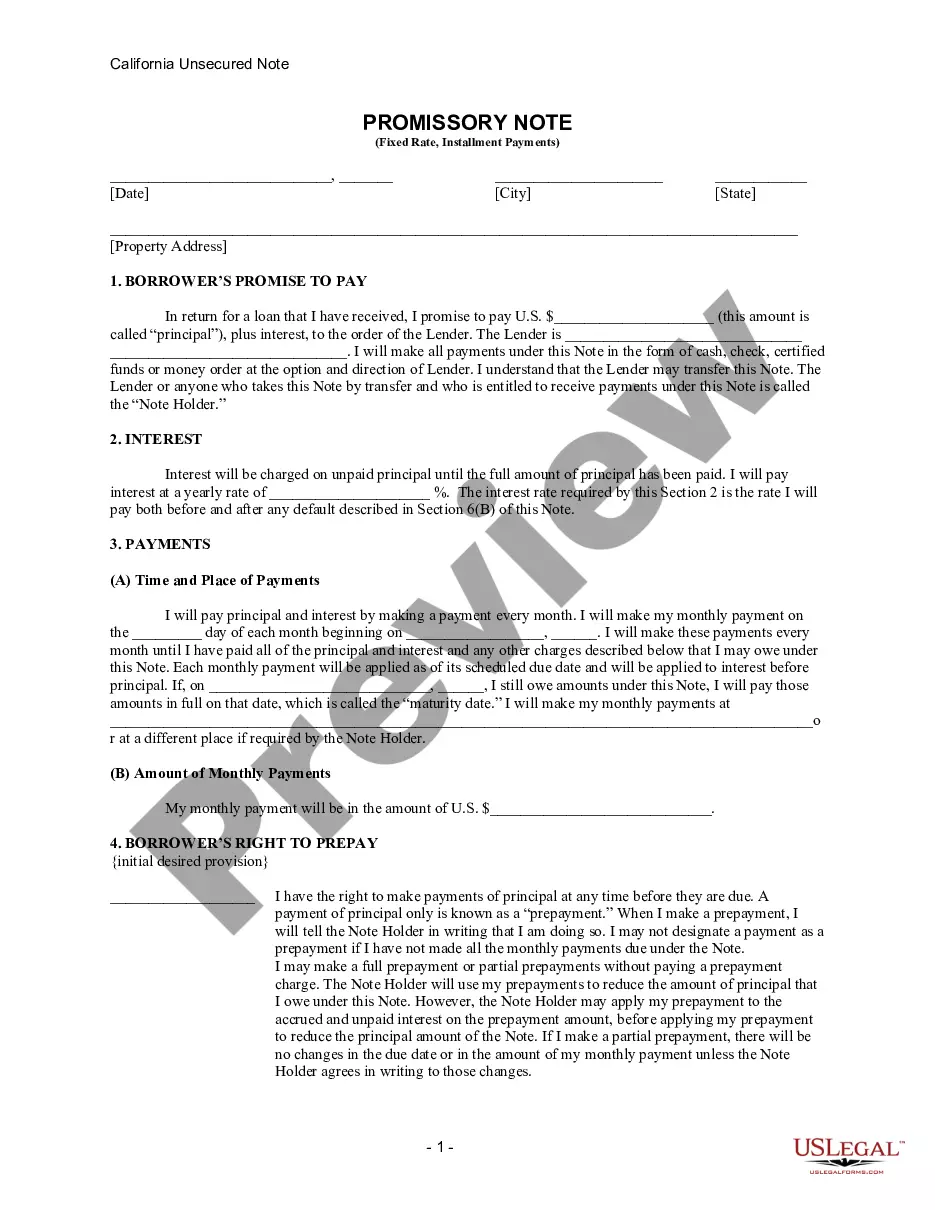

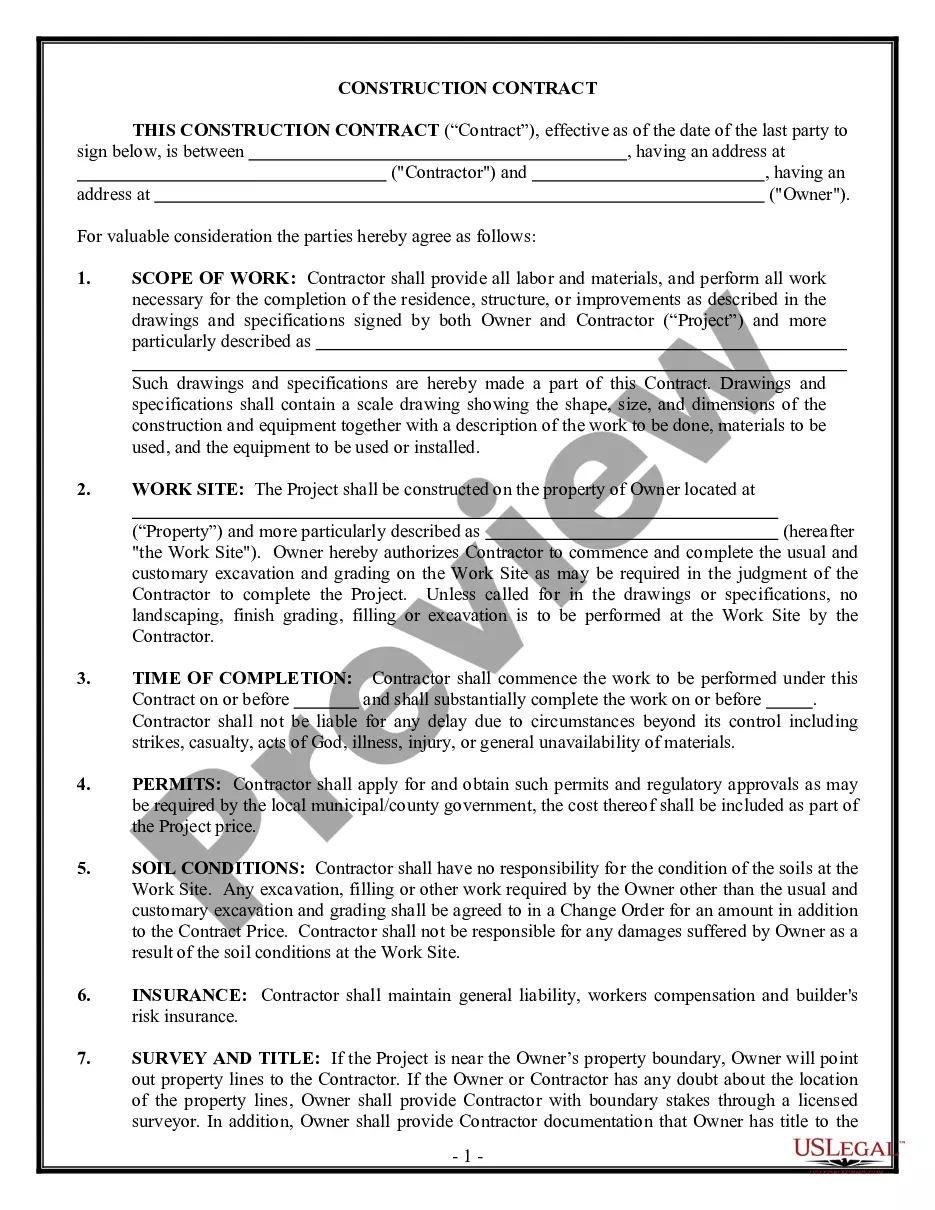

The Promissory Note Template California With Collateral you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and state laws. For more than 25 years, US Legal Forms has provided individuals, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, easiest and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Promissory Note Template California With Collateral will take you just a few simple steps:

- Look for the document you need and review it. Look through the file you searched and preview it or check the form description to verify it satisfies your needs. If it does not, use the search bar to find the appropriate one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Pick the format you want for your Promissory Note Template California With Collateral (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your papers again. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

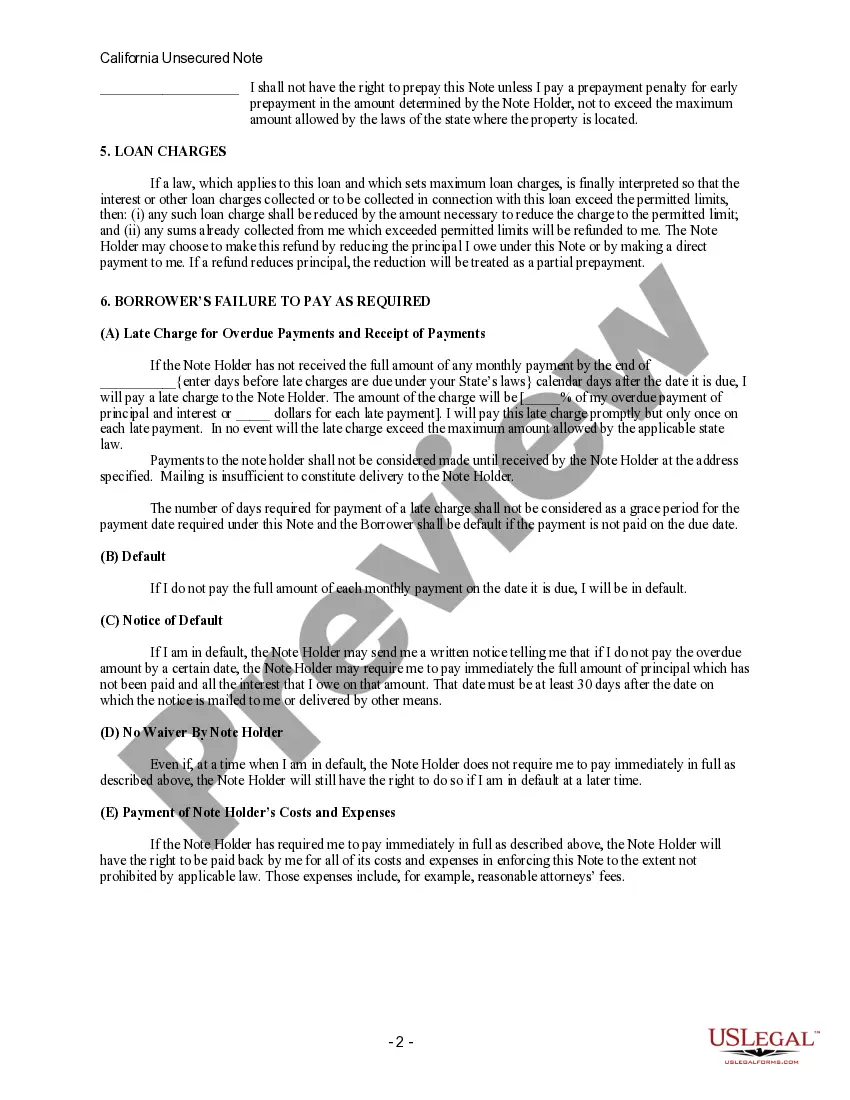

A contract for a collateral loan should clearly state what asset(s) are being used to secure the loan and include a clause on what could happen to the asset if the borrower defaults. It should also clearly outline the circumstances under which the collateral could be forfeited to the lender.

How to Write a Secured California Promissory Note Begin by entering the lender's complete information, the current date, the borrower's complete information, the amount of the loan, and the amount of the interest involved in the loan. Choose the method you would like the borrower to repay the balance.

The note can include specific details such as the borrower and lender's identities, the loan amount, interest rate, repayment terms, maturity date, and collateral (if any). There are two main categories of promissory notes: secured (with collateral) and unsecured (without collateral).

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.