Transfer On Death

Description

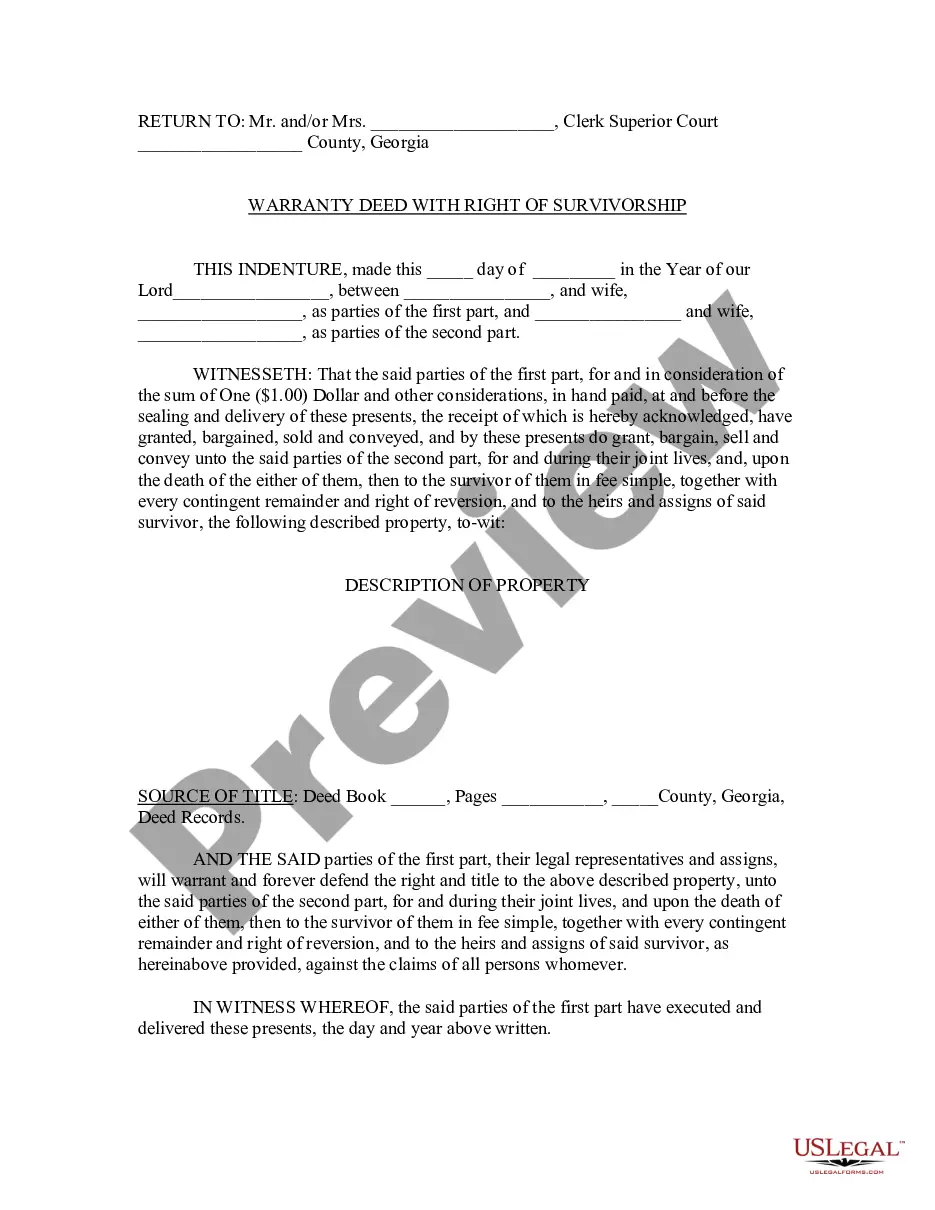

How to fill out Arizona Transfer On Death Or TOD - Beneficiary Deed - Individual Grantor To Three Individuals?

- Log into your US Legal Forms account or create a new account if you're a first-time user.

- Browse the extensive library and search for 'transfer on death' forms that meet your jurisdiction's requirements.

- Carefully review the form preview and description to confirm it suits your needs.

- Select an appropriate subscription plan and proceed to buy the document.

- Enter your payment information or opt for PayPal to finalize your purchase.

- Download the completed form to your device and save it for easy retrieval in your account's 'My Forms' section.

By utilizing US Legal Forms, you simplify the often complex task of preparing legal documents. With access to a vast array of templates and expert guidance, you are well-equipped to handle the transfer of your assets thoughtfully and legally.

Get started today by visiting US Legal Forms and ensure your affairs are managed as per your wishes!

Form popularity

FAQ

You do not necessarily need a lawyer to create a transfer on death (TOD) designation, as many states provide forms and guidance for individuals. However, having legal advice can help ensure that you complete the TOD correctly and in accordance with your state's laws. If your estate is complicated or if you want to ensure clarity, consulting with a lawyer is often a wise choice. Using the US Legal Forms platform can simplify this process by providing reliable resources.

A transfer on death (TOD) can complicate matters if the designated beneficiary predeceases you. This means that if you have not named a new beneficiary, your assets could be tied up in probate. Additionally, while a TOD helps avoid probate, it doesn't address debts of the deceased, potentially leaving the beneficiary responsible for those liabilities. Consider your situation carefully to understand all implications.

While a transfer on death deed offers advantages, there are also some disadvantages to consider. For instance, if you change your mind or circumstances change, it can be cumbersome to modify or revoke the deed. Additionally, not all states recognize transfer on death deeds, which may limit their applicability. It's essential to consult with legal professionals or services like USLegalForms to ensure it aligns with your estate planning goals.

The terms 'transfer on death' (TOD) and 'beneficiary' often overlap, but they serve different functions. A TOD designation specifically applies to transferring certain assets, while beneficiaries can apply to multiple contexts, including life insurance policies or retirement accounts. Each option has its benefits, and the right choice will depend on your financial situation and how you wish to distribute your assets. Utilizing resources from USLegalForms can simplify the decision-making process.

Transfer on death means that you have set up a provision allowing specific assets to transfer to your beneficiaries upon your death. This arrangement provides clarity and ease for your heirs, ensuring they receive their inheritance directly. It's important to document your wishes properly, so consider using platforms like USLegalForms to help establish a valid transfer on death deed.

Transfer on death refers to a legal mechanism that allows you to designate beneficiaries for your assets. Upon your passing, these assets automatically transfer to the beneficiaries you named, bypassing probate. This means a smoother transition of ownership, allowing beneficiaries to access their inheritance without undue delays. It's a straightforward way to manage your estate.

Yes, transfers on death accounts effectively avoid probate. This process allows assets to be passed directly to designated beneficiaries without the need for court intervention. This not only saves time but also reduces costs associated with probate proceedings. Taking advantage of transfer on death accounts can be a wise choice for simplified estate planning.

While it is not strictly necessary to hire a lawyer for a transfer on death account, consulting one can be beneficial. A legal professional can provide guidance on the best practices and help ensure your accounts align with your overall estate plan. Additionally, they can assist in addressing any potential complications or disputes that could arise. Utilizing platforms like US Legal Forms can also simplify this process.

Transfer on death accounts are specifically designed to bypass probate upon the death of the owner. These accounts allow designated beneficiaries to receive assets directly, avoiding delays that typically accompany probate. By establishing a transfer on death account, you can ensure a smoother transition of your assets to your heirs. This can be a critical component of effective estate planning.

No, a transfer on death account does not go through probate. This feature is one of the main advantages of such accounts, as it allows the designated beneficiary to receive the assets directly upon the owner's death. This can significantly reduce the stress and delays often associated with the probate process. By using transfer on death accounts, you can simplify the transfer of your assets to your loved ones.