No Contact Order Rules Arkansas With Spouse

Description

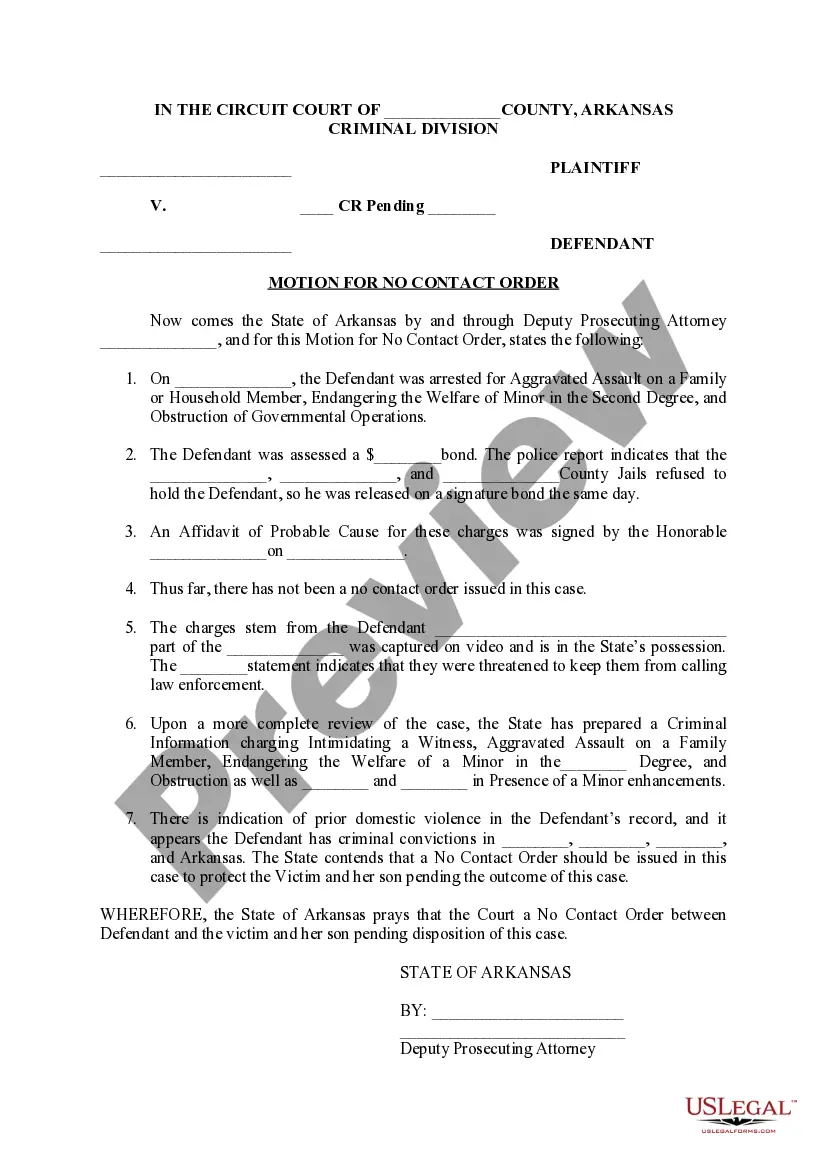

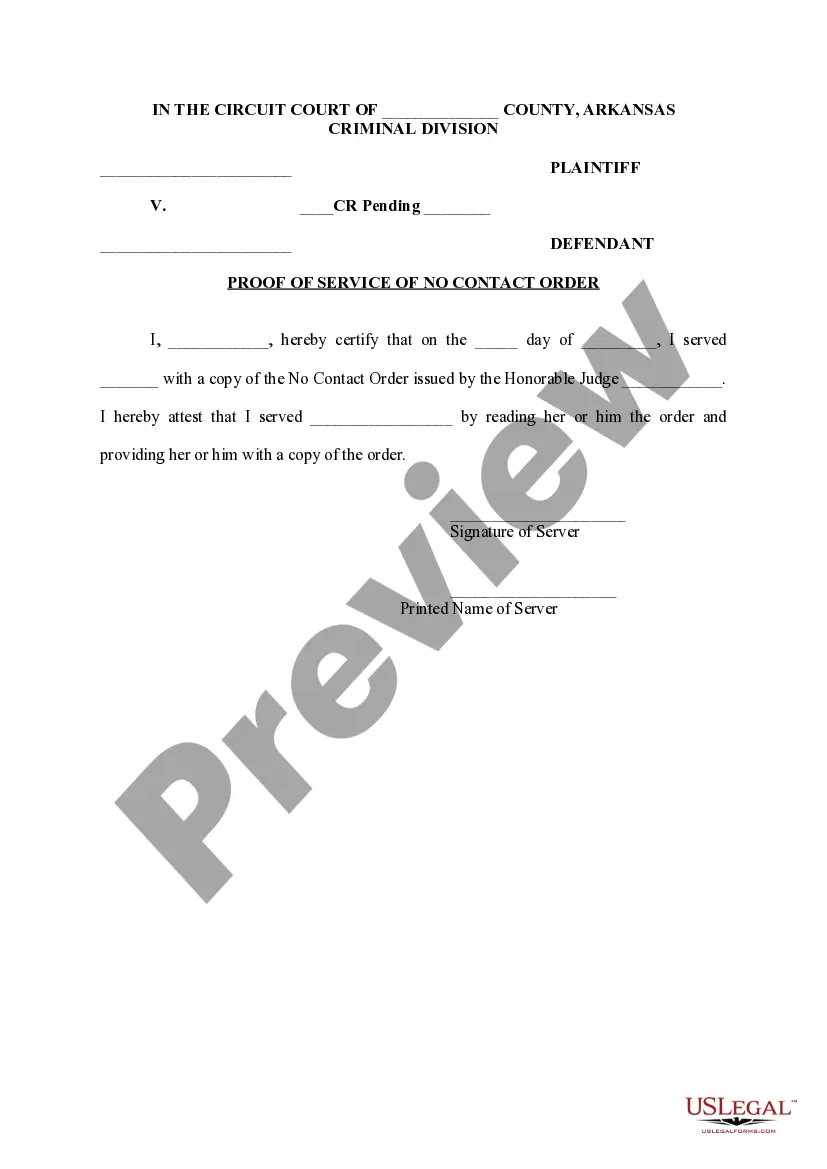

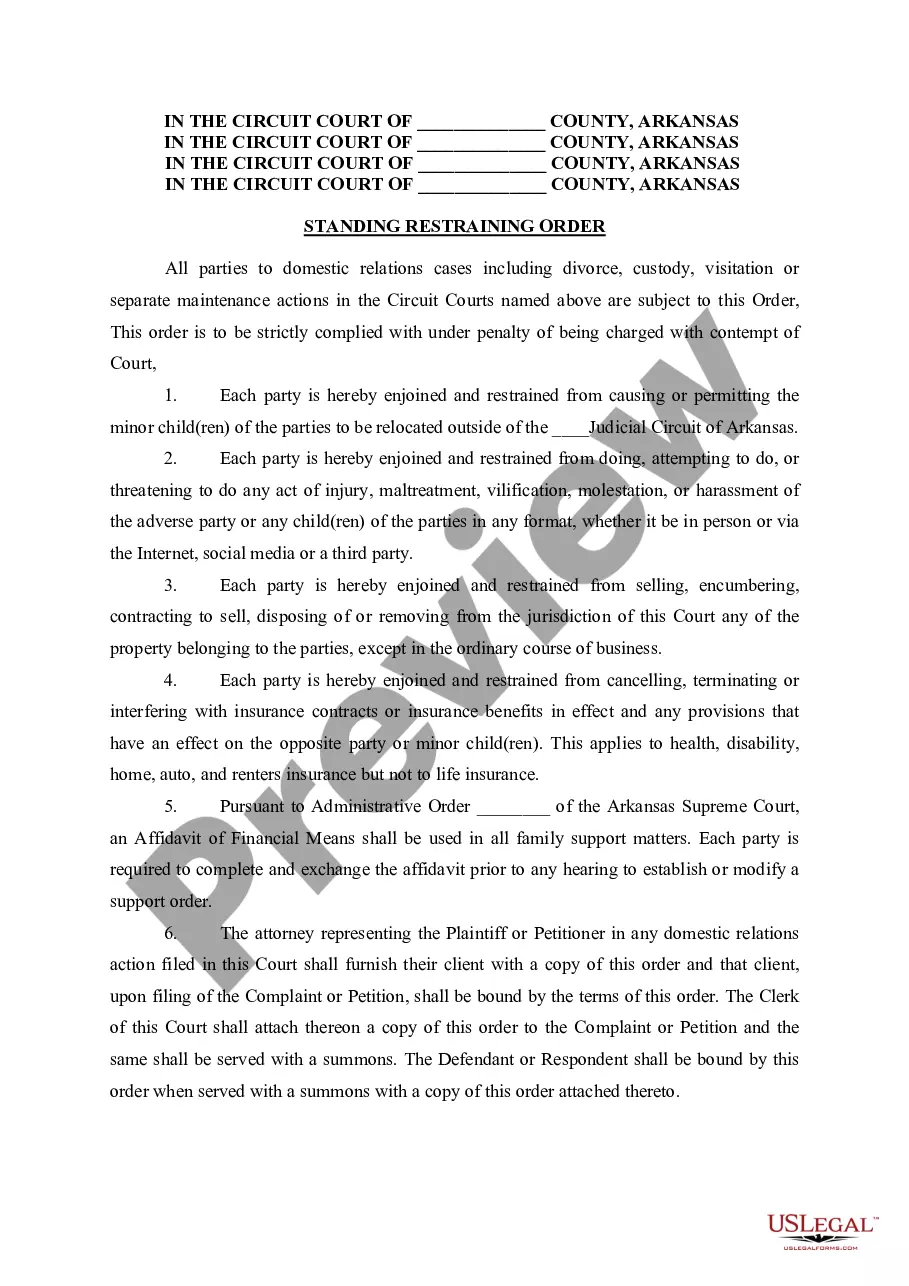

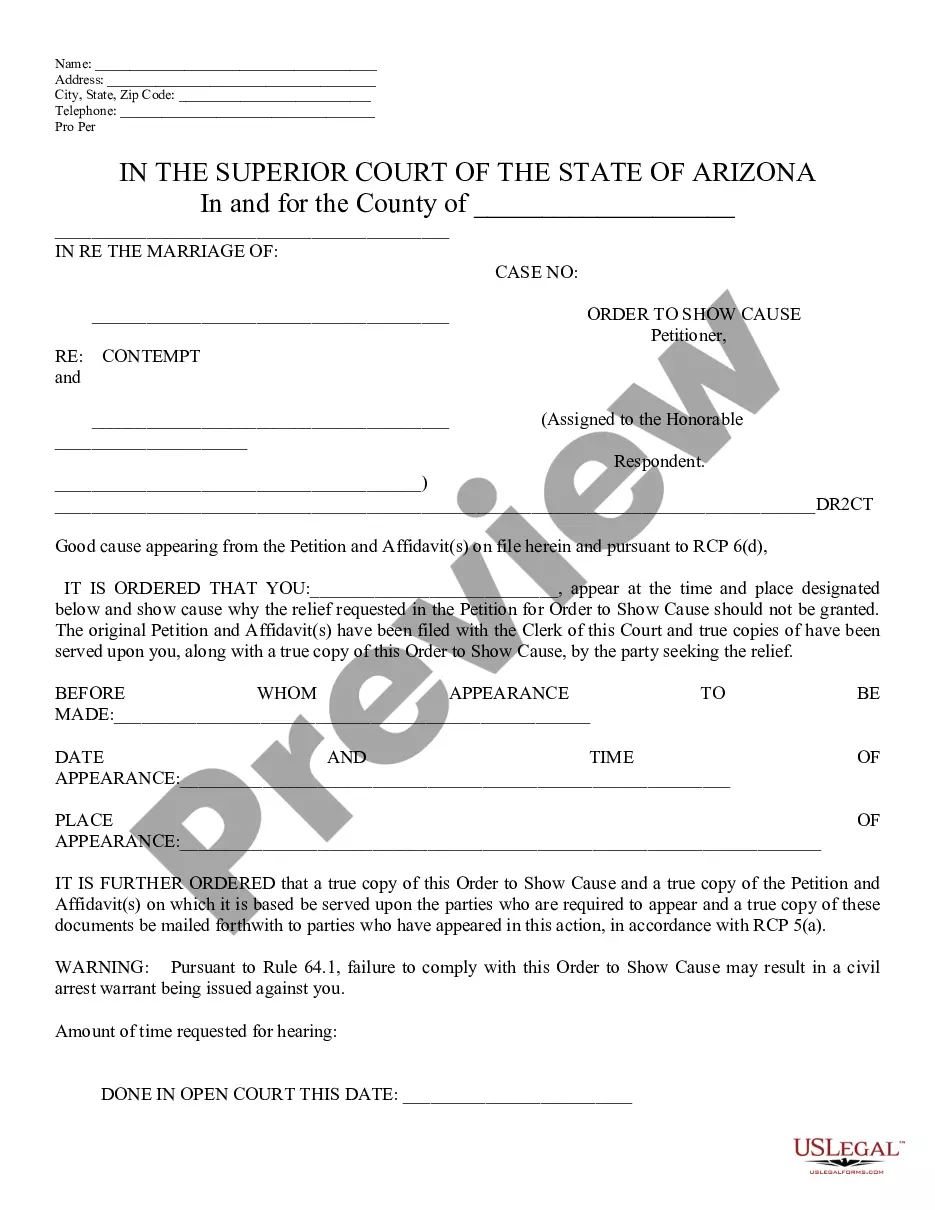

How to fill out Arkansas No Contact Order?

Whether for corporate objectives or for individual concerns, everyone must confront legal circumstances at some time in their lives.

Filling out legal documents requires meticulous care, starting with selecting the appropriate form template.

With an extensive US Legal Forms catalog available, you don’t need to waste time searching for the suitable sample online. Take advantage of the library’s straightforward navigation to find the appropriate form for any circumstance.

- Acquire the sample you need by using the search box or catalog navigation.

- Review the form’s description to ensure it suits your circumstances, state, and locality.

- Click on the form’s preview to view it.

- If it is the incorrect document, return to the search feature to locate the No Contact Order Rules Arkansas With Spouse sample you require.

- Download the template once it meets your needs.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously stored templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can use a banking card or PayPal account.

- Pick the file format you desire and download the No Contact Order Rules Arkansas With Spouse.

- Once it is downloaded, you can fill out the form using editing software or print it and fill it out by hand.

Form popularity

FAQ

Dakota's LLCs will protect your personal assets from the creditors of your business. These creditors could be employees, individuals the business has contracted with, or individuals bringing personal liability claims against the business.

In South Dakota partnerships are generally taxed as pass-through entities, meaning the profit and losses from the businesses pass directly into the partners' personal incomes.

Business Corporations - Domestic & Foreign ServiceFeeDomestic$150Foreign$750Annual ReportFiled Electronically online$50114 more rows

Home to Mount Rushmore and the Badlands, the state is known for tourism and agriculture.

South Dakota LLC Processing Times Normal LLC processing time:Expedited LLC:South Dakota LLC by mail:1-2 business days (plus mail time)24 hours ($50 extra)South Dakota LLC online:immediatelyNot available

It costs $150 to form an LLC in South Dakota. This is a fee paid for the Articles of Organization. You'll file this form with the South Dakota Secretary of State. And once approved, your LLC will go into existence.

To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.

1. Kentucky. Kentucky is the cheapest state to form an LLC, with a filing fee of just $40. The state also offers business owners incentive programs that provide small businesses with financial assistance.