The dissolution package contains all forms to dissolve a LLC or PLLC in Connecticut, step by step instructions, addresses, transmittal letters, and other information.

Ct Llc

State:

Connecticut

Control #:

CT-DP-LLC-0001

Format:

Word;

Rich Text

Instant download

Description Ct Llc Application

Free preview Dissolve Llc Connecticut

How to fill out Dissolve Liability Company?

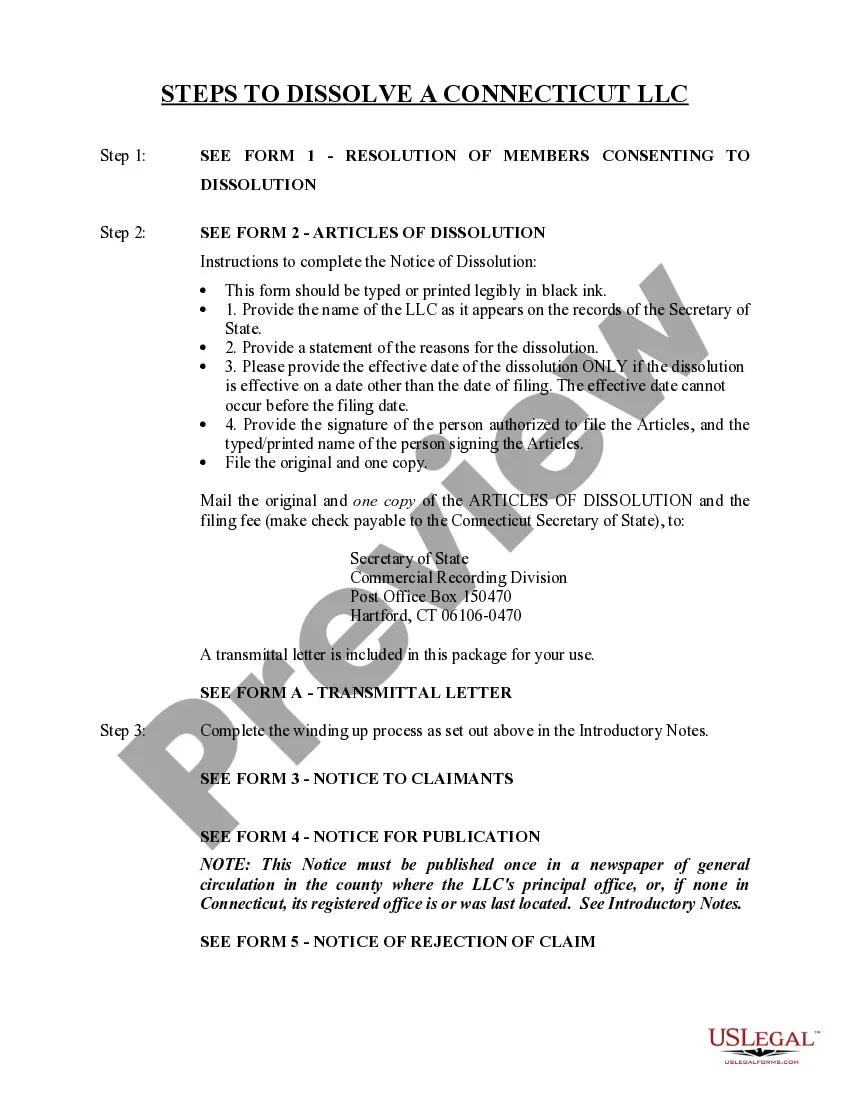

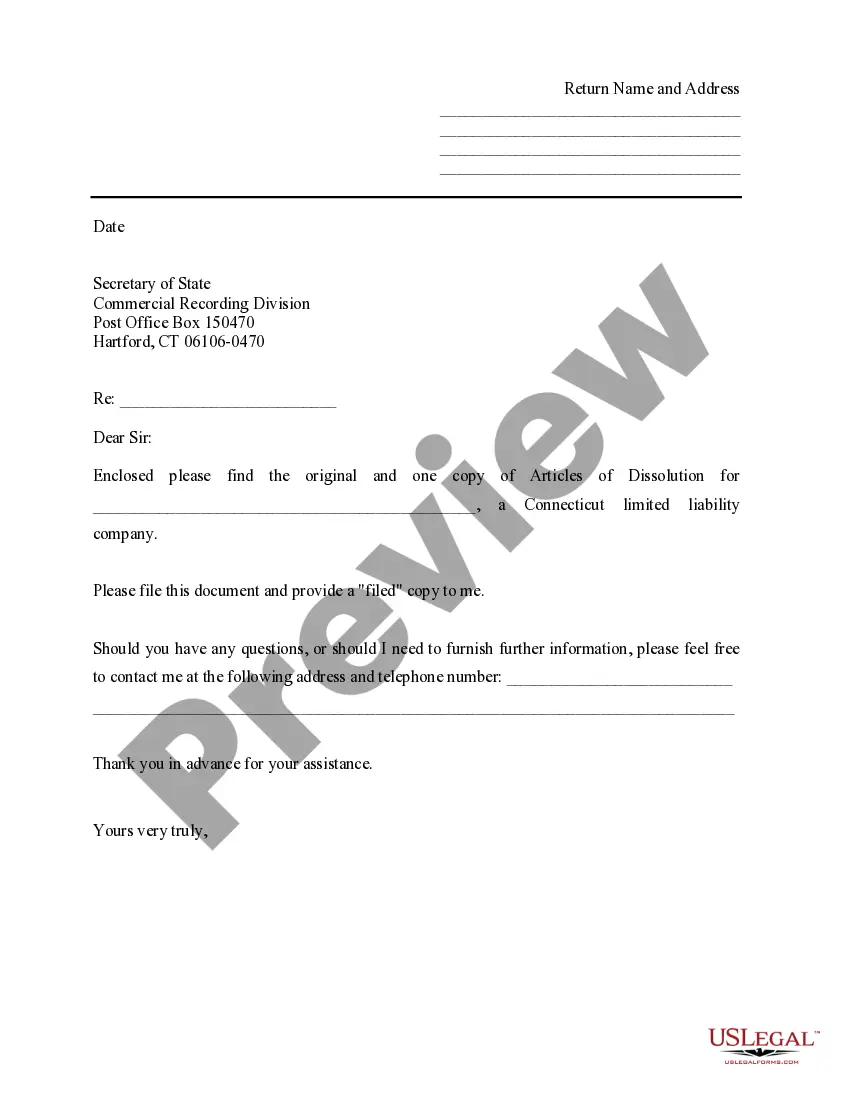

1. To dissolve a Limited Liability Company (LLC) in Connecticut, you will need to complete the Connecticut Dissolution Package for LLC form. This form can be found on the Connecticut Secretary of State website.

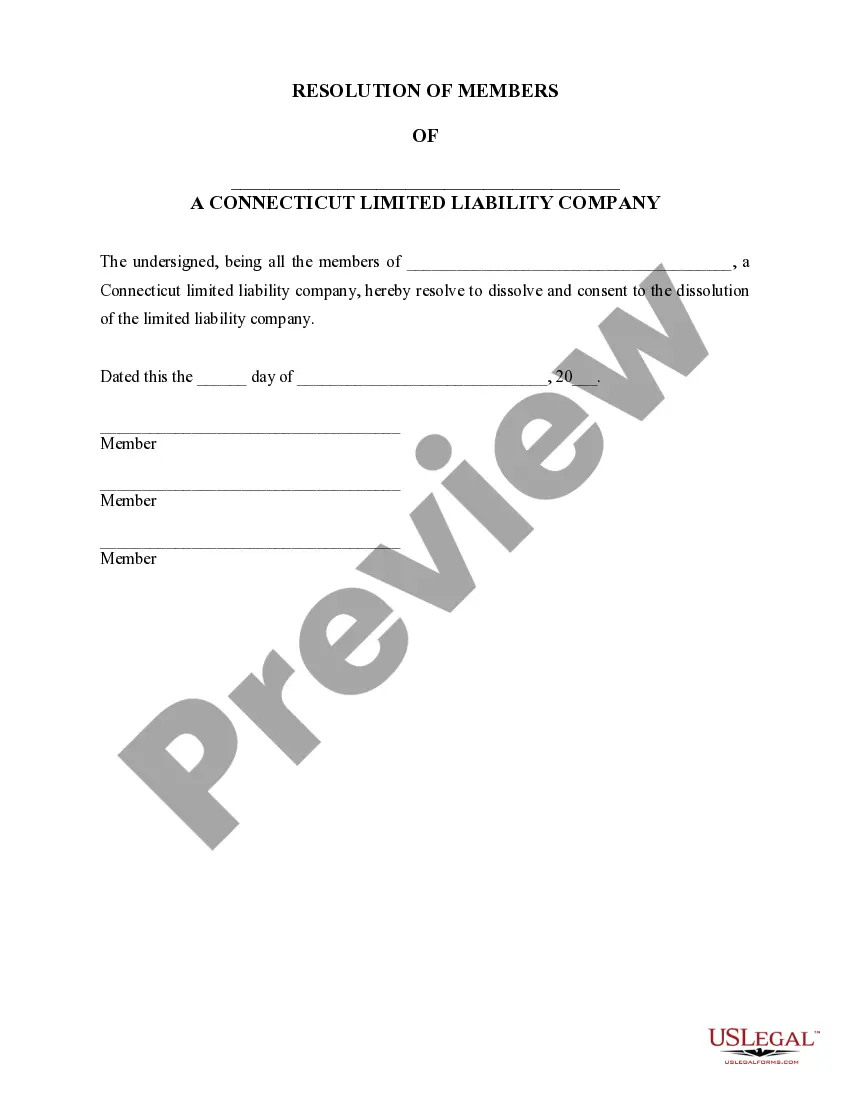

2. The required information to complete the Connecticut Dissolution Package for LLC form includes the name of the LLC, the date of formation, the reason for dissolution, the effective date of dissolution, and the signature of a member or manager of the LLC.

3. It is not possible to fill out the form online directly on the Connecticut Secretary of State website. However, users can find up-to-date lawyer-approved, state-specific form templates on US Legal Forms.

4. On the US Legal Forms website, users can complete or download the Connecticut Dissolution Package for LLC form in Word, PDF, and RTF formats.

5. To access the form on US Legal Forms, users need to register and buy a Basic or Premium subscription on a monthly or annual basis. This subscription will allow users to access a wide range of legal forms for their business needs.

By following the instructions and providing the necessary information on the Connecticut Dissolution Package for LLC form, you can successfully dissolve your LLC in Connecticut.

2. The required information to complete the Connecticut Dissolution Package for LLC form includes the name of the LLC, the date of formation, the reason for dissolution, the effective date of dissolution, and the signature of a member or manager of the LLC.

3. It is not possible to fill out the form online directly on the Connecticut Secretary of State website. However, users can find up-to-date lawyer-approved, state-specific form templates on US Legal Forms.

4. On the US Legal Forms website, users can complete or download the Connecticut Dissolution Package for LLC form in Word, PDF, and RTF formats.

5. To access the form on US Legal Forms, users need to register and buy a Basic or Premium subscription on a monthly or annual basis. This subscription will allow users to access a wide range of legal forms for their business needs.

By following the instructions and providing the necessary information on the Connecticut Dissolution Package for LLC form, you can successfully dissolve your LLC in Connecticut.