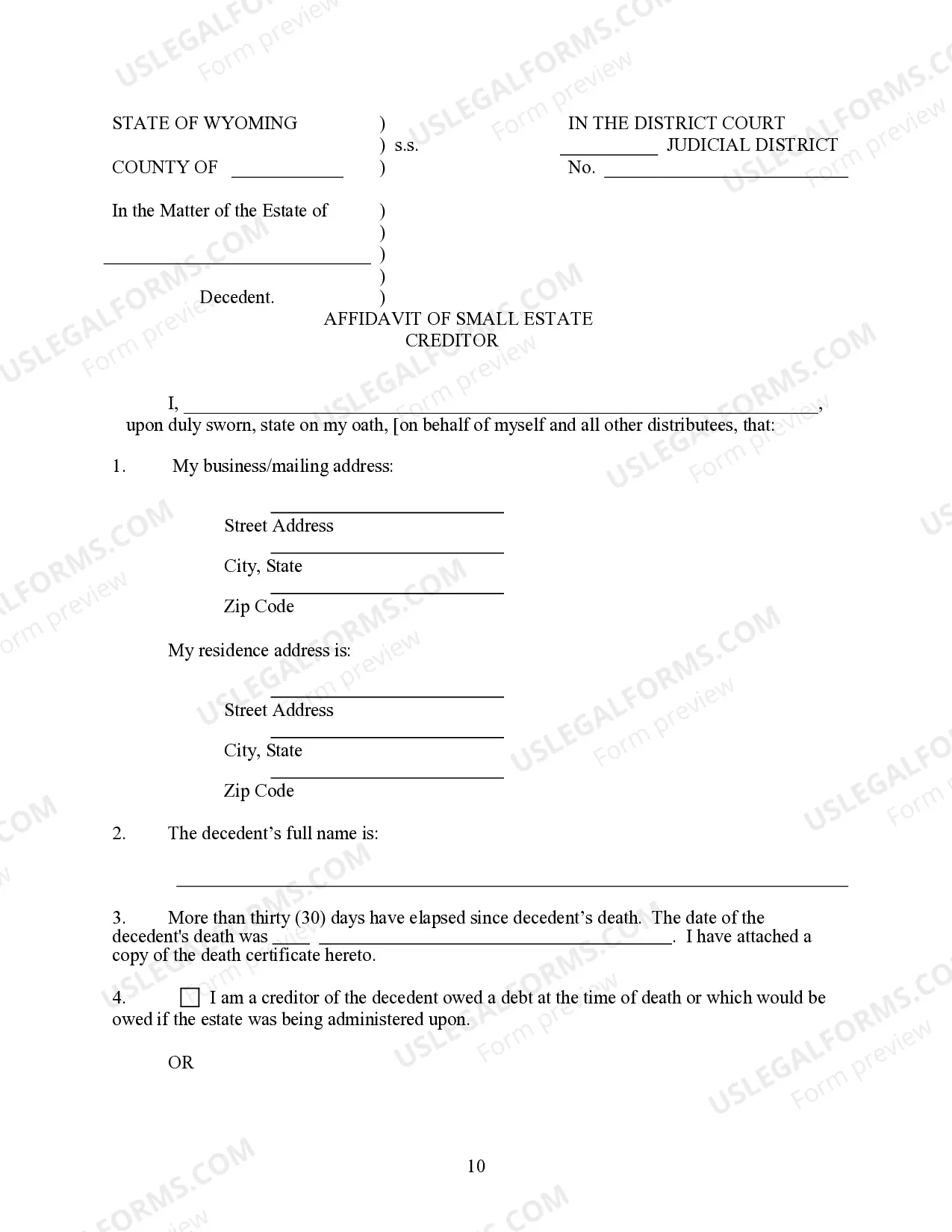

Small Estate Heirship Affidavit for Estates under 200,000

Small Estates General Summary: Small Estate laws were enacted in order to enable heirs to obtain property of the deceased without probate, or with shortened probate proceedings, provided certain conditions are met. Small estates can be administered with less time and cost. If the deceased had conveyed most property to a trust but there remains some property, small estate laws may also be available. Small Estate procedures may generally be used regardless of whether there was a Will. In general, the two forms of small estate procedures are recognized:

1. Small Estate Affidavit -Some States allow an affidavit to be executed by the spouse and/or heirs of the deceased and present the affidavit to the holder of property such as a bank to obtain property of the deceased. Other states require that the affidavit be filed with the Court. The main requirement before you may use an affidavit is that the value of the personal and/or real property of the estate not exceed a certain value.

2. Summary Administration -Some states allow a Summary administration. Some States recognize both the Small Estate affidavit and Summary Administration, basing the requirement of which one to use on the value of the estate. Example: If the estate value is 10,000 or less an affidavit is allowed but if the value is between 10,000 to 20,000 a summary administration is allowed.

Wyoming Summary:

Under Wyoming statute, where as estate is valued at less than $200,000, an interested party may, thirty (30) days after the death of the decedent, file with the county clerk a small estate affidavit. A certified copy of this affidavit can be used to demand payment from any party who owes a debt to the decedent.

Wyoming Requirements:

Wyoming requirements are set forth in the statutes below.

ARTICLE 2 DISTRIBUTION BY AFFIDAVIT AND SUMMARY PROCEDURE

2-1-201. Payment of indebtedness and delivery of tangible personal property or instruments evidencing debt.

(a) Not earlier than thirty (30) days after the death of a decedent, any person indebted to the decedent or having possession of tangible personal property or an instrument evidencing a debt, obligation, stock or chose in action belonging to the decedent shall make payment of the indebtedness or deliver the tangible personal property or the instrument evidencing the debt, obligation, stock or chose in action to the person or persons claiming to be the distributee or distributees of the property or the attorney for the distributee or distributees, upon being presented an affidavit, filed as provided by subsection (c) of this section, made by or on behalf of the distributee or distributees stating:

(i) The value of the entire estate located in Wyoming subject to administration, either testate or intestate, less liens and encumbrances, does not exceed two hundred thousand dollars ($200,000.00);

(ii) Thirty (30) days have elapsed since the death of the decedent;

(iii) No application for appointment of a personal representative is pending or has been granted in any jurisdiction in this state;

(iv) The person or persons claiming to be a distributee or distributees are entitled to payment or delivery of the property of the decedent; the facts concerning the distributee's or distributees' relationship to the decedent and concerning the legal basis upon which the distributee or distributees claim entitlement to such property, including facts regarding any intervening estates or other parties who may have a claim of entitlement from the decedent and from whom the applicant distributee or distributees claim and that there are no other distributees of the decedent having a right to succeed to the property under probate proceedings in any jurisdiction; and

(v) If an application for appointment of a personal representative has been made in a jurisdiction outside of Wyoming:

(A) The name and address of the proposed or appointed personal representative, the date of the application and the date of any appointment; and

(B) The title of the proceedings and name of the court and jurisdiction in which the application was made.

(b) The transfer agent for any security shall change the registered ownership on the books of a corporation from the decedent to the distributee or distributees upon presentation of an affidavit as provided in subsections (a) and (c) of this section.

(c) When the affidavit is filed with the county clerk and a certified copy is presented to any person with custody of the decedent's property or a holder of the decedent's property, the affidavit shall be honored and have the effect as provided in this section and W.S. 2-1-202.

(d) The county clerk of the county in which any vehicle is registered shall transfer title of the vehicle from the decedent to the distributee or distributees upon presentation of an affidavit as provided in subsection (a) of this section.

(e) Upon presentation of an affidavit as provided in this section, a person with custody of the decedent's property or a holder of the decedent's property shall pay or deliver any of the decedent's property held or on deposit in the sole name of the decedent, together with the interest and dividends thereon, to the distributee or distributees. A receipt for the payment by the distributee or distributees or proof of delivery by the custodian or holder of the decedent's property shall constitute a valid and sufficient release and discharge for the payment or delivery made.

2-1-202. Effect; refusal to pay, deliver.

(a) The person having custody of the decedent's property or a holder of the decedent's property:

(i) Paying, delivering, transferring or issuing personal property or the evidence thereof pursuant to affidavit is discharged and released to the same extent as if he dealt with a personal representative of the decedent; and

(ii) Is not required to see to the application of the personal property or evidence thereof or to inquire into the truth of any statement in the affidavit.

(b) If any person having custody of the decedent's property or a holder of decedent's property to whom an affidavit is delivered refuses to pay, deliver, transfer or issue any personal property or evidence thereof, the property may be recovered or its payment, delivery, transfer or issuance compelled upon proof of right in an action by or on behalf of the persons entitled thereto. If an action is brought under this subsection, the court shall award reasonable attorney's fees and costs of the action to the plaintiff if the court finds that the decedent's property was not paid, delivered, transferred or issued within forty-five (45) days after presentation of the affidavit under W.S. 2-1-201 unless the court finds just cause for the refusal to pay, deliver or transfer the property.

(c) Any person to whom payment, delivery, transfer or issuance is made is answerable and accountable to a personal representative of the estate or to any other person having a like or superior right.

(d) For purposes of this article, "holder" means any person who is in possession of property of the decedent and includes but is not limited to a security broker, security dealer, bank, savings and loan institution, credit union or any other like depository.

2-1-203. Deposits by minors or persons under a disability; joint and trust deposits; pay-on-death accounts.

(a) Deposits by minors or other persons under a legal disability may be paid on the order of the depositor and the payments are legally valid.<br />

<br />

(b) Any portion of a deposit by two (2) or more persons payable to either or any depositor, or to the survivor of the depositors, and interest or dividends thereon, may be paid in accordance with the contract of deposit. The receipt of the payment by the person paid is a valid and sufficient release and discharge to the financial institution for any payment made.<br />

<br />

(c) Any portion of a deposit by any person in trust for another and interest or dividends thereon, in the absence of other written notice to the financial institution of the existence and terms of a legal and valid trust, may be paid to the persons for whom the deposit was made in the event of death of the depositor.<br />

<br />

(d) Any payable on death (P.O.D.) account may be paid, on request, to any original party to the account. Payment may be made, on request, to the P.O.D. payee or in equal proportions to multiple P.O.D. payees upon presentation to the financial institution of proof of death showing that the P.O.D. payee or payees survived all persons named as original payees. Payment may be made to the personal representative or heirs of a deceased original payee if proof of death is presented to the financial institution showing that his decedent was the survivor of all other persons named on the account either as an original payee or as P.O.D. payee. The receipt of the payment by the person paid is a valid and sufficient release and discharge to the financial institution for any payment made. A person named as a payee in a P.O.D. account has no enforceable rights therein during the lifetime of the person or persons creating the account. As used in this subsection:<br />

(i) “P.O.D. account” means an account payable on request to one (1) person during his lifetime and on his death to one (1) or more P.O.D. payees, or to one (1) or more persons during their lifetimes and on the death of all of them to one (1) or more P.O.D. payees;<br />

(ii) “P.O.D. payee” means a person designated on a P.O.D. account as one to whom the account is payable on request after the death of all original payees.<br />

<br />

2-1-204. Collection of claims of certain creditors of decedent by affidavit.<br />

<br />

(a) Not earlier than ninety (90) days after the death of a decedent, the United States, or any agency or instrumentality thereof, or the state of Wyoming, or any agency, instrumentality or political subdivision thereof, to whom the decedent was indebted or to whom the decedent’s estate would be indebted if the estate were being administered upon, may collect all of the assets of the decedent referred to in W.S. 2-1-201, upon presentation of an affidavit to the parties referred to in W.S. 2-1-201, stating:<br />

(i) The value of the entire estate, wherever located, less liens and encumbrances, does not exceed two hundred thousand dollars ($200,000.00);<br />

(ii) Ninety (90) days have elapsed since the death of the decedent;<br />

(iii) No application for appointment of a personal representative is pending or has been granted in any jurisdiction;<br />

(iv) To the best knowledge of the affiant, no affidavit pursuant to W.S. 2-1-201, in connection with the decedent, has been presented to any party referred to in W.S. 2-1-201;<br />

(v) The facts concerning the creditor’s claim being made by the party on behalf of whom the affidavit is presented, the total amount of the claim, and any payments received thereon from any source whatsoever; and<br />

(vi) That by presentation of the affidavit the party on behalf of whom the affidavit is presented:<br />

(A) Waives any immunities from suit or levy of execution it might otherwise have;<br />

(B) Agrees to indemnify and hold harmless from all claims whatsoever any party delivering assets on the basis of such affidavit, to the extent of the full value of the assets so delivered; and<br />

(C) Is answerable and accountable to a personal representative of the estate, if appointed, or to any other person or party having a superior right.<br />

<br />

(b) When filed with the county clerk and a certified copy thereof is presented to a party with custody of assets, the affidavit shall be honored and shall have the effects as provided for in W.S. 2-1-201(b), (c) and (d) and 2-1-202.<br />

<br />

(c) If the total assets collected by a creditor designated in this section, by virtue of the affidavit or affidavits, exceed the net balance of the creditor’s claim, then the creditor shall:<br />

(i) Pay the overplus to any other creditor who proceeds properly under this section or, if there is no such creditor;<br />

(ii) Pay the overplus to the distributees named in an affidavit prepared and presented pursuant to W.S. 2-1-201, or, if none such be presented;<br />

(iii) Obtain an order from the probate court which would have jurisdiction were the estate being administered upon, designating itself the agent pursuant to W.S. 2-15-101, and thereupon proceed as provided in Chapter 15 of the Wyoming Probate Code.<br />

<br />

2-1-205. Summary procedure for distribution of real property; application for decree; notice by publication; presumptive evidence of title; effect of false statements.<br />

<br />

(a) If any person dies who is the owner of personal or real property, including mineral interests, but whose entire estate including personal property does not exceed two hundred thousand dollars ($200,000.00), less liens and encumbrances, the person or persons claiming to be the distributee or distributees of the decedent may file, not earlier than thirty (30) days after the decedent’s death, an application for a decree of summary distribution of property.<br />

<br />

(b) The application shall be sworn to and signed by any person claiming to be a distributee and shall state the facts required by W.S. 2-1-201(a)(i) through (v). The application shall also fully describe any real property, including any mineral interests, being claimed.<br />

<br />

(c) The application shall have attached thereto a sworn report of value which may be based upon a broker’s price opinion as defined by W.S. 33-28-102(b)(lxii), made by a person who has no legal interest in the estate, showing the value on the date of the decedent’s death of all interests owned by the decedent in real property located in Wyoming, including mineral interests.<br />

<br />

(d) A notice of application for a decree of summary distribution of property shall be published once a week for two (2) consecutive weeks in a newspaper of general circulation in the county in which the application was filed. The notice of application shall be served by first class mail to the last known address, with copy of application attached, to the surviving spouse of the decedent, if any, and to all other distributees, so far as known, or to their guardians if any of them are minors, or to their personal representatives if any of them are deceased and to any reasonably ascertainable creditors not later than ten (10) days after the date of first publication.<br />

<br />

(e) If the decedent received medical assistance pursuant to W.S. 42-4-101 through 42-4-114, the state department of health shall be provided a copy of the application for a decree within ten (10) days after the date of first publication.<br />

<br />

(f) If no objection to the application has been filed within thirty (30) days of the first date of publication, the court shall enter a decree establishing the right and title to the property located in Wyoming. A certified copy of the decree shall be recorded in the office of the county clerk of each county in which the real property, including mineral interests, is located. Upon recording of the decree, the decree and the record thereof shall be presumptive evidence of title to the property. If an objection to the application is filed within thirty (30) days of the first date of publication, the court shall set the matter for a hearing, after which the court shall enter an order either denying or granting the application.<br />

<br />

(g) In the event that the decree is entered as the result of an application containing a materially false statement, title to the property which passes as a result of the decree shall not be affected but the person or persons signing as distributee or distributees and knowingly swearing to a materially false statement in the application shall be subject to the appropriate penalties for perjury. Any distributee who is damaged by an application containing a material false statement may file an action to amend the decree, and for damages. The action shall be filed in the court in which the application was filed. Any action under this paragraph is barred unless commenced within two (2) years from the entry of the decree.<br />

<br />

(h) The procedure provided by this section may be used in addition to the affidavit procedure provided by W.S. 2-1-201.<br />

<br />

2-1-206. Proof of publication and service; filing with clerk.<br />

<br />

(a) The proof of publication of the notice required under W.S. 2-1-205(d) shall be by affidavit of the publisher.<br />

<br />

(b) The proof of service under W.S. 2-1-205(d) shall be signed by a distributee who signed the application or his attorney and shall state the name and address of the person served and the manner of service.<br />

<br />

(c) The affidavit for proof of publication and the proof of service shall be filed with the clerk of court prior to the court taking action on the application.<br />

<br />

(d) Proof of service by a distributee shall be signed under penalty of perjury.<br />

<br />

2-1-207. Missing distributees.<br />

<br />

(a) The person or persons claiming to be the distributee or distributees of the decedent who filed the application shall make reasonable efforts to identify and locate all living distributees of the decedent having a right to succeed to the interests of the decedent in the property described in the application. If all distributees are not located, the distributee or distributees filing the application shall advise the court of the efforts made to locate missing distributees. “Missing distributees” means distributees who were identified pursuant to this subsection but who could not be located. If a distributee cannot be located, the court shall grant the application as follows:<br />

(i) In the case of an interest in real property, the interest shall be set over to the missing distributee or distributees if known; and<br />

(ii) In the case of all other interests, the court may direct that the share of the missing distributee or distributees be paid to the state treasurer under the Uniform Unclaimed Property Act, W.S. 34-24-101 through 34-24-140.<br />

<br />

(b) The person or persons claiming to be a distributee or distributees of the decedent who filed the application shall report to the court upon payment of the share of the missing distributee or distributees.<br />

<br />

(c) The court may order the missing distributee’s or distributees’ share to be liquidated for value.<br />

<br />

2-1-208. Venue generally.<br />

<br />

(a) An application for a decree under W.S. 2-1-205 shall be filed as follows:<br />

(i) If the decedent was a resident of Wyoming at the time of his death, in the county of which the decedent was a resident;<br />

(ii) If the decedent was not a resident of Wyoming at the time of his death, in a county in which any part of the estate is located.