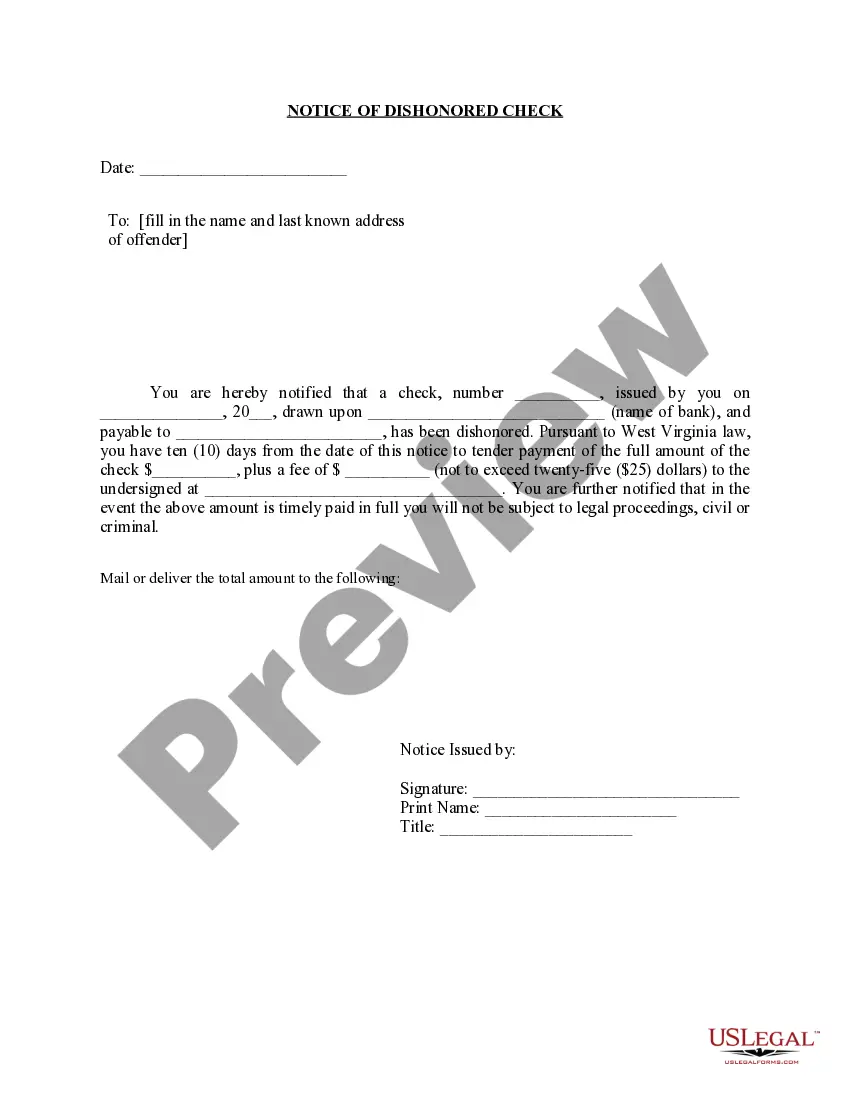

This is a Complaint - Warrant for Dishonored Check - Criminal. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner or any other person given a dishonored check may be required by state law to notify the debtor that the check was dishonored.

West Virginia Complaint for Warrant for Dishonored Check - Bad Bounced Check - Criminal

Description

Definition and meaning

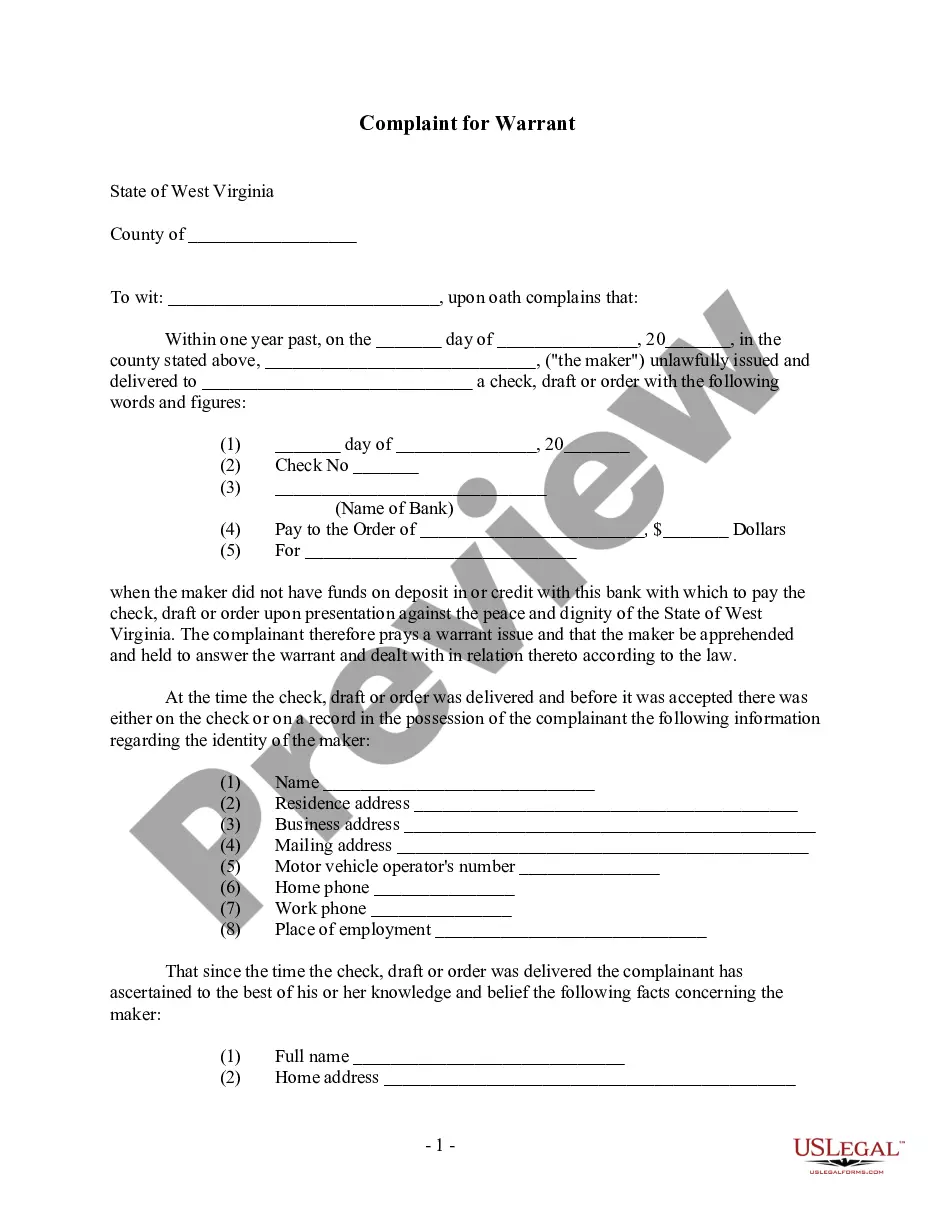

The West Virginia Complaint for Warrant for Dishonored Check is a legal document filed when an individual, referred to as the complainant, seeks to initiate criminal proceedings against a person who has issued a check that has bounced due to insufficient funds. This form is essential for individuals looking to hold someone accountable for failing to honor their financial obligations.

How to complete a form

To complete the West Virginia Complaint for Warrant for Dishonored Check:

- Clearly fill in the complainant's information, including name, address, and contact details.

- Provide details about the bounced check, including the date issued, check number, and the amount.

- Include pertinent information about the maker of the check, such as their full name and contact information.

- Sign and date the form to validate your complaint.

Who should use this form

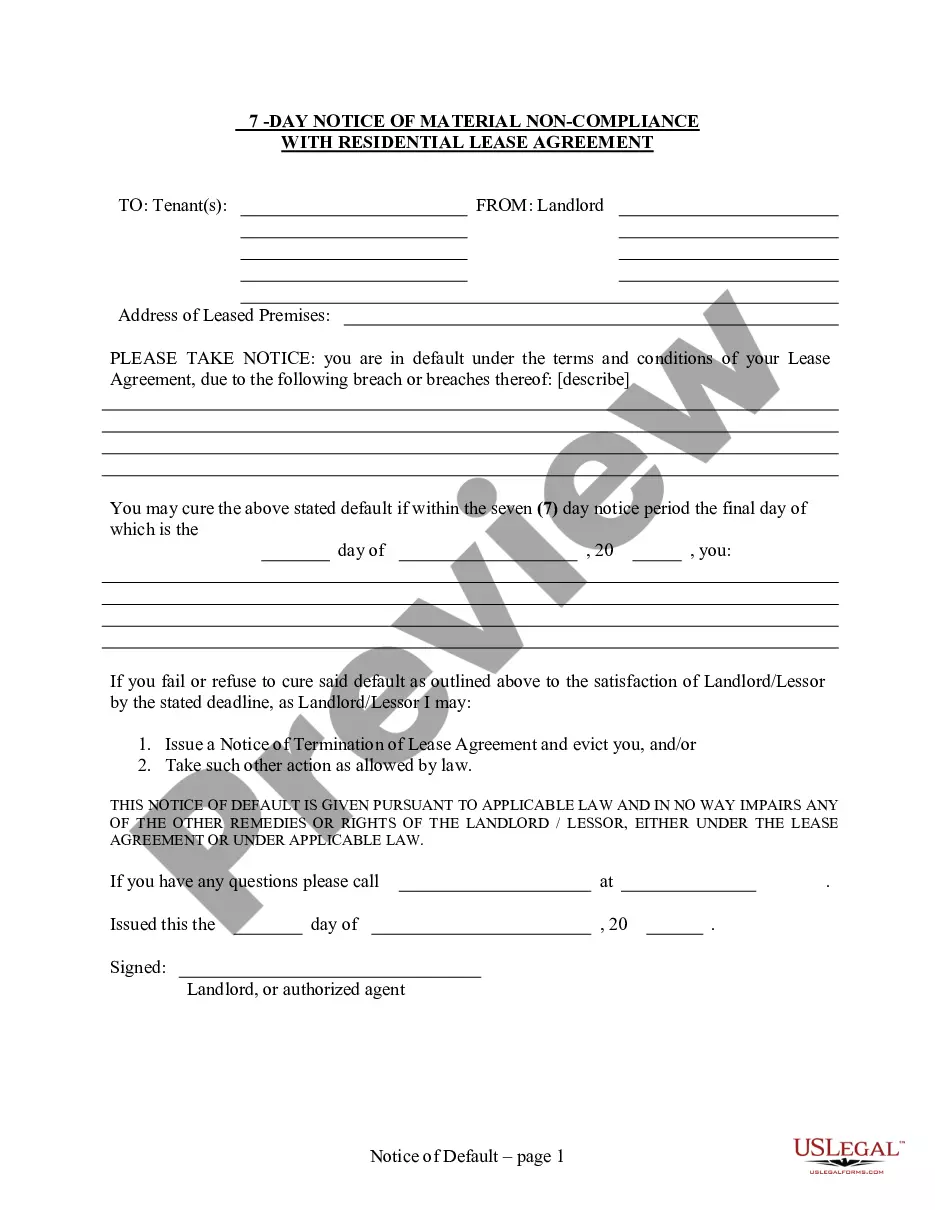

This form is designed for individuals or businesses who have received a bad check and wish to take legal action against the issuer. It is particularly relevant for vendors, service providers, or individuals who have incurred a loss due to the dishonored check.

Key components of the form

The West Virginia Complaint for Warrant for Dishonored Check includes the following key components:

- The complainant's details

- Information about the bounced check (date, amount, and issuing bank)

- The identity of the maker of the check

- Details regarding any service charges incurred by the complainant

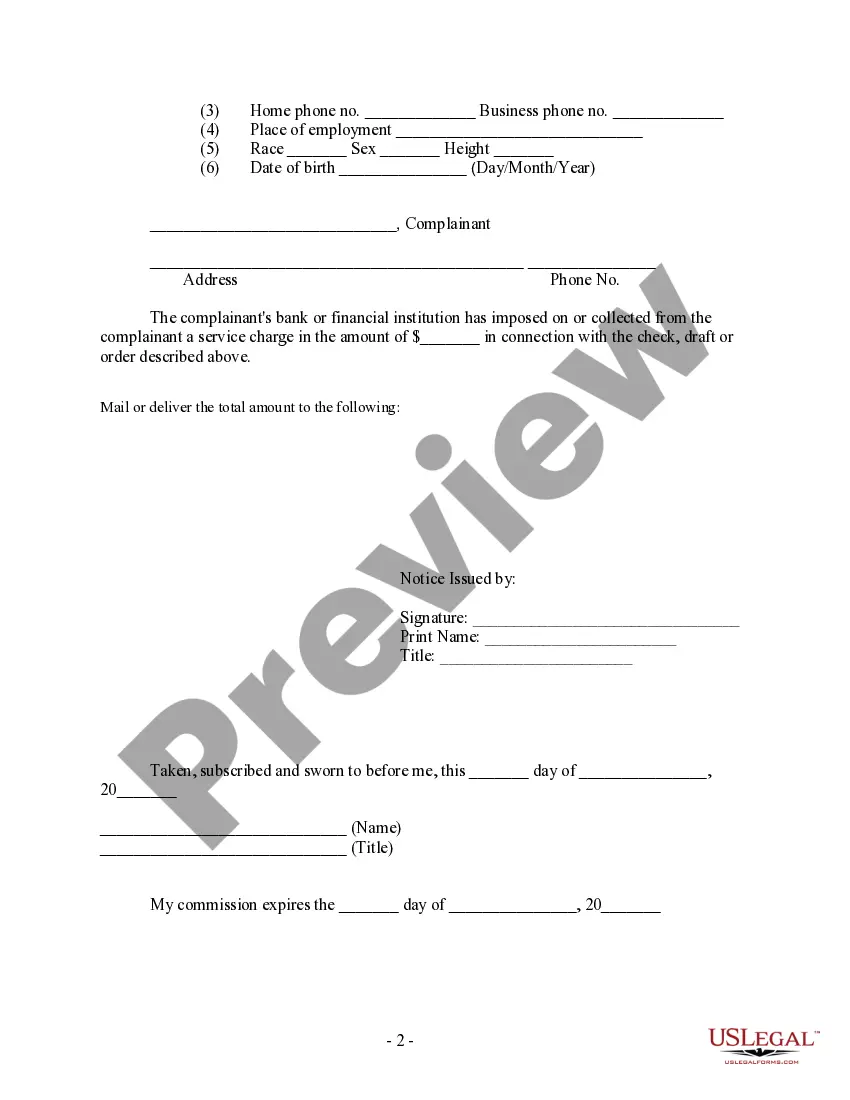

- A signature line for the complainant and a notary public

Common mistakes to avoid when using this form

When filling out the West Virginia Complaint for Warrant for Dishonored Check, be aware of common pitfalls such as:

- Not including all necessary details about the check and the maker.

- Failing to provide accurate contact information for both the complainant and the maker.

- Not signing the form or obtaining the necessary notarization.

- Assuming the form is a one-size-fits-all solution; ensure it meets your specific situation.

What to expect during notarization or witnessing

During the notarization of the West Virginia Complaint for Warrant for Dishonored Check, you should:

- Appear before a notary public with valid identification.

- Sign the complaint in front of the notary, who will then complete their section of the form.

- Be prepared to explain the nature of the complaint briefly, as it may be necessary for the notary to affirm your understanding of the document.

How to fill out West Virginia Complaint For Warrant For Dishonored Check - Bad Bounced Check - Criminal?

Out of the large number of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms before purchasing them. Its complete library of 85,000 samples is grouped by state and use for efficiency. All the documents on the platform have been drafted to meet individual state requirements by certified lawyers.

If you have a US Legal Forms subscription, just log in, search for the form, hit Download and access your Form name in the My Forms; the My Forms tab holds all your downloaded documents.

Stick to the guidelines below to obtain the document:

- Once you find a Form name, ensure it’s the one for the state you need it to file in.

- Preview the form and read the document description before downloading the template.

- Search for a new sample through the Search field if the one you have already found is not proper.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

When you have downloaded your Form name, you are able to edit it, fill it out and sign it in an web-based editor of your choice. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most up-to-date version in your state. Our platform provides fast and easy access to templates that suit both legal professionals and their customers.

Form popularity

FAQ

If the check did bounce (which it sounds like it did) they might take that NSF charge off for you. Yes, this means that the check you deposited was returned.The whole check shows up as a debit because the whole check bounced. Ask the bank if they tried to re-deposit the item.

Penal Code 476a PC is the California statute that makes it a crime for a person to write or pass a bad check, knowing there are insufficient funds to cover payment of the check. The offense can be charged as a felony if the value of the bad checks is more than $950.00. Otherwise, the offense is only a misdemeanor.

As defined under California Penal Code Section 476a, writing a check while knowing that funds are insufficient can be charged as a misdemeanor offense that can result in sentence of up to one year in county jail.

Send the letter certified mail. Visit your local district attorney's office if you do not hear back from the debtor. Bring your correspondence with you and a copy of the bad check. He will take the case over, and likely prosecute the check writer.

Knowingly writing a bad check is an act of fraud, and is punishable by law. Writing bad checks is a crime. Penalties for people who tender checks knowing there are insufficient funds in their accounts vary by state.If the check amount exceeds certain thresholds, the crime may be treated as a felony.

Bouncing a check can happen to anyone. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally. The punishment for trying to pass a bad check intentionally ranges from a misdemeanor to a felony.

Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.

Bouncing a check is usually a crime only if you intend to defraud the payee. In other words, the payee must be able to prove that you knew your check would bounce and therefore you intended to commit check fraud. Fortunately, most consumers don't wait long to repay bad checks and aren't charged with criminal penalties.