Washington Non-Foreign Affidavit Under IRC 1445

Definition and meaning

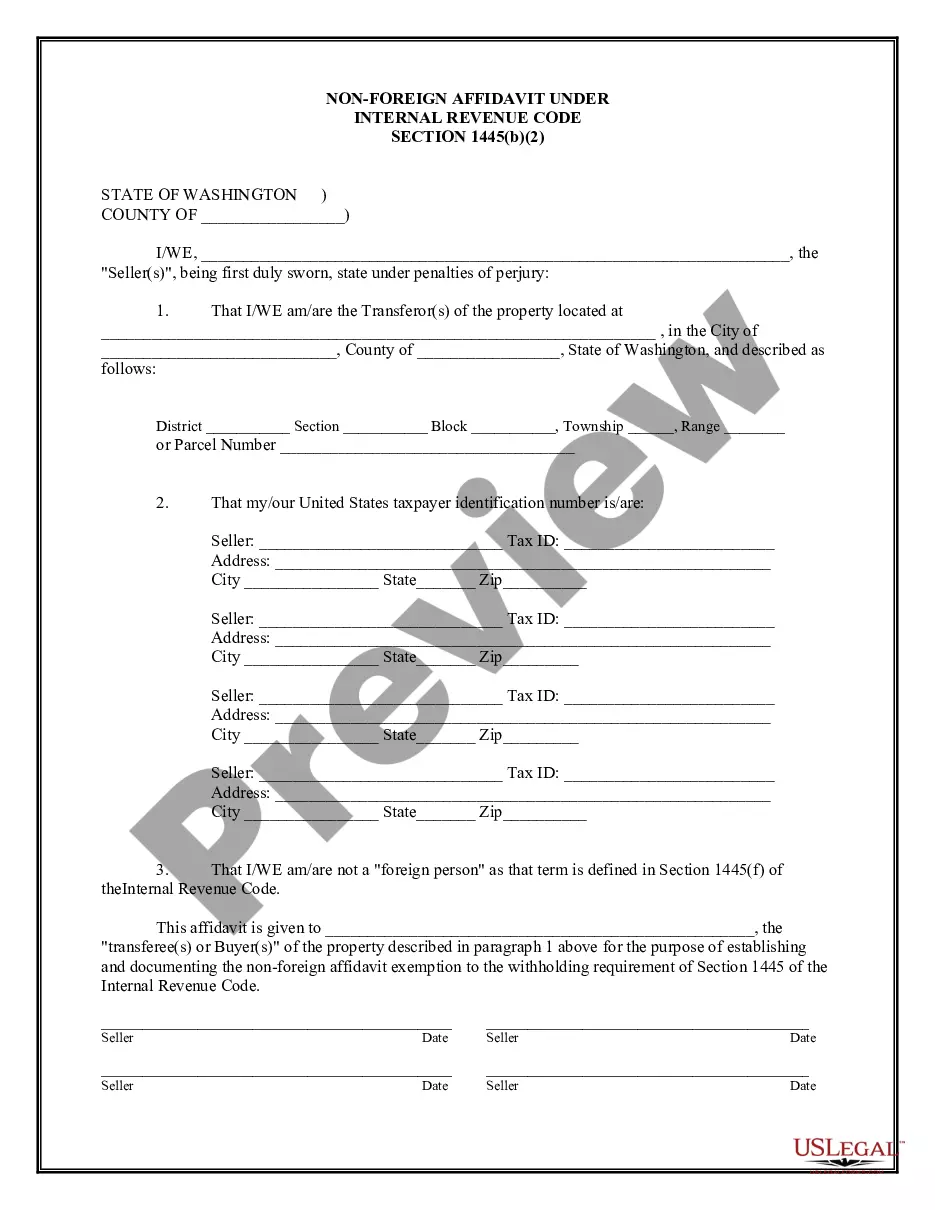

The Washington Non-Foreign Affidavit Under IRC 1445 is a legal document used to confirm that the seller of a property is not classified as a "foreign person" under Section 1445 of the Internal Revenue Code. This classification is crucial as it determines whether or not the buyer must withhold a percentage of the sale proceeds for federal tax purposes. By signing this affidavit, sellers provide assurance to buyers that they are not subject to this withholding requirement, facilitating a smoother property transaction.

How to complete a form

To complete the Washington Non-Foreign Affidavit Under IRC 1445, follow these steps:

- Fill in your name as the seller(s) at the top of the form.

- Provide the details of the property being sold, including the address and legal description.

- Enter your United States taxpayer identification number and address information.

- State that you are not a "foreign person" as defined in Section 1445(f).

- Sign the form and date it to validate the affidavit.

Ensure that all information is accurate and complete to avoid legal complications during the transaction.

Who should use this form

This affidavit is essential for sellers in Washington who are selling property and wish to tackle potential withholding taxes under Section 1445. It should be used by:

- Property sellers who are U.S. citizens or residents.

- Entity sellers, such as corporations or partnerships, that are not classified as foreign entities.

- Any seller who prefers to ensure compliance with tax regulations when transferring property ownership.

Key components of the form

The Washington Non-Foreign Affidavit includes several critical components, such as:

- Transferor Information: The names and taxpayer identification numbers of the property sellers.

- Property Description: Detailed address and legal description of the property being sold.

- Affidavit Declaration: A statement confirming that the seller is not a foreign person.

- Notary Information: Section for notarization to validate the affidavit

Each section must be filled out carefully to ensure the validity of the affidavit.

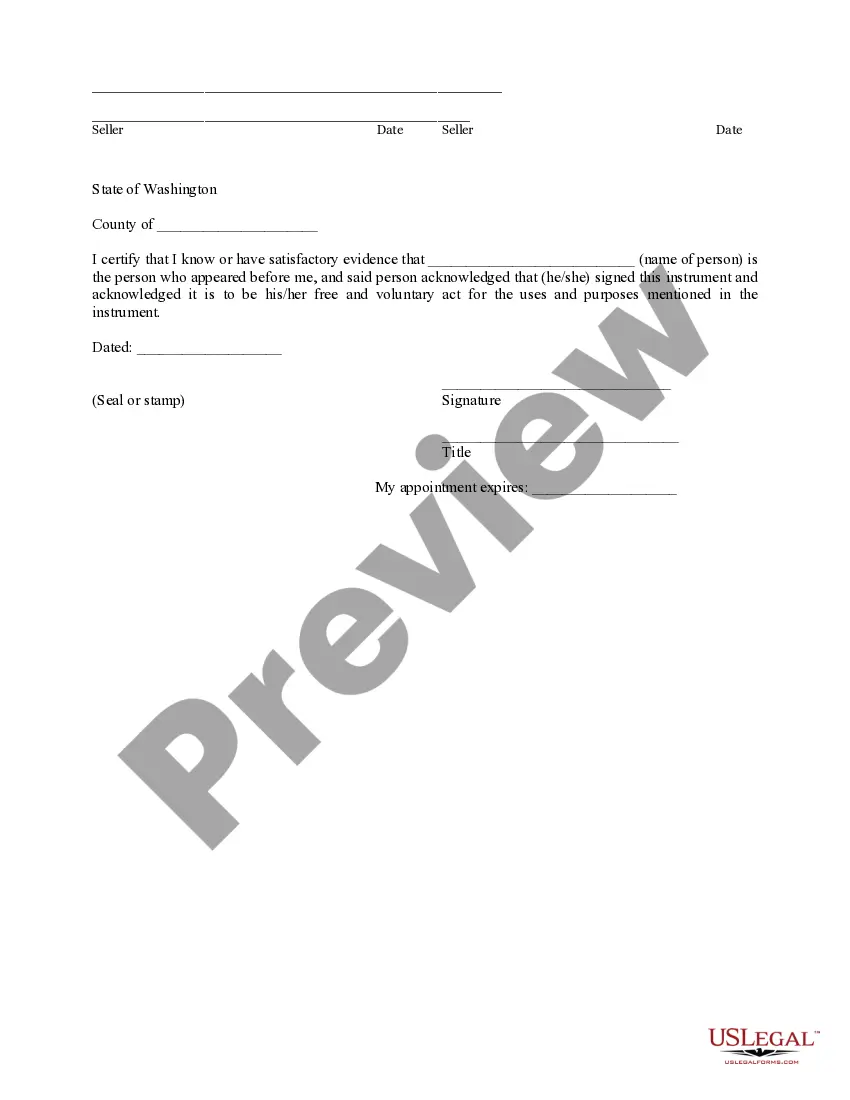

What to expect during notarization or witnessing

When you finalize the Washington Non-Foreign Affidavit Under IRC 1445, a notary public must witness your signature. During notarization, the following occurs:

- The notary will verify your identity using a valid form of identification.

- You will sign the affidavit in the presence of the notary.

- The notary will then complete their section, affix their seal, and provide the date of notarization.

This process ensures that the affidavit is legally binding and recognized by authorities.

Common mistakes to avoid when using this form

When completing the Washington Non-Foreign Affidavit, it’s important to be aware of common pitfalls:

- Failing to sign and date the affidavit.

- Providing incorrect taxpayer identification numbers.

- Inaccurate property descriptions that do not match public records.

- Omitting the notary section, which is essential for validating the document.

By avoiding these mistakes, you can create a valid and effective affidavit.

Form popularity

FAQ

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

FIRPTA Exemptions The sales price is $300,000 or less, and. The buyer signs affidavit at or before closing stating they intend to use property for personal purposes for at least 50% of time property occupied for the each of the first two 12 month periods immediately after closing.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

Persons purchasing U.S. real property interests (transferees) from foreign persons, certain purchasers' agents, and settlement officers are required to withhold 15% (10% for dispositions before February 17, 2016) of the amount realized on the disposition (special rules for foreign corporations).

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).

FIRPTA Certificate: Certification of Non-Foreign Status - FIRPTA is the Foreign Investment in Real Property Act and Form 8288. It was developed to ensure that foreign sellers of U.S. property be subject to U.S. tax on the sale.